It’s a bad time to do a review!

It’s a bad time to do a review!

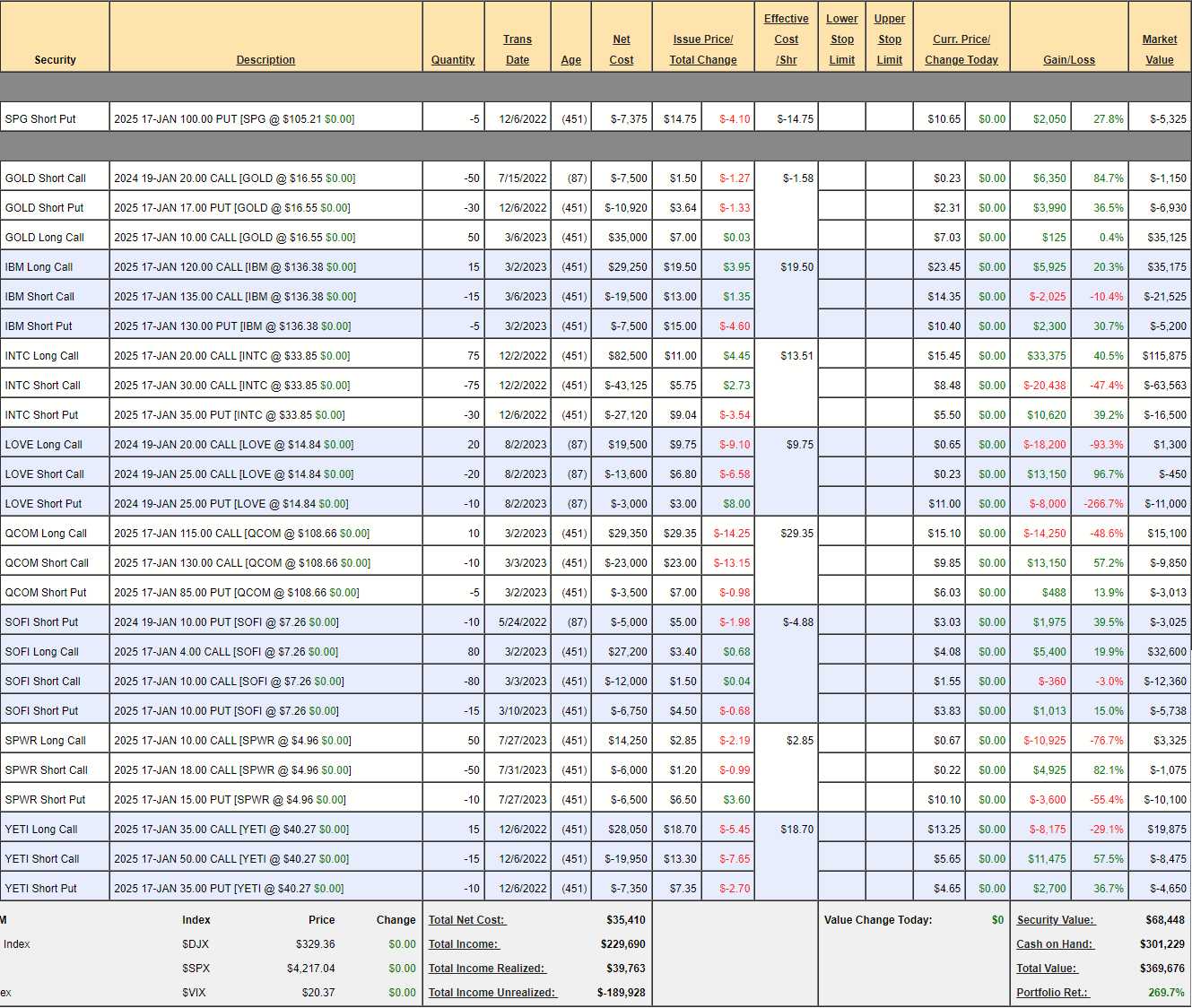

The Money Talk Portfolio – along with the rest of the market – is down quite a bit since we were last on the show on July 25th, when the portfolio topped out at $403,344 and up $92,373 since the March 1st show. Now, as we expected, we’ve taken a step back – all the way to $369,676 – so we’ve given back $33,668 but still up a healthy 269% overall.

