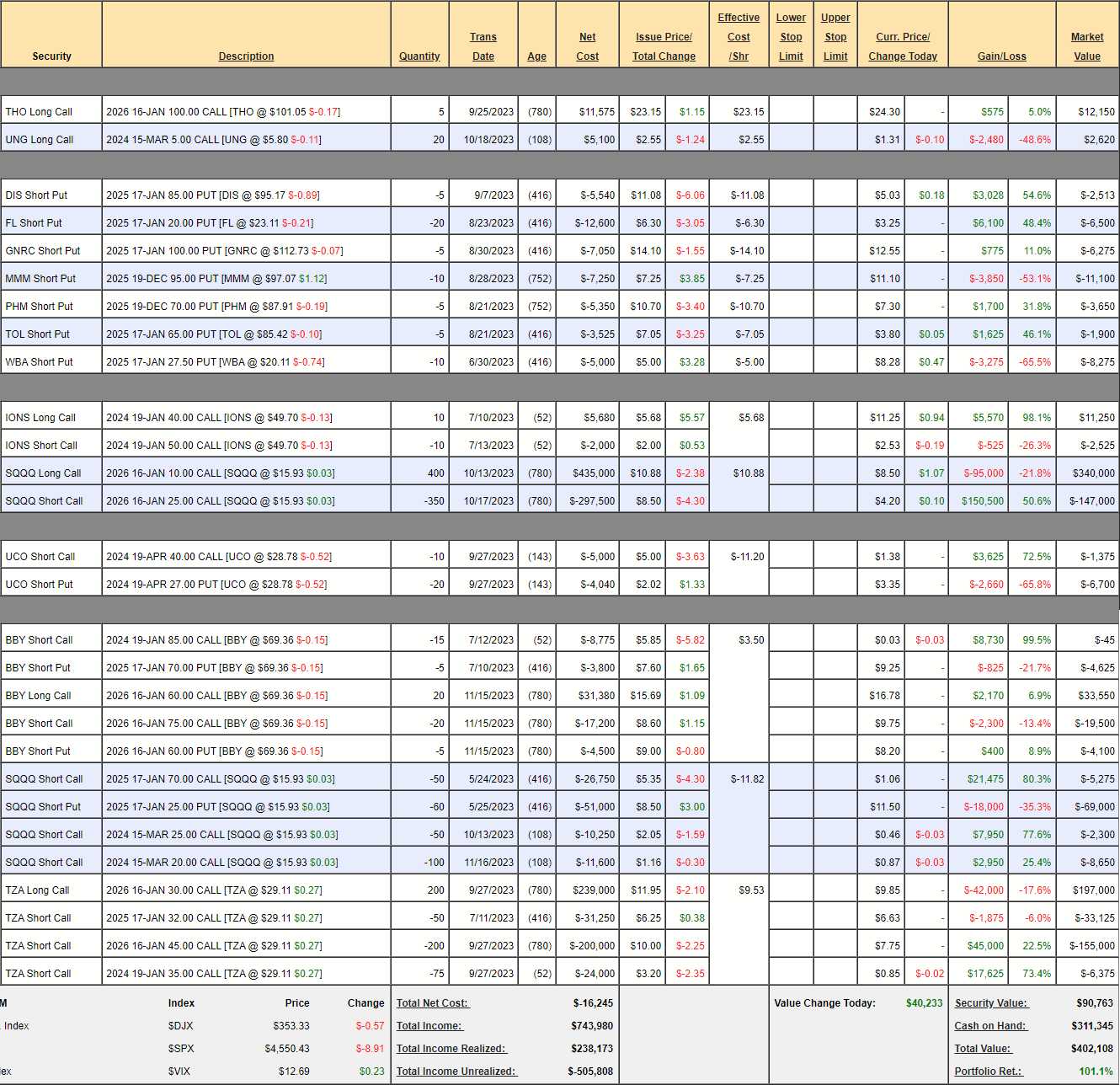

101.1%!

That's how much our Short-Term Portfolio is up as of yesterday's close (and it's only been 6 months!) and that's because we made some bullish adjustments on the 14th, when we did our review. We only made a couple of small changes as we had already gone bullish at the bottom (selling a lot of short-term calls against our index hedges) but, now that we're made $45,690 in two weeks - it would be silly not to make an adjustment.

