“Bill Ackman Bets Fed Will Cut Interest Rates as Soon as First Quarter“

That’s the headline on Bloomberg this morning as the Dollar dips back to it’s August lows; when the S&P was 4,600 (now 4,554) and the Nasdaq was 16,000 (now 16,000) and the Dow was 35,750 (now 35,416) and the Russell was 2,000 (now 1,792). None of this is surprising and we took the opportunity to increase our hedges a bit yesterday and today we are waiting for the 2nd estimate of Q4 GDP, which was at a blistering 4.9% on the first reading – far too hot to rationally expect rate cuts but who said the markets were rational?

The funny thing about the markets getting excited about what Ackman has to say is his reasoning is: “I think there’s a real risk of a hard landing if the Fed doesn’t start cutting rates pretty soon,” noting that he’s seen evidence of a weakening economy. Is that really a bullish premise – “We’re going to crash if they don’t hit the brakes” is not really the starting pistol for a bull run, is it?

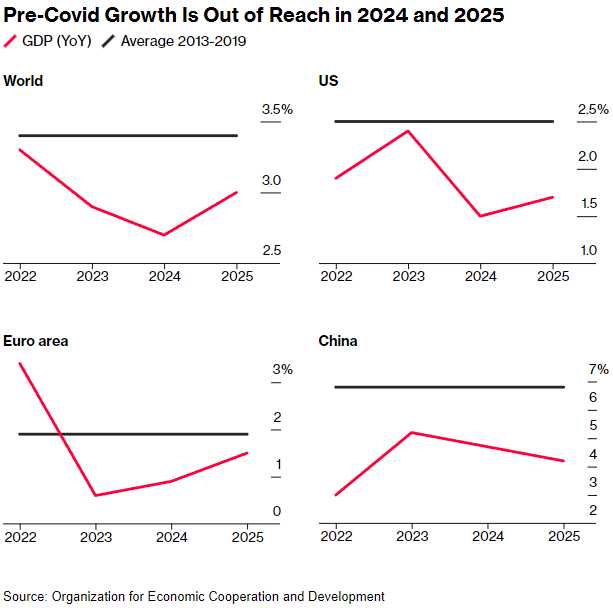

And it’s not just Ackman worried about a crash – the OECD sees Global Growth dropping to 2.7% in 2024, a 6.8% contraction from 2.9% in 2023. Growth is losing momentum in many countries and won’t edge up until 2025, when real incomes recover from the inflation shock and central banks will have begun cutting borrowing costs, the Paris-based organization said.

Moreover, the OECD said the risks to the forecast are tilted downwards amid heightened geopolitical tensions, an uncertain outlook for trade, and the risk that tight monetary policy could hurt firms, consumer spending and employment more than expected. “Inflation is easing, but growth is slowing,” OECD Chief Economist Clare Lombardelli said in a statement. “We are projecting a soft landing for advanced economies, but this is far from guaranteed.”

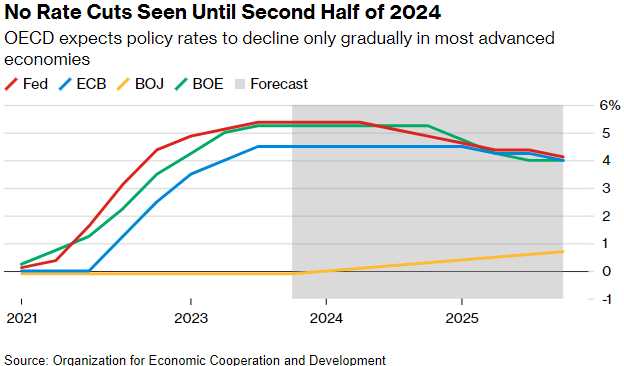

The OECD expects rate cuts in the US will only begin in the second half of 2024, and not until the spring of 2025 in the euro area. That contrasts starkly with the expectations of markets (and Bill Ackman), which are currently pricing the Federal Reserve and the European Central Bank will ease policy as soon as the first half of next year.

