Apple Inc. (AAPL), with its colossal user base and innovative prowess, is on a trajectory to reach a $5 trillion market cap by 2030. This ambitious goal hinges not just on maintaining its current momentum but also on expanding its ecosystem and introducing groundbreaking products.

Apple Inc. (AAPL), with its colossal user base and innovative prowess, is on a trajectory to reach a $5 trillion market cap by 2030. This ambitious goal hinges not just on maintaining its current momentum but also on expanding its ecosystem and introducing groundbreaking products.

Central to this strategy is leveraging Apple’s 1.5Bn iPhone users, who, if they can be persuaded to spend an additional $1,000 with AAPL over the next seven years ($1.5 trillion), would be enough to achieve this target – WITHOUT adding any new users at all!

This article explores how each segment of Apple’s business could contribute to this growth, underpinned by the robust ecosystem that drives the company’s incredible service revenues.

The Power of the iPhone User Base

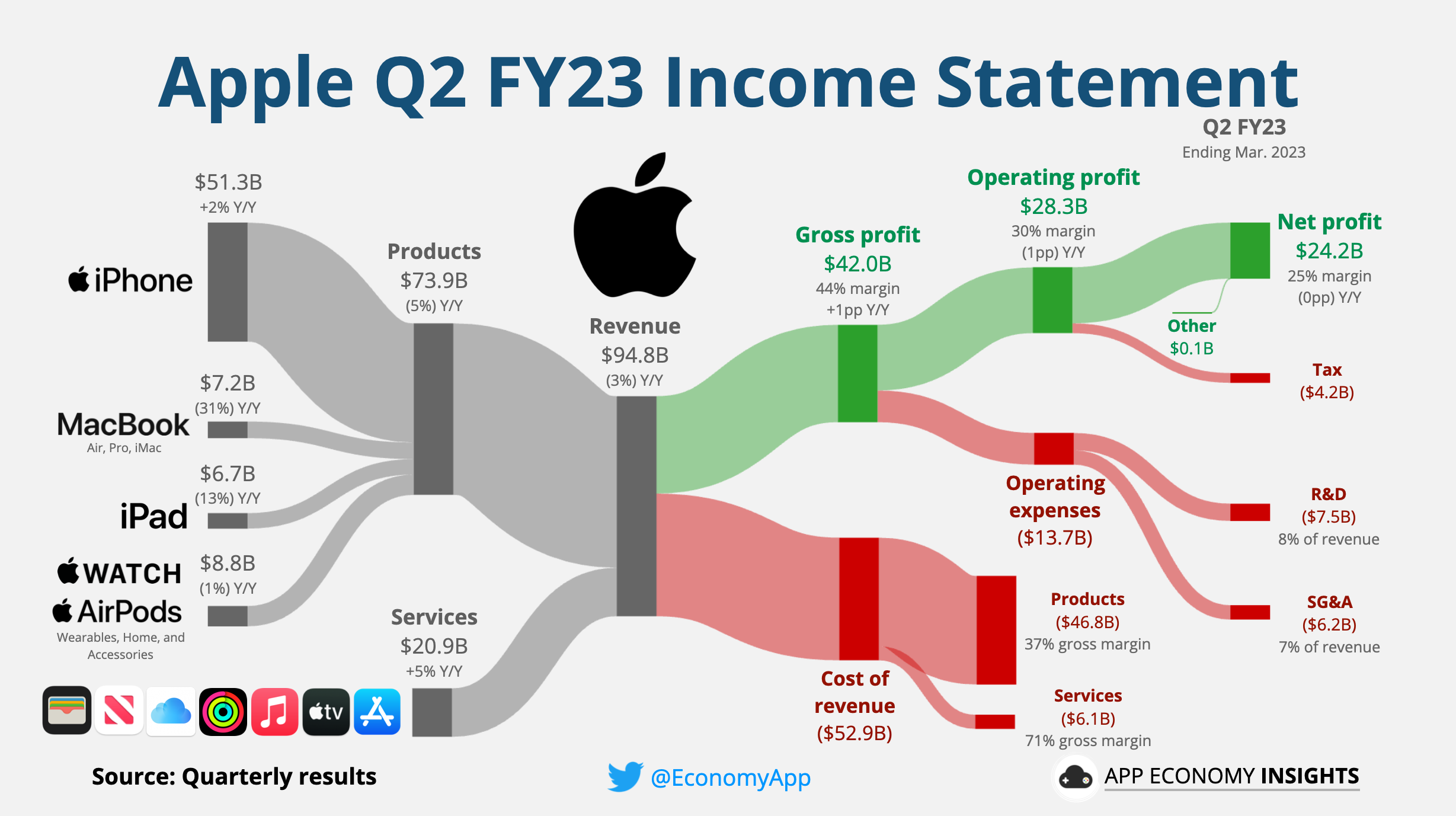

Increasing the average revenue per user (ARPU) could be the pivotal move Apple needs to dominate the latter part of the 2020s. If Apple can motivate its 1.5Bn iPhone users to spend an additional $1,000 over the next seven years, it would generate an extra $1.5Tn in revenue. This translates to an additional $200 billion annually, significantly enhancing Apple’s current $400 billion in sales and $100 billion in profits. To realize this, Apple must cleverly blend new product introductions with enhancements to existing services, compelling users to deepen their financial commitments to the Apple ecosystem. Source: Apple’s Financial Reports

