We’ve got a problem!

We’ve got a problem!

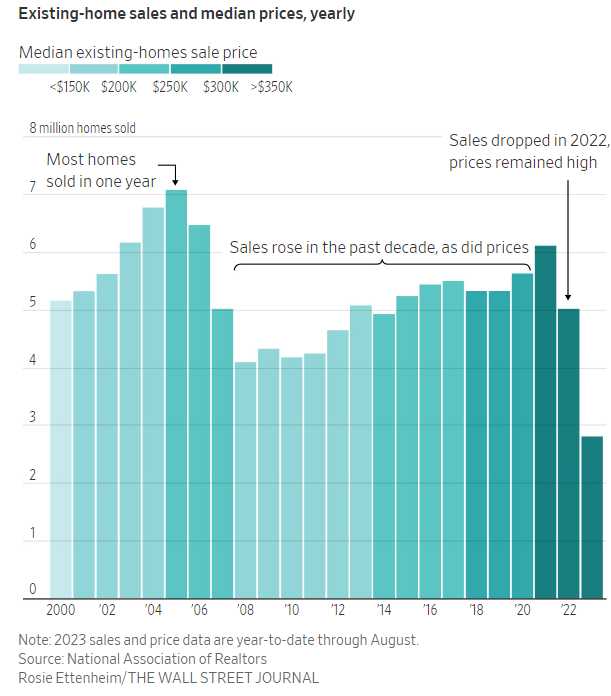

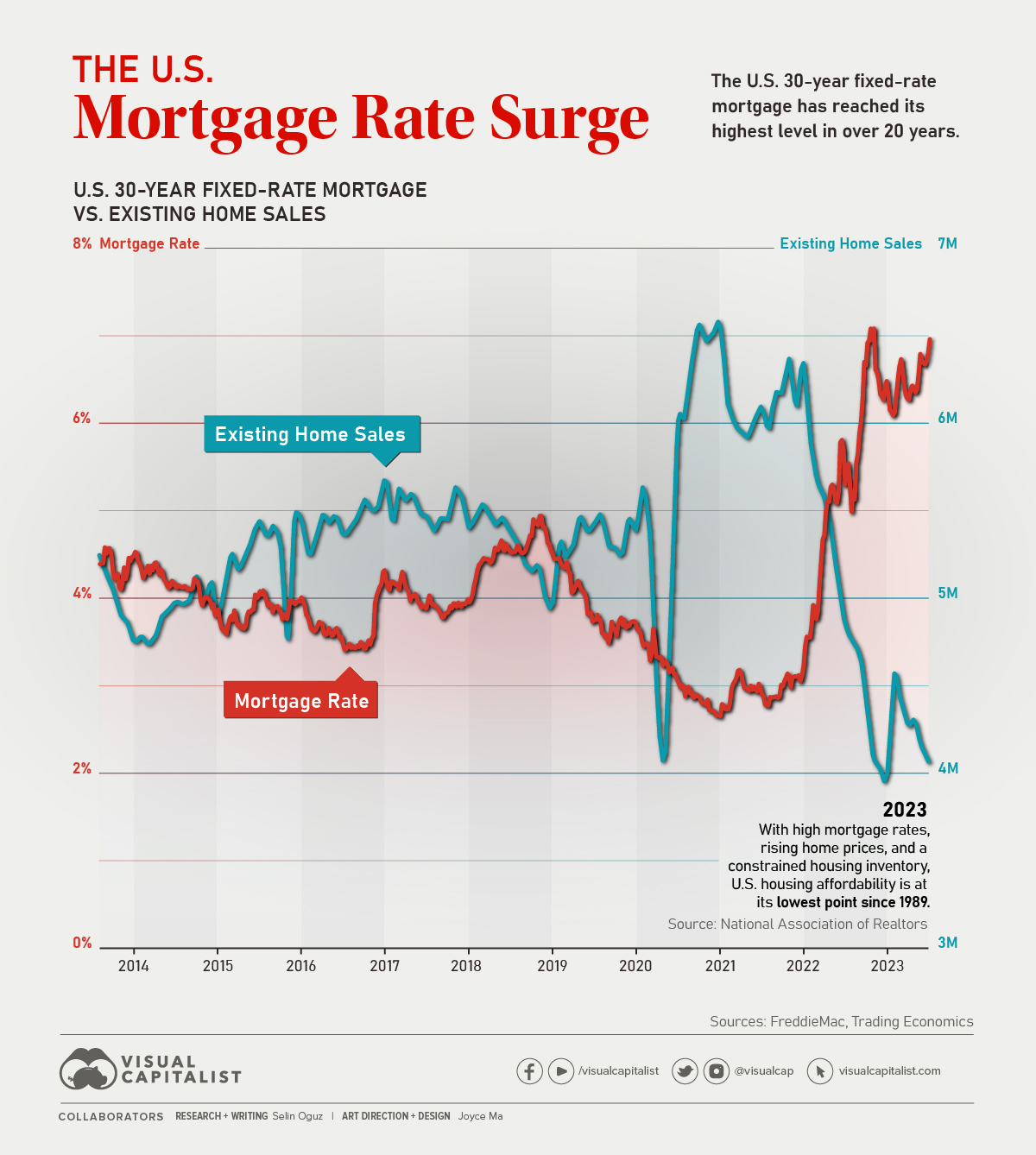

The highest mortgage rates in 23 years are causing the biggest housing slump since the Great Crash of 2008, which was also preceded by 3 years of rising prices. home-buying affordability fell over the summer to its lowest level since 1985. With mortgage rates rising and prices not falling, only those with high incomes or plenty of cash can afford to buy homes. This will lead to a more significant societal issue if not addressed – and who has time to address it when we’re fighting two wars and the World is melting?

🤖 Housing’s Domino Effect: Facts and Figures

-

-

Consumer Spending: The housing market is a significant driver of consumer spending. According to the National Association of Home Builders, building 100 single-family homes generates $28.7 million in wage and business income and $11.1 million in federal, state, and local tax revenue. A slump in the housing market means less income and less tax revenue, affecting public services and infrastructure.

-

Employment: The housing sector directly and indirectly employs millions. From construction workers to real estate agents to loan officers, a slowdown in home sales can lead to job losses. For example, the housing market accounts for nearly 15-18% of the U.S. GDP, according to various estimates. A decline in this sector could significantly impact employment rates.

-

Banking and Finance: Mortgages make up a significant portion of bank loans. A decline in new mortgages affects the banking sector’s profitability. During the 2008 crisis, mortgage-backed securities (MBS) led to massive losses for financial institutions, and we could see a similar trend if the current situation worsens.

-

