Happy day after Thanksgiving!

Happy day after Thanksgiving!

Black Friday is the busiest and most profitable shopping day of the year in the United States. The term “Black Friday” originated in Philadelphia in the 1950s, when police officers used it to describe the chaos and congestion caused by the influx of shoppers and tourists who came to the city for the holiday weekend and the annual Army-Navy football game. Later, the term was adopted by retailers who claimed that it marked the day when they turned a profit, or went from being “in the red” to “in the black” in accounting terms.

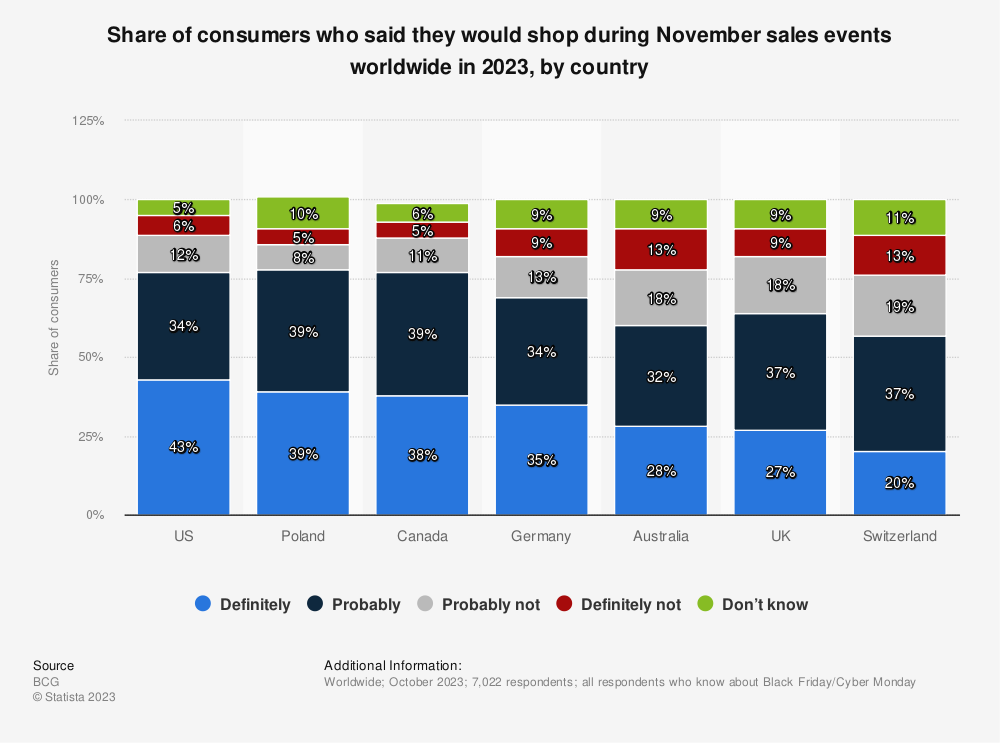

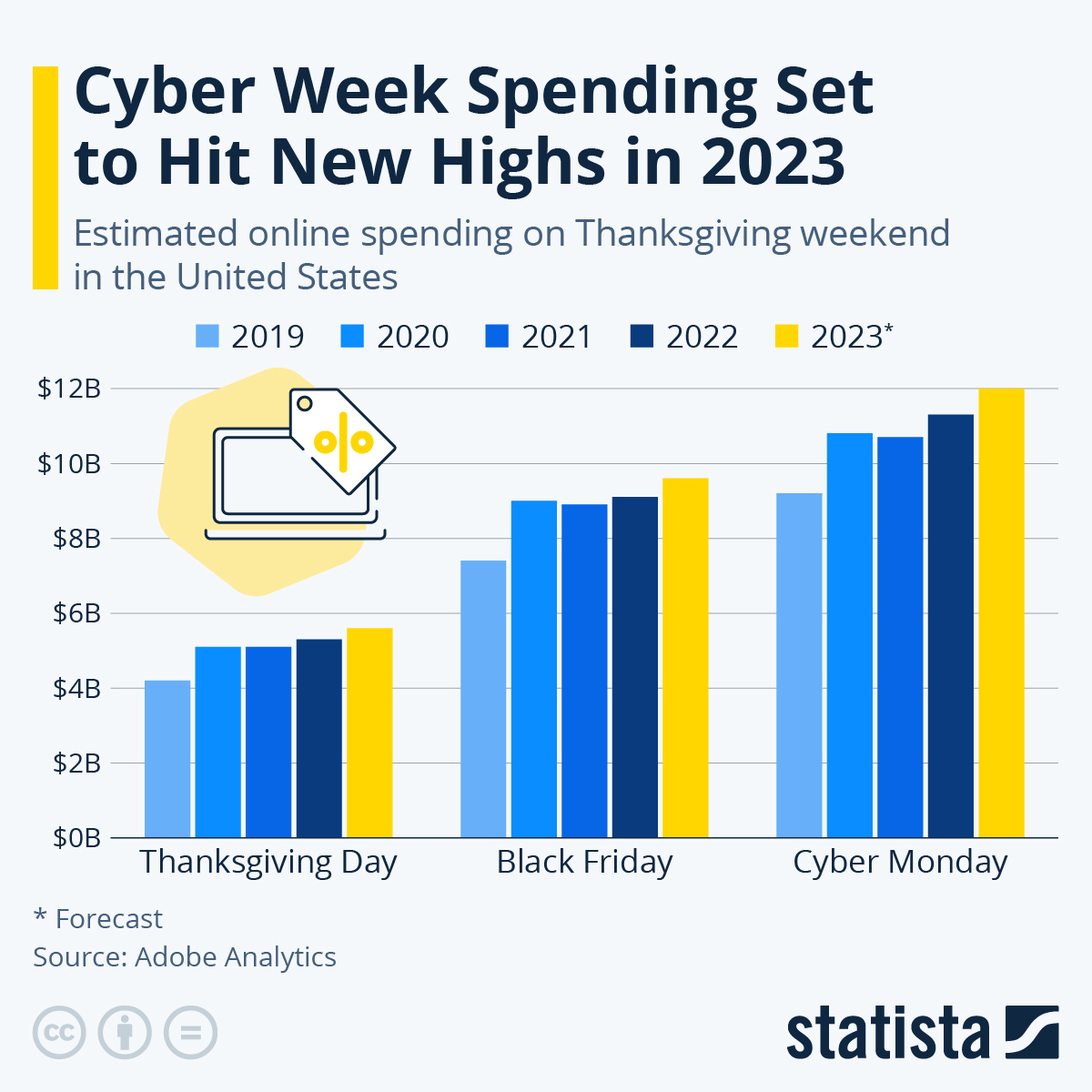

However, Black Friday is not just a U.S. phenomenon. It has become a Global Event, with many countries around the world adopting the tradition of offering discounts and deals on the same day or during the same week. According to Statista, global e-commerce sales on Black Friday reached $65.3Bn in 2023, up from $20.6Bn in 2020. The United Kingdom, Germany, France, Canada, and Brazil are some of the top markets for Black Friday outside the U.S.

For the week, including “Cyber Monday” (the day people go back to work but spend the day shopping on-line), $281Bn was spent on-line in 2022 – about a quarter of all on-line “Holiday” spending ($1.14Tn) into Christmas.

Covid has had a significant impact on the retail sector, especially on Black Friday. In 2020, due to lockdowns, social distancing, and health concerns, many physical stores were closed or had limited capacity, while online shopping surged to unprecedented levels. According to Adobe Analytics, U.S. online sales on Black Friday 2020 reached a record $9Bn, up 22% from 2019. On the other hand, U.S. in-store traffic on Black Friday 2020 declined by 52% from 2019, according to Sensormatic Solutions.

In 2021, as the pandemic situation improved and vaccination rates increased, consumers were more willing and able to shop in person, while still maintaining their online habits. According to Adobe Analytics, U.S. online sales on Black Friday 2021 reached $10.7Bn, up 19% from 2020, while U.S. in-store traffic on Black Friday 2021 increased by 47% from 2020, but was still 28% lower than 2019.

In 2022, as the pandemic situation worsened again due to the emergence of new variants and the resurgence of cases, consumers were more cautious and selective in their shopping behavior, while still seeking value and convenience. According to Salesforce, U.S. online sales on Black Friday 2022 reached $9.12Bn, down 15% from 2021, while U.S. in-store traffic on Black Friday 2022 decreased by 12% from 2021, and was 36% lower than 2019.

