The S&P is up 1% since our Oct 17th review but it's been a bumpy ride.

It's also been a very narrow rally and our longs have not fully recovered yet but our hedges performed exceptionally and we re-positioned just in time to take advantage of the massive swing in the Nasdaq, which is only up 2% for the month but it feels much more than that - as we're about 10% off the bottom already - back to where we were when the sell-off begin back in September.

At the moment, our portfolios are generally down a bit as we spent a lot of money on the way down last month but we are swimming with $299,650 in CASH!!! in our Short-Term Portfolio (STP), which is where we keep our hedges that protect the other portfolios - hopefully we won't need to transfer that cash anywhere as the other portfolios recover on their own.

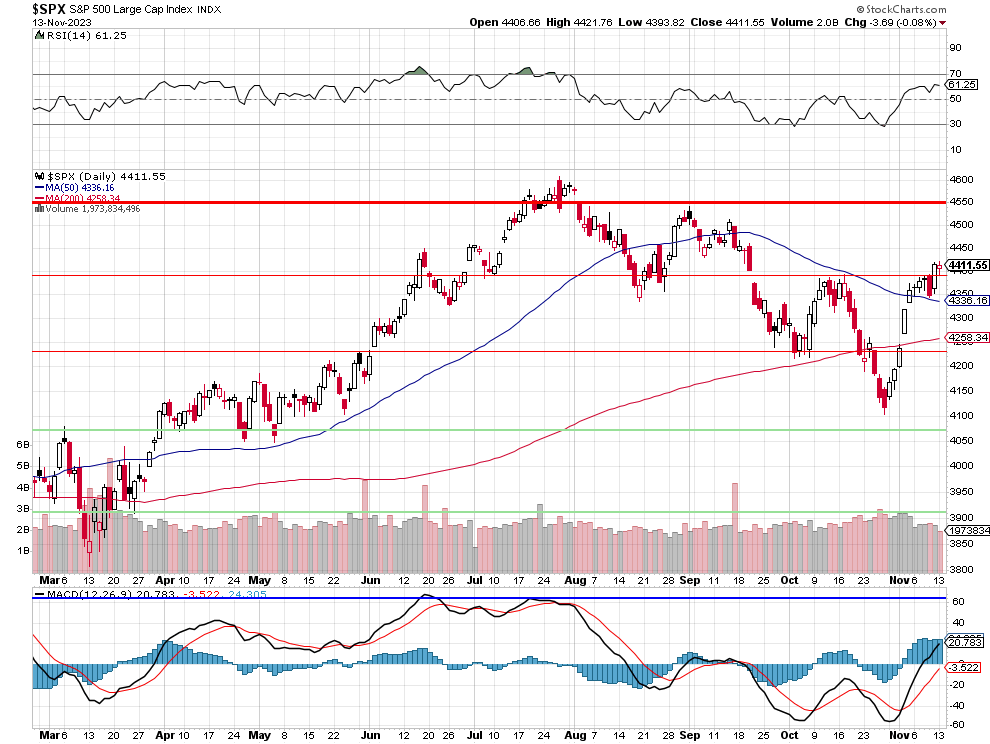

As you can see, the S&P 500 is still bouncing right along our 5% Rule™ - so we're very confident in our positions and our hedges. You can see how the RSI (top) and MACD (bottom) are both getting stretched but we might make our target of 4,550 before things get ugly again - fingers crossed!

Meanwhile, it's an exciting month because we finally got to adjust our Money Talk Portfolio for the first time since July and, fortunately, I was on the show on Wednesday, Oct 25th, which was the PERFECT time to make our very aggressive adjustments...

Money Talk Portfolio Review: $403,926 is up a blazing $34,251 (9.2%) since the 24th but let's not get excited as our July 25th high was $403,344 - so all we've done is recovered - along with the market BUT, hopefully we have re-positioned well for stronger gains into the future.