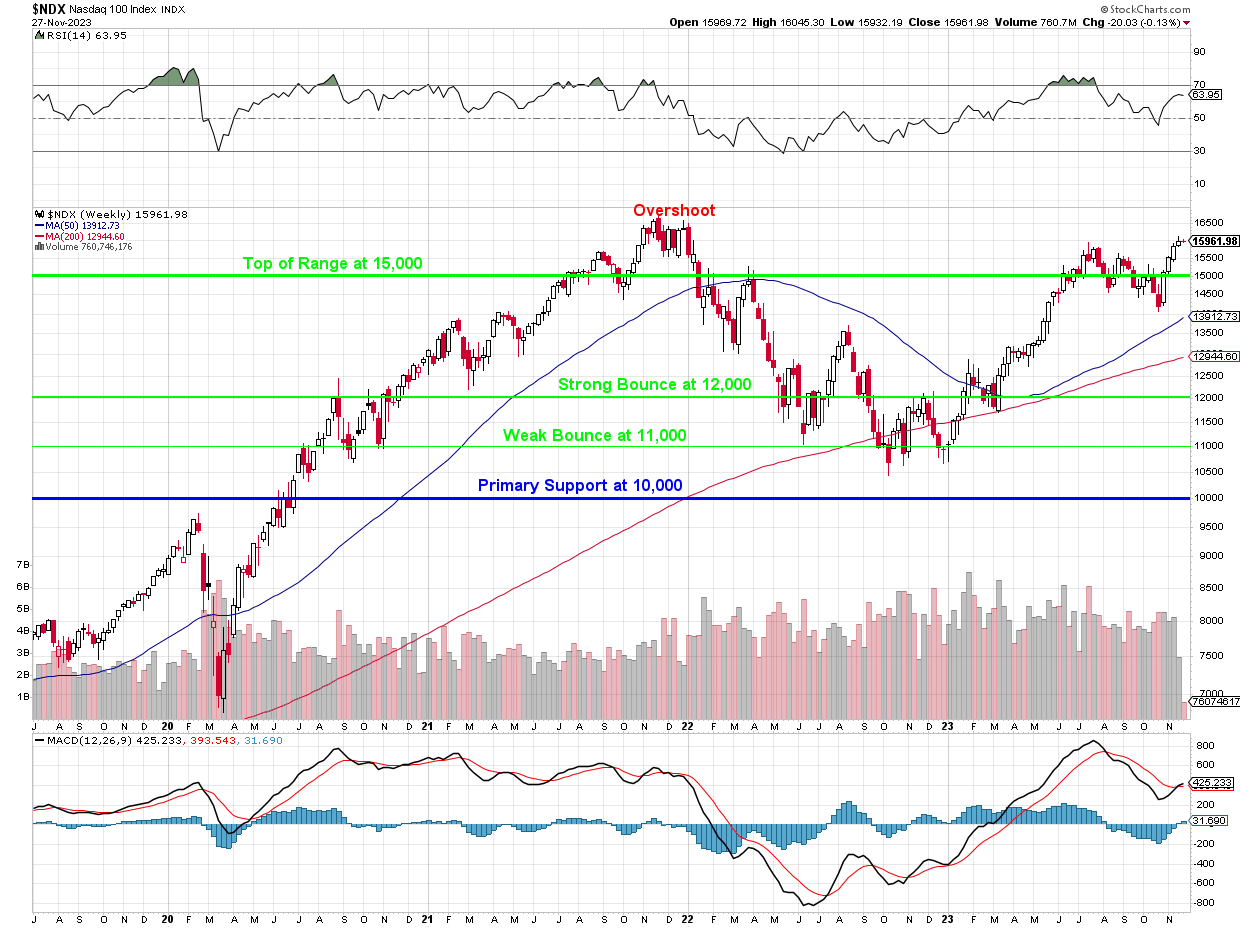

As I noted in yesterday's Live Member Chat Room, my concern lies with the Nasdaq, which is getting very close to 16,666 (30x earnings) - which is where we failed in Dec of 2021 - ultimately falling all the way back to 11,000 (34%) a year later. Is this time going to be different? I'm not willing to bet on it - not when we have so many gains in our long portfolios we should lock in!

The LTP also gained over $50,000 in the last two weeks and our other Member Portfolios are also up so it would simply be irresponsible of us not to lock in those gains by making a few adjustments - just in case the Nasdaq isn't going to trade at 40x earnings (2.5%) while a TBill pays 5%.

This is not a full review but I'll mention what needs mentioning:

-

- UNG - The March $5 calls are $1.31 ($2,620) and we're down about half. Hurricane season was a bust and apparently will continue to be as warmer waters are changing the patterns but LNG exports will pull demand so let's roll these calls to 25 2025 $3 ($3.50)/7 ($1.32) bull call spreads at net $2.18 ($5,450) and those pay $8,000 at $7, which would really just be even overall.

-

- MMM - I just want to point out how silly it is to worry about this put.