“People are strange

“People are strange

When you’re a stranger

Streets are uneven

When you are down” – Doors

Yesterday, the markets were rattled by two events that signaled a more hawkish stance from the Federal Reserve.

First, the Treasury’s $24 billion auction of 30-Year Bonds drew a much weaker-than-expected demand, pushing the yield on the long-term back up to 4.8% as Primary Dealers (the Fed) were forced to cover poor demand and pick up 24.7% of the bonds to avoid a 5% close. This once again raised concerns about the sustainability of the US Debt and the ability of the government to finance its spending plans AND, don’t forget – there’s another Government Shut-Down coming on the 15th – the first test of untested, unexperienced Mike Johnson’s ability to bring his party together and pass critical legislation – and today is the 10th (Monday is the 13th)!

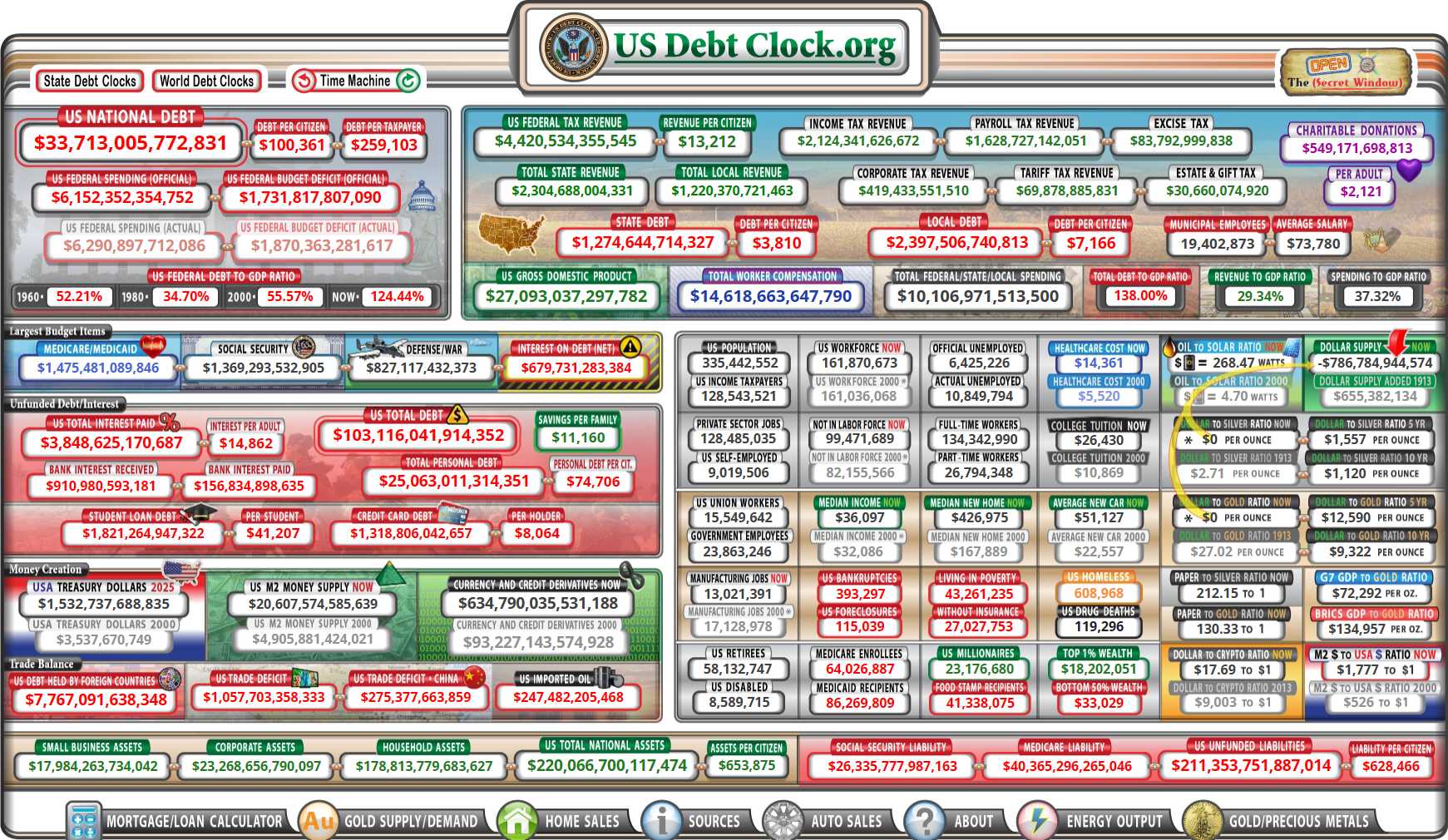

Notice the Interest on our Debt, which is still only at 2%, is now $679.7Bn – it’s our 2nd largest expense and, at 4% (as more rolls over), it will be $1.35Tn – as much as all of Social Security is today! Defense is creeping up on $1Tn and is over $1Tn if you count Veterans Benefits as Military Spending – which most countries do because you wouldn’t have veterans if the Military didn’t make them – LOGIC!

Second (see how smoothly we get back on track?), Fed Chair Powell said in a speech (which was interrupted by Climate Activists) at an IMF conference that the US economy may be more resistant to interest rates than in the past (like we’ve been vaccinated – over and over and over) and that the Fed may have to tighten policy further to rein in inflation.

Second (see how smoothly we get back on track?), Fed Chair Powell said in a speech (which was interrupted by Climate Activists) at an IMF conference that the US economy may be more resistant to interest rates than in the past (like we’ve been vaccinated – over and over and over) and that the Fed may have to tighten policy further to rein in inflation.

Powell also said that demand may have to slow for Inflation to cool down, suggesting that the Fed is not worried about hurting growth by raising rates and is, in fact, trying to contract the Economy (which did not cooperate with a 4.9% GDP read last month).

These comments at the IMF contrasted with his previous remarks that Inflation was transitory and that the Fed would be patient and flexible in adjusting its policy stance. Investors interpreted Powell’s speech as a sign that the Fed is ready to hike rates again in December, and possibly more than once next year. This sparked a sell-off in stocks, especially in the tech sector, which is highly sensitive to Interest Rates. The Dow fell 234 points, or 0.7%, the S&P 500 declined 0.8%, and the Nasdaq Composite lost 1.3% on the day as all that resistance we talked about in the morning was not futile at all…

We get the Consumer Sentiment Report this morning at 10am and that has been AWFUL (like, 2008/9 awful) and, judging by Biden’s recent polls – it’s not getting any better. Expectations fell to 59.3% last month from 68.3% in July and, with only 45 days remaining until Christmas – there’s little chance of a significant turnaround.

After a very slow data week, next week is packed with CPI Tuesday, Retail Sales PPI and Empire State Manufacturing (also awful) on Wednesday, Industrial Production, Housing & the Philly Fed Thursday and Housing Starts on Friday.

And yes, there will still be lots and lots of earnings reports from smaller and smaller companies (the kinds that don’t have massive accounting firms who finish their numbers right after the quarter closes) so we’ll be watching the Russell 2000 very closely and, as you can see, it’s down 15% from the recent highs but the high high for the Russell was back in 2021, at 2,250 so we’re actually down 25% on the RUT and, if that turns out to be justified by small-cap earnings – then we’re already in a recession that the large caps have simply not felt yet!

Have a great weekend,

-

- Phil