Both September and Q3 saw poor performance for markets across the board: as DB’s Henry Allen writes in the bank’s quarterly performance review, over Q3, or just 11 of the 38 non-currency assets the German bank tracks, were in positive territory, and in September, only 7 were positive making it the worst month of 2023 so far.

The declines had several causes, but the most important one was the sense that central banks were likely to keep interest rates higher for longer – until something breaks – alongside a $20/bbl rise in oil prices over the quarter. The losses also added to September’s reputation as the worst month for financial markets over recent years. Indeed, it was the 4th year in a row that the S&P 500 and the STOXX 600 were down for September, as well as the 7th year in a row that Bloomberg’s global bond aggregate was down for the month.

Here are some of the key highlights from the report, with full details below.

- September was the 4th year in a row that the S&P 500 (-4.8%) and the STOXX 600 (-2.0%) were down for September, as well as the 7th year in a row that Bloomberg’s global bond aggregate was down for the month.

- US 30yr Treasury yields saw their biggest quarterly climb (+83.9bps) since Q1 2009.

- 10yr JGBs nearly doubled (+36.5bps) to 0.76% in Q3, to the highest level since 2013.

- Brent Crude oil prices were up +27.2% in Q3 to $95.31/bbl, which is their biggest quarterly rise since Q1 2022 when Russia’s invasion of Ukraine began.

- The dollar index strengthened by +3.2% in Q3, aided by a sharp rise in US real yields. Conversely, other major currencies weakened against the dollar, including the Euro (-3.1%), the Japanese Yen (-3.4%) and the British Pound (-4.0%).

- On a YTD basis, the NASDAQ still leads the way (+27.1%) with the S&P (+13.1%) strong even with the September/Q3 sell-off. However, the equal-weight S&P 500 is “only” +1.8% in 2023, which highlights the narrowness of the rally.

- On a YTD basis, the Nikkei (+9.1%) and Stoxx 600 (+7.9%) remain buoyant even with a -6.6% and -5.0% correction in Q3 respectively. However the Hang Seng is -7.2% YTD following a -4.1% decline in Q3.

- Even with a bad year for fixed income, US HY (+5.3%), EU HY (+5.0%) and EM bonds (+4.1%) has shown that carry has ultimately won out in 2023, even if their returns are broadly in line with short-end cash rates.

Quarter in Review – The high-level macro overview

When it came to financial assets, the biggest story of Q3 was the massive bond sell-off, which sent yields up to multi-year highs around the world. For instance, the 10yr Treasury yield ended the quarter up +73.5bps at 4.57%, and at the intraday peak on September 28 it was as high as 4.686%, which we haven’t seen since 2007. Yields moved higher across the curve but there was also a clear steepening. That left yields on 2yr Treasuries up +14.8bps to 5.04%, whilst those on 30yr Treasuries saw their biggest quarterly increase since Q1 2009, with a rise of +83.9bps to 4.70%. It was much the same story elsewhere too, with the 10yr German bund yield up +44.8bps to 2.84%, which hasn’t been seen since 2011. Meanwhile in Japan, the 10yr yield was up +36.5bps to 0.76%, which is the highest since 2013.

Central banks played a role in that sell-off, as investors moved to push out the likely timing of any rate cuts. For instance, at the Fed’s September meeting, the FOMC raised their median dot for the fed funds rate in 2024 by 50bps, suggesting that there would be fewer cuts next year than previously thought. That’s been reflected in market pricing too, with the timing of a first 25bp rate cut from the Fed pushed out from Q2 2024 to Q3 2024. Meanwhile, the ECB hiked their deposit rate to an all-time high of 4% in September.

Concerns about inflation remained in the background as well, partly thanks to a fresh surge in oil prices over Q3. In fact, Brent Crude oil prices were up +27.2% to $95.31/bbl, which is their biggest quarterly rise since Q1 2022 when Russia’s invasion of Ukraine began. In part, that followed the news that Saudi Arabia and Russia were extending their production cuts to the end of the year. In the meantime, there was also a growing focus on persistent budget deficits and the impact that would have on rates, not least after Fitch Ratings downgraded the US credit rating in August from AAA to AA+.

