I think the Fed will raise this afternoon – they certainly SHOULD!

I think the Fed will raise this afternoon – they certainly SHOULD!

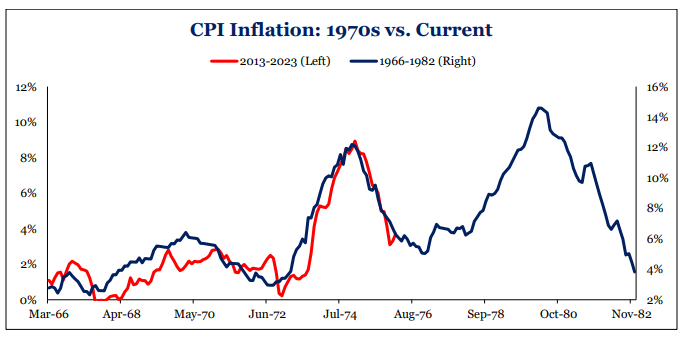

The latest economic data show that inflation is still running high and the labor market is still strong, despite some signs of slowing down. The Fed has already raised rates 4 times this year, by a total of 1 percentage point – after raising it 4.25% last year, to combat inflationary pressures. But is that enough to keep inflation under control and maintain the credibility of the Fed’s 2% target?

Let’s look at some of the key inflation and employment indicators since the last Fed meeting on September 20th:

- The Consumer Price Index (CPI) rose 0.4% in September, matching the increase in August1. Over the last 12 months, the CPI increased 3.7%, unchanged from the previous period1. This was the same as the annual inflation rate for the United States in September2. The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

- The core CPI, which excludes food and energy, rose 0.3% in September, slightly lower than the 0.4% increase in August1. Over the last 12 months, the core CPI increased 4.1%, also slightly lower than the previous period1. The core CPI is often used as a measure of underlying inflation trends.

- The Personal Consumption Expenditures (PCE) price index, which is the Fed’s preferred measure of inflation, rose 0.3% in September, after rising 0.4% in August3. Over the last 12 months, the PCE price index increased 3.6%, down from 3.7% in the previous period3. The PCE price index measures the change in prices of goods and services purchased by consumers.

- The core PCE price index, which excludes food and energy, rose 0.2% in September, after rising 0.3% in August3. Over the last 12 months, the core PCE price index increased 3.2%, down from 3.4% in the previous period3. The core PCE price index is the Fed’s main gauge of inflation and its target is 2%.

- The Producer Price Index (PPI) for final demand rose 0.5% in September, after rising 0.7% in August4. Over the last 12 months, the PPI for final demand increased 8.6%, up from 8.3% in the previous period4. The PPI for final demand measures the change in prices received by domestic producers of goods and services.

- The Employment Cost Index (ECI), which measures the change in labor costs, rose 1.2% in the third quarter of 2023, after rising 0.9% in the second quarter5. Over the last 12 months, the ECI increased 4%, up from 3.5% in the previous period5. The ECI reflects changes in wages and salaries and benefits paid by employers.

- The average hourly earnings of all employees on private nonfarm payrolls rose by 10 cents to $31.50 in September, after rising by 17 cents in August6. Over the last 12 months, average hourly earnings increased by 4.6%, up from 4.3% in the previous period6. Average hourly earnings are influenced by changes in both wage rates and hours worked.

- The unemployment rate fell to 3.7% in September, down from 3.8% in August6. This was near historic lows and below most estimates of the natural rate of unemployment7. The unemployment rate measures the number of people who are actively looking for work as a percentage of the labor force.

- Nonfarm payroll employment rose by 336,000 in September, after rising by a revised 172,000 in August6. This was above expectations and marked a strong rebound from a weak August report that was partly affected by Hurricane Ida8. Nonfarm payroll employment measures the number of jobs added or lost in the economy excluding farm workers, government employees, private household employees and employees of nonprofit organizations.

The bottom line is that inflation is still elevated and above the Fed’s target, while employment is still robust and near full employment. These data suggest that the Fed has not done enough to tame inflation and NEEDS to raise rates again today to signal its commitment to price stability and anchor inflation expectations BUT Fed policy is, more than ever, a political football and, with banks suffering from high interest – the Banking Cartel that is the Fed may do what’s good for their masters and not what’s good for the country.

Meanwhile, the earnings misses keep coming as companies struggle with higher interest rates and still-high inflation while the customers are running out of disposable income. Personal Income took a dip last month while Personal Spending once again climbed 0.7% – plunging Consumers well over $5Tn in non-mortgage debt. And, just in time for Christmas – student loan payments are starting up again after a 3.5-year pause.

But back to earnings. Last night 19 (54%) out of 35 companies reporting missed earnings and/or guided down and they were: AEIS, EQH, EQR, FLSR, HUN, LFUS, LTHM, LUMN, MTCH, OI, OKE, PAYC, PRO, SAFE, SON, TX, XHR, YUMC, ZWS and this morning is already looking ugly at 7:30.

