That’s in-line with last month’s 219,000 jobs and, in just 3 years, that’s going to be 14M jobs created under Biden – a nice comeback from Trump’s loss of 2.9M jobs in 8 years. Still, poll after poll shows people are not happy with Biden’s handling of the economy – even with a 10% increase in the workforce.

That’s because it doesn’t matter if people are working if their paychecks aren’t covering their expenses and that’s still the case for most Americans. Yesterday we got a consumer credit report which showed us just $5.1Bn in Credit Growth in November, despite the rapidly expanding work-force. That’s a dangerously Recessionary signal – but not to Wall Street – which is partying like it’s 1999, or 2007.

Average Hourly Earnings increased 4% over last year, when earnings were up 5% but inflation topped out at 9.1% last year and it’s still running at 3.2% so the wages, very simply, are not keeping up with inflation (and that’s just the BS Government Inflation number) – so that means the average American is falling behind.

Consumer Spending was very much held up this year by Travel & Leisure and we just had a great Thanksgiving for travel and Christmas looks good too but that’s because people haven’t had holidays with distant family members since 2019 – so there’s been a lot of pent-up demand for travel – we’ll have to wait and see if that’s still the case come Easter.

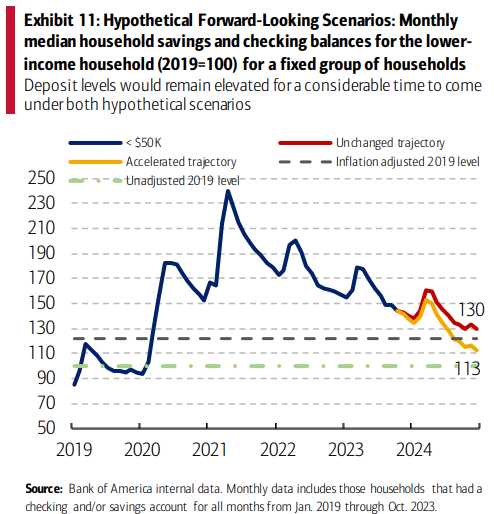

What’s going on behind the scenes is Americans, thanks to massive stimulus during the Trump/Covid years, had amassed a median savings level of $240,000 in early 2021 and, since that time (Biden), wages have not kept up with rampant inflation where thinks like homes, auto, education and health care are up 30%.

What’s going on behind the scenes is Americans, thanks to massive stimulus during the Trump/Covid years, had amassed a median savings level of $240,000 in early 2021 and, since that time (Biden), wages have not kept up with rampant inflation where thinks like homes, auto, education and health care are up 30%.

Since people tend to live in the real world where they do have to buy these things – household savings has dropped 40% during Biden’s 3 years and all those extra jobs are not helping at all as we continue to go lower to what Bank of America predicts will be $130,000 by next year’s election – nearly half of where savings were in the prior election and THAT is what voters are talking about when they say they are unhappy!

8:30 Update: “Only” 199,000 jobs created in November but unemployment dropped from 3.9% to 3.7% – so that’s strange. Mixed news for the Fed in that case. Average Hourly Earnings were up a hot 0.4% (4.8% annualized) and that’s double last month’s 0.2% and that’s NOT what the Fed wants to see at all. That’s sending our indexes lower with the Nasdaq giving back half of yesterday’s gains in the Futures.

The lower-than-expected job growth and the higher-than-expected wage growth in November could pose a dilemma for the Fed, which is will announce rates next Wednesday, the same day we get PPI for November after CPI on Tuesday. On one hand, the weak job growth could signal that the economy still needs more stimulus and support from the Fed, which could delay the tapering of its $120Bn MONTHLY ($1.44Tn/yr!) bond purchases and keep rates steady. On the other hand, the strong wage growth could fuel inflationary pressures and expectations, which could force the Fed to accelerate the tapering and raise rates – something that traders have completely written off at this point.

More jobs + more wages is already spiking the Dollar so we’d better take the oil profits from Wednesday’s Webinar trade off the table at $71 (stop if it falls below), for a nice $1,320 gain per contract (and we doubled down yesterday in our Live Member Chat Room!) – congratulation to all who played along with that one.

Our target was $71.50 (the weak bounce line) but, since we doubled down yesterday at $69, it dropped our basis to $69.355 and that’s put our gains well over our $1,500 per contract target but, even if you didn’t double down – the rising Dollar makes the oil a riskier hold – so why risk it?

There are always ways to make money in the market if you pay attention. Though we’ve been generally bearish on oil, we decided $70 was going to be bouncy and we took our profits on the oil shorts we had in the Short-Term Portfolio (STP) and we added these Futures longs in the Webinar.

Now we’ll have to go back to our reading and wait for the next interesting opportunity…

Have a great weekend,

-

- Phil