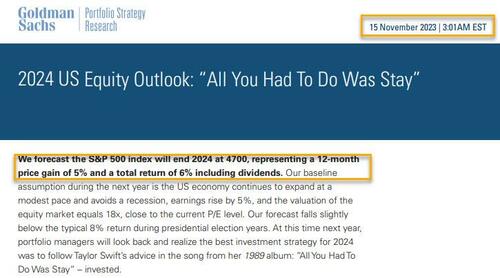

Back on November 15, when the S&P was trading at 4500, Goldman’s chief equity strategist David Kostin triumphantly published his 2024 US equity outlook and S&P price target, one which was supposed to leave an indelible mark on clients’ memories not least because it borrowed a line from that ultimate symbol of repeatedly chasing 15 minutes of fame, Taylor Swift, but because – well – it was supposed to be right, damn it and as a strategist you are paid to predict the future, something which for Kostin meant barely any increase in the S&P500, which he saw ending 2024 at 4,700, a paltry 5% increase from where it was in mid-November.

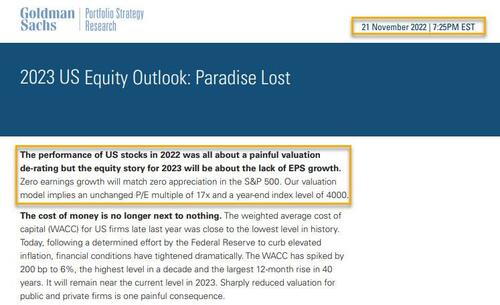

The problem is that as regular readers may recall, one year earlier, Kostin’s similar attempts to predict the future crashed and burned spectacularly, as his 2023 year-ahead forecast – which was published in November 2022 when the S&P was trading at 4,000 – projected zero change for the S&P500 which Kostin expected would close the year unchanged at 4000 as the “cost of money is no longer next to nothing” (hence the far more subdued report title “Paradise Lost”). In retrospect, it turns out the cost of money had exactly zero impact on where stocks would close the year (indicatively, Kostin’s year-ahead forecasts from 2021, 2020 and so on, were just as terrible).

It gets funnier: less than a month after Goldman – and every other bank – published their lengthy, 50+ page “2024 preview” pdf paperweights (which nobody besides us appears to read), Powell blew everyone up with his Dec 13 dovish pivot which ended any pretense that Powell was the second coming of Volcker (but was certainly a political emissary of the Biden White House at the Marriner Eccles building), and which instantly nuked every Wall Street sellside forecast. We said as much on Dec 14, when we lamented that “all those 2024 year-ahead Wall Street “forecasts” are now completely useless. Great job wasting weeks in the office for nothing.”

Oh and all those 2024 year-ahead Wall Street “forecasts” are now completely useless. Great job wasting weeks in the office for nothing

— zerohedge (@zerohedge) December 15, 2023

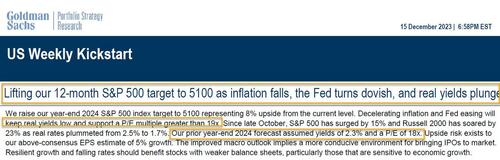

Just a few hours later we were proven right again, when Kostin published a brand new forecast, making a mockery of his 2023 magnum opus (which, again, nobody had read), this time boldly hiking his 2024 price target from 4,700 to 5,100. Why? After all, besides Powell’s dovish pivot, nothing else had changed in the preceding month (when the comprehensive 2024 full year forecast was published, a forecast which as the name implies is supposed to stay as is for, well, the full year). Well, with the S&P having already taken out his previous 2024 year-end target, Kostin had to come up with a bolder, more aggressive prediction (because never forget that on Wall Street all that matters is price, no matter how one gets to it), and he did just that, expecting the market to rise 8% (from 4,700) to 5,100, as “decelerating inflation and Fed easing will keep real yields low and support a P/E multiple greater than 19x.“

