By John Kemp, Senior energy analyst at Reuters

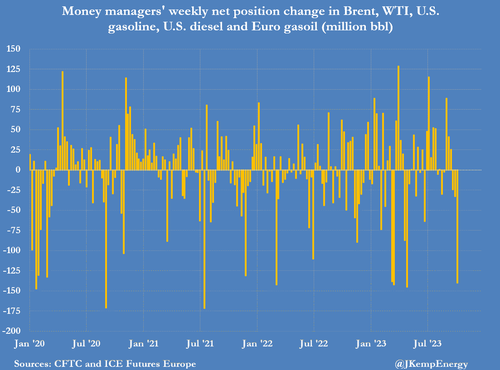

Portfolio investors have dumped positions in petroleum at some of the fastest rates in the last decade in the most recent week as the bullish sentiment that built up after OPEC+ production cuts evaporated.

Investors reacted negatively to the end of the squeeze on inventories around the NYMEX delivery point, oil prices breaking lower, rising borrowing costs, and the growing threat of conflict in the Middle East.

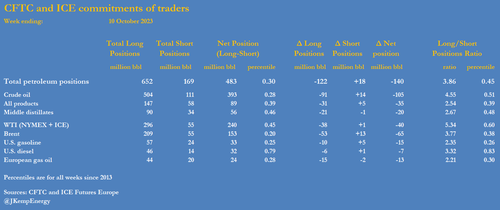

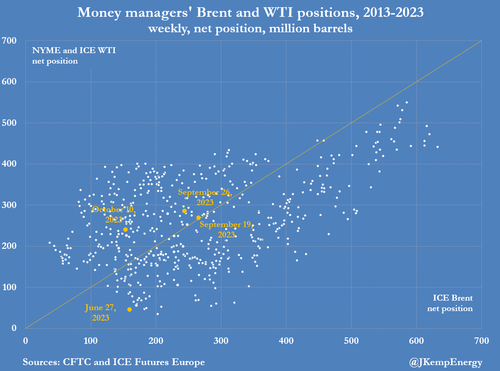

Hedge funds and other money managers sold the equivalent of 140 million barrels in the six most important petroleum futures and options contracts over the seven days ending on October 10. The sales volume was the 14th largest in 552 weeks since March 2013, based on records filed with ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

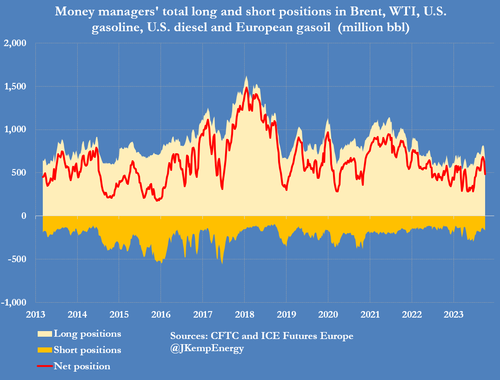

Funds slashed their total positions by 197 million barrels over the most recent three weeks, reversing about half of the 398 million barrels purchased over the previous 12 weeks since the end of June.

As a result, the combined position was reduced to 483 million barrels (30th percentile for all weeks since 2013) down from 680 million barrels (64th percentile) on September 19.

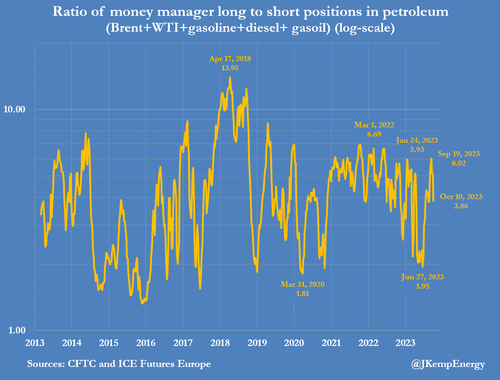

The ratio of bullish long positions to bearish shorts was cut to 3.86:1 (45th percentile) from 6.02:1 (81st percentile) as the bullish froth that had accumulated was blown away.

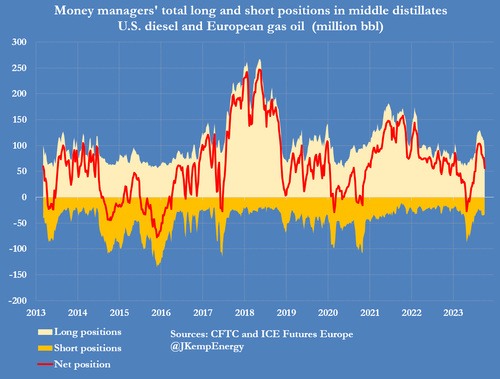

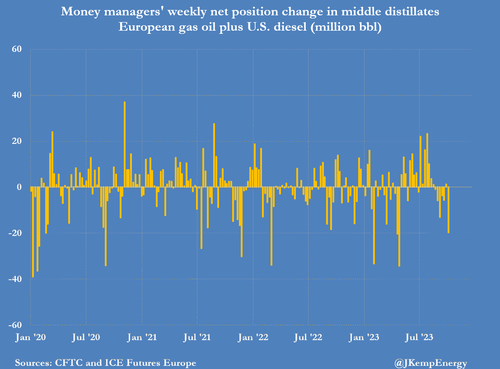

The most recent week saw massive sales across the board, including Brent (-65 million barrels) and NYMEX and ICE WTI (-40 million), U.S. gasoline (-15 million), European gas oil (-13 million) and U.S. diesel (-7 million). Most of the adjustment came from liquidation of former bullish long positions (-122 million barrels) rather than initiation of new bearish short ones (+18 million).