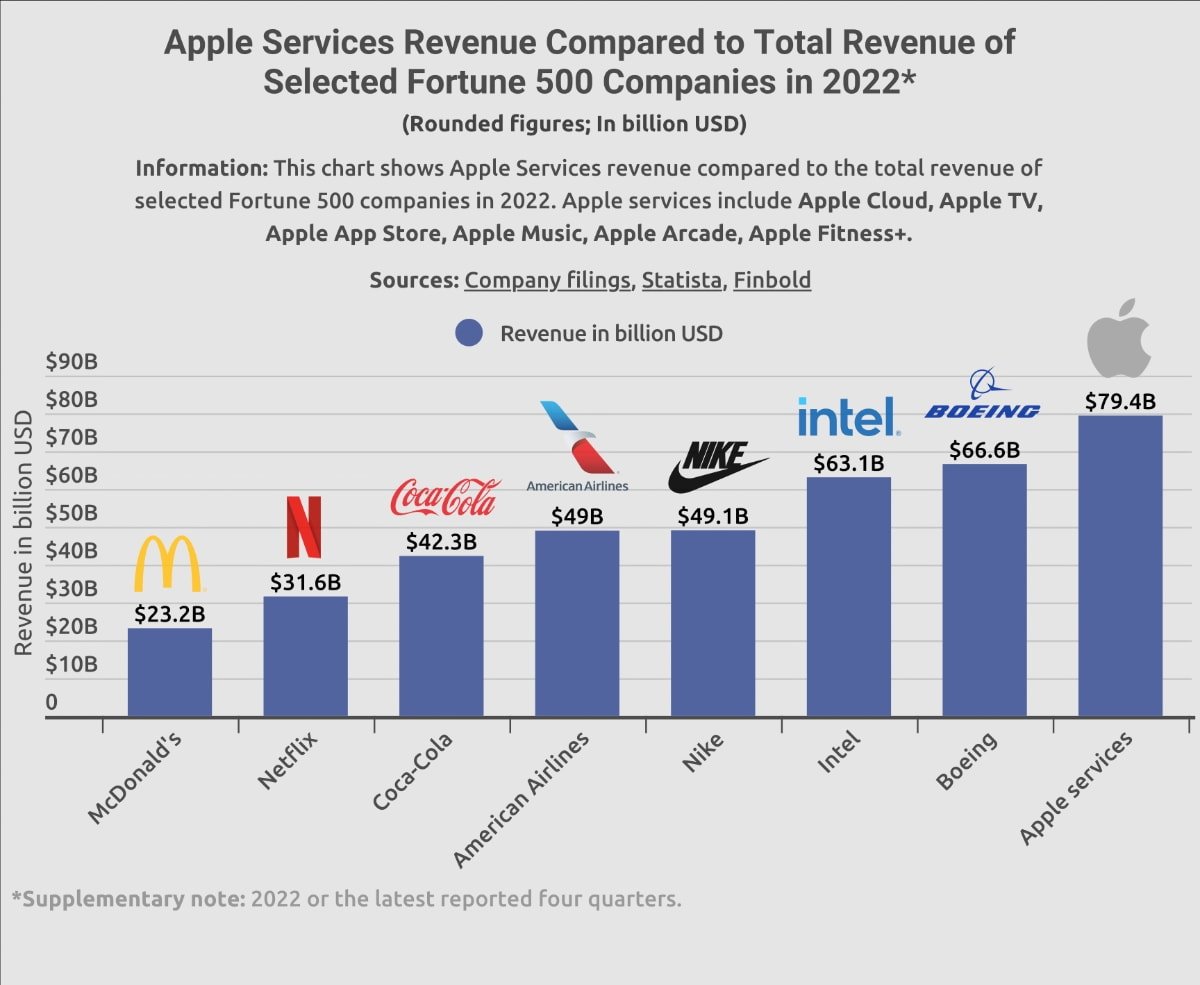

Expanding the Services Segment

Apple’s Services division, a high-margin powerhouse, stands at the cusp of significant expansion. Currently, with revenues potentially soaring to $164 billion, this segment is more than just a revenue stream; it’s a growth catalyst. The expansion of services like Apple Music and iCloud is just the beginning. The real game-changer could be Apple’s foray into AI-driven services.

Consider the current landscape: Bing and Google dominate the search engine market, with AI integration becoming increasingly central to their functionality. Apple, traditionally reliant on Google for search capabilities, has a unique opportunity to revolutionize this space with SiriAI. By developing an AI-powered search engine, Apple could not only retain more value within its ecosystem but also tap into the lucrative search engine market, which is a multi-billion dollar industry.

Moreover, the integration of AI into Apple’s existing services could significantly enhance user experience and create new revenue streams. For instance, AI could personalize music and content recommendations in Apple Music and TV+, optimize storage solutions in iCloud, and even introduce new AI-based health and productivity tools.

Financially, the impact could be substantial. If Apple captures even a fraction of the search engine market and successfully integrates AI across its services, we could see a surge in service revenues. For perspective, Google’s parent company Alphabet is reporting over $300Bn revenues this year, a significant portion of which came from search-related advertising. If Apple’s SiriAI captures even 10% of this market, it could add tens of billions to its annual revenue.

In essence, Apple’s expansion into AI-driven services isn’t just an addition to its portfolio; it’s a strategic move that could redefine its revenue model and significantly contribute to reaching its $5 trillion valuation goal. Source: Seeking Alpha – Apple’s Services Growth Flywheel