Additionally, Kostin also explained that his prompt flip-flopping and “strong view of the equity market” also dovetailed with Goldman’s “upgrades to the US GDP growth and interest rate outlooks. Following the Fed’s dovish signaling, our economists now expect the FOMC will cut the policy rate sooner and faster than they previously anticipated. Their revised funds rate forecast assumes consecutive 25 bp cuts in March, May, and June followed by quarterly cuts that will place the policy rate at 4.0%-4.25% at year-end 2024. Futures prices currently imply a total of six cuts to 3.75%-4.0% by the end of next year.“

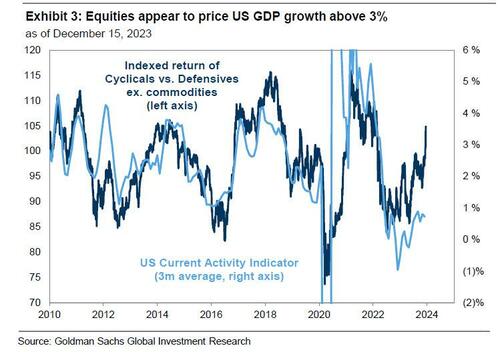

Which is amusing because while Goldman expects 5 rate cuts (vs the Fed’s three and the market’s six), Kostin writes that “equities were already pricing positive economic activity but now reflect an even more robust outlook. The performance of cyclical vs. defensive stocks has moved from pricing GDP growth of 1.5% to above 3% during the last seven weeks.“

Which of course, is a paradox: why would the Fed be pivoting at all if the economy was not only not decelerating but was expected to grow at the fastest pace in over two years, leading to even lower unemployment and higher wages and price pressures. In other words, how could Goldman possibly justify 5 rate cuts while expecting the pace of economic growth to effectively double, yet at the same time, Goldman somehow sees core PCE inflation “on track for a striking slowdown from a 4% annualized pace in the first half of 2023 to a 2% pace in the second half… which strengthens our conviction that the rapid decline in US inflation is not just brief good luck—the “last mile” of the inflation fight is turning out not to be so hard after all.”

These were some of the questions we were pondering after reading Kostin’s revised price target (which we expect will be revised again as soon as the Fed realizes it has made another terrible policy mistake), and when Goldman’s economist team published its final note for 2023, the customary “10 Questions for 2024″ (full note available to pro subs in the usual place) we had high hopes that many of these paradoxical divergences would at least be at least superficially addressed if not explained. Alas, that was not the case, and we are now left with even more questions than before, which leads us to conclude that once again – like every year previously – either Goldman’s cheerful market forecast or its even more cheerful economic outlook will be dead wrong. Most likely both.

So for the benefit of readers, who may be as confused as us and are left puzzled by what are increasingly more ridiculous mental acrobatics year after year to justify force-fed optimism by sellside strategists, we have excerpted some of the key rhetorical questions posed by Goldman in its full research note which discusses what Goldman believes “are the most important questions for 2024″, a year when -as even the Fed found out the hard way – the US will hold what are perhaps the most important presidential elections in its history.

Below we excerpt from the Goldman Q&A (note here for pro subs). It’s, as the name implies, a discussion Goldman’s chief economist Jan Hatzius has with himself.

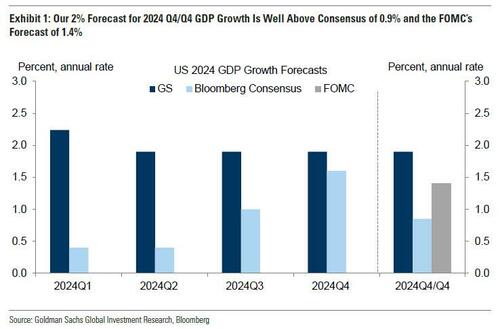

1. Will GDP grow faster than consensus and the FOMC expect?

Yes. We expect the US economy to substantially outperform expectations again in 2024. Our 2% forecast for 2024 Q4/Q4 GDP growth is more than double the Bloomberg consensus forecast of 0.9% and solidly above the FOMC’s forecast of 1.4% as well (Exhibit 1). But it is not a particularly bullish forecast in an absolute sense because we estimate that the economy’s short-run potential growth rate is currently about 2%, boosted modestly by above-trend immigration that is driving faster labor force growth.

