$445,394!

$445,394!

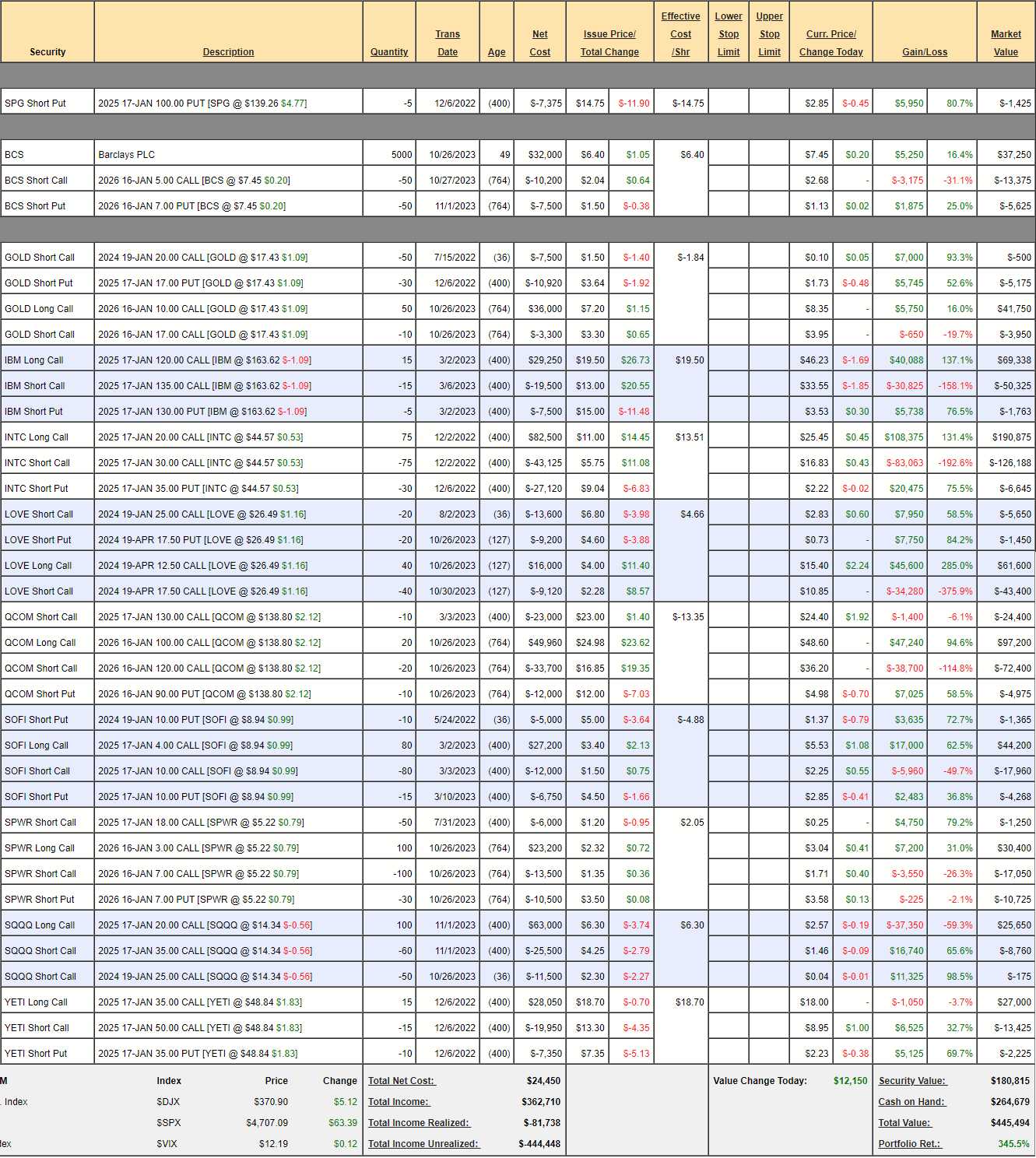

That’s up $75,718 (20.4%) since our October 24th review and up a total of 345.5% since starting with $100,000 back on Nov 13th, 2019 – not bad for 4 years. The previous MTP was up 148.1% in two years – so we’re pretty consistent with our returns! The rule of the Money Talk Portfolio is we only trade on show days (about once each quarter) and never touch the positions in between – that causes us to be fairly conservative with our selections.

