This is getting repetitive.

This is getting repetitive.

The market SEEMS to be gaining ground but then it drops back off and POOF! – all the gains are gone. This is fine for those of us who believe in gravity and know to sell at the top and we also buy at the bottom because we believe there is a floor that we discover via our Fundamental Analysis and that tells us when we have a good buy point for our stocks.

On Tuesday we went over our 6 Member Portfolios and one of them, our Short-Term Portfolio (STP) is JUST for hedging the others. Hedging is just our way of saying we believe in gravity and I discussed the gravity of the markets yesterday, so I won’t bore you with repetition – but I do want to hammer home the point so do read it if you haven’t yet!

It’s been all downhill since Tuesday morning and you can see there were hopes that Powell would fix things at 1pm yesterday but then he didn’t. Notice we rallied back to just over 4,327 ahead of Powell and that was last Friday’s close – we need to get back to that this morning to have a positive week and, sorry but that’s not likely to happen as Regions Bank (RF) already missed this morning and First Financial (FFIN) missed last night. It certainly could have been worse, but it also could have been much better.

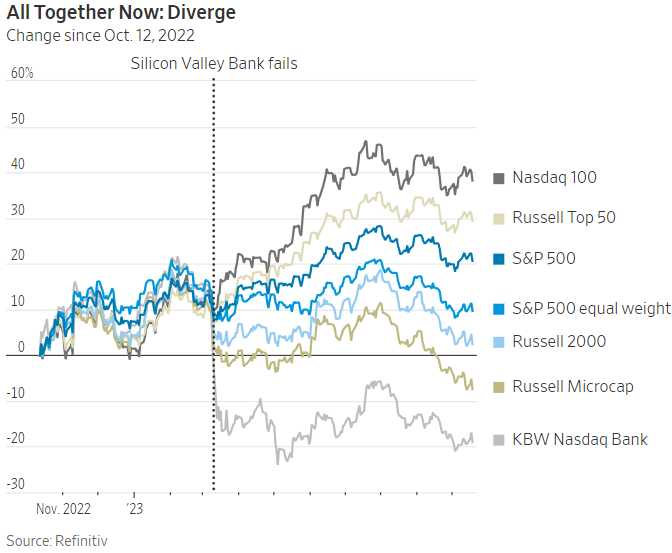

That’s been a theme this year as KBW (the Banking Section of the Nasdaq) has been weighing on the markets since the March collapse of Silicon Valley Bank et al. Fortunately for the Nasaq, the 100 has no banking stocks at all – and it has AI too! So, unlike the rest of the indexes, the Nasdaq has held up very well and the Russell is also not weighed down by banks – and it’s our 2nd best performer – despite it’s recent 20% pullback.

That’s been a theme this year as KBW (the Banking Section of the Nasdaq) has been weighing on the markets since the March collapse of Silicon Valley Bank et al. Fortunately for the Nasaq, the 100 has no banking stocks at all – and it has AI too! So, unlike the rest of the indexes, the Nasdaq has held up very well and the Russell is also not weighed down by banks – and it’s our 2nd best performer – despite it’s recent 20% pullback.

As we’ve discussed in the past, half of the gains in the S&P 500 were driven by merely 8 stocks, a stark contrast to previous bull markets where at least 38 stocks contributed to half the gains. This concentration of gains among the largest stocks is often observed towards the tail end of bull markets, not the beginning. The Government put $2Tn into the banking system in March and we had a rally – that’s the story of 2023 – it has nothing to do with Corporate performance – as I noted yesterday.

That’s why Earnings are dangerous and why we add to our hedges. We KNOW the Emperor has no clothes – we just hope we can march our earnings reports out in public and get away with it before some little boy points at his exposed junk!

That’s why Earnings are dangerous and why we add to our hedges. We KNOW the Emperor has no clothes – we just hope we can march our earnings reports out in public and get away with it before some little boy points at his exposed junk!

Speaking of exposed junk – Tesla (TSLA) is down about 20% since last week as they faced all sorts of issues – including the fact that the guy who destroyed Twitter is still their CEO – that problem became plainly visible during Tesla’s Conference Call where the Notortious MU*S*K had these notable quotes:

“The Cybertruck, I know a lot of people are excited about the Cybertruck. I am too. I’ve driven the car. It’s an amazing product. I do want to emphasize that there will be enormous challenges in reaching volume production with the Cybertruck, and then in making a Cybertruck cash flow positive. This is simply normal for when you’ve got a product with a lot of new technology or any new vehicle, brand new vehicle program, but especially one that is as different and advanced as the Cybertruck, you will have problems proportionate to how many new things you’re trying to solve at scale.”

“We will continue to invest significantly in AI development, as this is really the massive game changer, and I mean, success in this regard in the long term, I think has the potential to make Tesla the most valuable company in the world by far. If you have fully autonomous cars at scale and fully autonomous humanoid robots that are truly useful, it’s not clear what the limit is.”