Innovations and New Ventures

Apple’s entry into new markets like the iCar, iRobot, and iHome is not just an expansion but a strategic transformation. Here’s a look at the potential of each venture by 2030:

iCar: Revolutionizing the EV Market

Apple’s iCar project aims to make a significant impact in the global electric vehicle (EV) market. Considering Tesla’s current market cap of approximately $771Bn, with $100Bn in sales and $11Bn in profits, the EV market presents a massive opportunity. By 2030, the global EV market is projected to grow exponentially. If Apple captures even a modest share of this market, it could contribute tens of billions to its annual revenue. The challenge lies in outshining competitors with Apple’s unique blend of technology and user experience. Source: Tesla Market Cap

iRobot: Global Robotics Adoption

While Japan is a leader in robotics, Apple’s iRobot venture has the potential to tap into a worldwide market. The Japanese robotics market alone is expected to generate around $2.7Bn in revenues in 2023. Globally, the robotics market is projected to expand significantly, potentially reaching over $100Bn by 2030. Apple’s entry into this market, with its focus on consumer-friendly robotics, could capture a significant portion of this growth, especially in household and personal robotics. Source: Robotics – Japan

iHome: Smart Home Evolution

The iHome project is set to redefine smart living. The global smart home market is on a rapid growth trajectory and is expected to surpass $150Bn by 2030. Apple’s foray into this market, enhancing its existing products and introducing innovative new devices, could see it capturing a substantial market share. The integration of these devices with Apple’s ecosystem will be key to providing a seamless and intuitive user experience. Source: Smart Home Market Analysis

