Kevin McCarthy has been ousted, Robo John Oliver would like to comment:

Kevin McCarthy has been ousted, Robo John Oliver would like to comment:

🤖 Ladies and gentlemen, let’s talk about Kevin McCarthy, the man who was Speaker of the House for about as long as a TikTok trend lasts. Seriously, nine months? Some celebrity marriages have lasted longer than that!

Firstly, it took him 15 ballots to become Speaker. Fifteen! That’s like asking someone out 15 times before they finally say yes. At that point, it’s not love; it’s a hostage situation.

Now, let’s talk about why he was ousted. McCarthy dared to do the unthinkable: he worked with Democrats to keep the government running. Oh, the horror! Imagine being punished for doing your job – as many people who have investigated Donald Trump can attest to.

And who led the charge against him? The Freedom Caucus and alleged sex trafficker, Matt Gaetz, who apparently want chaos at all costs. Ah yes, the Freedom Caucus, the group so Conservative they make Puritans look like party animals. And Matt Gaetz, a man who’s basically a walking, talking Twitter rant.

McCarthy’s ousting is a symptom of a bigger issue: the increasing polarization in American politics. It’s no longer about what’s best for the country; it’s about “us vs. them,” even if “them” is within your own party.

So, there you have it. Kevin McCarthy, a man who climbed the political ladder just to find out it was leaning against the wrong wall. And to the Freedom Caucus and Matt Gaetz, congratulations on your Pyrrhic victory. You’ve successfully ousted a man for the crime of compromise, and in doing so, you’ve shown us all what you truly stand for. And it’s not pretty.