“We’re also seeing significant promise with FSD version 12. This is the end-to-end AI where it’s a photon count in controls out or really you can think of it as there’s just large midstream coming in and a tiny bit stream going out, impressing reality into a very small set of outputs, which is actually kind of how humans work.”

“We recently completed a 10,000 GPU cluster of H100s. We think probably bringing it into operation faster than anyone’s ever brought that much compute per unit time into production since training is the fundamental limiting factor on progress with full self-driving and vehicle autonomy.”

I’m sure the Muskovites think this is all brilliant stuff and, for that, I have one last quote:

“So off went the Emperor in procession under his splendid canopy. Everyone in the streets and the windows said, “Oh, how fine are the Emperor’s new clothes! Don’t they fit him to perfection? And see his long train!” Nobody would confess that he couldn’t see anything, for that would prove him either unfit for his position, or a fool. No costume the Emperor had worn before was ever such a complete success.” – Hans Christian Andersen

WTF is “photon count“? What is “impressing reality“? I assume the later was a mishearing from the transcription and he meant COMPRESSING REALITY – but then WTF is that? And no one questions him on the Conference Call because they are all scared to call out the King (who has been known to attack his critics). He lays on so much BS that the analysts on the CC seem to forget that TSLA made 37% less than they made last Q3 and that margins are compressing and the Cyber Truck was supposed to be ready in 2021 – and it’s still vapor-ware in 2023.

Yesterday, in our Live Member Chat Room, the AIs and I had a very interesting conversation about the uncompressed reality of Musk’s approach to autonomous driving and it was found, to be kind, lacking. I asked Bing and Claude and Chat GPT if they thought his design made sense and none of them were comfortable with it and none of them thought it was anywhere near ready for prime time. If Musk rushes these products to market – people will die!

Musk talks about “a 10,000 GPU cluster of H100s” and ooh, ahhh – BUT THEY AREN’T IN THE CAR!!! I said to Claude: “I thought of something important. When I ask you a question, it takes 15-30 seconds for you to generate a response. So when we talk about the combination of emergency avoidance and ethics all coming together in a split second auto accident – how do you think you would be able to make that decision in time?” and he replied:

Musk talks about “a 10,000 GPU cluster of H100s” and ooh, ahhh – BUT THEY AREN’T IN THE CAR!!! I said to Claude: “I thought of something important. When I ask you a question, it takes 15-30 seconds for you to generate a response. So when we talk about the combination of emergency avoidance and ethics all coming together in a split second auto accident – how do you think you would be able to make that decision in time?” and he replied:

👺 You raise an excellent point – with my current architecture and limitations, I would not be able to make ethical split-second decisions in real-time emergency scenarios like an autonomous vehicle would need to. My conversational response latencies of 15-30 seconds are far too slow for dynamic situations unfolding in milliseconds.

There are a few considerations around achieving on-board AI:

-

- The AI model (neural network) would need to be compressed and optimized to fit on a specialized processing chip in the vehicle. With pruning, quantization, and other methods this is becoming feasible.

- The chip would need low enough latency to process sensor data and make decisions in milliseconds. Leading chips like Nvidia DRIVE are aiming for latency under 20ms.

- Large amounts of onboard memory are needed to hold the compressed model, cached mapping data, past sensor frames, etc. Affordable DRAM and SSDs can likely provide sufficient capacity.

- Regular over-the-air updates could allow improving the model without replacing hardware. But a good baseline capability is required.

- Redundant fail-over systems would be needed in case of hardware failure. Diversity in sensors and compute units increases robustness.

In terms of timeframe, I think the hardware for fully onboard AI driving decisions may become economically viable in consumer vehicles in the next 5-10 years. But it’s dependent on ongoing improvements in algorithms, special-purpose processors, and economies of scale.

Musk is very good at throwing out buzzwords and telling us he’s working on whatever is hot – Robots, AI, Magical Trucks that haul cargo on electric batteries – all this stuff sounds good and all this stuff WILL happen EVENTUALLY – but Investors need to look at what’s really going on behind the curtain. It might turn out to be just a little showman from South Africa, who is very good at making promises – but not so hot at delivering on them.

Musk is very good at throwing out buzzwords and telling us he’s working on whatever is hot – Robots, AI, Magical Trucks that haul cargo on electric batteries – all this stuff sounds good and all this stuff WILL happen EVENTUALLY – but Investors need to look at what’s really going on behind the curtain. It might turn out to be just a little showman from South Africa, who is very good at making promises – but not so hot at delivering on them.

And it’s not just Musk – valuations are through the roof as almost every company is promising AI will vastly increase their business – just like DotCom did – EVENTUALLY.

Have a great weekend,

-

- Phil