In 2023, as the pandemic situation stabilized and the economy recovered, consumers are more optimistic and confident in their spending power, while still looking for deals and discounts. According to Adobe Analytics, U.S. online sales on Black Friday 2023 are expected to reach $9.8Bn, up 7% from 2022, while U.S. in-store traffic on Black Friday 2023 is expected to increase by 10% from 2022, but still 30% lower than 2019.

In 2023, as the pandemic situation stabilized and the economy recovered, consumers are more optimistic and confident in their spending power, while still looking for deals and discounts. According to Adobe Analytics, U.S. online sales on Black Friday 2023 are expected to reach $9.8Bn, up 7% from 2022, while U.S. in-store traffic on Black Friday 2023 is expected to increase by 10% from 2022, but still 30% lower than 2019.

The shift to online shopping has been driven by several factors, such as convenience, safety, price, and selection. According to the Salesforce Shopping Index, digital shopping grew by 58% year over year in Q1 2021, with online traffic increasing by 27% and spending per visit increasing by 31%. Moreover, online shopping has been influenced by new technologies and platforms, such as mobile devices, social media, and retail media networks. According to eMarketer, U.S. mobile commerce sales reached $314.3Bn in 2020, up 41.4% from 2019, and accounted for 44.5% of total e-commerce sales.

According to Business Insider Intelligence, U.S. social commerce sales reached $36.6Bn in 2020, up 38.9% from 2019, and accounted for 4.3% of total e-commerce sales. According to eMarketer, U.S. retail media network ad spending reached $17.37Bn in 2020, up 38.8% from 2019, and accounted for 12% of total digital ad spending.

However, online shopping also faces some challenges, such as supply chain disruptions, delivery delays, cyberattacks, and privacy issues. The COVID-19 pandemic has exposed the vulnerabilities and inefficiencies of the global supply chain, resulting in shortages, bottlenecks, and higher costs for raw materials, components, and finished goods.

However, online shopping also faces some challenges, such as supply chain disruptions, delivery delays, cyberattacks, and privacy issues. The COVID-19 pandemic has exposed the vulnerabilities and inefficiencies of the global supply chain, resulting in shortages, bottlenecks, and higher costs for raw materials, components, and finished goods.

According to the Institute for Supply Management, the U.S. manufacturing purchasing managers’ index (PMI) fell to 50 in October (2023) vs 61.1% in October 2021, indicating a major contraction – we will see how much of this spills over into a slowdown in actual spending by the consumers. Covid caused many, rapid changes in the ECommerce landscape:

- U.S. parcel delivery delays increased by 172% year over year in Q4 2020, affecting 18% of all packages.

- U.S. e-commerce websites experienced 2.3 billion malicious bot attacks in Q4 2020, up 788% from Q4 2019, posing threats to the security and integrity of online transactions.

- 79% of U.S. adults are concerned about how companies use the data they collect from them online, and 81% feel that they have little or no control over the data.

