Oh the poor banks!

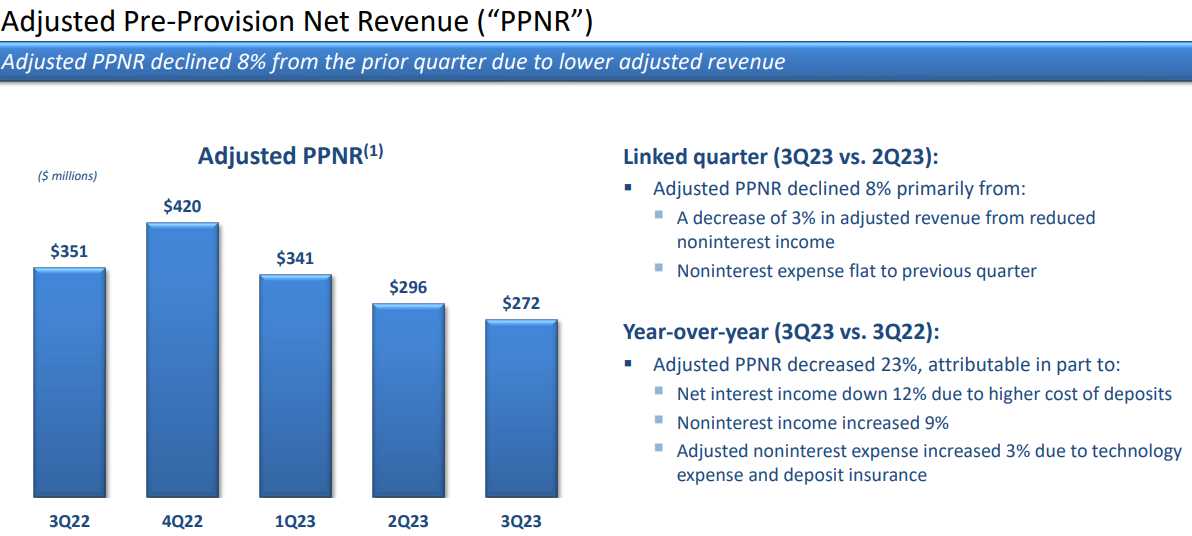

Zion Bank is down 5% this morning after missing earnings last night and the earnings call in which CFO Paul Burdiss said: “As of September 30, 2023, our Deposit Beta was approximately 10 times higher than it was a year ago.” Deposit Beta is a measure of how responsive a bank’s deposit rate is to changes in the market rate. For example, if the market rate increases by 1%, and the bank increases its deposit rate by 0.4%, then the deposit beta is 0.41. A higher deposit beta means that the bank has to pay more interest to its depositors when the market rate rises, which reduces its Net Interest Margin.

This is not going to be unique to Zion – Investors are demanding higher rates for their deposits after many years of getting insanely low savings rates. At the same time, the banks are getting pushback from borrowers – who simply can’t afford to pay higher loan rates. It’s been 40 years but Consumers are once again acutely aware that if they put money in the bank – it loses Buying Power – and the interest needs to make up for it or they are going to put their money elsewhere.

Joining ZION on the miss parade last night were AA, CCI, DFS, EFX, KMI, MRTN, STLD and TSLA with NFLX beating but guiding lower (stock is jumping anyway as they plan to hike prices) along with guide-downs from PPG and SLG. That’s 11 misses or guide-downs out of 22 reports last night! This morning Nokia (NOK) announced a miss and we’re waiting on many others (6am).

