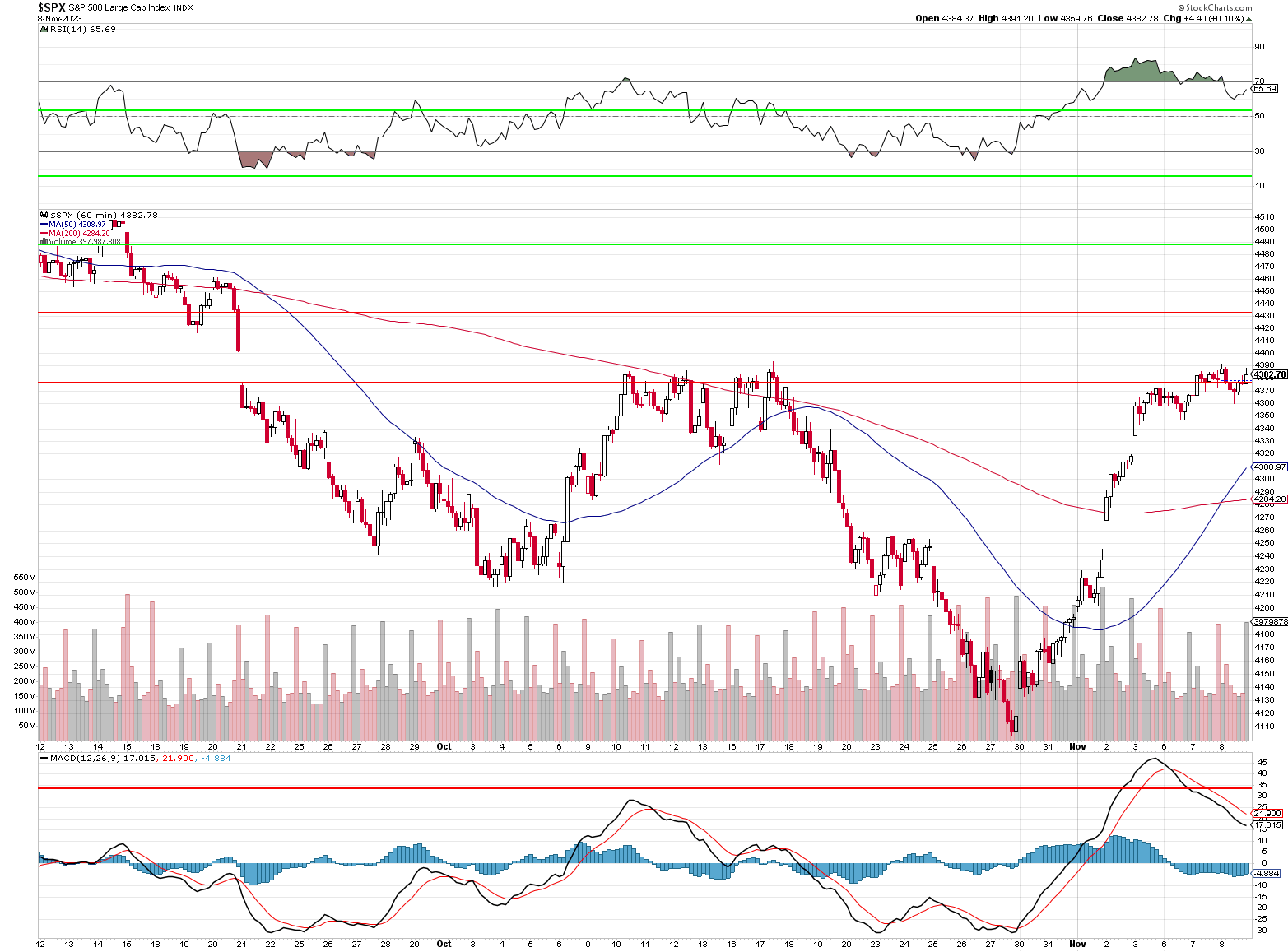

We’re back to flatlining on the S&P.

We fell out of the bullish zone in October and we’re just barely in the bearish zone a month later and everyone is acting like we’re in a bull market? This is a very weak recovery so far. That MIGHT be good news if things keep going – then it will have been an opportunity to invest again at S&P 4,200 but REALITY shows us that this repricing may be permanent and we’re heading back to a zone that’s more like 3,800 to 4,200 on the S&P 500 in 2024.

