A stay of execution?

A stay of execution?

Evergrande has been granted a temporary reprieve until December 4th by a Hong Kong court. During a winding-up hearing on Monday, the court adjourned the proceedings, giving Evergrande a chance to come up with a restructuring plan to avoid liquidation123. This development certainly brings a momentary sigh of relief amidst the ongoing financial tumult, and will likely have implications on investor sentiment and market dynamics.

That’s given the markets a boost, which is perfect for dressing the windows at the end of October.

Claude’s detailed weekly wrap-up paints a vivid picture of a market teetering on the verge of uncertainty, propelled by mixed earnings, the specter of inflation, and the unfolding drama in China’s real estate sector, most notably Evergrande & Country Garden. The juxtaposition of tech behemoths’ earnings is particularly compelling, showcasing the duality of AI’s promise and the existing hurdles in its pathway.

The contrasting narratives between Microsoft (MSFT) and Google (GOOG/L), underscored by their respective earnings and market share dynamics in cloud and AI sectors, reflect a broader divergence in the tech arena. MSFT’s alliance with OpenAI, as opposed to GOOG’s somewhat lackluster performance in AI and cloud, paints a telling narrative of strategic partnerships and focused investments bearing fruit in a fiercely competitive landscape. This further unfurls with Amazon (AMZN) and Intel’s (INTC) earnings, elucidating the relentless pace of innovation and the incessant quest for market dominance, with AI as the fulcrum.

The 4.9% GDP growth, along with the rising inflation and lingering concerns about consumer sentiment, exemplify the dichotomy the market finds itself in. The Fed’s upcoming decision on Wednesday looms large, shaping not just domestic but global market sentiment, given the ripple effects of its monetary policy.

The 4.9% GDP growth, along with the rising inflation and lingering concerns about consumer sentiment, exemplify the dichotomy the market finds itself in. The Fed’s upcoming decision on Wednesday looms large, shaping not just domestic but global market sentiment, given the ripple effects of its monetary policy.

The Chinese real estate saga, melds into the global narrative, rendering a complex tapestry of interconnected risks and potential domino effects. The ‘ghost of global debt’ we mentioned is a haunting reminder of the fragile economic edifice upon which market exuberance precariously perches.

As the we navigate these turbulent waters, prudent risk management, as in our discussions about hedging and salvaging troubled positions – holds paramount significance. The mantra of “better to be safe than sorry” rings true, especially in a landscape rife with both visible and latent risks.