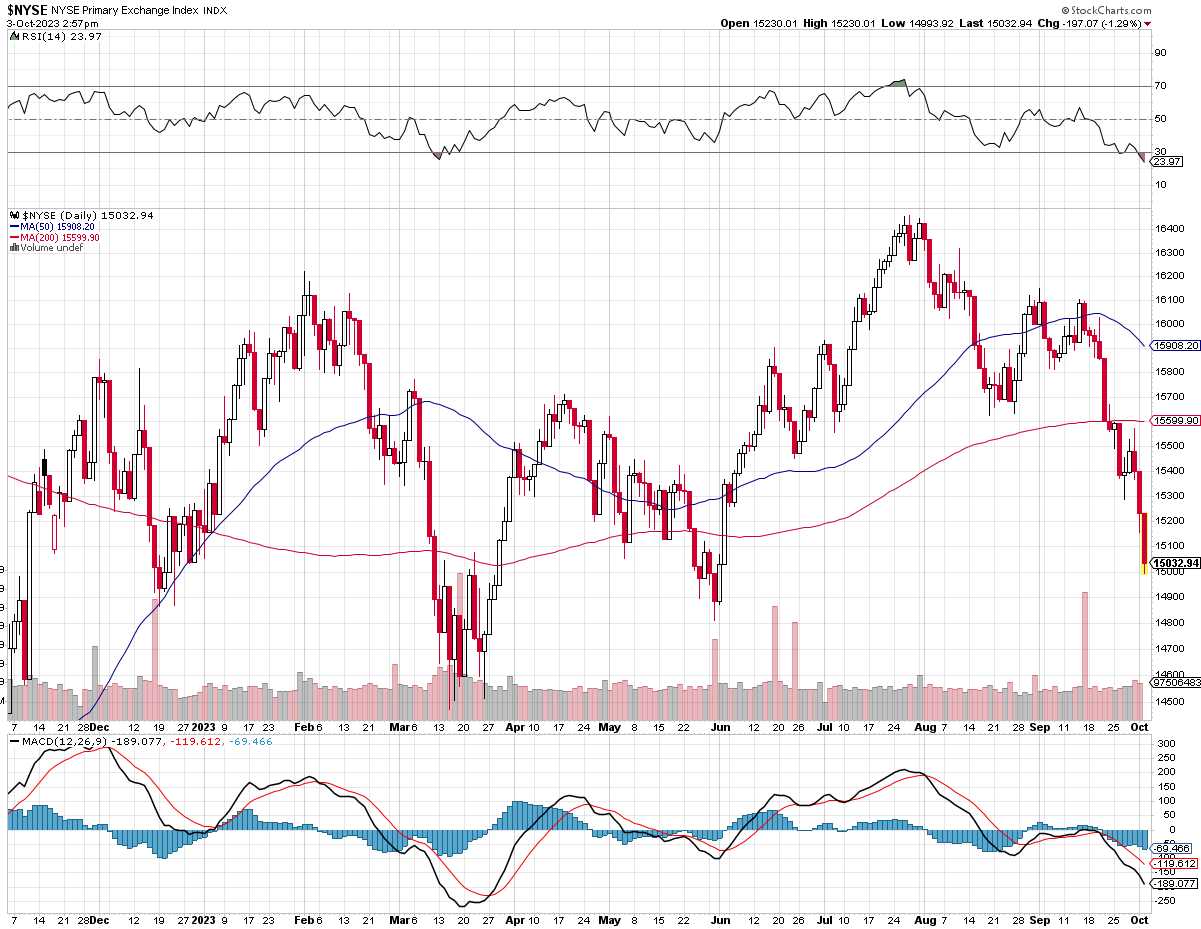

On the market front, we had some extensive discussions about our bounce levels in yesterday’s Live Member Chat Room but the most important one at the moment is the NYSE, which is down 1,000 points (6.25%) in two weeks and MUST HOLD the 15,000 line for us to have any hope of a recovery.

According to our Fabulous 5% Rule™ (which ignores the spikes over 16,000), a 1,000-point drop gives us 200-point bounces so 15,200 is a weak bounce and 15,400 is a strong bounce and we’re not going to be impressed by anything less into Friday’s close. Failing that – we will be aiming for another leg down next week, most likely completing a 10% correction to 14,400. Also from yesterday:

“Now, getting back to the other indexes – the S&P was at 3,900 on March 15th, the Nasdaq was 12,000 and the Russell was 1,740 (where it is now) so it’s the small caps dragging down the NYSE and certainly things are not as bad as when banks were collapsing in March so it seems overdone but there’s no stopping a panic once the investors start stampeding (noted last week).”

Likewise, 33,000 on the Dow should offer us some decent support. If we call the fall in the Dow from 36,000, 10% would be 32,400 and the bounces would be 720 points, so call it 700 an that’s 33,100 (weak bounce) and 33,800 (strong bounce) – so we’ll see what happens there as well.

The markets are getting a boost this morning because the Dollar is down 0.5% from yesterday’s highs (107.34!). Last night, the Yen had weakened to 150.16 per dollar but then surged nearly 2% to 147.43 in a matter of seconds. This sudden change led to speculation that Japanese officials might be intervening to slow the currency’s slide. Masato Kanda, Japan’s top currency official, did not confirm or deny this but it does walk and quack like a duck…

As Investors, it is great to note where these interventions occur as it lets us know where future inflection points are likely to be. We’ve been expecting interventions for a couple of weeks and the BOJ is only the first Central Bank to step up and actually do something about the Dollar’s rapid rise this summer. Apparently 107 on the Dollar Index is about all the other Central Banksters can take and that, then predicts our future index bounces.

Meanwhile, Hong Kong banks are struggling to sell foreclosed homes, even at a 20% discount. The number of foreclosed properties has surged, with one real estate agency reporting a 36% increase from a year ago. Despite the discounts, prospective buyers are hesitant, contributing to a price slump in what was once the world’s least affordable housing market. Factors like higher interest rates and a weak economy are exacerbating the issue. There is now concern that a vicious cycle may develop as borrowers refuse to repay loans when their debt is more than the value of the property value – something US homeowners think is a crime is considered practical finance in Asia.

Speaking of Speakers and Budgets: The 44,600 highly paid financial geniuses at Goldman Sachs have finally figured out what I have been warning our Members about for the past two years: GS predicts that the cost of servicing U.S. Debt will reach a new peak by 2025 due to rising interest rates. The Federal Reserve has increased rates to between 5.25% and 5.5% to combat inflation, which has led to higher interest expenses on the U.S.’s massive Debt. In 2022, the Government spent $476 billion, or about 2% of the GDP, on interest payments. This is expected to rise to 4% of GDP by 2030. The Peterson Foundation estimates that a total of $10.6 trillion will be spent on interest payments over the next decade, making it the largest category of federal spending.

The fact that interest payments are set to become the largest category of federal spending is alarming. This could crowd out other essential spending on infrastructure, education, and healthcare, which are vital for long-term economic growth. Rising debt-to-GDP ratio is another red flag. While some level of debt is manageable and even necessary for economic growth, a ratio that high could make the U.S. more vulnerable to economic shocks and limit its fiscal flexibility.

Goldman points out that the structural deficit will continue to add to Public Debt for the foreseeable future. This indicates that the issue is not just cyclical but structural, requiring more than just short-term fixes. Rising interest rates and growing Federal Debt could have a ripple effect on the markets. Higher interest rates generally lead to lower stock prices, and concerns about the Federal Debt could impact investor sentiment, possibly leading to increased market volatility.

The U.S. debt situation has global implications as well. As the issuer of the world’s primary reserve currency, any instability in the U.S. financial system could have a cascading effect on global markets.