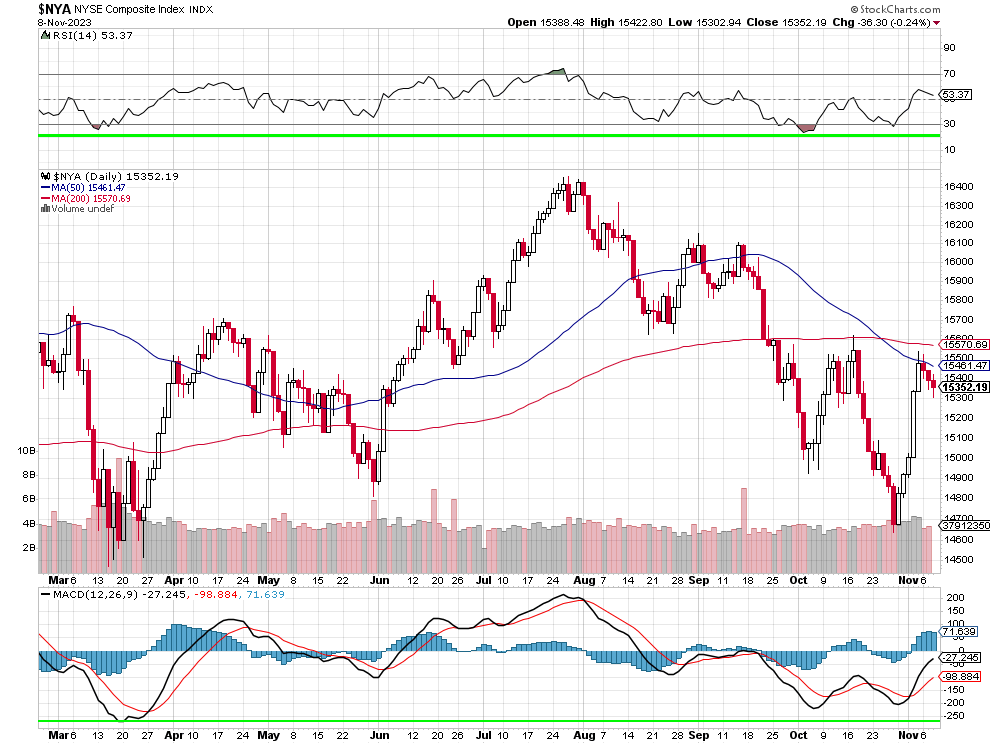

Notice the NYSE stopped dead at the falling 50-dma and now it’s falling right along that line – that is NOT GOOD! It’s a weight around the neck of the other indexes because the NYSE is a broad-market indicator and the Nasdaq 93 (minus the 7 super-stocks) is not all that impressive either.

Notice the NYSE stopped dead at the falling 50-dma and now it’s falling right along that line – that is NOT GOOD! It’s a weight around the neck of the other indexes because the NYSE is a broad-market indicator and the Nasdaq 93 (minus the 7 super-stocks) is not all that impressive either.

