$1,156,556!

$1,156,556!

That's the fastest (7 months) we ever hit $1M in our paired Long and Short-Term Portfolios but, to be fair, we never started the STP with $200,000 before. Usually it's $500,000 for the LTP and $100,000 for the STP but we were pretty cautious when we started fresh portfolios back on May 14th - so we wanted plenty of money available for hedging - just in case...

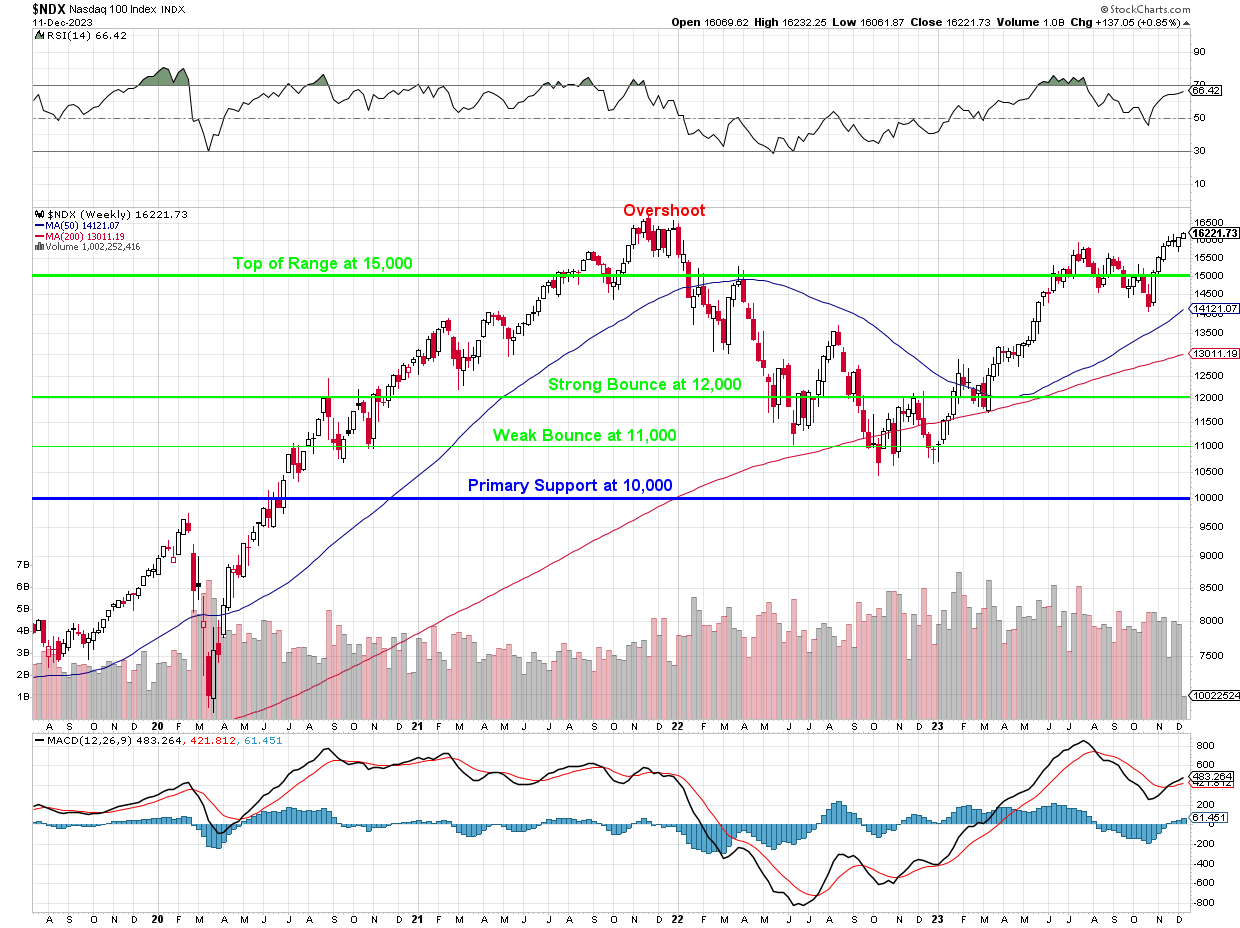

"In case" never really happened and we've had a spectacular 2nd half of 2023 with the Nasdaq blasting up from 13,000 to 16,000 (23%), which puts our $456,556 (65%) a little into perspective. Our outsized gains came from the anticipated (by us) summer pullback, which turned the STP into a huge winner as well. At the moment, we're strongly hedged - expecting another pullback into Q1 earnings - having made adjustments to our STP as the Nasdaq pushed back to 16,000, from where we dove off a cliff in 2022.