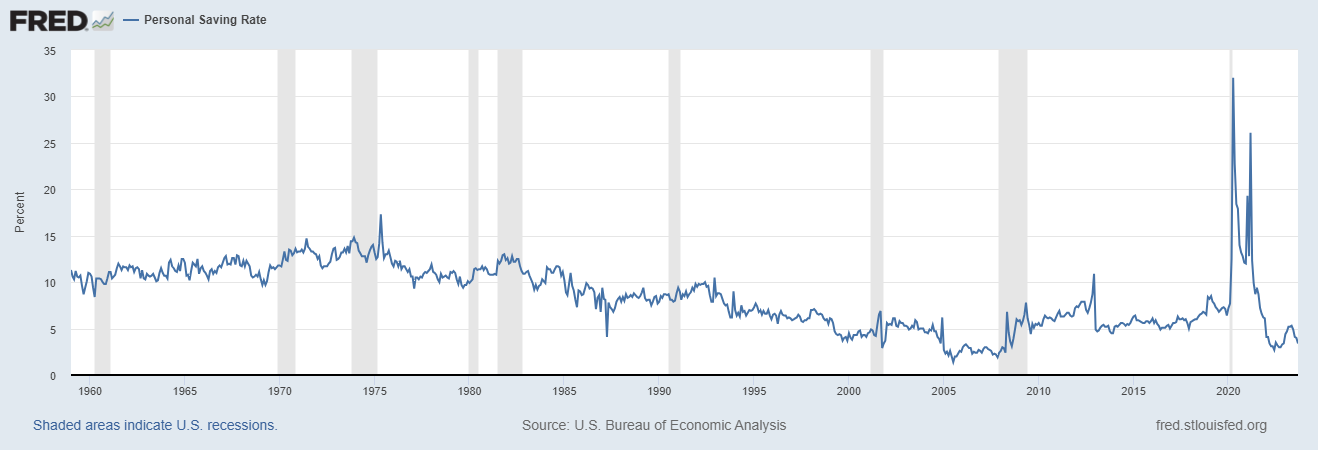

Consumer buying power in Q4 is also affected by several factors, such as inflation, income, savings, and sentiment. The COVID-19 pandemic caused a surge in consumer demand, but also a decline in supply, leading to higher prices and lower purchasing power. According to the U.S. Bureau of Labor Statistics, the U.S. consumer price index (CPI) topped out at 9.1% year over year in October 2022 (now 3.2% higher than last year), the highest rate since 1986. According to the U.S. Bureau of Economic Analysis, the U.S. personal income increased by 6.7% over that same period – leaving consumers 5.6% behind the total inflation coming into the Holidays.

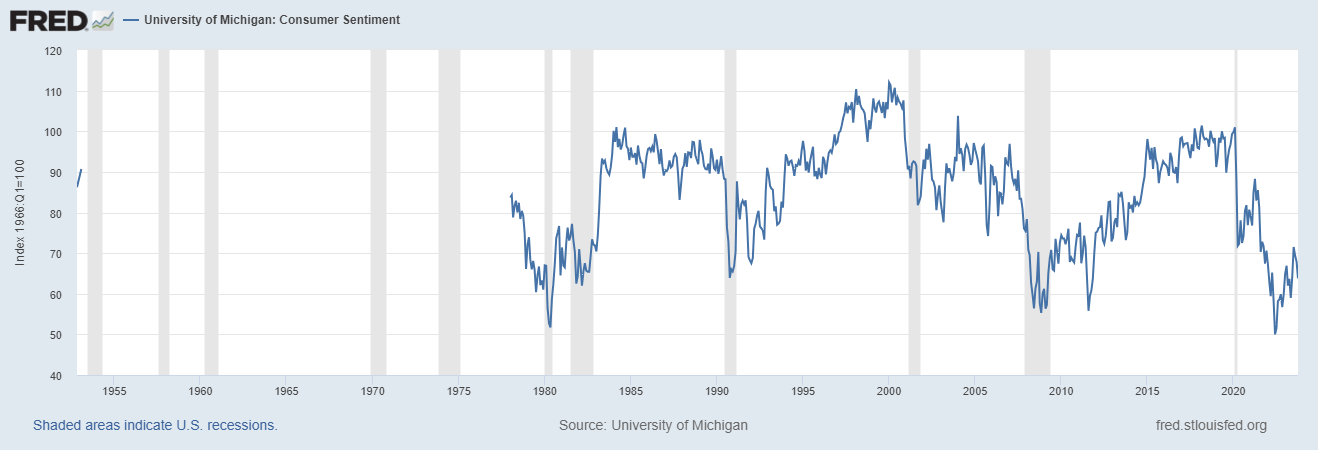

U.S. personal saving rates decreased to 3.4%, down from 32% in April 2020. According to the University of Michigan, the U.S. Consumer Sentiment Index fell to 63.8 in October, down from 99.8 in 2020 and that makes sense as falling 5.6% behind in buying power and having no savings left can make people a little gloomy in their outlook, right?

Black Friday is a phenomenon that reflects the changing behavior and preferences of Consumers, as well as the opportunities and challenges of the retail sector. We’ll be watching the numbers very closely this year as the market is pricing in a very happy holiday and actual consumer behavior may still derail that thesis.

Have a great weekend,

-

- Phil