Despite upside surprises in PPI and CPI these past two sessions, equities initially refused to meaningfully sell-off with S&P extending gains off the payrolls lows, heading towards its 4450 Call Wall (as SpotGamma notes, the reason for stalling to the upside is that gamma builds sharply up into the 4,450 area and 4,500 is where they see max upside ahead of the 10/20 OpEx)…

BUT… and it’s a big BUTT.

Small Caps had been suffering but it took a seriously ugly 30Y auction (after yesterday’s ugly 10Y auction) to spark selling pressure across the rest of the majors… (Small caps were the worst performers by a big margin)

…as yields surged (with the long-end lagging)…

Source: Bloomberg

The psychology of rates players heading into today can be summarized as follows (h/t Nomura’s Charlie McElligott):

1. The people in Macro Rates with actual positive performance (have been short and/or in steepeners of late) are increasingly being incentivized to monetize and protect P&L into year-end.

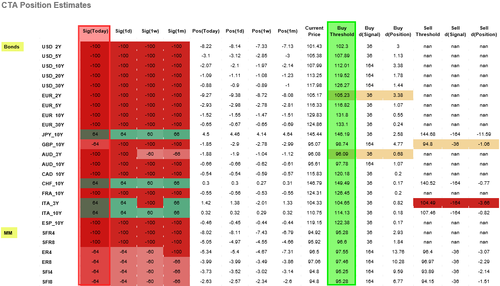

G10 Bond and STIRS (MM on the table) signals remain consensually “Short” outside a handful of securities, as “in-aggregate” across the five time horizons in the model, the vast majority of said legacy “Short” signals remain deeply “in the money” (particularly with an extremely heavy “loading” or weighting in the 12m model, due to the magnitude of the signal strength over that time horizon)

2. Real Money has been struggling mightily with scar-tissue after multiple failed attempts to catch the falling “Duration knife” YTD, and have been tepid and scared to dip toes in again… until the last week, as the magnitude of the rally picked up speed with more “synthetic short Gamma / negative Convexity” acting as “chasing” buyers the more we rally.

Hope…

But today’s bloodbath of a 30Y auction once again slapped those duration-chasers in the face once again…

Source: Bloomberg

So much for the Israel-Hamas Flight-to-Safety bid.

But we do note that from Friday’s close, yields are still lower…

Source: Bloomberg

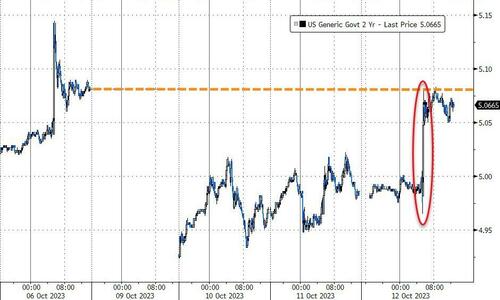

With the 2Y yield’s surge stalling at Friday’s close…

Source: Bloomberg

And the yield curve (2s30s) resteepened…

Source: Bloomberg

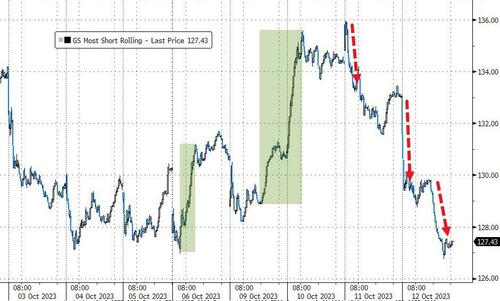

“Most Shorted” stocks double-puked today…

Source: Bloomberg

Now in the red for the year…

Source: Bloomberg

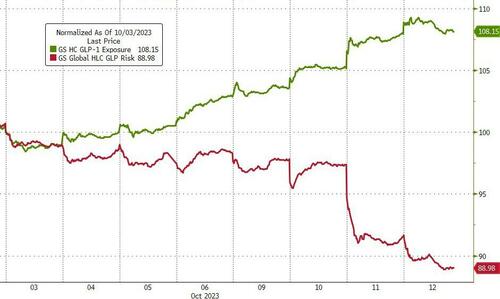

Meanwhile, the GLP-1 Agonists are killing it…

Source: Bloomberg

Energy and Tech stocks were the only sectors green…

Source: Bloomberg

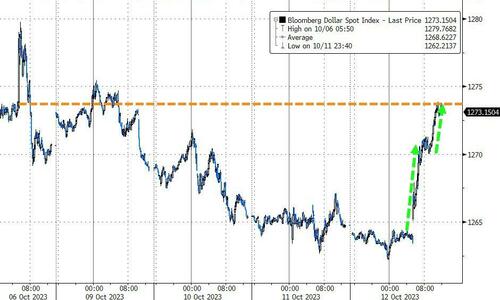

The dollar exploded higher on the day, back to pre-payrolls spike levels. Today was the dollar’s second biggest daily gain since March…

Source: Bloomberg

Bitcoin ended the day unchanged after a pump’n’dump, holding above the $26,500 level…

Source: Bloomberg

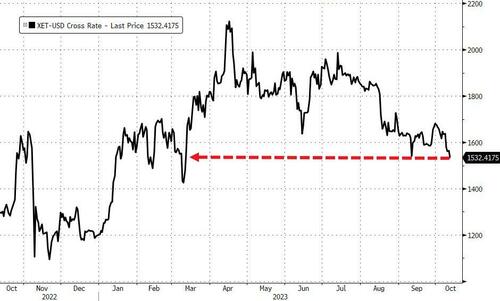

Ethereum was dumped for the 9th day in the last 12 to its lowest close since March…

Source: Bloomberg

Gold ended lower on the day, erasing overnight gains…

Oil prices ended unchanged but not before a lot of intraday vol…

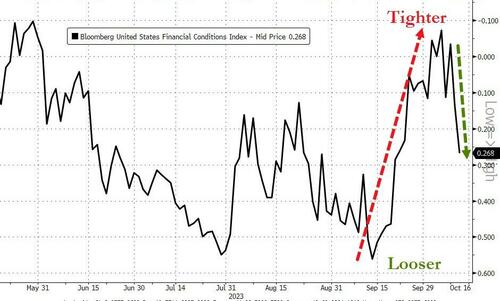

Finally, maybe The Fed should watch more and and speak less… just days after The Fed says “the market did the tightening job” for them over a few weeks, the market undoes that job in just a few days…

Source: Bloomberg

Maybe today’s dollar surge and carnage in credit will start the tightening once again?

Additionally, there was $82bn sucked out of The Fed’s reverse repo facility overnight…

…and it’s not going into stocks.