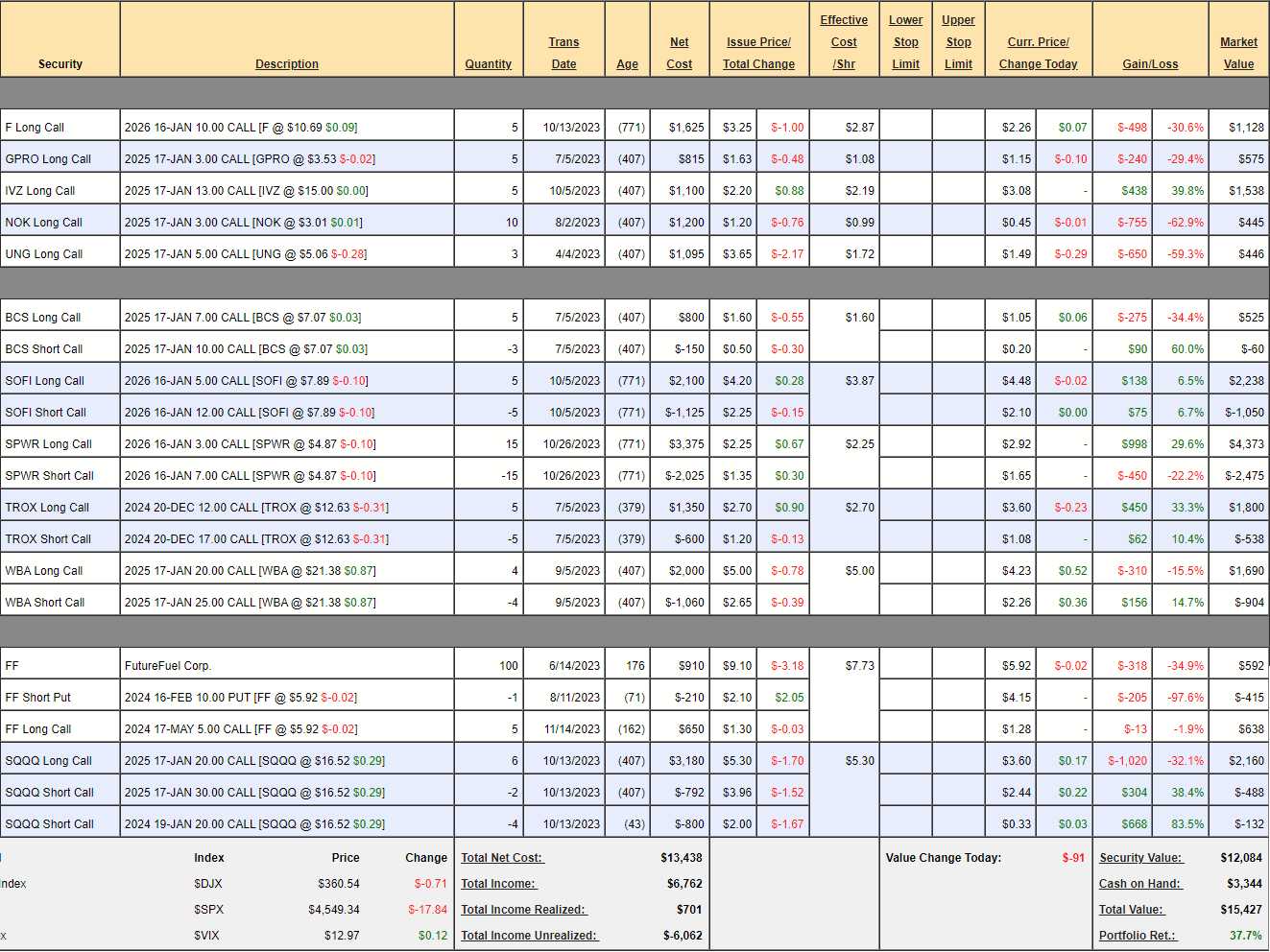

$15,427!

$15,427!