Rental Market: As home ownership becomes less attainable, more people turn to renting. This increased demand pushes up rental prices. According to the U.S. Census Bureau, the median asking rent has increased by approximately 20% over the last five years.

-

Social Mobility: Home ownership is often considered a form of ‘forced savings’ that allows families to build wealth over time. A decline in home ownership rates could exacerbate wealth inequality. The Federal Reserve’s Survey of Consumer Finances indicates that the median net worth of homeowners is significantly higher than that of renters.

-

Secondary Markets: A decline in home sales also affects secondary markets like home improvement and furnishings. Companies like Home Depot and Lowe’s could see a decline in sales, affecting their stock prices and, by extension, the stock market.

-

Local Governments: Property taxes are a significant revenue source for local governments, funding everything from schools to emergency services. A stagnant or declining housing market could lead to reduced tax revenues, affecting public services.

-

The interconnectedness of the housing market with various sectors of the economy makes it a critical area to monitor, especially for investors looking to understand broader market trends and risks.

Still, you have to be careful where you place your bets. Trade like this can SEEM obvious but then the Government intervenes and you can be caught on the wrong end of a trade. Our friend Carl Icahn recently bet against the future of U.S. shopping malls using credit-default swaps (CDS), essentially insurance policies insuring bonds against losses and lost his ass(ets).

At PSW, we were going long on Simon Property Group (SPG) and Tanger Factory Outlets (SKT) and we were very happy but Carl had a $2.1Bn bet against malls and got hit with a $742M loss last year, which was one of the factors that sent his fund (IEP) spiraling down this year.