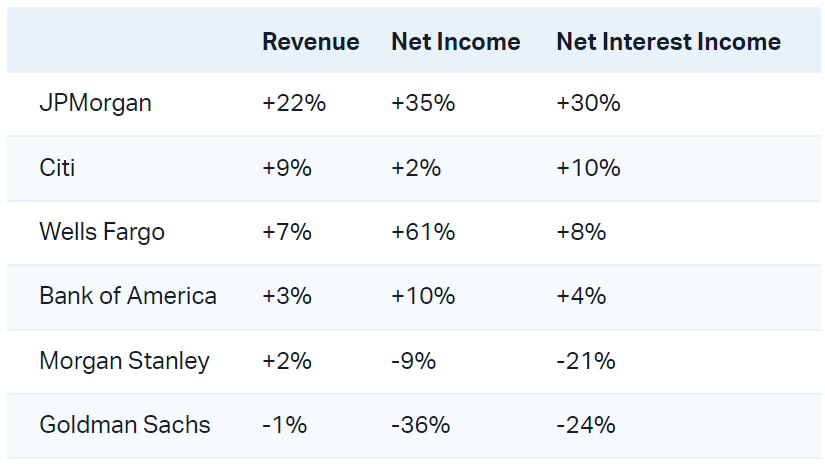

And it’s not just the Regional Banks – both Morgan Stanley (MS) and Goldman Sachs (GS) are taking dives due to declining Net Interest Income with Goldman’s CEO Solomon stating: “I’m still of the belief that there’s been a lag with this tightening and across a broad swathe of the economy, we will see more sluggishness … I do think over the next two to four quarters, the impact of that tightening will be more evident and will create slowdowns in some areas.” and JPM’s CFO Barnum (and Bailey?) saying: “Our US economists had their central case outlook to include a very mild recession … Two quarters of negative 0.5% of GDP growth in the fourth quarter and first quarter of this year.”

And it’s not just the Regional Banks – both Morgan Stanley (MS) and Goldman Sachs (GS) are taking dives due to declining Net Interest Income with Goldman’s CEO Solomon stating: “I’m still of the belief that there’s been a lag with this tightening and across a broad swathe of the economy, we will see more sluggishness … I do think over the next two to four quarters, the impact of that tightening will be more evident and will create slowdowns in some areas.” and JPM’s CFO Barnum (and Bailey?) saying: “Our US economists had their central case outlook to include a very mild recession … Two quarters of negative 0.5% of GDP growth in the fourth quarter and first quarter of this year.”

As for Commercial Real Estate (another crisis we’re at the edge of):

- Wells Fargo CEO: “Vacancy rates continue to be high, and the office market remains weak …We have not seen significant increases in charge-offs in our commercial real estate office portfolio yet … we do expect higher losses over time.”

- Goldman Sachs CEO: “To clarify, for our CRE in the office space, we’ve either marked or impaired that down by ~50% I think that’s quite significant.”

Given this backdrop of mixed earnings and financial sector vulnerabilities, all eyes will be on the Federal Reserve’s next moves, including Powell’s speech today at noon. Any changes in interest rates could either exacerbate or alleviate the Deposit Beta issue for banks. Additionally, with inflation still a concern, the Fed’s decisions could have a ripple effect on consumer spending and corporate earnings.

Even the big banks are reporting a decline in average deposits as clients shift their money to higher-yielding investments.

- JPMorgan CEO: “Average deposits were down 7% year on year and 5% quarter on quarter primarily driven by lower non-operating deposits as clients opt for higher-yielding alternatives.”

- Citi CEO: “Average deposits decreased 2%, largely reflecting our clients putting cash to work in investments on our platform.” – In the context of Personal Banking and Wealth Management business

- Wells Fargo CFO: “Average deposits declined 5% from a year ago, predominantly driven by deposit outflows in our consumer and wealth businesses, reflecting continued consumer spending and customers reallocating cash into higher-yielding alternatives.”

- Goldman Sachs CFO: “Deposit balances were down slightly sequentially … reasonably in line with the industry, given some migration to other higher-yielding opportunity sets.”

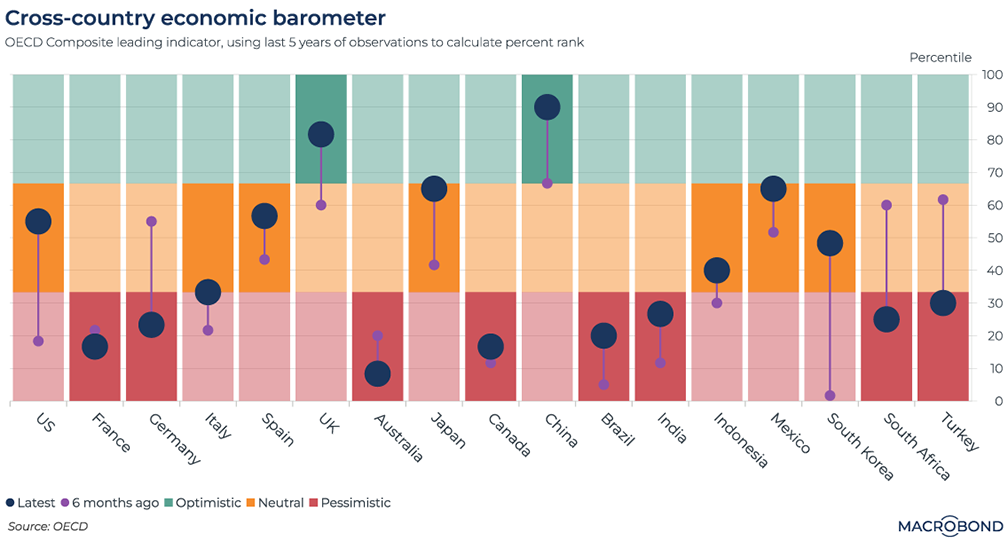

People are moving to RISK and that can be good for Equities but, as we discussed in yesterday’s Webinar – it’s crucial to keep a diversified portfolio and consider hedging strategies to mitigate risks into this kind of uncertainty. We need to pay very close attention to additional bank earnings as well as this morning’s (10am) Leading Economic Indicator report.