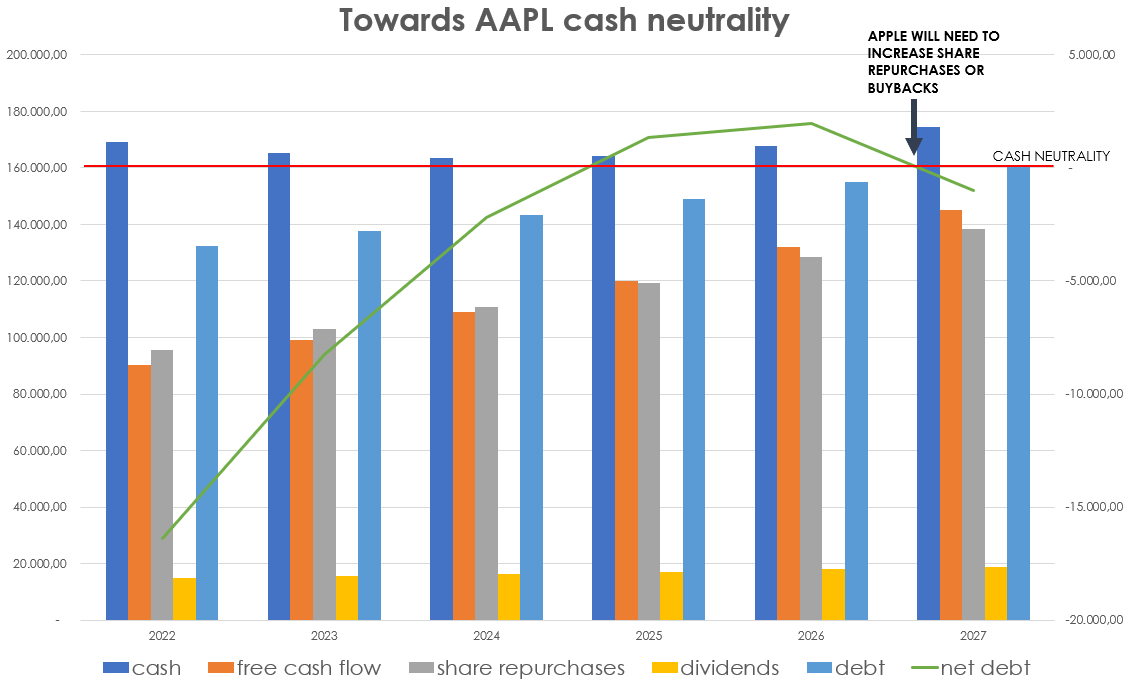

Financial Strategy and Shareholder Value

Apple’s cash neutrality policy, a strategic approach to managing its vast financial resources, is designed to balance shareholder returns with the company’s growth needs. This policy involves maintaining a cash balance that is neither excessively high nor low, using excess cash for shareholder-friendly activities like buybacks and dividends, while ensuring enough reserve for R&D and market expansion.

Understanding Cash Neutrality

Cash neutrality means Apple aims to avoid hoarding excessive cash, but also avoids depleting its reserves. This strategy is crucial in a tech landscape where innovation and rapid response to market changes are key. By not sitting on excessive cash, Apple signals confidence in its ability to generate more cash and a commitment to returning value to shareholders.

Adjusting the Strategy

However, as Apple ventures into new markets like the iCar, iRobot, and iHome, this strategy might need recalibration. The development costs for these projects are substantial, and Apple will need to ensure it has enough capital to cover these expenses without compromising its ability to return value to shareholders. This might mean a more dynamic approach to cash neutrality, where Apple adjusts its buyback and dividend strategies based on its investment needs in a given year.

Balancing Act

The key for Apple will be to strike a balance between rewarding shareholders and reinvesting in its business. This balance is crucial for maintaining investor confidence, especially as Apple enters new, capital-intensive markets. The success of this strategy will be evident in Apple’s ability to sustain growth, innovate, and maintain its market-leading position. Source: Seeking Alpha – Apple Cash Neutrality Policy

Ecosystem Synergy: The Driving Force

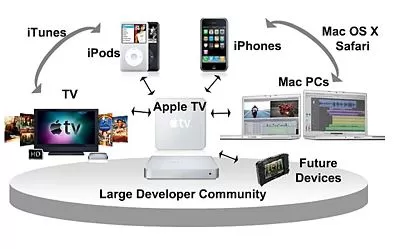

Apple’s ecosystem, often lauded as its most significant competitive advantage, is more than just a buzzword; it’s a comprehensive strategy that has been the cornerstone of Apple’s success and will be pivotal in achieving its future revenue goals.

Understanding the Ecosystem Strategy

Understanding the Ecosystem Strategy

At its core, Apple’s ecosystem strategy is about creating a network of products and services that are so deeply integrated and user-friendly that customers are inclined to stay within the Apple universe. This integration means that each new Apple product a customer buys works seamlessly with the ones they already own, enhancing the overall user experience.

Historical Success: The iPod and iTunes

A classic example of this strategy in action is the synergy between the iPod and iTunes. When the iPod was launched, it wasn’t the first MP3 player on the market. However, its integration with iTunes, which provided an easy way to legally purchase and organize music, made it a revolutionary product. This synergy not only boosted iPod sales but also drove users to iTunes, creating a profitable cycle of hardware and service revenue.