Icahn alleges that the market was rigged against him by his trading counterparties. He points to the fact that the debt for Crossgates Mall, for example, was sold at a price just high enough to avoid triggering CDS payouts as evidence of market manipulation. Small differences in asset prices can translate into hundreds of millions of dollars won or lost on derivative bets. What happened with Icahn’s bet could be indicative of broader issues in the derivatives market, where small manipulations can have outsized impacts.

We called the comeback of malls because of math – there’s a limit to how much ECommerce can deliver to your door and there’s no substitute for trying on shoes or feeling the fabric of clothes you want to buy. ECommerce is now 16% of Retail sales and we predicted the 80/20 rule was likely to be a barrier for ECommerce Growth, where slowing market share has been masked by inflation – so far.

As to housing, low interest rates, high salaries, and other benefits acquired during the pandemic have led to a form of inertia among Americans. People are reluctant to change jobs or homes because they fear losing these advantages. For instance, homeowners are holding onto sub-3% mortgages, unwilling to trade up to more expensive homes with higher interest rates, causing an inventory shortage – which is keeping housing prices high even as numerical sales fall off a cliff.

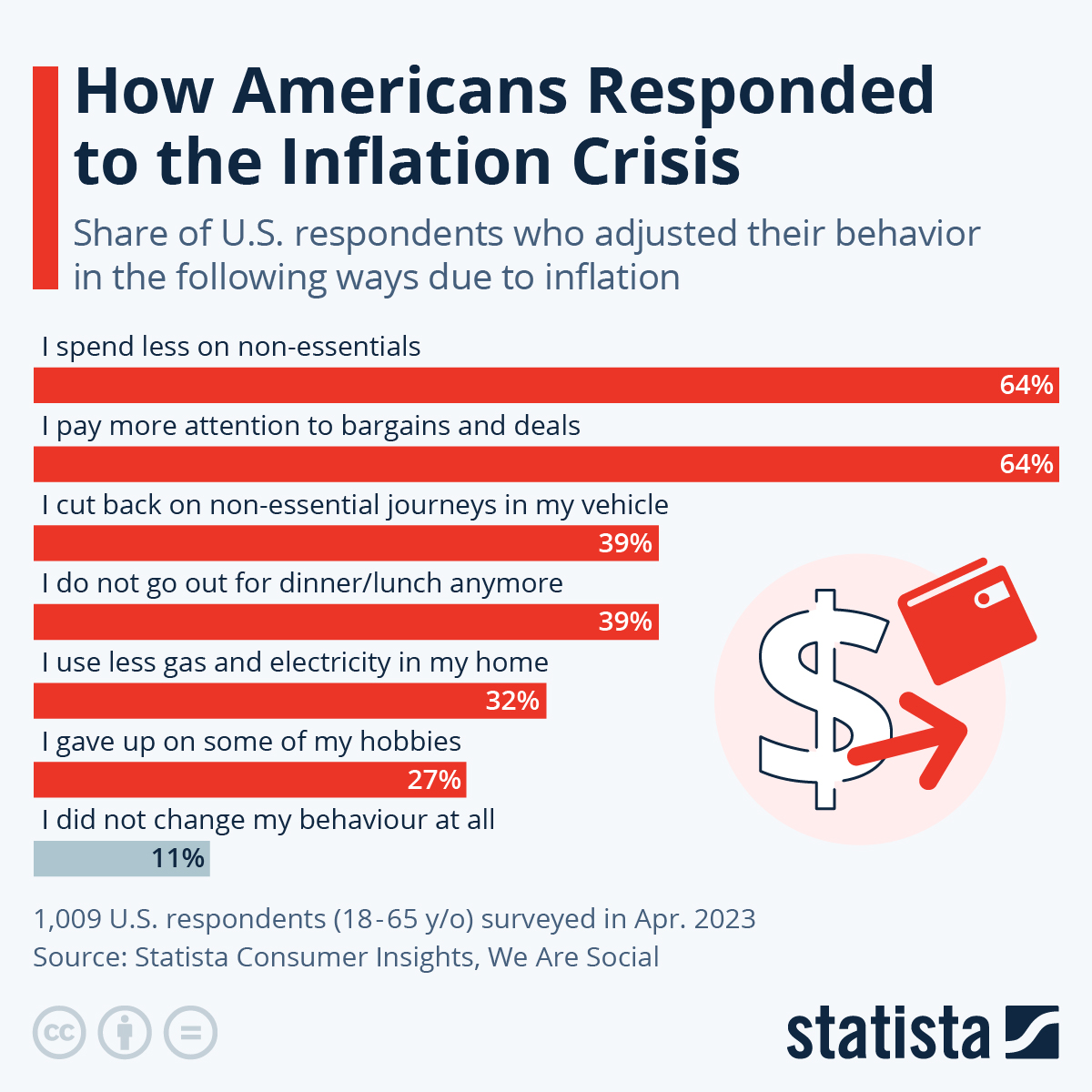

The Federal Reserve’s strategy to combat inflation by raising interest rates is exacerbating this issue. While it may help control inflation, it’s also diminishing consumers’ buying power, making them even more reluctant to make significant life changes. This situation could be indicative of a larger issue: the erosion of the American dream, the belief that better opportunities are always within reach. If people continue to feel stuck even after interest rates eventually lower, it could signal a more systemic problem that may require more than just monetary policy adjustments.

