Week two of the war.

Well, which war? In Ukraine, it’s month 20, funny how we get used to things, isn’t it? But the new war is just getting started, though it’s been a very calm weekend as Hamas has been behaving itself (relatively) as convoys of aid trucks are now crossing the border into Gaza and evidence has mounted that it was Hamas rockets that blew up a hospital in Gaza, causing hundreds of deaths.

About 1,400 Israelis and 4,600 Palestinians are dead in two weeks, while Ukraine has 150,000 casualties vs an estimated 200,000 Russian Troops that won’t be coming home.

Meanwhile, more Patriot Missiles (LMT) and THADD Missile Defense Systems (LMT) are on the way to Israel and Biden wants Congress to foot the bill but there is no Congress (still) as you need 218 votes to pick a speaker and 222 Republicans can’t seem to make their minds up while all 212 Democrats voted for Hakeem Jeffries. Jim Jordan just gave up after 3 attempts (it took 15 votes for McCarthy to be speaker for 269 days) and it’s only 3 weeks until our next shut-down – on November 15th – which seemed like plenty of time a few weeks ago but not one thing has been resolved and nothing can be resolved until the GOP settles it’s crap.

Meanwhile, the indexes continue to melt down in that slinky-going-down-stairs pattern we have discussed and that’s basically just a series of unimpressive bounces following each sell-off and this has been happening since long before the Gaza war began.

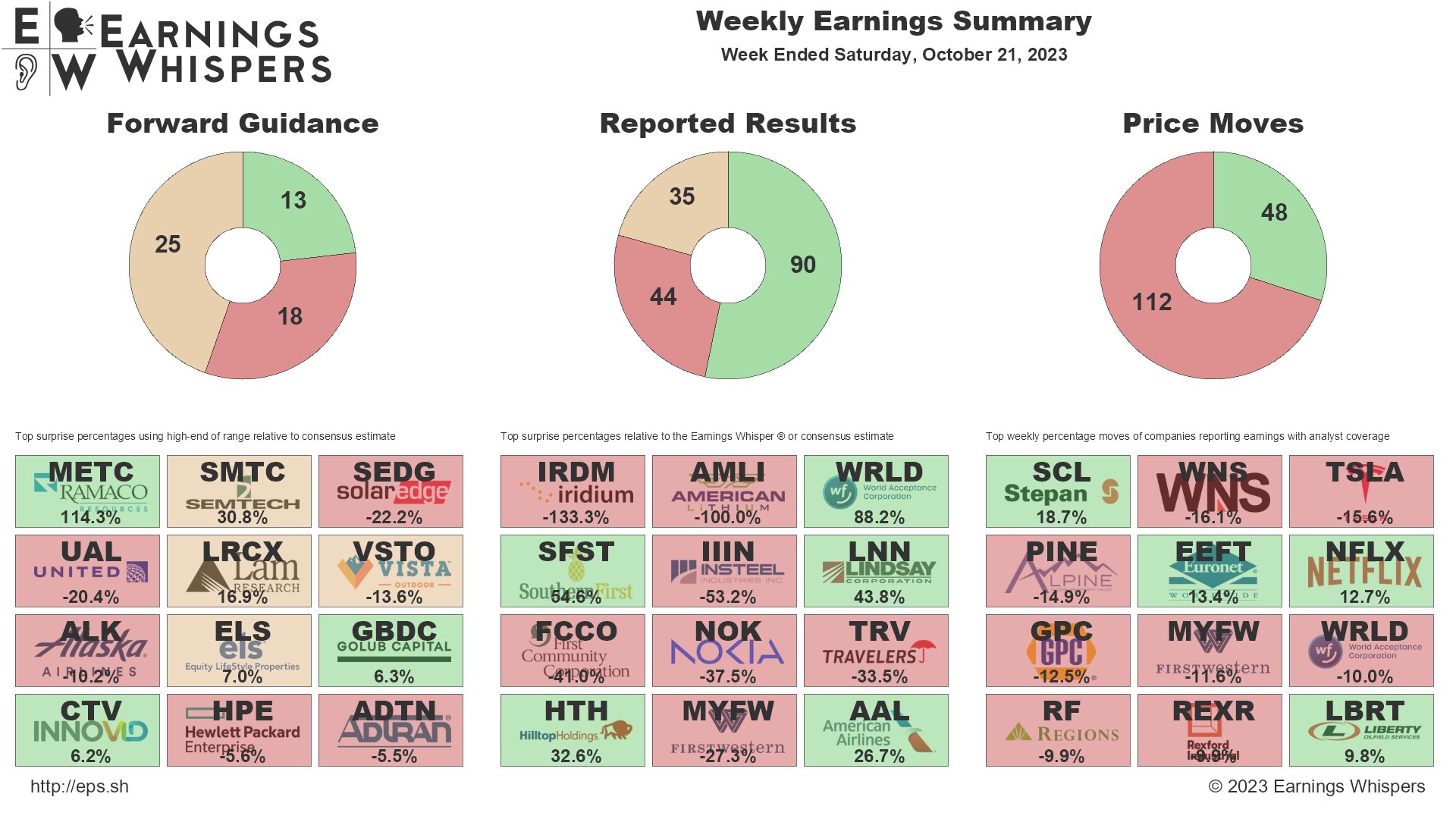

Earnings have been uneven so far but guidances have been more disappointing with 32% of the 56 S&P companies that gave guidance lowered it and that’s double the usual rate. As you can see on the chart below, 112 (66%) out of 169 reporting total reporting S&P 500 companies had negative reactions to their earnings despite only 44 (26%) actually missed.

