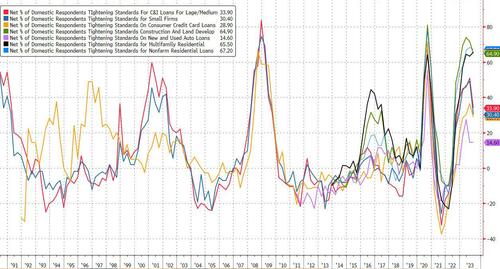

In our preview of the week’s key updates, we said that while today’s Senior Loan Officer Survey (or SLOOS) was likely the otherwise quite’s week’s main event, even if it was unlikely to be a market mover as it would – in a quarter where the 10Y yield briefly topped 5% – signal more of the same: tighter financial conditions and weaker demand for consumer loans.

Sure enough, moments ago the Fed reported that – as expected – in Q3 the SLOOS respondents “on balance, reported tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the third quarter. Furthermore, banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.”

But while the big picture remains downbeat, with both supply and demand in tight/contracting territory, the silver lining is that the underlying measures improved somewhat compared with the second quarter, which is bizarre since rates are far higher now than they were in Q2.

Specifically, the proportion of US banks tightening standards for the all important commercial and industrial (C&I) loans for medium and large businesses fell to 33.9%, from 50.8% in the second quarter even as some 62.7% of banks are keeping lending conditions basically unchanged. Other notable categories also posted improvements:

- The proportion of banks reporting tightening standards for small firms fell from 49.2 to 30.4

- The proportion of banks reporting tightening standards for consumer credit card loans fell from 36.4 to 28.9

- The proportion of banks reporting tightening standards for construction and lend development loans rose from 63.3 to 64.9

- The proportion of banks reporting tightening standards for new auto loans was unchanged at 14.6

- The proportion of banks reporting tightening standards for nonfarm residential loans fell from 68.3 to 67.2

Among the banks that reported easing lending standards, the most frequently cited reasons were an improvement in the credit quality of loans and a more favorable or less uncertain economic outlook.

- In comparison to large banks, other banks more frequently cited concerns about deposit outflows, funding costs, deterioration in or desire to improve their liquidity positions, and concerns about declines in the market value of fixed-income assets as reasons for tightening lending standards.

- For foreign banks, major shares reported that a less favorable or more uncertain economic outlook; a deterioration in customers’ collateral values; a reduced tolerance for risk; a deterioration in the credit quality of loans; and a reduction in the ease of selling loans in the secondary market were important reasons for tightening lending standards over the third quarter.

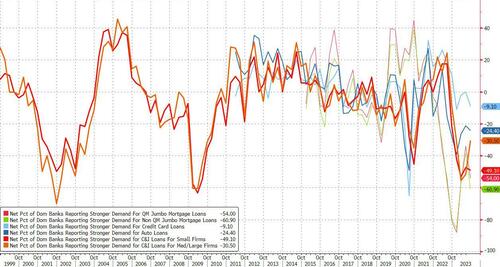

The survey showed a modest improvement in demand for credit, with the share of banks reporting weaker demand for C&I loans among large and mid-sized firms at 30.5%, down from 51.6% in the second quarter. On the other hand, demand for both qualifying and non-qualifying Jumbo mortgage loans declined, as did demand for credit card loans and C&I loans for small firms.

Over the third quarter, banks reported tightening standards for all types of CRE loans. Such tightening was more widely reported by other banks than by large banks. Major net shares of banks reported weaker demand for all CRE loan categories, which was more widely reported by large banks than by other banks. Furthermore, a significant net share of foreign banks reported tighter standards for CRE loans, while a moderate net share of foreign banks reported weaker demand for such loans.

The October SLOOS also included a set of special questions that asked banks to assess the likelihood of approving credit card and auto loan applications by borrower FICO score (or equivalent) in comparison with the beginning of the year. Banks reported that they were less likely to approve such loans for borrowers with FICO scores of 620 and 680 in comparison with the beginning of the year, while they were more likely to approve credit card loan applications and about as likely to approve auto loan applications for borrowers with FICO scores of 720 over this same period.

The October SLOOS also included a set of special questions that inquired about banks’ reasons for changing standards for all loan categories in the third quarter of 2023. Banks most frequently cited a less favorable or more uncertain economic outlook; reduced tolerance for risk; deterioration in the credit quality of loans and collateral values; and concerns about funding costs as important reasons for tightening lending standards over the third quarter.

dollar and US 2y yields rise after the Q4 Senior Loan Officer Survey data showed “credit was not as tight as people thought”. The net percentage of domestic respondents tightening standards for C&I loans (Large and Medium sizes) dropped to 33.9 (from 50.8 in Q3), the lowest since Q3 2022. In G10, the desk saw Real Money clients buying USDSEK and USDJPY, while also buying NZDUSD. Hedge Funds were buying AUDUSD gamma and looking at mid-dated EURUSD topside structures.