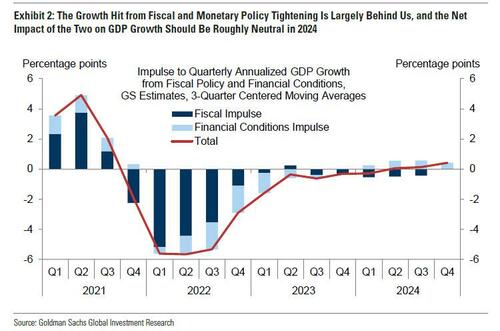

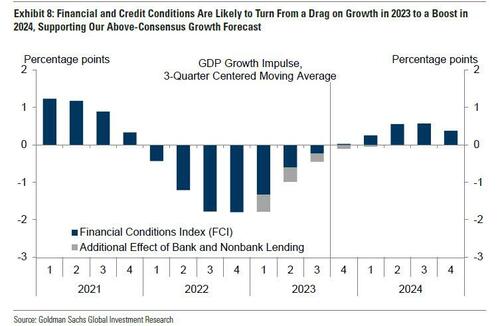

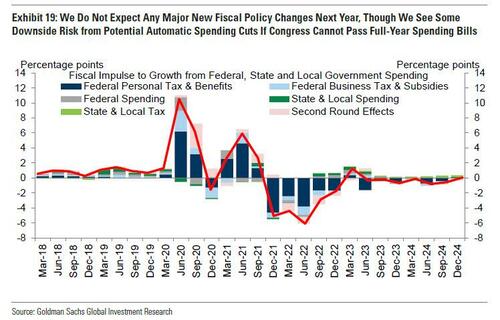

A top-down explanation of why we expect GDP growth to be near potential next year is that the net effect of the impulses from changes in fiscal policy and changes in financial conditions is likely to be roughly neutral (Exhibit 2). This assessment is likely a key reason why we depart from consensus—many other forecasters still expect more lagged pain from higher interest rates than we do.

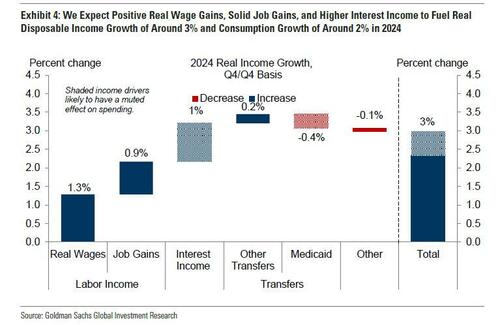

2. Will consumer spending beat consensus expectations?

Yes. Our forecast for consumer spending in 2024 is essentially a watered-down version of the 2023 story. We expect real disposable income to grow robustly again, though likely closer to 3% next year rather than this year’s 4%+ (Exhibit 4). Most of this comes from labor income gains—largely reflecting mundane potential growth in an economy with a growing labor force and rising productivity that tends to lift real wages—that should translate roughly one-for-one to higher consumer spending. The still-high level of job openings (Exhibit 8 below) implies that continued strong hiring is the default path and that expecting a virtuous cycle of income and consumption growth is not just circular reasoning.

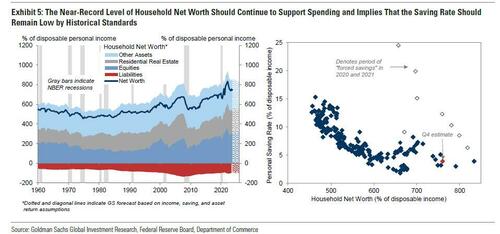

Interest income will also likely rise meaningfully next year but should have a more modest per-dollar impact on spending because it accrues mostly to upper-income households. In part for this reason, we expect the saving rate to rise about 1pp, meaning that roughly 3% income growth should translate to roughly 2% consumption growth, well above consensus expectations of 1% growth.

