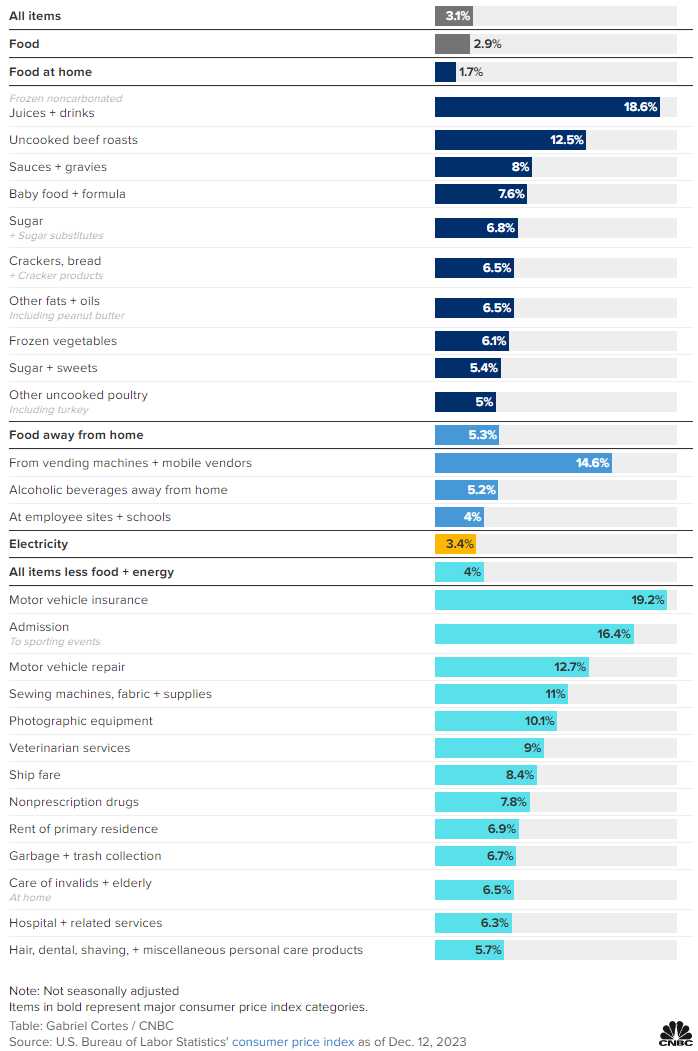

Here’s one chart that shows you what total BS the CPI is:

In reality, there are 7 methods the Fed uses to track Inflation and only ONE out of SEVEN is below 4.5%. Guess which one the Government chooses to use:

So the total CPI is supposedly 3.1% yet the only item on the list that is less than 3.1% is food – yet none of the items in the Food category are below 3.1% and this magic trick is called “Substitution“. Substitution, in the context of the CPI, refers to the idea that when prices of certain goods or services rise, consumers may switch to cheaper alternatives. This behavior can significantly affect how inflation is measured and reported. Here’s how it plays out:

-

-

Substitution Bias: Traditional CPI calculations can suffer from what’s known as substitution bias. This occurs because the CPI uses a fixed basket of goods and services to measure price changes over time. However, when the price of an item in this basket increases significantly, consumers might shift their consumption to a less expensive alternative and the CPI basket is adjusted to reflect these changes in consumer behavior. This adjustment often lags behind real-time shifts. When the basket is finally updated to include more chicken and less beef (reflecting the substitution), the overall price increase in the basket may appear smaller. This is because the basket now contains a larger proportion of the cheaper item (chicken) and less of the expensive item (beef) that was in the basket last year.

-

Chain-Weighted CPI: To address this, the chain-weighted CPI was introduced. It updates the basket more frequently, attempting to more accurately reflect what people are currently buying. However, this method can understate inflation as experienced by consumers who don’t or can’t substitute cheaper alternatives for their preferred or necessary goods and services.

-

Impact on Perception: The use of substitution in CPI calculations can lead to a perception that inflation is lower than what consumers actually experience. For example, if the price of beef skyrockets and consumers switch to chicken, which is cheaper, the CPI will report a lower basket price BUT they are literally comparing apples to oranges – or beef to chicken in this case.

-

Policy Implications: The way CPI is calculated has significant implications for economic policy. Lower reported inflation can influence decisions on interest rates, social security adjustments, and other economic policies. Keeping CPI artificially low means COLA adjustments don’t reflect reality and reality is not the pill the Government is selling…

-

On the bright side, energy is a thing all of us do use and Fuel in November was down 24.8% from last year as prices continued to collapse in the fall. Other than Medical Care (less Covid) and Used Cars, Fuel is the only category that is down from last year’s massive inflation.

