MoneyTalk – The Salvage Play: How it works

Here is a summary with timeline and key points for the video transcript:

0:00:00 – Phil Davis explains his “salvage play” options technique that he developed during 2008 financial crisis

0:00:25 – What is a Salvage Play?

- Salvage play involves taking the remaining value of losing options and rolling them into new longer-term options

- Example: With a bull call spread, when market drops, long and short calls lose value. We can cash in the remaining long call value, keep the short call, and use proceeds to fund a new longer-term call spread.

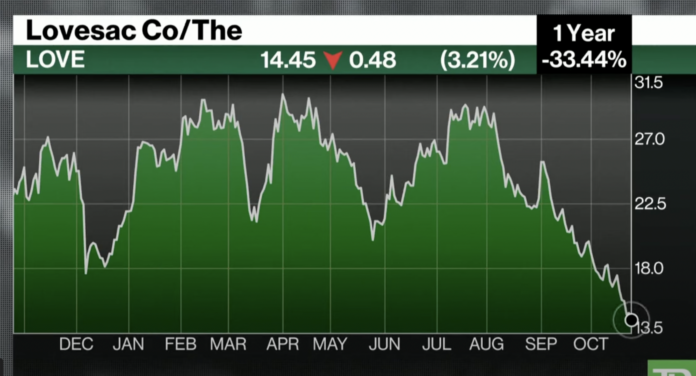

0:01:54 – LoveSac Example

- Furniture company stock dropped 50% since August due to supply chain issues

- Taking remaining value of August calls and rolling into April calls with lower strikes and longer timeframe

0:03:32 – Qualcomm Example

- Cashing August calls and rolling into 2026 calls, lowering strikes

- Also selling puts to create a net credit on the roll

0:05:08 – SunPower Example

- Stock dropped on need to restate financials, but outlook still positive

- Taking January calls and rolling into 2026 calls with 3x exposure

- Also selling puts for additional income

0:07:40 – Coming Up Next