The year is finishing on a high note.

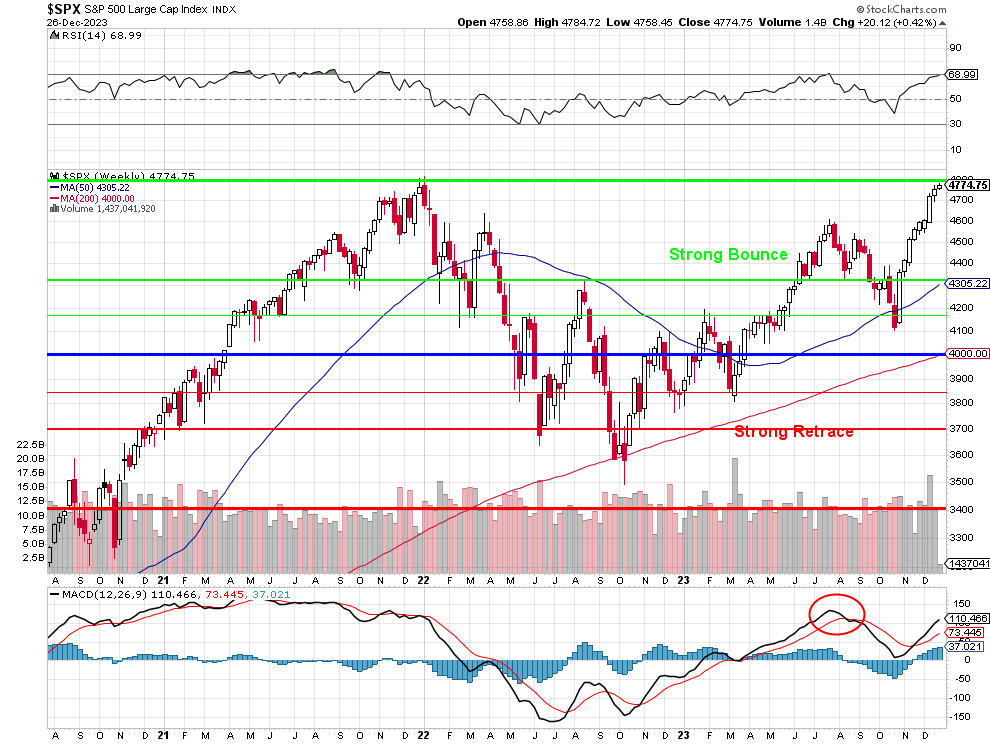

The last time we reviewed our Watch List was Sept 27th and it was more like a shopping list with everything on sale at the time. Now it's Dec 27th and we're seeing of anything is still a bargain after the S&P has popped back from 4,300 to 4,800 (11.6%) in the past 3 months.

For our Watch List, we look for Blue-Chip type companies with low debt, low p/e and reasonable anticipated growth. As we are including legacy prices from last December, I’m going to leave those in place (in the descriptions) so we’ll know at what price we began watching – regardless of the date we begin.

There were originally over 100 stocks on the list but many have gotten away from us (some are also in our portfolios already) – these are the ones we think are still a buy at the moment – especially if they get cheaper on a broad-market pullback. Updates will be in blue:

AAPL – $164 is 2.6Tn and 26x earnings but the fact that earnings are $100B, which is enough money to buy most other companies – keeps them interesting. Still, too high for now but if they come back down below 20x – we want them (again).

- In our Butterfly Portfolio and LTP.

- $193.05 is $3Tn and I wrote an article about how they can get to $5Tn by 2030, which would be a bit under $300 so plenty of room to grow but not cheap at the moment.

ALL – $136 is $36Bn and 15x and topping in a range they will likely break over. Higher rates are good for insurance companies, who are forced to park their reserves in “safe” assets.

- We added them to the LTP on the dip in Sept.