The most important take-away from our October adjustments is the market was at the lows after falling from (on the S&P) 4,600 in August back to 4,140 (10%) in late October and, as of yesterday, the S&P is back to 4,775 and that’s up 15.3% BUT rather than just get back to even in our portfolio, we made key bullish adjustments to put ourselves in position to take advantage of a recovery. That’s the key to making outsized portfolio returns – you’ve got to make these adjustments at the tops and bottoms of these trading channels.

As of the October review, our upside potential was $219,388 but now we’ve covered $75,718 of that in just two months so we’ve “only” got $143,760 left to gain with the existing positions and that’s only 32.2% over the next couple of years – we can certainly do better than that! Fortunately we have $264,679 (59.4%) in CASH!!!, so we’ve got plenty of room to pick up some new trades.

But first, let’s have a look at our current positions and whether or not they need adjusting:

-

- SPG – Huge comeback since October and we certainly expect them to make that last $1,425 for us so just a matter of being patient.

-

- BCS – This was our new pick on the last show. We bought the stock to capture the dividends but it’s a $25,000 spread at net $18,250 so we have $6,750 (36.9%) left to gain if BCS can manage to hold $7 going forward.

-

- GOLD – With Gold back over $2,000 you would think GOLD would be doing better. I think this one is a sleeper at the moment and we have a $50,0000 spread that’s over $35,000 in the money. Let’s buy back the short 2026 $17 calls for $3,950 in anticipation of a move back to $20. That will leave us with net $36,075 with $13,925 (38.6%) upside potential and we’ll get back to selling short calls after the Jan $20s expire worthless.

-

- IBM – We’re deep in the money at net $17,250 on the $22,500 spread so there’s only $5,250 (30.4%) left to gain but we have to factor in how positive we are we’ll make that money so there’s no reason NOT to leave it alone, unless we need the cash – and we certainly don’t.

-

- INTC – Finally they are doing what we expected! This is a $75,000 spread and still only net $58,042 despite being a mile in the money. As with IBM, we’re just waiting for our $16,948 (29.2%) but you can see how our overall upside potential is eroding – we are victims of our own success!

-

- LOVE – We got much more aggressive in October and it’s paying off already at net $11,100 on the $20,000 spread. This one has $8,900 (80.1%) of upside potential between now and April. Since I won’t be on the show in Jan, let’s roll the 20 short Jan $25 calls at $2.83 ($5,650) to 20 short April $30 calls at $2.80 ($5,600) – just to give ourselves a bit more margin for error.

-

- QCOM – Another one we got more aggressive on just in time. It’s a $20,000 spread and way in the money now at a net $4,575 credit so our upside potential is $24,575 (537%) so that’s respectable but the short 2025 $130 calls are now in the money but, rather than spend money to adjust them, let’s spend $4.30 ($8,600) to roll the 20 short 2026 $120 calls at $26.20 to 20 2026 $130 calls at $30.50. That gives us $20,000 additional potential upside and now our net is $4,025 on the $40,000 spread with $35,975 (893%) upside potential – clearly that was a good trade-off.

-

- SOFI – Heading back to our goal at $10 and it’s a $48,000 spread at net $20,607 so there’s a healthy $27,393 (132%) left to gain and I still love this trade.

-

- SPWR – Our Stock of the Decade is running out of decade! Actually, we already made our 10x on them and this is round 2 and we just took up the new position that already has a nice profit at net $1,375 on the $40,000 spread so there’s $38,625 (2,809%) left to gain if you are a believer.

-

- SQQQ – The market moved up so sharply we’re down almost $10,000 on this hedge but clearly it didn’t stop the overall portfolio from doing well and having the strong hedge is what allowed us to get aggressive as the market dropped last month. Now, can we take advantage of anything? Well, we’re up 98.5% on the short Jan $25s and SQQQ is at $14.34 so it would have to jump 74% to put those in the money and that would be a 25% drop in the Nasdaq and we don’t see that happening.

- We only spent net $26,000 on the spread and we collected $11,500 in our first sale so it’s just a matter of patience. At the moment, the March $20 calls are only 0.42 – not worth selling. June $21s are $1 and we could sell those for $5,000 but I’d rather wait and see if there’s ever a pullback.

- So then the question is, should we roll our 2026 $20 calls at $2.57 down to the $15 calls at $4.85? Well, it’s only $2.28 and we go back to at the money and that also means we CAN sell the June $21s for $1 and we have plenty of room. So the overall cost of the roll would be $22,800 and we certainly have the cash but I hate to spend so much so – here’s my solution:

- Roll the 100 SQQQ 2026 $20 calls ($25,650) to 100 2026 $15 calls at $4.85 ($48,500) and sell 75 of the 2025 $30 calls at $3.30 ($24,750) and buy back the 60 short 2026 $35 calls at $1.45 ($8,700). That’s net $6,800 spent to move us from the $20/35 spread to the $15/30 spread and we have 15 less uncovered calls but our very improved position means we can still sell 50 short calls without much worry. The net was $16,715 and now it’s $25,415 on the $150,000 spread so we have $124,585 of downside protection – I feel very safe!