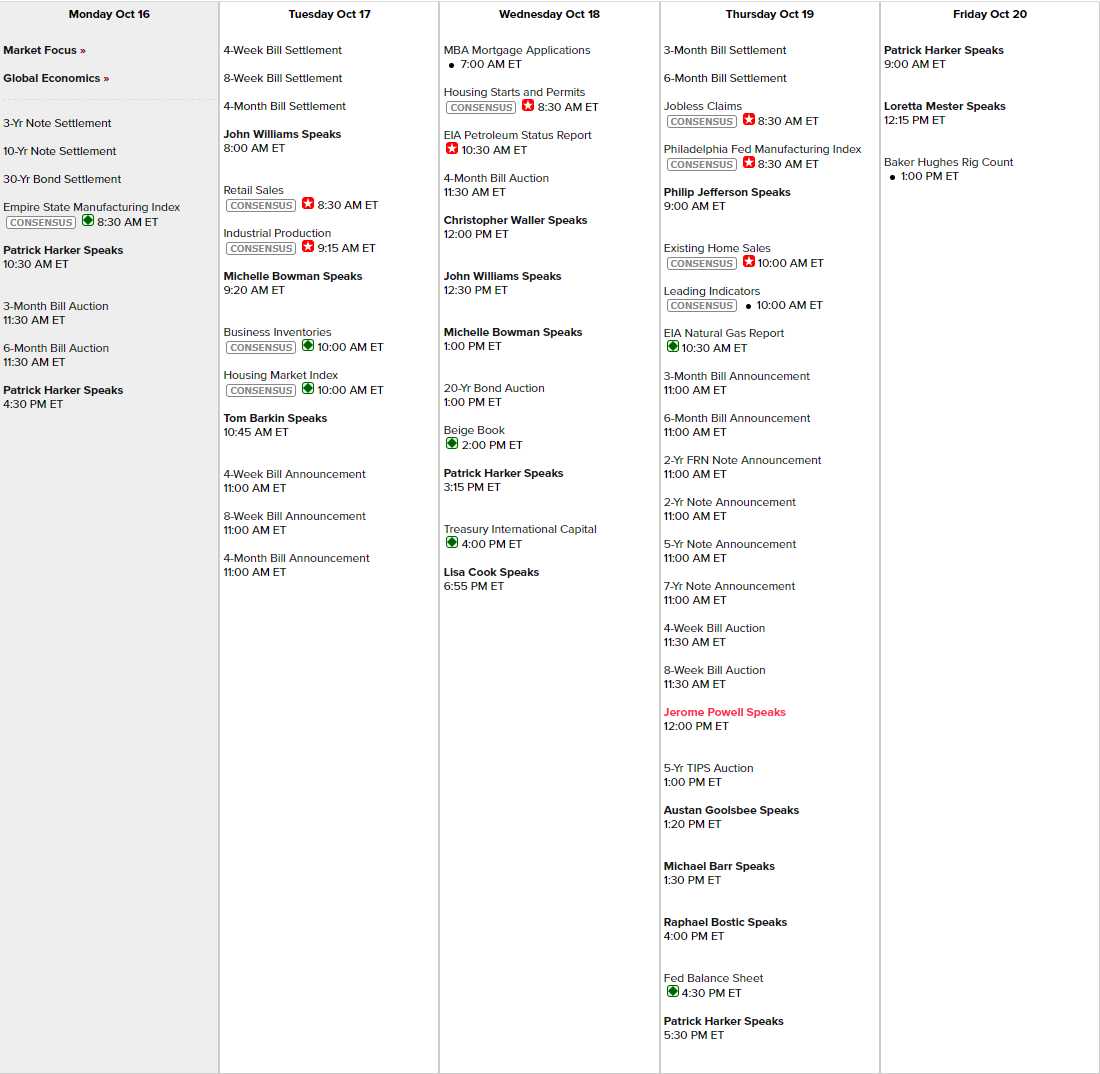

We will get our Retail Sales Data tomorrow morning, along with a week’s worth of Housing Data and 18 Fed Speeches starting with Patrick Harker, who leans doveish, this morning at 10:30. Powell speaks on Thursday along with some bond auctions. He’ll be the lunch entertainment at the Economic Club of New York and you know the local Banksters will be pressuring him for an indication of what will happen at the Nov 1st meeting.

We will get our Retail Sales Data tomorrow morning, along with a week’s worth of Housing Data and 18 Fed Speeches starting with Patrick Harker, who leans doveish, this morning at 10:30. Powell speaks on Thursday along with some bond auctions. He’ll be the lunch entertainment at the Economic Club of New York and you know the local Banksters will be pressuring him for an indication of what will happen at the Nov 1st meeting.