More pessimistic forecasters highlight potential risks from more aggressive mean reversion of the saving rate from its low current level or from the exhaustion of excess savings. These concerns worry us less. The saving rate is low by historical standards at 4.1%, but it should be low because both precautionary and retirement motives for saving are currently weak. The layoff rate is historically low, and the ratio of household net worth to income is historically high. In that context, the low level of the saving rate is not that puzzling (Exhibit 5), though again our forecast does embed a modest increase next year.

Fears about the exhaustion of excess savings also look overblown. Pandemic savings likely provided key support for consumer spending in 2022, but because of two unusual circumstances that have not been true for a while—real income was falling, which meant that many families needed to tap their savings to sustain their real spending, and low-income households who usually do not have appreciable savings had some. Real income has instead risen in 2023 and the Fed’s Survey of Consumer Finances shows that the lowest-income families’ liquid financial assets had already fallen back to normal levels by the end of 2022. At this point, the remaining excess savings are a modest increment to the wealth of middle- and upper-income consumers that amount to about 1% of net worth and deserve less attention than they receive.

3. Will the gap between real goods and services consumption narrow back to the pre-pandemic trend?

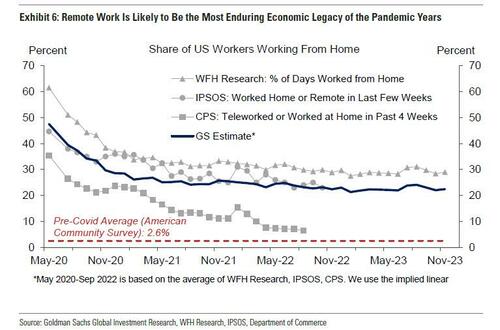

No. Remote work appears likely to be the most persistent economic legacy of the pandemic. The share of US workers working from home at least part of the week has stabilized at around 20-25%, below its peak of 47% at the start of the pandemic but well above the pre-pandemic average of 2-3% (Exhibit 6).

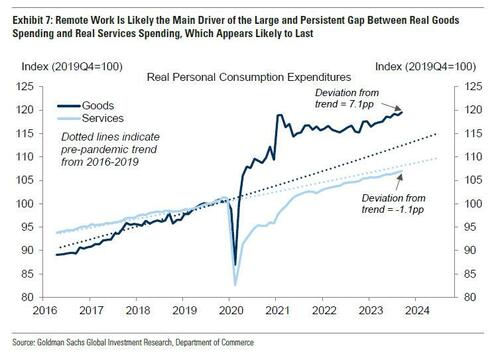

This shift to working from home is likely the key driver of the large gap between goods and services consumption that has persisted even as virus fears have diminished. Real goods consumption was already growing more quickly in the pre-pandemic years and is now about 7% above trend, while real services consumption is still about 1% below trend (Exhibit 7). Metro-level credit card data show that remote workers spend less on office-adjacent services such as transportation and more on home office and recreation goods. This suggests that much of the shift in consumption patterns is likely to last.

4. Will bank lending reaccelerate?

Yes. The regional bank stress this spring provided the biggest growth scare of the year. Banks have reported a significant tightening in lending standards, and bank lending growth has slowed from 8% last year to just 2% this year. Some analysts worry that banks will face further pain from losses on commercial real estate (CRE) lending that could lead to a credit crunch next year.