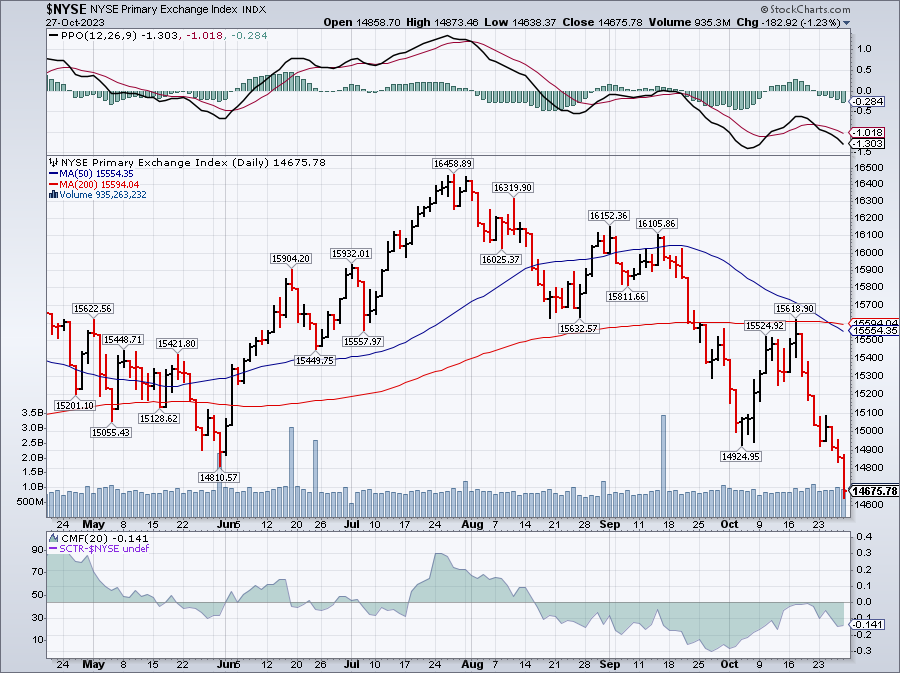

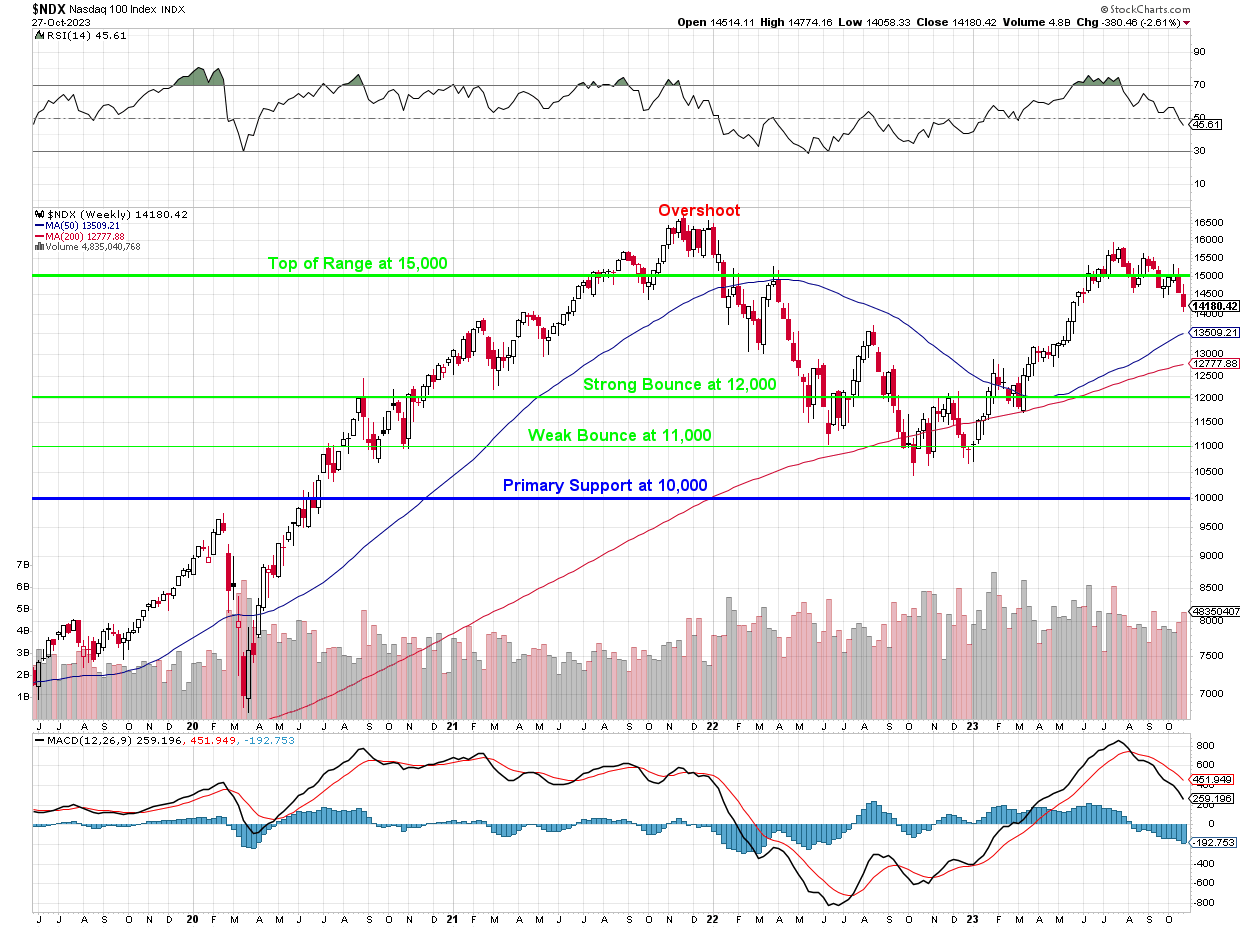

The technical breakdown of major indices and the breach of key support levels, like the NYSE 15,000, herald potential rough waters ahead. The possibility of a potential Nasdaq breakdown, following the NYSE’s footsteps, creates an environment of caution, urging investors to tread with a blend of vigilance and informed optimism.

The upcoming week, with the Fed’s rate decision at its crux, coupled with the unfolding earnings season and the simmering geopolitical tensions, holds the promise of further elucidation, if not resolution, of the market’s current narrative as we continue to navigate through these complex market dynamics.