- And, don’t forget, even if we only collect $5,000 per quarter selling short calls – that’s still $40,000 we’ll get back over 2 years! Imagine if your Life and Health insurance paid you every quarter that you didn’t get sick or die? That’s what this is like!

-

- YETI – Last year’s Trade of the Year and now you can see why as our net $750 entry is now net $11,350 for a $10,600 (1,413%) gain and we’re just short of our goal, which will pay us $22,500 in a year for another $11,150 (105%) yet to come.

So our 10 current longs have $166,341 of upside potential and we have $124,585 of upside protection – feels nice and well-balanced to me. We spent about $20,000 of our $264,697 cash pile so I feel very good about adding some new long positions that will hopefully get us over the $200,000 mark in potential gains.

We just announced our Trade of the Year and you can read all about it here and, officially for the Money Talk Portfolio, we’re adding the following positions:

-

- Sell 10 LEVI 2026 $15 puts at $2.50 ($2,500)

- Buy 20 LEVI 2026 $12 calls at $5.00 ($10,000)

- Sell 20 LEVI 2026 $17 calls at $2.60 ($5,200)

This trade capitalizes on LEVI’s solid fundamentals and brand strength in the apparel sector, offering a balanced risk-reward profile. The cash outlay is net $2,300 on the $10,000 spread, so the upside potential is $7,700 (334%).

The risk is being assigned 1,000 shares of LEVI at $15 ($15,000) and losing the $2,300 so net $17.30 per share ($17,300) is your worst case – a 12.7% premium to the current price but LEVI only has to HOLD $15 for us to collect $6,000 and make $3,700 (160%). If you were to buy 1,000 shares for $15,350 you would need more than a 50% pop ($23) to make the same $7,700 and your risk is not much less to the downside – options give you superior performance up or down!

-

- Sell 10 GLW 2026 $32 puts for $5.00 ($5,000)

- Buy 25 GLW 2026 $28 calls for $5.00 ($12,500)

- Sell 25 GLW 2026 $35 calls for $2.20 ($5,500)

This options spread leverages GLW’s innovation and market position in the tech sector, aiming for substantial upside with managed risk. In this case, our cash outlay is just $2,000 on the $17,500 spread that’s $3,750 in the money to start!

The upside potential is $15,500 (775%). Our worst-case scenario is owning 1,000 shares of GLW at $34,000 ($34/share) because we aggressively sold the puts but that’s a reflection of how deeply undervalued we feel GLW is at $28.72.

And, finally, our Trade of the Year is VALE. VALE is the stock we feel is least likely to go down (massive infrastructure projects worldwide, stupidly low (6.1%) p/e), has an upside catalyst pending (higher ore prices than last year lead to better earnings) and has an options spread that is extremely likely to deliver 300% gains on cash in 2024. Our trade idea is:

-

- Sell 15 VALE 2026 $17 puts for $4.10 ($6,150)

- Buy 20 VALE 2026 $10 calls for $5.35 ($11,700)

- Sell 20 VALE 2026 $15 calls for $2.45 ($4,900)

This trade idea is designed to capitalize on VALE’s strong position in the commodities sector, offering significant upside potential with controlled risks. As with LEVI, we make our money even if the stock stays flat. We are spending a net $650 on the net $10,000 spread, so there’s $9,350 (1,438%) upside potential (less buying back the short puts) if the stock simply holds $15.

Our worst case here is owning 1,500 shares of VALE at $17 ($25,500) and losing the $650 so $26,150/1,500 = $17.43/share is a number we can certainly live with if assigned. Imagine the stock is at $10 and we then double down, buying 1,500 more shares at $10, and we average $13.715/share. So, if we don’t mind owning 3,000 shares of VALE for $13.715, which is 8.2% off the current price – that’s our WORST case!

Our three new trades have added $32,500 worth of upside potential bringing the portfolio’s total upside potential up to $198,891 and, since we started with $100,000 – that’s about 100% per year we’ll be adding in years 5 and 6 – that’s not bad at all and, of course, we’ll be adding a few more each quarter – I am definitely a believer!