It’s wages that matter, not payrolls.

It’s wages that matter, not payrolls.

There are about 165M people working in the US and last month we added 336,000, which is a lot (4M pace) when you consider that we have nearly zero population growth and nearly zero immigration so the only way to add workers to the payroll is to entice them to join the workforce.

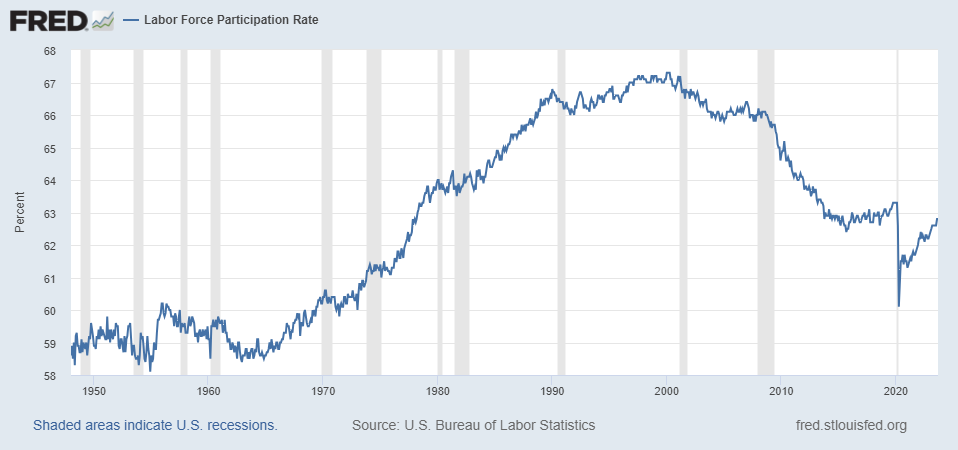

The transformation from non-worker to worker isn’t merely a matter of flipping a switch. It’s a complex dance of Incentives, Opportunities, and Economic Signals. At the heart of this metamorphosis is the concept of the Labor Force Participation Rate, which measures the percentage of working-age people who are either employed or actively looking for work.

To entice the sidelined spectators into the employment arena, several factors come into play:

-

Wage Incentives: As wages increase, the opportunity cost of not working rises. This can lure those who have previously opted out of the workforce, such as retirees or homemakers, to reconsider their stance. It’s the classic carrot on a stick, but in this case, the carrot is a fatter paycheck and the stick is Inflation eating into your family’s Disposable Income.

-

Education and Training: By investing in education and vocational training, individuals who might not have the skills required for today’s job market can become more employable. This, unfortunately, is an expensive and time-consuming process – and you need to hire people to train the other people – it’s complicated…

-

Workplace Flexibility: Potential workers value flexibility – and that’s the reason many of them can’t work at regular jobs. Telecommuting, flexible hours, and a better work-life balance are important to younger workers as well. Offering these benefits can coax those who value autonomy over the traditional 9-to-5 grind.

-

Healthcare and Childcare Support: For many, the lack of affordable Healthcare and Childcare is a strong barrier to entry. Subsidies or employer-provided solutions can break down these walls, allowing more individuals to join the workforce but neither the private or public sector is doing much about this major issue.

This brings us back to Unit Labor Costs and Productivity. Corporations don’t hire people if they can’t make a profit from them, do they? This is why almost anyone who quits a job to go work for themselves never comes back – it’s much more profitable to make your own money! Take Apple (AAPL) for example, they make $609,756 per employee (164,000) and they pay them an average of $159,000 each so AAPL makes $450,000 for each employee they hire.

Of course, one employee can’t walk off the assembly line and start making IPhones in their kitchen but, on the other hand, Jobs and Wozniak did start off making computers in their garage so an Engineer and a few line workers COULD, in theory, walk away and make MUCH more money selling their own.

The trick is to balance the scales. Wages need to be enticing enough to draw people in, but not so high that they outpace productivity gains, leading to additional inflationary pressures. It’s a delicate balance and, this quarter, Productivity jumped 4.7% while Compensation “only” increased 3.9% meaning Unit Labor Costs DROPPED by 0.8% in Q3.

In short, moving people into the labor force is about creating an environment where the benefits of working outweigh the comforts of not working, without tipping the economic scales into the red zone of runaway costs.

8:30 Update: Only 150,000 jobs were created in October, very far down from last month’s 336,000, which has now been revised down to 297,000 – no wonder the Fed felt they could pause, labor has calmed down considerably. Of course a portion of that was the auto strike – so let’s not get too excited. Unemployment ticked up slightly to 3.9% – also good for the market and Hourly Earnings were only up 0.2% – right where the Fed wants them.

Less workers means less Dollars needed to pay them so the Dollar is diving back to 105.50 and that’s another 0.6% down from yesterday’s close and SHOULD give the markets another 1% pop to end the week on a very high note.

In other news:

- Biden Says Israel and Hamas Should ‘Pause’ for Hostage Release

- Nothing Worries CEOs Right Now as Much as Geopolitics

- Powell Touts Tight Financial Conditions, Causing Them to Loosen

- FedEx CEO warned of ‘worldwide recession’ a year ago. Here’s what he sees now

- Bankman-Fried Found Guilty of Fraud at FTX Criminal Trial

- The US Housing Market Has Become an Impossible Mess

- Adam Neumann Wounded WeWork. An Office-Market Bust Finished It Off.

- Oil Heads for Second Weekly Drop as Israel War Still Contained

- OPEC Oil Production Remains Relatively Flat In October

- Starbucks wants to have 55,000 stores by 2030 — and expects to pay its workers more long before then

- Foxconn Makes Your iPhone. Now It Wants to Make Your Electric Car

- Apple Warns of Sluggish Holiday Quarter After China Slowdown

- Apple’s grim streak of revenue declines could continue into the holidays

Have a great weekend,

-

- Phil