We are less concerned and instead see room for bank lending to pick up. Our bank and credit analysts emphasize that much of the risk from CRE has already been priced into public debt markets and that banks’ limited exposure to office real estate should be manageable. And reassuringly, the most severe risks from the spring have been avoided—deposit outflows have remained modest, deposit betas remain within the range seen in past cycles, and net interest margins have held up. Now that interest rates are falling, the fears about unrealized losses on bank balance sheets that drove the initial panic should diminish further. Coupled with a brighter economic outlook for 2024 than the recession fears that dominated 2023, this should cause bank lending to pick back up.

Nonbank lenders cut back on new loans to businesses by less than banks this year, softening the impact on total credit availability, and should also be emboldened to lend more as recession fears fade.

5. Will the unemployment rate remain below 4%?

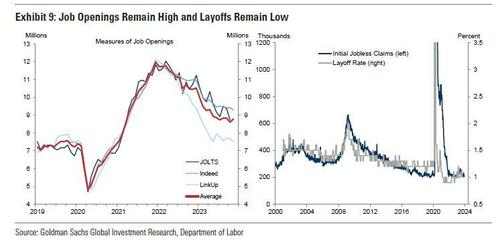

Yes. After a brief scare this fall, the unemployment rate ticked down to 3.7% in November. We have downplayed the modest uptick since the spring because other labor market data remain very strong: job openings remain high in aggregate and across nearly every industry (Exhibit 8, left), and layoffs and initial jobless claims remain very low (Exhibit 8, right).

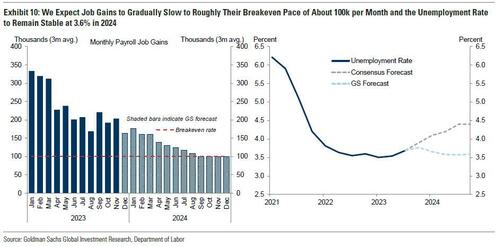

This healthy starting point coupled with solid final demand growth and reduced recession fears should continue to support steady job gains in 2024 at a rate that only gradually converges later in the year to the breakeven pace, which we put at around 100k for now to incorporate an extra boost from elevated immigration. This should keep the unemployment rate fairly stable at around 3.6% (Exhibit 9).

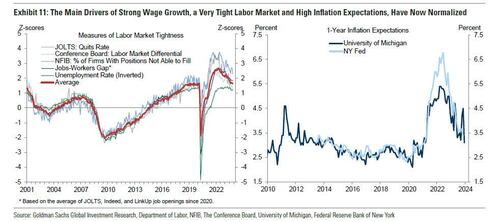

6. Will wage growth fall below 4%?

Yes. The two main contributors to high wage growth over the last two years were a historically tight labor market in which our jobs-workers gap peaked at nearly 6 million, and large inflation shocks that raised near-term inflation expectations and sparked demands for much larger than usual cost-of-living adjustments. Both are now largely behind us. Measures of labor market tightness have returned to pre-pandemic levels, on average (Exhibit 10, left), and near-term inflation expectations have returned to levels that were consistent with 2% inflation in the years before the pandemic (Exhibit 10, right).

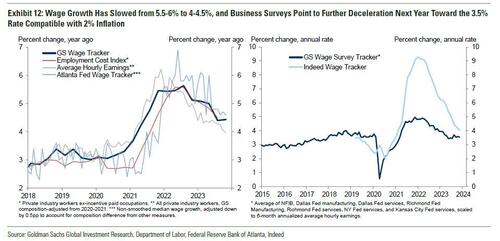

As a result, we expect wage growth to continue to fall with a bit of a lag. Our wage growth tracker has already slowed from a 5.5-6% peak pace to 4-4.5%, and business surveys that ask companies about their expectations for wage increases over the next year point to further deceleration to roughly the 3.5% rate that we estimate would be compatible with 2% inflation. Wage growth is the one piece of the broad inflation data set that is not yet quite where Fed officials would ideally like it to be before they start lowering interest rates. But it is close, and we suspect it remains elevated mainly because of the usual lags, which have been particularly visible in recent wage negotiations by union members, whose longer contracts have delayed the opportunity for some to win catch-up raises until this year.