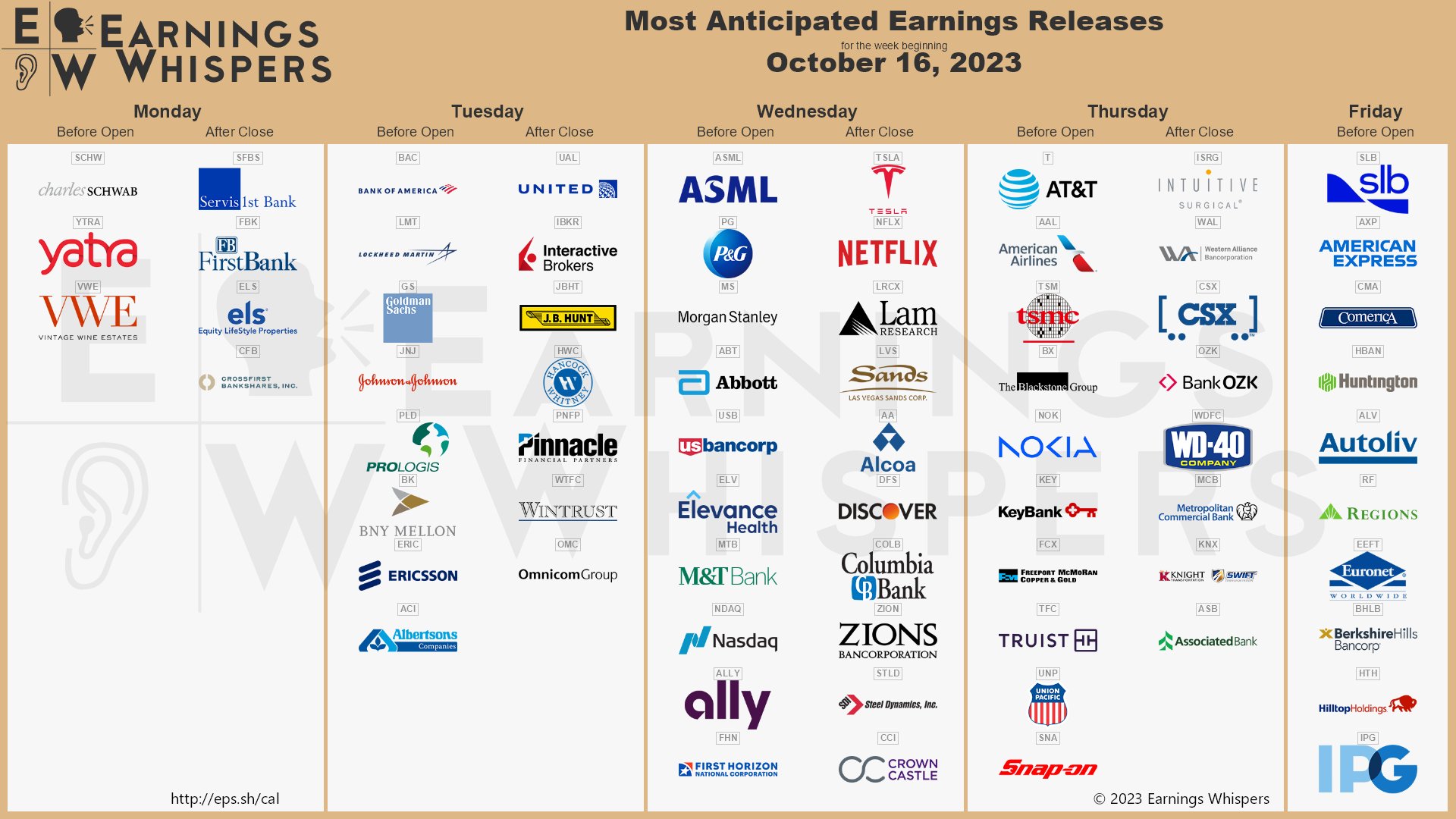

Not too much exciting data this week so that means the focus will be on earnings and we have plenty of those.

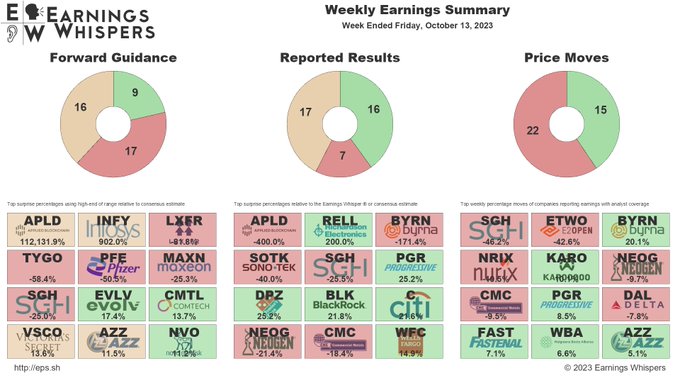

Despite all the good news from the Big Banks last week, the rest of the S&P 500 has been crap so far – check out the scorecard:

17 negative guidance reports? 22/15 (60%) negative price moves? Take advantage of the bounce to bulk up those hedges we discussed on Friday! Speaking of what we discussed, after a bit of retooling, Claude AI is back to writing our weekend wrap-ups at PSW and he did such a great job this week that we had time for a very interesting discussion, which I documented in the comment section.

It’s going to be an interesting week – AND we have options expirations as well…

- Opinion: A US Armada Is Growing Off Israel’s Shore. What’s Next?

- Israel Is Preparing for ‘Significant’ Ground Operation in Gaza

- Trauma Over Hostages Shapes Israel’s Unflinching Gaza Response

- Charting the Global Economy: Broader Mideast War Risks Recession

- ECB’s Nagel Says Upside Inflation Risks Still ‘Pretty Present’

- Investors zero in on health of consumer with retail sales, earnings

- Ex-Walmart CEO Says US Consumers Reaching ‘Breaking Point’

- A Soft Landing in the U.S. Could Be Hard for Everyone Else

- China’s Birth Rate Plummets 10% To Lowest On Record

- Key takeaways from the IMF/World Bank meetings

- Big Bank Loan Volumes Continue To Decline As Deposit Outflows Return

- Big-Bank Profits May Be Higher, but for How Much Longer?

- Stellantis, Ford furlough another 1,250 workers because of UAW strike

- UAW says it may call more strikes at Big Three ‘at any time’

- Widespread use of weight loss drugs faces major hurdles, experts warn

- What’s driving up prices for sporting events? Taylor Swift is one factor, alongside inflation and pent-up demand