Another theme of the quarter has been growing indications that global economic data is softening. In the US, the 3-month average growth of nonfarm payrolls now stands at just +150k, which is the weakest that’s been since the initial wave of the pandemic in 2020. And in the Euro Area, the composite PMI has been in contractionary territory throughout Q3, with readings below 50 in July, August and September.

This backdrop meant that equities had a weak performance, with the S&P 500 down -4.8% in total return terms over September. That’s the worst month of the year so far for the index, and leaves it down -3.3% over Q3 as a whole. It is still positive on a YTD basis, however, with a +13.1% gain, although those gains have been driven by a relatively narrow group of stocks, with the equal-weighted S&P 500 only up +1.8% YTD. It’s also been a weak quarter for equities elsewhere, with the STOXX 600 (-2.0%) and the Nikkei (-3.4%) also losing ground.

Which assets saw the biggest gains in Q3?

- Energy commodities: Oil prices saw a strong rebound in Q3, which followed a run of 4 consecutive quarterly declines. Brent crude was up +27.2% to $95.31/bbl, and WTI rose +28.5% to $90.79/bbl. Natural gas prices also moved higher, with those in Europe up +12.8% to €41.86/MWh, after a run of 3 consecutive quarterly declines.

- US Dollar: The dollar index strengthened by +3.2% in Q3, aided by a sharp rise in US real yields. Conversely, other major currencies weakened against the dollar, including the Euro (-3.1%), the Japanese Yen (-3.4%) and the British Pound (-4.0%).

Which assets saw the biggest losses in Q3?

- Sovereign bonds: It was the worst quarterly performance for sovereign bonds in a year, with losses for US Treasuries (-3.4%) and Euro sovereigns (-2.5%). The moves mean that both are negative on a YTD basis again.

- Equities: Equities were down across the board in Q3, with declines for the S&P 500 (-3.3%), the STOXX 600 (-2.0%) and the Nikkei (-3.4%). The main exception to this pattern were energy stocks, with those in the S&P 500 up +12.2% over the quarter.

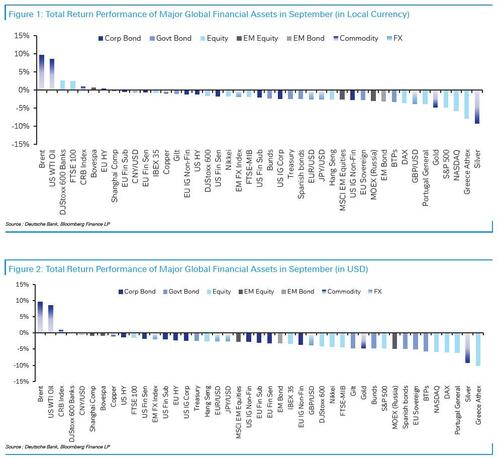

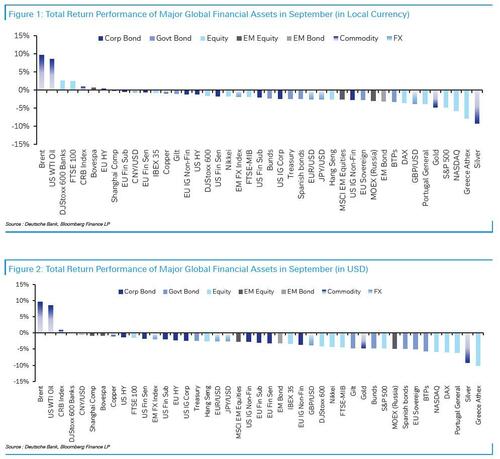

Finally, here is a summary of performance by assets class denominated in local FX as well as USD, for the month of September…

…. for Q3…

… and for 2023 YTD.

More in the full note available to pro subs.