Adapting the Ecosystem for New Ventures

As Apple moves towards achieving their $5Tn valuation, this ecosystem strategy needs to evolve to accommodate new revenue streams. For instance, with the introduction of the iCar, Apple could integrate it with existing services like Apple Music, Maps, and Siri, providing a unique in-car experience that could only be offered by Apple. Similarly, for iRobot, integration with HomeKit and other Apple services could make it a valuable addition to the smart home ecosystem.

The Future: Seamless Integration and Expansion

The Future: Seamless Integration and Expansion

The future of Apple’s ecosystem lies in its ability to not only maintain this seamless integration but also to expand it to include new technologies like AI and robotics. By ensuring that new products are not standalone offerings but part of a larger, interconnected ecosystem, Apple can drive sales across multiple product lines while enhancing customer loyalty.

In essence, Apple’s ecosystem strategy is about creating a holistic user experience that transcends individual products, making the sum greater than its parts. This approach will be crucial in driving both hardware sales and service revenues, creating a self-reinforcing cycle of growth that is essential for reaching their $5Tn target.

Potential Bumps in the Road:

It would be foolish to assume that a 7-year journey will not have it’s obstacles (just ask Odysseus). Apple will surely run afoul of their own mortal versions of Lotus Eaters, Cyclops (what’s the plural?), Sirens and Enchantresses – here’s a few we can think of:

Competitive Threats:

- In smartphones and wearables, Android/Samsung continues applying pricing pressure and eroding market share in key growth markets like India.

- Google and Microsoft present growing competitive threats as they improve hardware offerings and ecosystem stickiness (e.g. Microsoft Surface line).

Macroeconomic Issues:

- An economic slowdown or recession could significantly reduce consumer discretionary spending power and hamper iPhone user base revenue expansion.

- Supply chain bottlenecks and rising inflation could squeeze hardware product margins.

Market Saturation Concerns:

- Smartphone and other hardware markets showing signs of saturation could cap unit sales growth potential.

- Streaming music and video markets becoming crowded could limit services expansion.

Regulatory Challenges:

- Antitrust legislation could require changes to App Store policies and reduce services revenue.

- Data privacy regulations may restrict some advertising and personalization opportunities.

The Road Ahead:

As we stand at the precipice of a new decade, Apple Inc.’s journey towards a $5 trillion valuation is not just a testament to its past triumphs but a bold statement about its future. This journey, underpinned by a blend of strategic foresight, technological innovation, and an unwavering commitment to user experience, paints a picture of a company that is not content to rest on its laurels.

The power of Apple’s 1.5Bn iPhone users is a sleeping giant, ready to be awakened. By persuading each user to spend just an additional $1,000 over the next seven years, Apple could single-handedly redefine the economic landscape of the tech world. This is not a mere increase in sales; it’s a revolution in consumer technology engagement.

The power of Apple’s 1.5Bn iPhone users is a sleeping giant, ready to be awakened. By persuading each user to spend just an additional $1,000 over the next seven years, Apple could single-handedly redefine the economic landscape of the tech world. This is not a mere increase in sales; it’s a revolution in consumer technology engagement.

In the realm of services, Apple is poised to break new ground. The potential expansion of its AI-driven services could see it challenging the titans of search and AI, carving out a new domain in a market ripe for innovation. This is not just growth; it’s a leap into uncharted territories.

The ventures into iCar, iRobot, and iHome are not just new product lines; they are Apple’s bold statements in the EV market, robotics, and smart home technology. These ventures represent Apple’s vision of the future, a world where technology is not just a tool but an integral part of our daily lives.

Apple’s financial strategy, a delicate balance of shareholder value and reinvestment, is a tightrope walk over the chasm of market unpredictability. This strategy is a testament to Apple’s understanding that true growth is not just about profits but about sustainable value creation.

And at the heart of it all lies Apple’s ecosystem, a synergy of products and services that has become the gold standard in the tech industry. This ecosystem is not just a business model; it’s a lifeline that connects every Apple product and service, creating an experience that is more than the sum of its parts.

As we look towards 2030, Apple’s journey to a $5Tn valuation is more than just numbers on a financial report. It’s a story of a company that dares to dream big, push boundaries, and redefine what is possible. This is a story that deserves to be shared, not just in the annals of business history but in the conversations of everyday life, inspiring us all to think bigger and reach higher.