Positions in NYMEX and ICE WTI and in U.S. diesel are still basically bullish, reflecting low crude inventories around the Cushing delivery point, low distillate inventories and the resilience of the U.S. economy.

But positions in Brent, U.S. gasoline and European gas oil have become bearish, amid growing threats to the global economy and the risk that production of extra distillates to rebuild depleted stocks will leave the market with too much gasoline as a co-product.

Net positions in Brent (20th percentile), U.S. gasoline (25th percentile) and European gas oil (28th percentile) were all well below their long-term averages.

The net position in Brent was basically back to the recent low at the end of June when the front-month contract was trading only a little above $70 per barrel.

U.S. NATURAL GAS

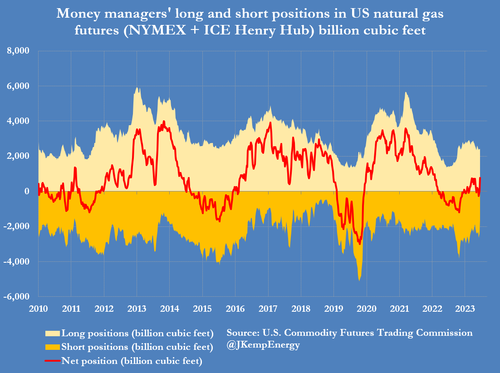

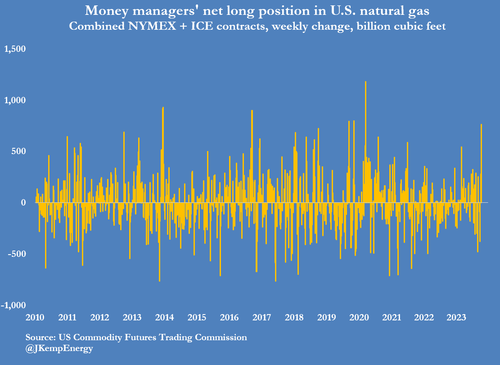

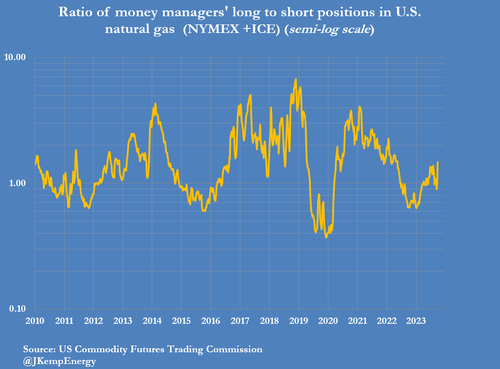

In contrast to oil, investors became much more bullish about the outlook for U.S. gas, buying the most gas in a single week for more than three years since March 2020.

Hedge funds and other money managers purchased the equivalent of 766 billion cubic feet in the two principal futures and options contracts over the seven days ending on October 10.

Rising prices finally triggered a severe bout of short covering, with short positions slashed by 780 billion cubic feet, even as longs were trimmed by 14 billion cubic feet.

The combined position was marginally below the 50th percentile for all weeks since 2010 up from just the 21st percentile two weeks earlier.

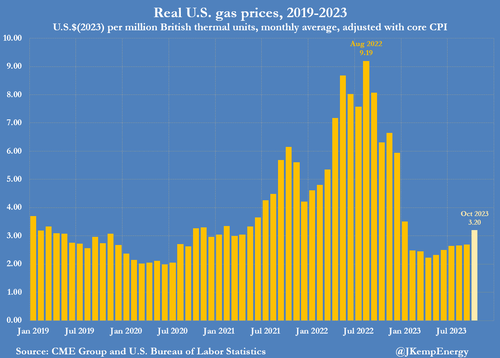

Front-month futures prices have averaged $3.20 so far in October, the highest since January, and up from just $2.20 in April.

After adjusting for inflation, prices are in the 14th percentile for all months since 2000, still well below the long-term average, but up significantly from the 2nd percentile in April.

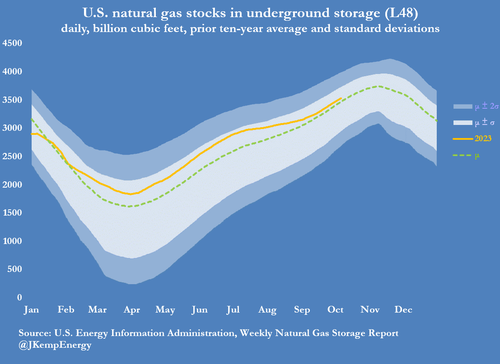

The most recent long-range government weather forecasts show average temperatures lower than last winter even if they remain significantly above the long-term average.

With working inventories just 60 billion cubic feet (+2% or +0.23 standard deviations) above the prior ten-year seasonal average…

… the prospect of a colder winter has been enough to lift prices off their previous lows at last.