All of our Member Portfolios are having the best time and usually we start with the Money Talk Portfolio but I'll be on the show tomorrow - so we'll do a special post for the Money Talk Portfolio in the morning. Today we'll start with a look at the hedges in our STP - which is why we can be so confident holding the longs in our other portfolios:

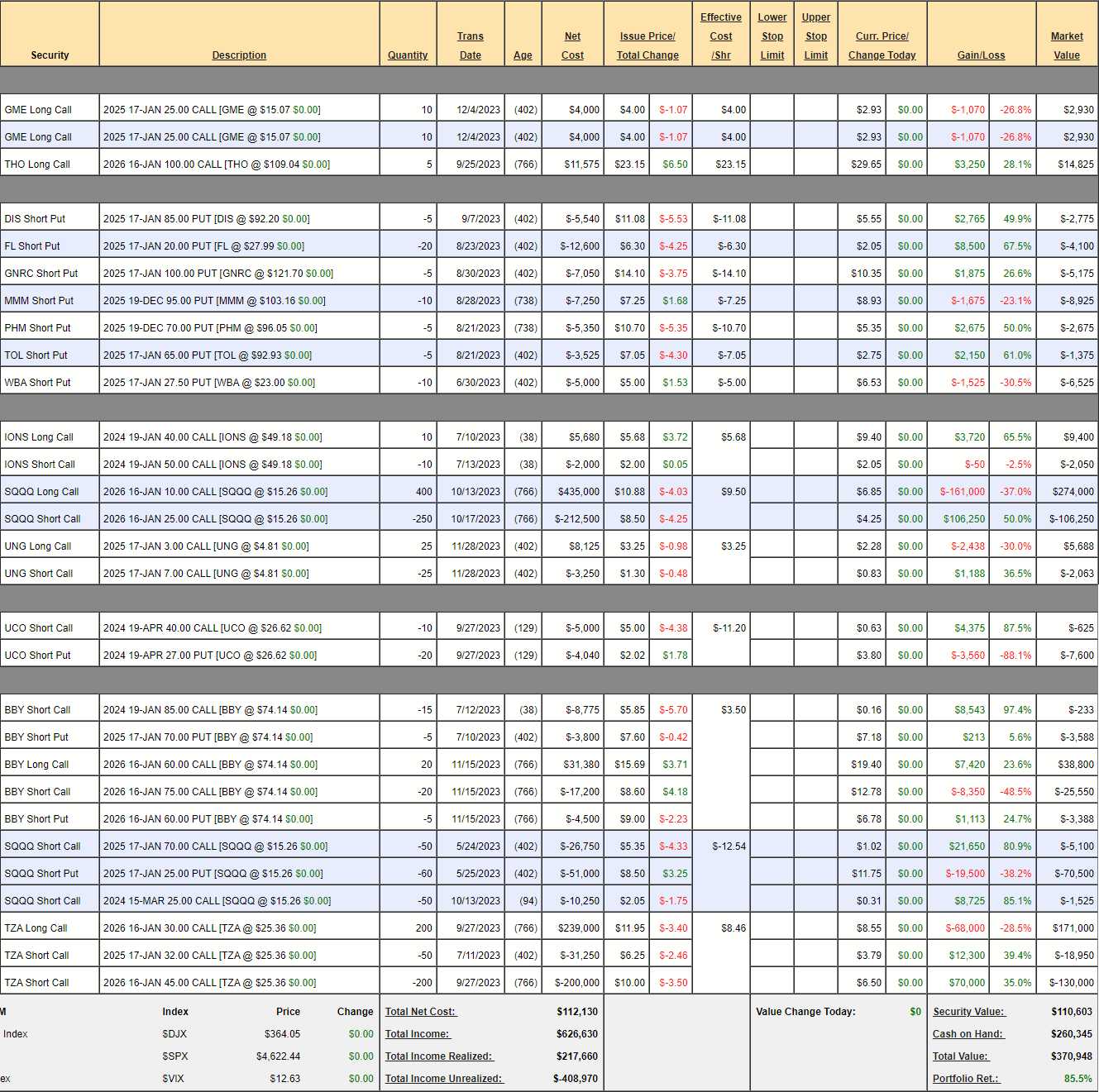

Short-Term Portfolio (STP) Review: $370,948 is up 85.5% and we've started hedging our hedges to protect our gains. I'm thrilled that we have $260,345 (70%) in CASH!!! as that keeps us nice and flexible and we can raise a lot more cash if the Nasdaq would stop making new highs but nooooooooo!!!, it just keeps going higher and higher and higher...

-

- GME - Double entered by mistake. It wasn't so much we felt strongly about them but the potential reward if they had good earnings was far more than the risk but the risk cost us $1,070 and we'll take the loss.