A “challenging fiscal outlook” is confronting many governments as debt-servicing costs rise, the OECD warned. To meet demands from aging populations and the climate transition, it said countries need to make stronger efforts in the near term to create space for future spending. “In summary, the global economy is grappling with inflation, slowing growth, and mounting fiscal pressures,” Lombardelli said.

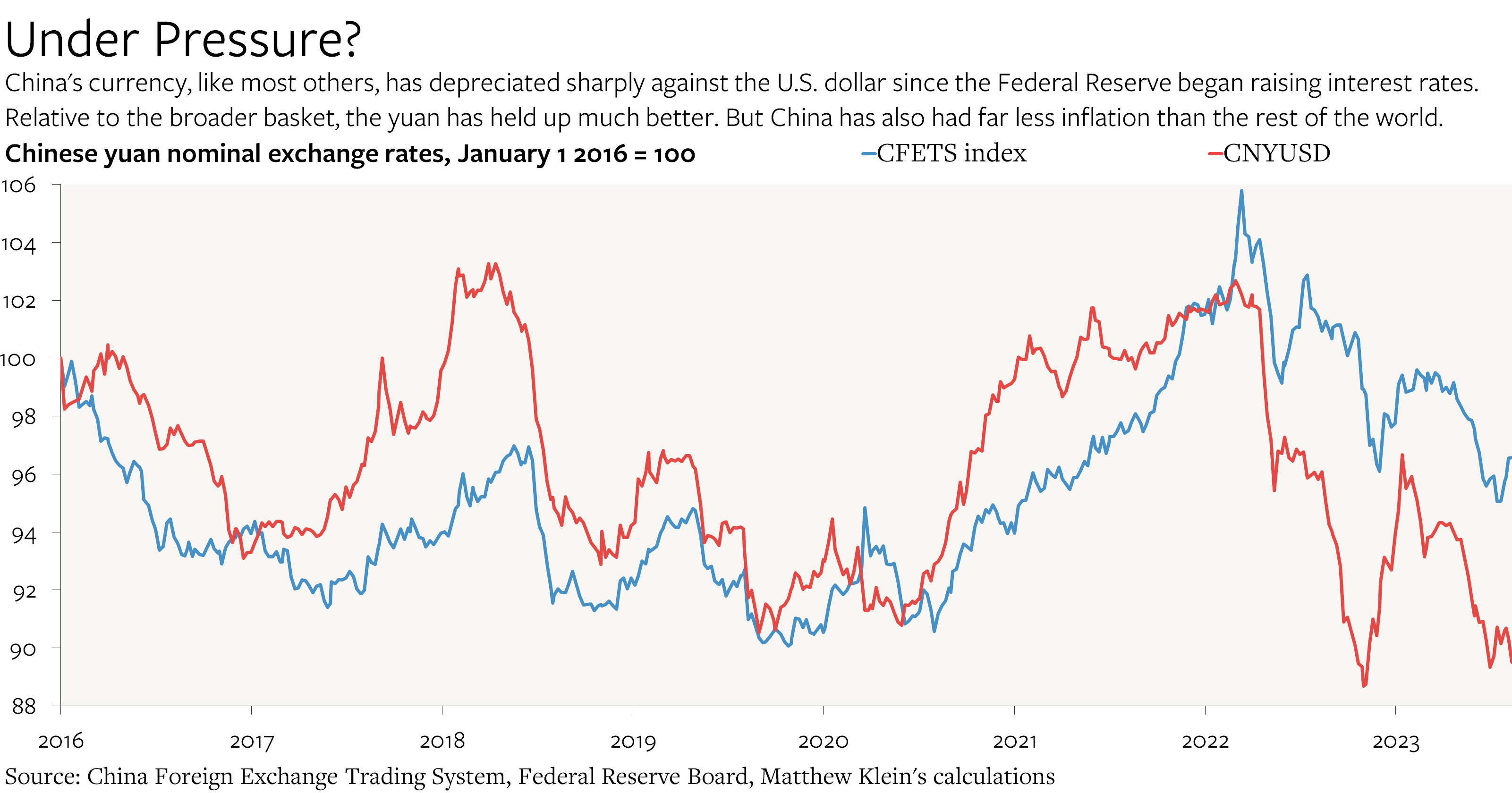

Meanwhile, over in China – PBOC Governor, Pan Gongsheng emphasized the need to pursue sustainable economic growth. He said at a conference that the policy priority would be pursuing a steady credit expansion and an optimized lending structure to transition the country’s growth engine from debt-reliance mode to more sustainable modes, which is a nice way of saying they will bail out Real Estate and prevent it from being 1/3 of their economy in the future.