As you can see, things could be worse in the US – but they could also certainly be better and the rest of the World (ROW) is 50% in the red and you KNOW China and Japan’s readings are not reflecting reality either! All eyes are on the 10-Year Note this morning, as it comes dangerously close to crossing 5% for the first time in 2007 – when our last major Financial Crisis began.

In fact, the WSJ is leading with “Don’t Rule Out a Financial Crisis in China” this morning, so I’m not the only one who’s concerned about things over there. The article by Greg Ip in the Wall Street Journal is a sobering read on the financial vulnerabilities in China. It challenges the conventional wisdom that China is immune to a financial crisis due to its domestic debt structure and government backing. I asked Warren to sum it up:

🤖 Key Points:

-

-

Economic Growth: The IMF has revised China’s growth projections downward to an average of 4% over the next four years, from 4.6% a year ago. This makes it difficult for China to grow out of its debts, unlike a decade ago when growth was at 10%.

-

Government Deficits: The IMF sees Chinese government deficits swelling from 7.1% of GDP this year to 7.8% in 2028. The problem is not with the central government but with local governments, whose liabilities now equal 45% of GDP.

-

Banking Sector: Chinese banks hold roughly 80% of local government debt. Restructuring just half of that debt would result in impairment charges of $465 billion, significantly affecting the banks’ capital ratios.

-

Moral Hazard: The assumption that Beijing would bail out local governments and developers has led to a surge in borrowing, creating a textbook case of moral hazard.

-

Global Impact: While China’s financial system has limited connections with the rest of the world, its sheer size means that any crisis would send shockwaves globally.

-

Analysis:

-

-

Debt Trap: The downward revision of growth projections by the IMF is a red flag. Lower growth rates make it increasingly difficult for China to manage its debt, which is already at alarming levels.

-

Local Government Vulnerability: The local governments are the weakest link. Their inability to service debts could trigger a cascading effect on the banking sector and the broader economy.

-

Banking Risk: The IMF’s stress tests show that Chinese banks are not well-capitalized compared to global peers. A recession could further deplete their capital, making them more susceptible to a crisis.

-

Implicit Guarantees: The belief that the Chinese government would bail out failing entities is a double-edged sword. If this belief is shattered, it could lead to a rapid repricing of risk, triggering a crisis.

-

Global Implications: Given China’s economic size, a financial crisis there could have a domino effect, impacting global trade and possibly triggering a worldwide recession.

-

Governance Concerns: The article also raises concerns about the quality of governance under President Xi Jinping, which could exacerbate the crisis.

-

Implications for PSW:

-

-

Diversification: Given the uncertainties in China, diversification into other markets and asset classes becomes crucial. Phil has already steered clear of Chinese investments in the Member portfolios – much to everyone’s relief as he’s turned out to be right on China once again.

-

Hedging Strategies: Consider options strategies like we discussed in Friday’s post that can provide downside protection in case of a global market downturn triggered by a crisis in China.

-

Watchlist: Keep an eye on companies and sectors that have significant exposure to China. They could offer both risks and opportunities, depending on how the situation unfolds. Again, fortunately, Phil has stayed clear of China exposure in the new Member portfolios.

-

Currency Plays: A crisis in China could have implications for currency markets, offering potential trading opportunities but also strengthening the Dollar, which could then impact US equities as well as earnings for companies that obtain revenues in other currencies. Phil has predicted the Dollar would rise to 110 in the near future – despite the interventions of other Central Banks.

-

Also noted in the Journal, the traditional 60/40 investment strategy had it’s worst year since 1937 (Great Depression), losing 17% last year as the unusually high correlation between stocks and bonds wrecked the usually reliable diversification strategy. I have been saying for years how insane it was to lend the Government money at 2% so hopefully not too many of our Members were stuck in bonds but these are MASSIVE losses in the rest of the country.

