Oh what a month it has been!

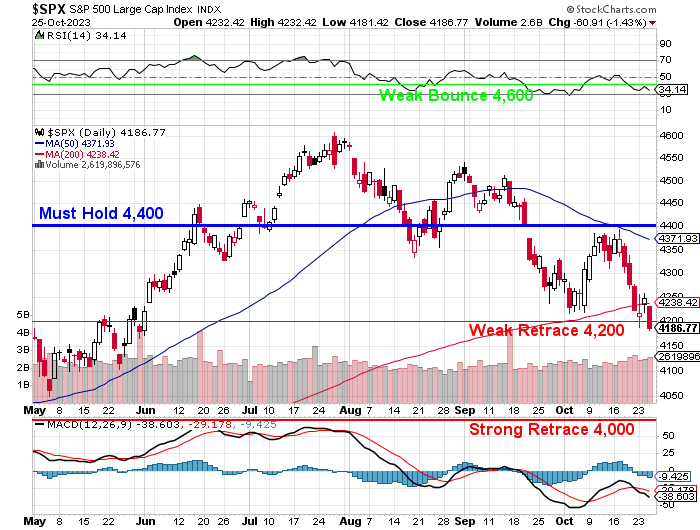

That’s right, it was back on September 22nd, in fact, when I wrote: “Summer is Over and So is the Rally” (I know, how does he do that?) and we had a little chart-fest where we discussed the coming fall and we expected a pullback to at least 4,200 with a bounce back to 4,320 but, now that that has failed and 4,200 is failing – we will be lucky not to see 4,000 again – which is only 5% down from here.

As we bounced back on October 10th, I warned in “Tuesday’s Ticking Time Bomb: Evergrande’s October 30th Deadline and the Global Implications“: “While Country Garden is struggling with debt restructuring and repayment deadlines, Evergrande is on the brink of the catastrophic event we have long been warning about: a winding-up hearing scheduled for October 30, 2023. This could have serious implications for the Global Markets.“ That event is closer now, not further away.

As we bounced back on October 10th, I warned in “Tuesday’s Ticking Time Bomb: Evergrande’s October 30th Deadline and the Global Implications“: “While Country Garden is struggling with debt restructuring and repayment deadlines, Evergrande is on the brink of the catastrophic event we have long been warning about: a winding-up hearing scheduled for October 30, 2023. This could have serious implications for the Global Markets.“ That event is closer now, not further away.

We increased our hedges on October 13th (“Fickle Friday – Checking our Hedges into Earnings Season“) and, as Claude noted in his Weekly Wrap-Up: “On Friday, Phil prudently advised caution heading into the weekend without over-hedging as geopolitical uncertainty remained. He increased SQQQ downside protection while advising care hedging PARA’s buyout potential. Members discussed challenges of volatile options spreads.”

As earnings season kicked off, I observed last week it was: “Faltering Thursday – “Our Deposit Beta Is 10 Times Higher Than Last Year” and, when the banks are in trouble – no one is going to be having a good time! Worse than the Banks, it was Tech that has blown Earnings Season with disappointing results but that’s no surprise to our Members as I have emphasized many times that only 11 of the S&P 500 are PROVIDERS of AI and the other 489 companies are CONSUMERS of AI and you don’t get rich buying a new service – not in the first few quarters at least.

Like Internet services and Web sites – it’s a new expense for most and only a few companies really end up capitalizing on the new technology. As we saw with MSFT and GOOG earnings yesterday – not even all the providers are making things work this early in the game. All this is why SQQQ is our primary hedge…

Like Internet services and Web sites – it’s a new expense for most and only a few companies really end up capitalizing on the new technology. As we saw with MSFT and GOOG earnings yesterday – not even all the providers are making things work this early in the game. All this is why SQQQ is our primary hedge…

8:30 Update: Durable Goods shot up to 4.7% from -0.1% in Aug and 1.1% expected so blow-out numbers thanks to BA and other Transports. Take them out and we’re still up 0.5% and that’s equal to August. GDP also came in way hot at 4.9% – that’s CHINA numbers. Only 3.8% was expected so a +50% blowout is good and bad as it’s clearly inflationary and the GDP Deflator was also hot, double last quarter’s 1.7% at 3.5% and 40% above the 2.5% expected by leading Economorons.

Globally, the unfolding Country Garden/Evergrande crisis underscores our looming Economic reality: The fragile intersection of soaring global debt, real estate tremors, and technological pivots amidst a shifting macroeconomic tableau. Evergrande, once China’s apex developer, has now morphed into the emblem of an extensive debt crisis that shrouds China’s property sector, which constitutes nearly a quarter of its economy.

This debt debacle is not confined to China; a staggering 80% of the $10 trillion surge in global debt during the first half of this year emanated from developed economies, catapulting global debt to a record $307 Trillion! The narrative is grim, with the United States facing a credit rating downgrade due to rising debt and deteriorating governance standards. As the debt burden swells, the ghost of a potential crisis looms, reflecting a financial ecosystem on thin ice.

And the Tech Sector isn’t immune to these macroeconomic tremors. The earnings season is unveiling a mixed bag, where not even the vanguards like Microsoft (MSFT) and Google (GOOG/L) could entirely escape the volatility. Nvidia (NVDA), a bellwether for AI demand, now trades at nearly 40 times the consensus earnings for the next 12 months, a position much loftier than its counterparts.

The undercurrents of AI adoption are forging ahead with generative AI tools witnessing explosive growth. A third of organizations surveyed are already harnessing gen AI regularly in at least one business function. The manufacturing sector, according to an Accenture report, is projected to garner the lion’s share of financial benefits from AI adoption, anticipating a windfall of $3.8 trillion by 2035 – but that’s 12 year away – will ANY of that show up on the bottom line by 2025?

The undercurrents of AI adoption are forging ahead with generative AI tools witnessing explosive growth. A third of organizations surveyed are already harnessing gen AI regularly in at least one business function. The manufacturing sector, according to an Accenture report, is projected to garner the lion’s share of financial benefits from AI adoption, anticipating a windfall of $3.8 trillion by 2035 – but that’s 12 year away – will ANY of that show up on the bottom line by 2025?

The interconnectedness of global debt, the Evergrande/Country Garden quagmire, and the Tech Sector’s earnings amidst the AI adoption wave sketches a complex economic landscape. Each element, with its unique economic ramifications, intertwines with the others, crafting a narrative of cautious optimism tempered with prudent hedging against the ever-lurking systemic risks.

As the Evergrande clock ticks closer to D-day next week, the Global Economy remains on tenterhooks, awaiting the reverberations of this financial time bomb on the broader Macro and Tech Sector Landscapes.

“They say the sea turns so dark that

You know it’s time, you see the sign

They say the point demons guard is

An ocean grave for all the brave

Was it you that said, how long, how long

How long to the point of no return?“