That’s up $4,227 (37.7%) in 15 months and that’s miles ahead of our 10% annual goal. At a 37.7% rate of return, using our compound rate calculator and adding $700/month – we will hit $1M in year 10 – not year 30! Don’t get too excited though, last month we were only up 24% as the market dipped and that could easily happen again – it’s a long and winding road…

If you are just getting started on your path to being a Millionaire – you haven’t missed very much at $15,427 and you can go over months 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14 and 15 to see all the moves we’ve made to get this far. This is a small portfolio, which means we can’t use all of our favorite option techniques yet – but it’s a great way to learn how to get started on a wealth-building adventure.

Last month we did not add any new positions but we made a few bullish adjustments. With this month’s $700, we now have $3,344 but we’re using $1,000 in margin so $2,344 is what we have to play with this month:

-

- F – I think $14 is a very conservative target and that would be $4 per share ($2,000) so the upside potential is $872 (77.3%). Of course, at $14 we would probably cover and reduce the basis but let’s not complicate things…

-

- GPRO – At $6 the calls will be worth $1,600 so upside potential of $1,025 (178%) would be very nice in 13 months.

-

- IVZ – We are ahead on these but $20 would be $2,500, which is an upside potential of $962 (62.5%), so it’s worth holding for now.

-

- BCS – We’re a little aggressive on these and our goal is $1,500+ and currently just net $465 but what’s the point of the short $10 calls if all we can make is $60 in 13 months? Let’s buy those back and hopefully earnings will be kind to us in January. Upside potential should be better than $915 (156%) after we spend the $60.

-

- SOFI – I’m very confident in this one hitting its $3,500 goal and that’s $2,312 (194%) upside potential from here.

-

- SPWR – Maybe NOW!?!? I’d buy back the short calls if they were cheaper. It’s a $7,500 spread at net $1,898 but we’re almost $3,000 in the money – aren’t options fun? Upside potential is $5,602 (295%) – this could be the only trade in the whole portfolio and we’d be on track if it works!

-

- TROX – This one is on track with a year to go. It’s a $2,500 spread at net $1,262 so $1,238 (98%) upside potential here.

-

- WBA – Annnd NOW!!! Another horse that won’t leave the starting gate but they’ll get there. It’s a $2,000 spread at net $786 so $1,214 (154%) upside potential on this one.

-

- FF – We’re down on this one but not down enough to make changes. They just paid out 0.06/share ($60) on Nov 30th and we only paid net $700 for the position so that’s 8.5% for the quarter in just dividends – that’s a keeper! We added the calls last month but going the wrong way so far. If they get back to $10 that’s $823 (552%) upside potential – not even counting the long calls (May is too soon to count on).

So, if all goes well, our 11 long positions have $14,963 (96.9%) of upside potential over the next two years and that will keep us on the 40% annual path – IF all goes well. If it does not, we have our hedges:

-

- SQQQ – It’s a 3x ETF so at $16.52, if the Nasdaq drops 20%, SQQQ should go up 60% and that would be $26.43, not $30. At $26.43 we’d get $3,858 from our longs to cover losses on the rest of the portfolio. It’s probably not enough now that we’re up to $15,433 so even a 20% loss of that would be $3,000+ and we’re leveraged – so it could easily be worse.

- We haven’t spent any money yet this week so let’s spend a bit on hedges and buy back both sets of short calls for $620. We’ll sell some again when SQQQ bounces. This does not, however, fix the problem of only collecting $3,858 on a 20% drop so let’s roll our 6 2025 $20 calls ($2,160) to 10 2026 $15 calls at $6.40 ($6,400) and sell 7 2026 $25 calls for $5 ($3,500). That roll will cost us net $740 + the $620 to buy back the old calls is $1,360. Now we’re $1,652 in the money with another year of protection and, at $25, we get back $10,000 – now THAT’s PROTECTION!

- And, don’t forget, we can collect $420 selling 3 March $18 calls for $1.40 (but not yet) – so we’ll make that $1,652 back in no time!

Well that only leaves us with $692 to spend so let’s wait until the holidays have passed before we deploy any more cash. It’s been a great first year (and 4 months) – thanks for joining us on this Investment Journey Lesson!

Come and join us inside! You will gain access to our portfolios, live chats, and other member-exclusive perks.

Email Maddie – Admin@philstockworld.com – for a 7-day free trial at sign up.