This will be our 2nd major earnings week, with another 130 of the S&P 500 reporting and we have great reports from MCD and SOFI – which has been one of my major table-banging stocks for 2023 as it was a Stock of the Year finalist last November.

SoFi Technologies (SOFI) stock climbed 5.8% in premarket trading after the lender posted stronger-than-expected Q3 results and increased its 2023 guidance for revenue and EBITDA, as it continued to gain new customers and attract deposits. For our Members, we have SOFI in our Income Portfolio and our Money Talk Portfolio and we just made a very aggressive adjustment on the Dip – you’re welcome!

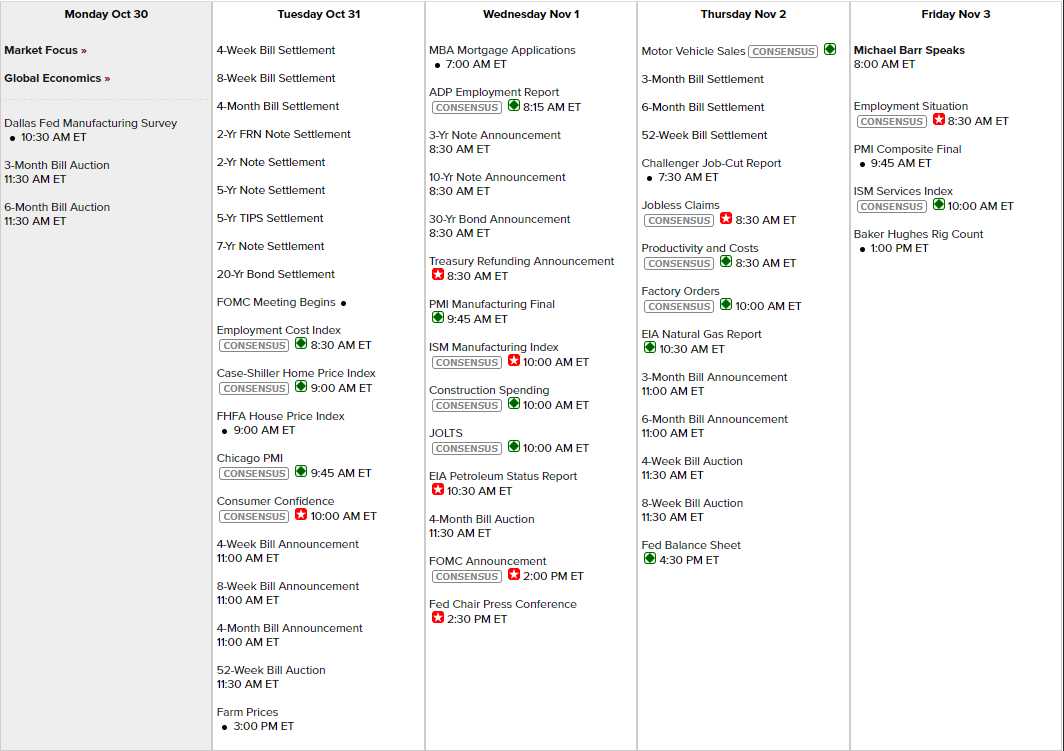

With the Fed meeting on Wednesday, not much else matters and the market consensus is the Fed will not move rates but I think they need to – so we’ll see how that plays out. Chicago PMI (44.1 last) is likely to be lower than estimated (44.8) – even though it’s already awful. We know Employment Costs are climbing so that estimate (0.9%) is probably low. I also don’t see Consumer Confidence holding 100 after last week’s Personal Income & Spending showed consumers falling further into debt – and that’s just tomorrow’s data.

Wednesday, ahead of the Fed, we get ISM, which hopefully isn’t lower than 49% and shouldn’t be as Durable Goods last week got an upside surprise from weapons manufacturing (LMT!) and we already made our bets on Construction Spending with a couple of Residential Real Estate plays last month for our Members.

Thursday we get Productivity and that needs to show some benefits of all this AI spending, as well as all this additional spending on Labor as strikes begin to settle (and more strikes are coming!). Factory Orders will give us an idea of how Christmas is shaping up and then, on Friday, it’s the Big Kahuna – as we get another Non-Farm Payroll Report after last month’s blazing hot 336,000 jobs were added.

Anything can happen and it probably will so please – be careful out there!