Not Quite a No-Brainer

Courtesy of Michael Batnick

There is no such thing as a no-brainer when it comes to predicting the future. I was reminded of this painful lesson over the weekend when the kicker of the 49ers missed a 40-yard field goal and busted several of my bets.

The 49ers are arguably the best team in the league. While their opponent the Cleveland Browns have an incredible defense, they were without their starting quarterback. And so the 49ers were heavily favored, at -500 on the money line. What this means is that if you bet $500 that the 49ers would win the game, you’d only earn $100. The market thought San Francisco would win pretty easily, with the point spread at -9.5. And alas, they did not. There are no sure things. No-brainers don’t exist.

I say all this to say that while longer-dated maturity bonds look very attractive here, it’s important to stay grounded and humble in the face of an uncertain future.

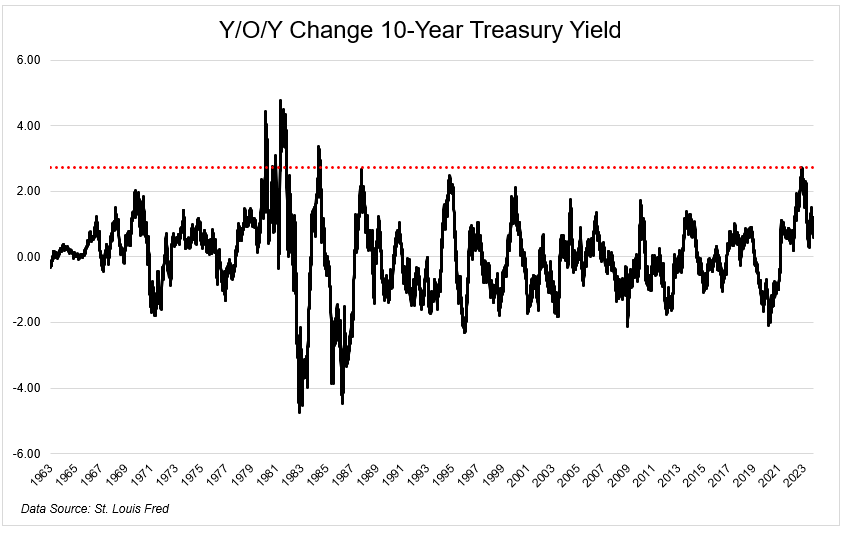

Bonds have gotten massacred over the last couple of years. Bonds across every duration, other than the ultra-short-term, are in their deepest drawdown ever. This is what happens when you get the largest year-over-year increase in rates going back to the late 1980s. The fact that this spike happened from the lowest levels ever was a recipe for disaster. IEF, the 7-10 year treasury bond ETF is currently in a 23% drawdown, and that’s including coupons.

The good news is that we already dragged the fixed-income portion of our portfolios through shards of glass. Investors will have a much better time moving forward. That’s not a prediction, that’s just math.

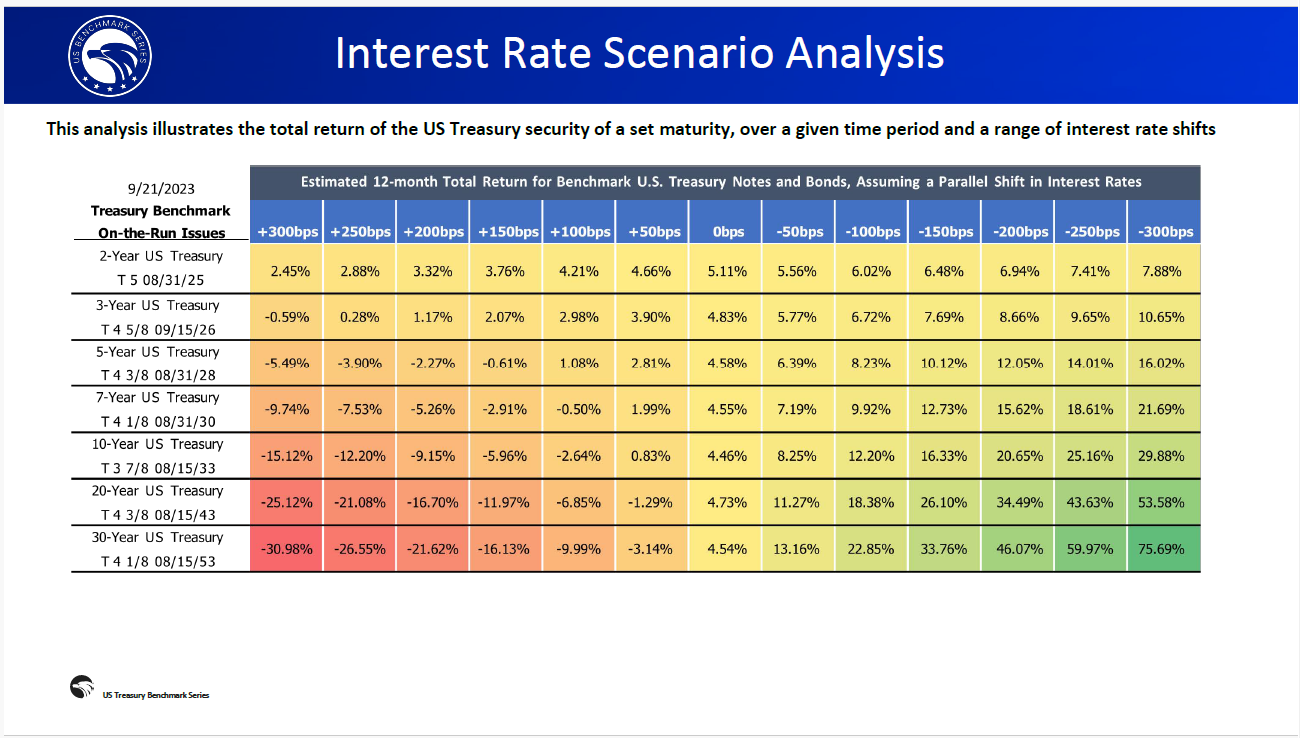

The chart below from US Treasury Benchmark Series shows what will happen to different maturity bonds assuming parallel shifts in the yield curve. You can see across all maturities that the risks are asymmetric.

With yields breaking out to new cycle highs, I’m not brave or dumb enough to say that today is the top, but if the 10-year rises another 100 bps (1%) from here; they will decline ~2.6%. But if it falls 100 bps, they’ll rally 12%. The same shift for 20-year bonds would result in a loss of 6.9% or a gain of 18.4%.

No-brainers don’t exist, but risk-reward certainly does. I think you can make a strong case for extending your duration here. That being said, with cash yielding north of 5%, I can certainly understand the desire for people to sit tight with zero volatility and no chance for a decline in principal. Despite the grueling path it took to get here, I’m happy that fixed-income investors are finally being compensated for the rewardless risk they’ve taken over the last decade. Fixed income finally provides real income.