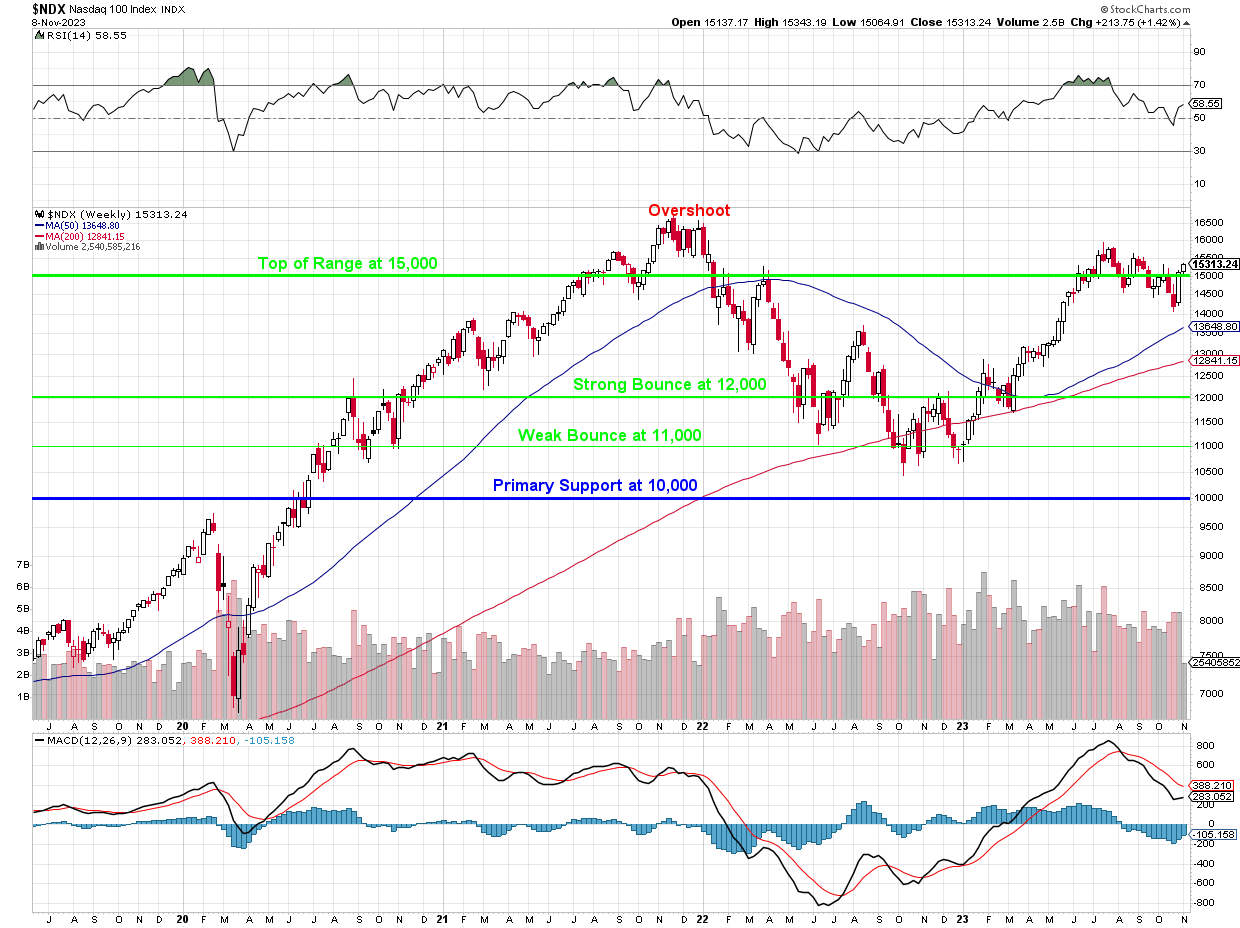

It is the Nasdaq and, of course, the Magnificent 7 (AAPL, AMZN, GOOG, META, MSFT, NVDA and TSLA), who are holding up the markets but even the Nasdaq hasn’t gone anywhere since July and we’re still almost 10% below the 2021 highs – that’s ZERO progress in two years, folks!

The Magnificent Seven companies are worth a combined $10.4 TRILLION, making up 27.7% of the S&P 500’s total $37.7 trillion in total market cap. So the group can really sway the index — and I’ll show you by just how much.

To remove the influence of the Magnificent Seven, investors can look at the S&P 500 Equal Weight Index. It features exactly the same companies as the S&P 500, except they are each given an equal representation in this index no matter their market capitalization. Here’s the difference in performance between the two indexes this year:

|

INDEX |

2023 RETURN |

|---|---|

|

S&P 500 |

8.5% |

|

S&P 500 Equal Weight Index |

(4%) |

On the Nasdaq, with AAPL alone counting for 11% of the 100, the Magnificent Seven are 40.75% of the entire index and, since the end of July, the Seven have performed as follows:

- Apple (AAPL): The stock closed at $182.89 on Nov 8th, down -6.8% from $196.19 on July 31st. AAPL reported its Q3 earnings on August 3, 2023, with revenue of $81.8 billion, down 1% year-over-year, and earnings per share of $1.26, up 13% year-over-year. The company set an all-time record for Services revenue at $21.2Bn, up 33% year-over-year, and saw strong growth in its Wearables, Home and Accessories segment, up 36% year-over-year. The company also benefited from the strong sales of its iPhone 15, which was launched on September 24th and sold more than 10M units in the first weekend. However, the stock faced some challenges from the global chip shortage, which affected its supply chain and production capacity. Apple also faced some legal and regulatory issues, such as the antitrust lawsuit from Epic Games, which challenged its App Store policies and resulted in a mixed ruling from the judge. The stock also suffered from profit-taking after reaching an all-time high of $198.23 on July 19th. AAPL has a weight of 11.021% in the Nasdaq 100 index.

-

Amazon (AMZN): The stock closed at $142.08 on Nov 8th, up +6.3% from $133.68 on July 31st. The stock reported its Q3 earnings on October 27, 2023, with revenue of $143.1 billion, up 13% year-over-year, and earnings per share of $0.94, beating the analysts’ estimates of $0.58. The company set an all-time record for Services revenue at $21.2 billion, up 33% year-over-year, and saw strong growth in its Advertising segment, up 41% year-over-year. AMZN also benefited from the Prime Day promotion in July, which was the biggest ever sale for the company. However, the stock faced some challenges from the slowing growth of its e-commerce business, which grew only 7% year-over-year, compared to 15% in the previous quarter. Amazone also faced rising costs of its operations, such as shipping, fulfillment, and hiring, which increased 18% year-over-year to $131 billion. The stock also faced competition from other online retailers, such as Walmart, Target, and Shopify, which have been expanding their e-commerce offerings and gaining market share. AMZN has a weight of 5.668% in the Nasdaq 100 index.

- Alphabet (GOOGL): The stock closed at $133.26 on Nov 8th, down -3.0% from $137.35 on July 31st. GOOGL reported its Q3 earnings on October 24th with revenue of $76.69Bn, up 11% year-over-year, and earnings per share of $1.55, beating the analysts’ estimates of $1.45. The company returned to double-digit revenue growth for the first time in over a year, driven by the recovery of its advertising revenue, which grew 15% year-over-year to $59.65Bn. Google also benefited from the expansion of its cloud business, which grew 22% year-over-year to $8.41Bn, and the innovation of its other bets such as YouTube, Waymo, and Google Health. YouTube advertising revenue grew 28% year-over-year to $7.95Bn while Waymo announced a partnership with Hertz to provide self-driving cars for its customers. Google Health also launched a new app called Care Studio, which aims to help clinicians access and analyze patient data. However, GOOGL faced some challenges from the global chip shortage, which affected its hardware production and sales. The stock also faced some legal and regulatory issues, such as the antitrust lawsuit from the U.S. Department of Justice, which accused the company of abusing its dominance in online search and advertising. Google also suffered from profit-taking after reaching an all-time high of $140.71 on October 24th. GOOGL has a weight of 3.039% (x 2 with GOOG) in the Nasdaq 100 index.

- Meta Platforms (META): The stock closed at $319.78 on Nov 8th, up +0.4% from $318.60 on July 31st. The stock reported its Q3 earnings on October 26, 2023, with revenue of $34.15 billion, up 23% year-over-year, and earnings per share of $4.39, beating the analysts’ estimates of $3.621. The company returned to double-digit revenue growth for the first time in over a year, driven by the recovery of its advertising revenue, which grew 15% year-over-year to $59.65 billion2. The stock also benefited from the growth of its Services segment, which set an all-time record of $21.2 billion, up 33% year-over-year2. However, the stock faced some challenges from the company’s name change from Facebook to Meta Platforms, which was announced on October 28, 20233. The name change reflected the company’s vision to build the metaverse, a virtual environment where people can interact and create3. The stock also faced some backlash from the whistleblower revelations, which exposed the company’s internal research on the negative impacts of its social media platforms on mental health, misinformation, and violence4. The stock also faced regulatory scrutiny over its social media platforms, such as the antitrust lawsuit from the U.S. Federal Trade Commission, which accused the company of maintaining a monopoly in social networking5. The stock has a weight of 3.874% in the Nasdaq 100 index6.

