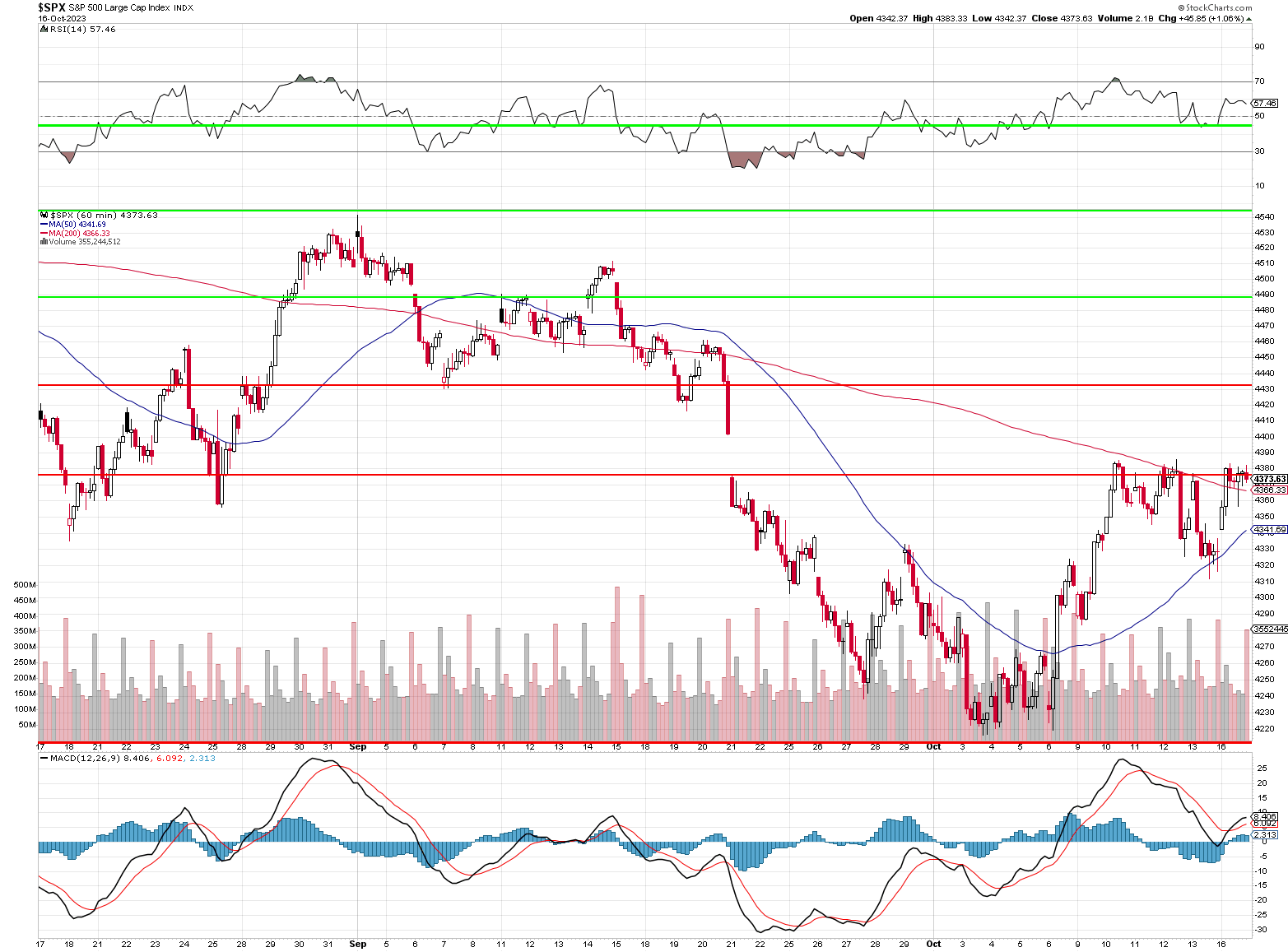

Down 3% since our Sept 12th Review:

It's not so bad, really. We were down 6% earlier in the month and we're halfway back and, more importantly, the S&P is perfectly following the lines of our 5% Rule™, which means it's nice and predictable for our Members and we've been able to add new trades at the bottom (see Watch List Wednesday – Bargain Hunting During the Sell Off) and boost our hedges as we top back out (see Fickle Friday – Checking our Hedges into Earnings Season).

The timing of our buys (Sept 27th) and hedges (Oct 13th) seem perfect and prescient but we're just following our 5% Rule™, which tells us where resistance is likely to be and we combine that with FUNDAMENTAL analysis - which takes into account ALL THE NEWS IN THE WORLD - Financial and otherwise, which we then use to decide whether or not those resistance lines will be a bounce or a pause on the way to the next level.

The difference between TA and our 5% Rule is TA people draw lines like those AFTER the chart is formed - we drew those lines 3 YEARS AGO!

All this war stuff makes it extra tricky and we're currently playing the market in a fairly balanced fashion though we are looking to press our hedges into the later part of earnings season as we think small caps are going to start showing some strain.

I reviewed our Economic Pain Points last month and, other than adding the war, not much has changed so let's get right into our reviews, starting with the Money Talk Portfolio, which is very interesting as we can't touch it when we're not on the show, so it's a great barometer for what is going on in an unhedged and unadjusted portfolio:

Money Talk Portfolio Review: I was last on the show July 26th and will be on again next month and we weren't worried enough to hedge - especially because we were up 307.2% at the time (4 years) at $407,234 and 75% in CASH!!!