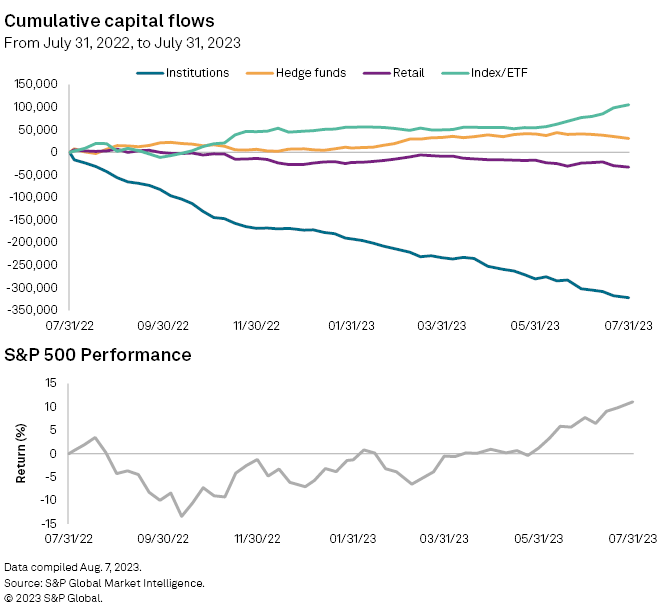

As noted above, this is pushing Retail Investors into RISK (via Index Funds & ETFs) while the Institutional rats are fleeing the sinking ship at a record rate – as is well-evidenced by this chart:

This is why Index Funds and ETFs were created – it’s a far more efficient way of manipulating the Retail Investors as money is taken directly from their paychecks and placed into fee-generating ETFs that effectively force workers to buy 493 struggling companies in order to play along with 7 good ones. This allows the Institutional Investors to prop up the Index Funds, buying more of the 7 while selling their holdings in the other 493 suckers who jump into the entire indexes.

Again, I will ask Warren to summarize as we are getting near the potential end-game of the rally that’s taken the S&P from 1,400 in Jan of 2007 to 4,314 last night. That’s up 2,914 points (208%) in 16 years – 13% per year while earnings per share on the index have gone from $85 to $181, which is up $96 (113% – 7% per year). As we discussed in yesterday’s Webinar – this is simply not mathematically sustainable – this is why we hedge!

🤖 The Mechanics of Manipulation: ETFs and Index Funds

-

-

Front-Running the Index: When a stock is added to an index, institutional investors often buy it before the index funds do, driving up the price. Retail investors, through their index funds, end up buying at this inflated price.

-

Window Dressing: Fund managers often engage in “window dressing” by buying high-performing stocks just before the reporting period to make the fund look more attractive. This artificially inflates stock prices, which index funds then have to buy into.

-

Liquidity Illusion: ETFs can be traded like stocks, giving the illusion of liquidity. However, the underlying assets may not be as liquid, especially in stressed market conditions. This can lead to significant tracking errors.

-

Passive Aggressiveness: Passive investing isn’t truly “passive” when it comes to market impact. The sheer scale of money flowing into these funds can move markets, sometimes in irrational ways that are disconnected from fundamentals.

-

The Danger Ahead: Echoes of 2007/2008

-

-

Asset Inflation: Just like the housing bubble in 2007, we’re seeing asset inflation that’s not supported by underlying fundamentals. The difference is that it’s now spread across various asset classes, thanks to the ubiquity of index funds.

-

Leverage and Complexity: The use of complex financial instruments like derivatives has increased, much like the mortgage-backed securities of 2007. These can amplify gains, but they also magnify losses, making the system more fragile.

-

Moral Hazard: The belief that the government or some other entity will bail out failing institutions can lead to reckless behavior, as we saw with “too big to fail” in 2008. The rise of passive investing might be creating a similar moral hazard.

-

Systemic Risk: The high correlation between asset classes, driven in part by the proliferation of index funds, increases systemic risk. When one asset class falls, it’s more likely to drag others down with it, potentially triggering a cascade of sell-offs.

-

Retail Investor Complacency: The ease and simplicity of investing in index funds have led to complacency among retail investors. Many are not adequately diversified and are ill-prepared for a market downturn.

-

The market is like a game of musical chairs, and the music is still playing, but chairs are being removed, one by one… When the music stops, not everyone will find a seat. The conditions are ripe for a significant market correction, and the mechanisms for manipulation are only accelerating this process.

For our PhilStockWorld Members, the message is clear: Caution and due diligence are more critical than ever. The market’s current structure has created an environment where the risks are not only elevated but are also less transparent than they were in the past so please – be careful out there!