-

Microsoft (MSFT): The stock closed at $363.20 on Nov 8th, up +8.2% from $335.21 on July 31st. MSFT returned to double-digit revenue growth for the first time in over a year, driven by the growth of its cloud computing platform Azure, which grew 27% year-over-year to $18.9Bn thanks to MSFT’s $10Bn investment in OpenAI. The company also benefited from the popularity of its Office 365 and Teams products, which saw strong demand from both consumers and businesses amid the hybrid work environment. Office 365 Commercial revenue grew 14% year-over-year to $15.6Bn, while Teams reached 300M daily active users. Additionally, MSFT gained from the acquisition of Activision Blizzard, the largest video game publisher in the world, which was announced on January 18, 2022. The deal, valued at $68.7Bn, was finalized on October 13th after receiving regulatory approval from the UK’s Competition and Markets Authority. The acquisition added iconic franchises such as Call of Duty, Warcraft, Diablo, Overwatch, and Candy Crush to Microsoft’s gaming portfolio, which already included Xbox, Bethesda, and Minecraft. MSFT has a weight of 10.369% in the Nasdaq 100 index.

-

NVIDIA (NVDA): The stock closed at $465.74 on Nov 8th, down -0.2% from $467.25 on July 31st. NVDA reported its Q3 earnings on November 21st, with revenue of $7.19 billion, up 21% year-over-year, and earnings per share of $0.89, beating the analysts’ estimates of $0.761. The company achieved record revenue for its Gaming, Data Center, and Professional Visualization segments, driven by the strong demand for its GPUs, the launch of its GeForce NOW cloud gaming service, and the adoption of its AI and ray tracing technologies. NVDA also benefited from the progress of its acquisition of Arm Holdings, which was announced on September 13th. The deal, valued at $40Bn, was expected to create the world’s premier computing company for the age of AI, accelerating innovation and expanding into large, high-growth markets. However, the stock faced some challenges from the global chip shortage, which affected its supply chain and production capacity. The stock also faced some legal and regulatory issues, such as the antitrust concerns from the UK’s Competition and Markets Authority, which launched an in-depth investigation into the Arm deal on November 8th. The stock has a weight of 4.158% in the Nasdaq 100 index.

-

Tesla (TSLA): The stock closed at $222.11 on Nov 8th, down -16.9% from $267.43 on July 31st. TSLA reported its Q3 earnings on October 23rd, with revenue of $23.35Bn, down 1% year-over-year, and earnings per share of $0.66, missing the analysts’ estimates of $0.731. The company faced some headwinds from the global chip shortage, which affected its supply chain and production capacity. TSLA also faced some legal and regulatory issues, such as the antitrust lawsuit from the U.S. Department of Justice, which accused the company of abusing its dominance in electric vehicles. The stock also suffered from the controversial tweets and actions of its CEO Elon Musk, who announced the acquisition of Twitter for $44Bn in April of 2022, but later tried to back out of the deal, citing Twitter’s bot problem. Musk also changed the name of Twitter to X, removed the block feature, and introduced a subscription model that sparked backlash from users. The stock also faced volatility due to the mixed earnings results, the production and delivery challenges, and the market sentiment. TSLA delivered 241,300 vehicles in Q3, up 20% quarter-over-quarter and 72% year-over-year but still miles and miles behind the Big 3 + Toyota – who deliver 10x as many cars at 1/10th the valuation – EACH! The company also warned that it expects slower growth in Q4 due to supply chain issues and seasonal factors. The stock has a weight of 2.631% in the Nasdaq 100 index and is no bargain at $222!

While the S&P and Nasdaq may SEEM to be holding up, a deeper look indicates lingering weakness and uncertainty in the overall market. The equal-weight S&P 500 and the NYSE is down for the year, showing how the outsized impact of mega-cap tech stocks is distorting our view of the markets. Outside of the “Magnificent Seven,” performance has been mixed for other major companies. Ongoing challenges like supply chain disruptions, inflation, rising interest rates, and global instability continue to create headwinds.

With the S&P 500 still below 2021 highs and flatlining below key technical levels, there are reasons to be cautious about calling a new bull market. While there may be opportunities for savvy investors, indexes are likely to remain range-bound into 2024. Prudent portfolio protection through hedges and cash is warranted until more definitive trends emerge.

Be careful out there!