As you can see from the chart, the S&P is down 7.3% and our portfolio dropped 8.3% so it’s nothing to be ashamed of and maybe it’s an opportunity as we expected a rough summer and left the portfolio mainly in CASH!!! after wisely cashing in some winners last time.

As of our July review, the portfolio had $173,303 in upside potential and, now that we dropped $33,668 it has $206,971 of upside potential BUT now we have to decide whther or not the upside potentials are still coming from realistic targets – given the changing situation.

The rule of the Money Talk Portfolio is we only make adjustments on show days (about once per quarter) so we tend to pick rock-solid companies that can hold their own in a crisis – and SunPower 8(. Let’s see how the rest are doing:

-

- SPG – Dropped over $2,000 since July but still, our potential entry is net $85.25 and the stock is at $105.21 – so nothing to worry about and we really wouldn’t mind owning them at that price. If we don’t get to buy them for less and $100, the upside potential is $5,325 if the short puts expires worthless. This is how we get paid just to watch a stock!

-

- GOLD – Gold itself (the metal) is back to $1,975 and I think we’re consolidating for a move over $2,000. The short Jan $20s will expire worthless (and make us $7,500 total). The net of the $35,000 spread is $24,045 and our plan was to generate an income while we wait. Still, we are tying up $24,045 and it has to be worth it – what can we make?

- We sold the short Jan $20 calls in July and we made $6,350 in 3 months (but it was a 6-month contract). Even though we’re essentially at the same price as we were in July, the March $20s are only 0.42 so I have no interest in selling them so we’ll wait for the option buyers to get more enthusiastic and, meanwhile, we can improve our position by rolling our 50 long 2025 $10 calls at $7.03 ($35,125) to 50 2026 $10 calls at $7.40 ($37,000) and we’ll sell 10 2026 $17 calls at $3.40 ($3,400) to cover the cost. The upside potential will remain $10,955 (45.5%) but we have another year to sell short-term calls.

-

- IBM – The Godfather of AI. We’re already over target on this one but it’s only net $8,450 on the $22,500 spread so there’s still $14,050 (166%) left to gain if IBM can hold $135 in 2025. Seems like free money to me!

-

- INTC – We waited a long time for them to move up and they finally did. We should take advantage by selling 25 March $35 calls for $3.10 ($7,750) and that will make up for the GOLD calls we couldn’t sell. It’s a $75,000 spread priced at net $35,812 so there’s $39,188 (109%) upside potential – no even counting those cute little short call sales!

-

- LOVE – Added them last time and not a winner so far. The company screwed up and underreported their delivery costs but I believe it was an honest mistake and we should consider this an opportunity to improve the position. We initially invested net $2,900 in the $10,000 spread and it would have been nice if it all went perfectly and we just made $7,100 (244%) with no effort – but it did not.

- The short Jan $25s will go worthless – so there’s no point in buying them back. The 10 Jan $25 puts at $11 ($11,000) can be rolled to 20 April $17.50 puts at $4.25 ($8,500) and we initially collected $3,000 for them so now it’s $1.50 each for net $16 is our break-even on those. As to the 20 Jan $20 calls at 0.65 ($1,300), let’s roll them out to 40 of the April $12.50 ($4.25)/17.50 ($2.15) bull call spreads at net $2.10 ($8,400) so now we have spent net $9,600 ($12,500 total) to be in the $20,000 April $12.50/17.50 spread that is $2.34 ($9,360) in the money with $10,400 (110%) upside potential at $17.50. This is what is called a “Salvage Play” – and you can find it in our Strategy Section at www.philstockworld.com!

-

- QCOM – Another one that’s slipped a lot but looks like nothing but opportunity to me. Let’s roll the 10 2025 $115 calls at $15.10 ($15,100) to 20 of the 2026 $100 ($28)/$120 ($20) bull call spreads at net $8 ($16,000). So we’ve double covered the short calls and the puts are so stupidly low we may as well buy them back ($488) and sell 10 2026 $90 puts for $11 ($11,000) so now the entire transaction is a $9,612 credit and that’s enough to pay for 15 more spreads or to buy back the short calls. Either way, we’re good!

- We spent net $2,850 initially and now the credit leaves us in this now $40,000 spread with a net credit of $6,762 so the upside potential is net $46,672 (704%) and all QCOM has to do now is get over $120 (was $130). SALVAGE!