Echoing Pan’s remarks, the PBOC’s third-quarter monetary policy report, published on Monday, underscored the rising urgency to accelerate economic transformation due to the diminishing effect of debt on driving growth and the significant change in the supply-demand relationship in the Real Estate Market.

The PBOC report pledged to funnel more financial resources into technological innovation, private and smaller businesses, advanced manufacturing and green development, and pay more attention to improving the efficiency of existing loans in supporting economic growth. The central bank has also reinforced its commitment to guarding the stability of the Renminbi exchange rate which, in turn, puts downward pressure on the Dollar.

While Inflation is not currently a problem in China, in the US it continues to trash Consumer Confidence with October now having been downgraded from 102.6 to 99.1 but the good news is that adjustment made November’s initial reading of 102 now seem an increase (to 99.1), rather than a decrease to the unrevised 102.6 – aren’t numbers fun?

This afternoon (2pm) we’ll take a look at the Fed’s Beige Book during our Live Trading Webinar and tomorrow we get Personal Income and Spending and PCE Prices at 8:30 so all these people speculating this morning (Futures are up a half a point) are doing so in absence of data based on statements by people that are being featured by Financial Market Cheerleaders and their pet media holdings in order to drive retail investors in while professional investors head for the exits.

8:30 Update: GDP revision is coming in hot, Hot, HOT – now at 5.2% and the Price Index is now 3.6% from 3.5% so the 0.3% INCREASE in GDP is another 6.1% more than it was last month and if this were the ONLY data point we had – the Fed would HAVE to raise rates to get a handle on Inflation – before it’s too late to control it at all.