That’s another thing people tend to forget – even if you accept the BS 3.1% number, that’s 3.1% higher than the 6.4% higher last year – still up 10% in two years. Wages have not kept up with inflation, people are falling behind and they blame the Administration for the fact that steak nights turn into burger nights, movie theaters are swapped for streaming at home and premium beers are replaced by whatever’s on sale.

These are not choices, they are sacrifices! The Government’s refusal to acknowledge those sacrifices by pretending there isn’t a problem is why they are failing to connect with the voters. They can twist the numbers as much as they want but people know when they are being screwed.

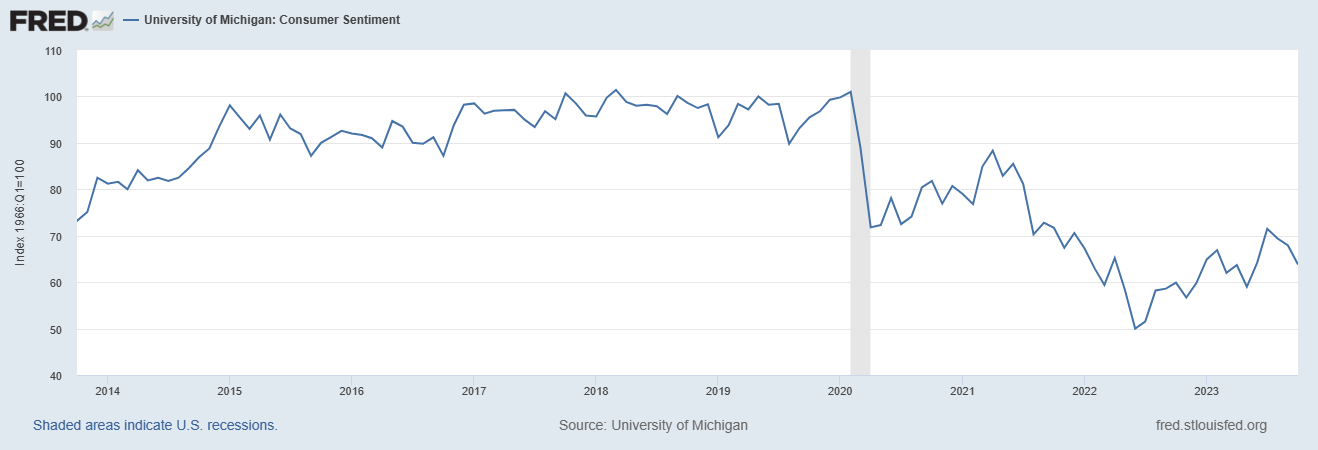

As you can see from this Consumer Sentiment Chart, people are less happy now than they were when we were locked in our homes for a couple of years – that’s saying something, isn’t it? Consumers know when there is a problem – we are all just trying to pretend it’s not there. Christmas shopping is strong because it’s the first Christmas since 2020 that people are getting to spend with their families but, after this fling – the bills come due and the interest rates are at record highs.

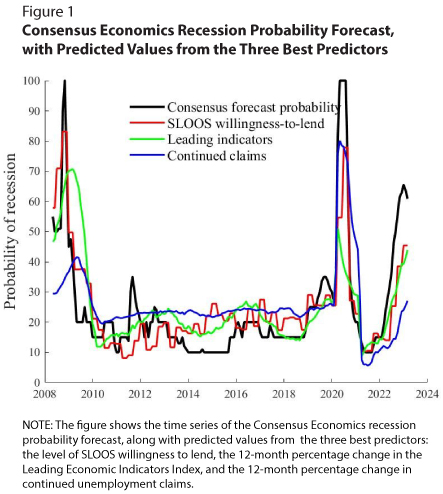

That’s why, other than Unemployment Claims, the primary recession signals are already at recessionary levels – this is a rug that can be very suddenly pulled out from under the markets – which is why we’re maintaining very strong hedges for our Member Portfolios. The reason is staring us right in the face!

That’s why, other than Unemployment Claims, the primary recession signals are already at recessionary levels – this is a rug that can be very suddenly pulled out from under the markets – which is why we’re maintaining very strong hedges for our Member Portfolios. The reason is staring us right in the face!

And that brings us to today’s upcoming rate decision by the Fed. Inflation is clearly still with us but the broad economy seems to be teetering at the edge of a cliff – which fire is more important for the Fed to put out? Even worse, the one they put out will fan the flames of the one they ignore and walking the middle ground – as they have chosen to do in the last few meetings – has only lets them both burn to the point where we now have two urgent issues that require opposite policy actions.

8:30 Update: PPI came out flat at 0% but last month was revised up 0.1% but, even so, it gives the Fed more room to ignore inflation – certainly we shouldn’t expect any grinchy action this afternoon (2pm). Tomorrow we get November Retail Sales and October was down 0.1% so anything to the plus side would be an improvement.

2050 is not that far away folks so, if you have investments in companies that sell fossil fuels – you might want to consider their future (or lack thereof) over the next 26 years.