-

- SOFI – We’re up quite a bit but it’s a $48,000 spread and still only net $11,477 so $36,523 (318%) of upside potential at $10 and I don’t think that’s unreasonable at all.

-

- SPWR – Believe it or not, this is our stock of the decade. We started at $5, though and we’ve already been in and out several times but this round in July was bad timing as they’ve dropped like a rock since. Still, we only paid net $1,750 so let’s spend some money to make this more attractive going forward.

- We SALVAGE the $3,325 left in the long calls and roll them to 100 of the 2026 $3 ($3)/7 ($1.80) bull call spreads at net $1.20 ($12,000) – so it’s the same $40,000 spread but at a MUCH lower strike with another year to get there for net $8,675. We can also roll the 10 short puts ($10,100) to 30 of the 2026 $7 puts at $3.10 ($9,300).

- That brings our total adjustments to $9,475 along with the $1,750 we originally paid is $11,225 but now our $40,000 spread is $20,000 in the money and halfway to goal with $28,775 of realistic upside potential. SALVAGE!

-

- YETI – Our current Trade of the Year is already at net $6,750 and it was a net $750 entry so we’re up $6,000 (800%) in less than a year and that’s Mission Accomplished for our Stock of the Year and it’s not even December yet. Even better, this trade still has $15,750 (233%) left to gain if we hit our $50 target (again) over the next 12 months. Aren’t options fun?

So, after taking advantage of the dip and spending net $3,888 of our $310,229 CASH!!! balance we are left with $207,638 of upside potential on these 9 trades. It’s essentially the same upside potential as we started with but we have drastically improved our targets by taking advantage of the sales.

Given the overall uncertainty in the markets, I’d like to place a hedge in the portfolio BUT, given the overall uncertainty – I’d like not to have a big loss if the market keeps going up. Two weeks ago, we came up with a clever hedging solution for our Members for our Short-Term Portfolio and, for the Money Talk Portfolio, I’m going to do something very similar to what we did on the 13th:

-

- Buy 100 SQQQ 2025 $20 calls for $6.30 ($63,000)

- Sell 60 SQQQ 2025 $35 calls for $4.20 ($25,200)

- Sell 50 SQQQ Jan $25 calls for $1.50 ($7,500)

What we have is a net $30,300 investment in a potentially $130,000 spread. SQQQ is a 3x inverse ETF on the Nasdaq so, for it to gain 75% to $35, the Nasdaq would have to drop 25%. Hopefully that does not happen but, if it does, we make just under $100,000 to offset our losses (the short calls will be rolled to higher strikes if we have to).

There’s also an income-producing component here as we sold 60 of the Jan $35 calls short for $7,500 and that’s using just 87 of the 451 days we have to sell so, if the Nasdaq does not pop higher, in January we’ll sell another set of short calls and another in April and, before you know it – we have FREE INSURANCE! Who doesn’t love free insurance?

Since we have free insurance and plenty of CASH!!!, let’s add a bank to our portfolio and Barclays (BCS) just disappointed on earnings by announcing they are taking charge-offs in Q4 – so that disappointment stands ahead. Fortunately, BCS is on our Watch List so we’re well-aware of the issues and $6.50 is a good $2.50 (38%) below fair value so this is a great time to learn a Stupid Options Trick and buy the stock for half price so we can collect that 0.38 annual dividend.

-

- Buy 5,000 shares of BCS for $6.50 ($32,500)

- Sell 50 BCS 2026 $5 calls for $2.25 ($11,250)

- Sell 50 BCS 2026 $7 puts for $1.60 ($8,000)

That’s net $13,250 for 5,000 shares ($2.65/share) and we will collect about 0.10 ($500) per quarter in dividends for 9 quarters ($4,500) and, if called away at $5, another $25,000 less whatever amount we are below $7 but, even if we’re just at $5, it’s net $19,500 back for a profit of $6,250 (47%). That’s what happens if we drop $1.50 to $5.

If we rise 0.50 to $7, then we end up with $16,250 in profits (260%) in two years. Our worst-case scenario is being assigned another 5,000 shares at $7 ($35,000) and, if we lose the initial $13,250 entirely, we’ll have 10,000 shares at net $48,250 ($4.825/share), which is STILL a 25% discount to the current price – that’s our WORST case! Aren’t options fun?

Interested in joining? You will gain access to our portfolio, live chat, and other member exclusive perks!

Email Admin@philstockworld.com for a seven day free trial at sign up.