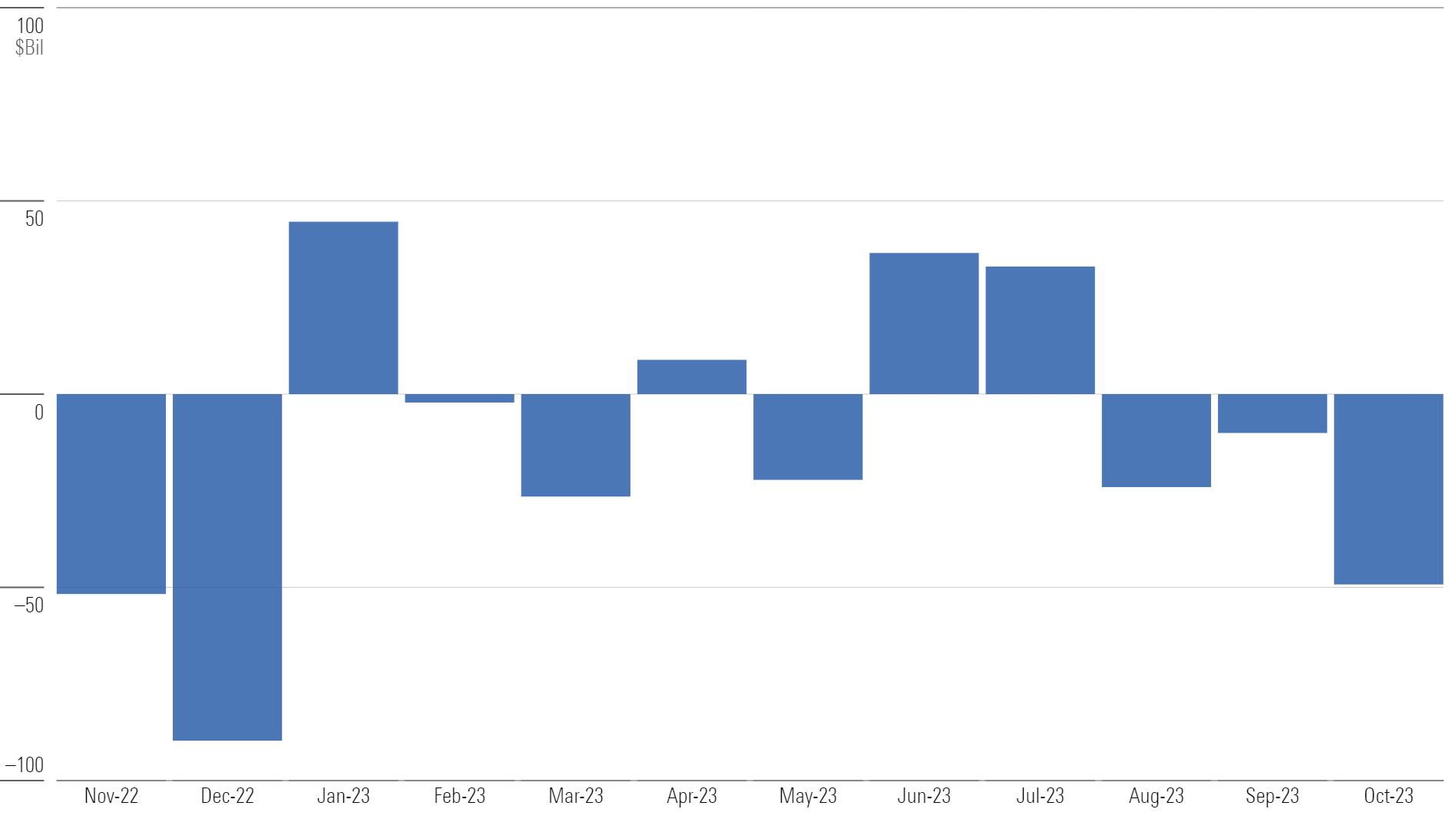

The Fed can’t keep ignoring the data they claim to be dependent on or they will lose all credibility. Monday’s auction of 2-Year Notes hit a yield of 1.75%, topping levels not seen since March 2020, while yesterday’s 7-Year Note sale yielded 2.5% – again returning to January 2020 highs. Bid-to-Cover ratios were also at decade lows – indicating our recently terrible 10-year auction was not the fluke that was being spun by the media – who claimed a hack was responsible for that auctions near failure in interest.

Poor bond auctions reflect the market’s expectations of higher Inflation and Interest Rates in the future, as the economy continues to recover (5.2% GDP!) from the pandemic and the Fed continues to taper their own bond-buying program that has supported these auctions for many years. Higher Inflation erodes the purchasing power of the bond’s fixed payments, making the bond less attractive to investors. Higher base interest rates increase the opportunity cost of holding the bond, as investors can find better returns elsewhere. Therefore, investors demand a higher yield to buy the bond, which lowers the price of the bond – QED.

Poor bond auctions reflect the market’s expectations of higher Inflation and Interest Rates in the future, as the economy continues to recover (5.2% GDP!) from the pandemic and the Fed continues to taper their own bond-buying program that has supported these auctions for many years. Higher Inflation erodes the purchasing power of the bond’s fixed payments, making the bond less attractive to investors. Higher base interest rates increase the opportunity cost of holding the bond, as investors can find better returns elsewhere. Therefore, investors demand a higher yield to buy the bond, which lowers the price of the bond – QED.

The bond auctions have implications for stock investors, as they indicate the cost of borrowing and the outlook for the economy. Higher bond yields mean higher borrowing costs for businesses and consumers, which can reduce their spending and investment, and lower their profits and income. Higher bond yields also mean lower bond prices, which can reduce the wealth and confidence of bondholders, and make them more likely to sell their bonds and buy stocks.

Higher bond yields also reflect higher Inflation and Interest Rates, which can hurt the stock market by reducing the present value of future cash flows and increasing the discount rate used to value stocks. Higher Inflation and Interest Rates can also reduce the economic growth and corporate earnings, which can lower the demand and price of stocks.

Let’s be careful out there…