It's been 5 months since we reviewed our 2023 Watch List.

It's been 5 months since we reviewed our 2023 Watch List.

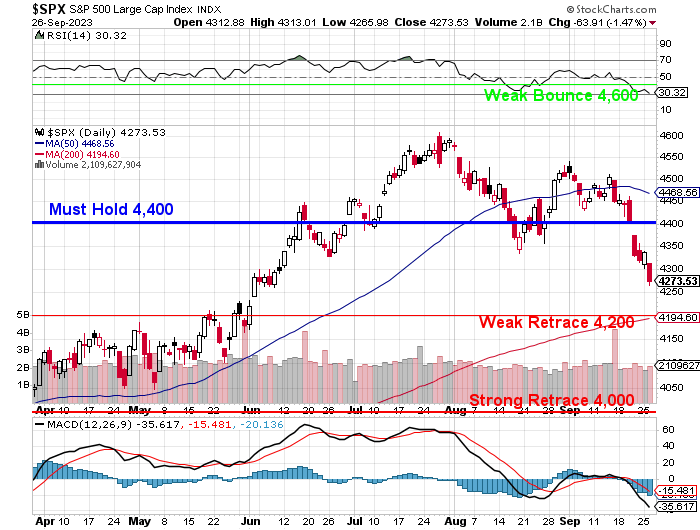

We added a lot of those stocks to our portfolios but then the market took off in late May and, on June 1st, the S&P 500 ran up to 4,275 and, yesterday, the S&P closed at 4,273 so I guess it's time to take another look and see what looks cheap - again.

Though the Futures are up this morning on news of a bi-partisan (77-19) Funding Bill coming out of the Senate but it's likely the bill won't pass the House as it includes $6Bn of funding for Ukraine and the Putin Puppets in the House GOP want all funding for Ukraine to be cut off as the first step in any bill.

Anyway, let's let Congress screw up the country and we can go shopping! Remember, the Watch List gives us a quick guide to remind us which stocks we LIKED back in October of last year (when we are narrowing down our Trade of the Year picks) - now we have to decide if they are still worthy but conditions are no different than what we expected (more inflation, tight job market, higher oil, higher interest) so most of them are still in the running. To repeat what I said back in April:

"Generally, we look for Blue-Chip type companies with low debt, low p/e and reasonable anticipated growth. As we are including legacy prices from December, I’m going to leave those in place (in the descriptions) so we’ll know at what price we began watching – regardless of the date we begin."

There were originally over 100 stocks on the list but many have gotten away from us (some are also in our portfolios already) - these are the ones we think are still a buy at the moment - especially if they get cheaper on a broad-market pullback.