But back to earnings. Last night 19 (54%) out of 35 companies reporting missed earnings and/or guided down and they were: AEIS, EQH, EQR, FLSR, HUN, LFUS, LTHM, LUMN, MTCH, OI, OKE, PAYC, PRO, SAFE, SON, TX, XHR, YUMC, ZWS and this morning is already looking ugly at 7:30.

Despite this week’s bounce, the NYSE is still below 15,000 at 14,919 and there is no recovery until that’s back over 15,000. Meanwhile, as you can see on the S&P Chart, we fell from 4,550 to 4,150 which is 400 points and that makes for 80-point bounces so 4,230 is weak and we’re not even there yet and 4,300 would be a strong bounce, followed by 4,380, which was the strong retrace support back in August – so the 5% Rule™ is certainly running the market at the moment.

The scariest thing that happened yesterday was the sudden, sharp rise in the Dollar, which had fueled the rally as it dropped this week. Almost all at once yesterday morning, the Dollar popped back over 106.66 and closed at a 15-year high.

There are lots of reasons for this – there’s an overall flight to safety as the war(s) heat up and China’s Local Government Debt came in at $3.9Tn at the end of September, so now over $4Tn. Meanwhile, over in Japan, the Yen continue to collapse like a Fukishima containment wall and neither the BOJ or the PBOC are doing enough to reverse the slide in their currencies so PRESTO!!! – a stronger Dollar.

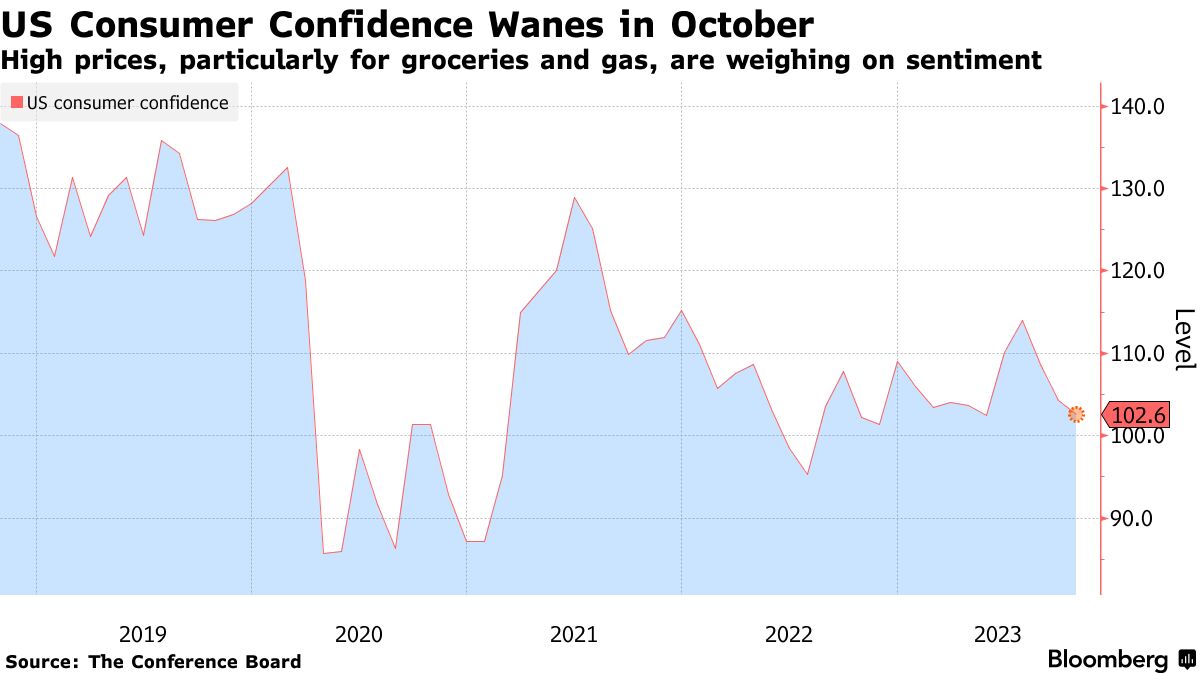

While Economists’ expectations of a recession have steadily waned in the wake of the surprising resilience of the economy and labor market, Americans continue to be squeezed by high prices. The lingering impact of inflation, even if it has improved significantly since last year, remains a key hurdle to a more significant rebound in confidence.

Yesterday’s Consumer Confidence Index was a complete disaster, with lows creeping back to last year’s crush, when the S&P fell from 4,550 in March to 3,580 in October – which puts our recent fall in perspective – for now…

Today is all about the Fed and what Powell has to say at 2:30, join us for our Live Trading Webinar at 1pm, EST, where we’ll discuss it all live – as it happens.