It’s not so much and underperforming Quarter as 26% is only a bit high but the indications are that these companies are simply overvalued so NOTHING is going to make investors happy enough to pay 30x earnings and you top that off with a worsening outlook and we have a problem…

This week we have 160 more reports from S&P 500 components, including these lovely candidates for Speaker of Your Portfolio:

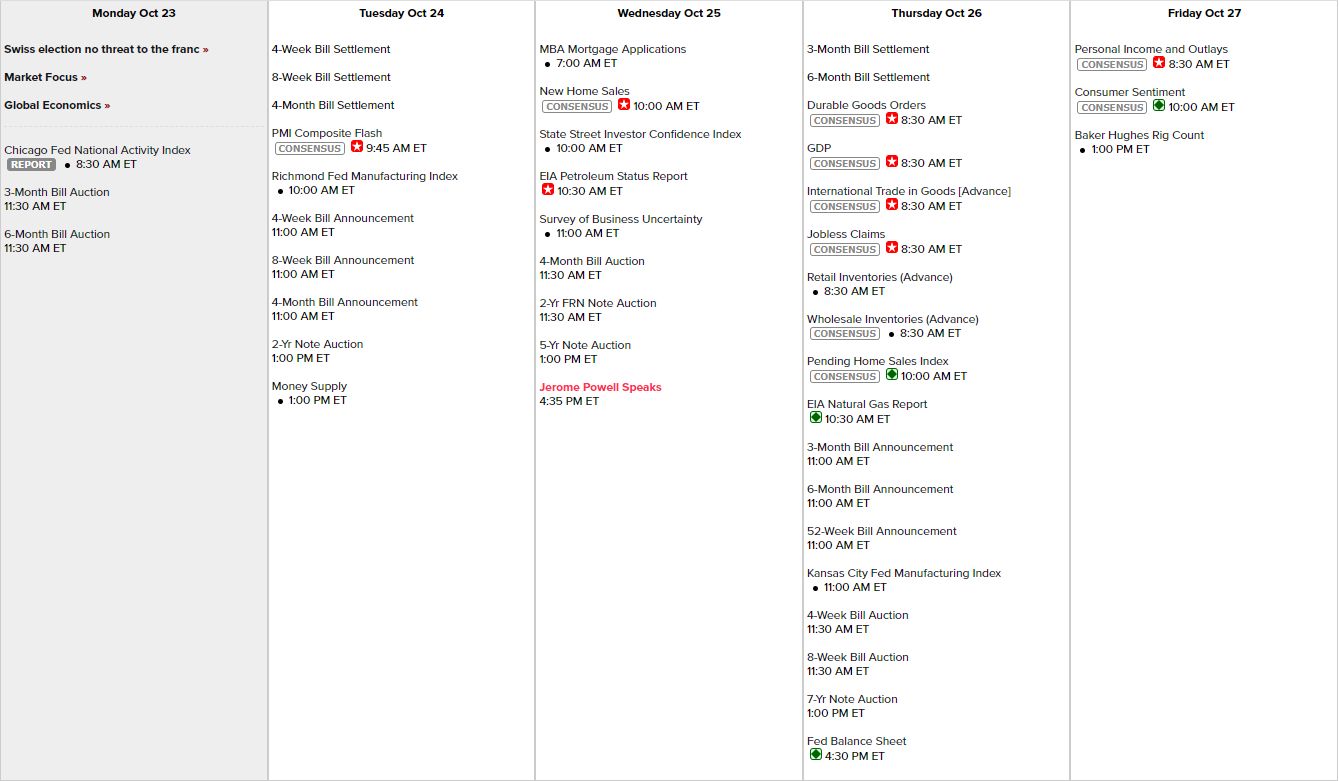

Now let’s talk about the data week ahead: The Fed has gone silent ahead of the Nov 1 meeting other than Powell on Wednesday but, if last week was any indication, we’d be better off if he stayed silent too. Tuesday we have PMI, which has been contracting and the Richmond Fed Report. Wednesday’s Mortgage Applications are unlikely to have improved and New Home Sales have been nothing but depressing. Even more depressing – if you are a homeowner – is the plunging price you can get for your home as rates have gone up – forcing your prospective buyer to give their money to the bank instead of you.

Thursday is a big data day but it’s all about GDP at 10:30 and the Atlanta Fed’s GDPNow shows us in the 4% range – way hotter than the Fed wants us to be so, even if we recover a bit into Thursday – I think a hot GDP will send us counter-intuitively lower. We finish the week on Friday with Personal Income and Spending and Consumers have been falling further and further behind to Inflation this year and we’ll see that reflected in the Consumer Sentiment Report, which also looks like a Recession:

We’ve got about 25 Consumer Discretionary stocks reporting this week – so let’s pay close attention to those with only 62 days until Christmas! When you have CEOs getting on conference calls with gloomy outlooks – that’s as of TODAY – there isn’t time for things to get better by the end of the year, which is why these negative guidance reports are being taken so seriously by investors.

Be careful out there!