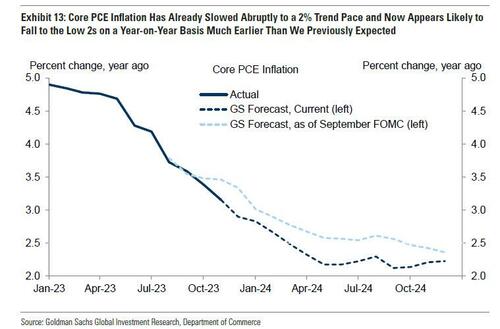

7. Will core PCE inflation undershoot the FOMC’s forecast of 2.4% Q4/Q4?

Yes. Core PCE inflation has surprised to the downside recently and is on track for a striking slowdown from a 4% annualized pace in the first half of 2023 to a 2% pace in the second half. Our inflation forecast has fallen meaningfully as we have incorporated the good news (Exhibit 12). Similar patterns have also played out globally, which strengthens our conviction that the rapid decline in US inflation is not just brief good luck—the “last mile” of the inflation fight is turning out not to be so hard after all.

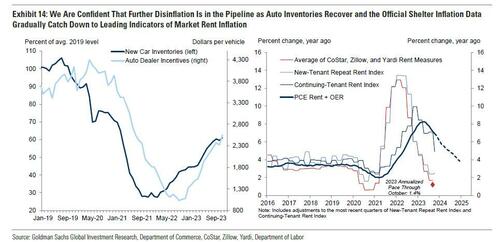

We are confident that year-on-year core PCE inflation will fall substantially next year from its current 3.2% rate because there is plenty of disinflation still in the pipeline from rebalancing in the labor, auto, and housing rental markets. With the auto strikes now over, inventory levels should continue to rebound quickly, which should further increase competition and reduce prices (Exhibit 13, left). We expect shelter inflation to remain firmer than some forecasters at 3.8% next year because while market rents have grown just 1-2% this year (Exhibit 13, right), we estimate that continuing-tenant rents still have to close a roughly 2% gap with market rates. But even this would be a big drop in a large category.

We expect core PCE inflation to fall 1pp from 3.2% to 2.2% by December 2024, reflecting a 1.1pp decline in core goods inflation to -1% and a 0.9pp decline in core services inflation to 3.4% (Exhibit 14).

8. Will the Fed cut at least four times?

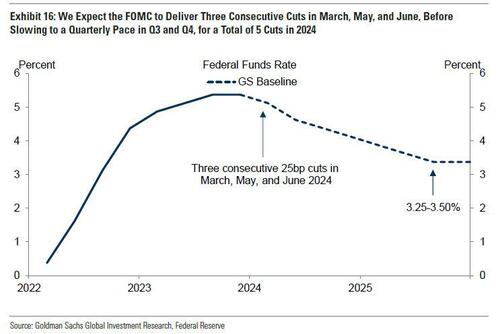

Yes. Because inflation is returning to target surprisingly quickly and by some measures is already trending near 2%, we expect the FOMC to cut early and fast to reset the policy rate from a level that most of the FOMC will likely soon see as far offside. We expect three consecutive 25bp cuts in March, May, and June, followed by one cut per quarter (or every other meeting) until the funds rate reaches a terminal rate of 3.25-3.5% in 2025Q3. Our forecast implies 5 cuts in 2024 and 3 more cuts in 2025.

Our financial conditions index growth impulse model implies that the hit from higher rates is already behind us and that rate cuts are therefore optional next year, whereas Chair Powell said in December that the FOMC is “very focused” on the risk of staying too high for too long. We are also skeptical the neutral funds rate is as low as the FOMC thinks. But we are forecasting what the FOMC is likely to do, not what they “should” do, and its perspective on these issues implies that large cuts are more clearly urgent and appropriate than our analysis suggests (ZH: one wonders why what the Fed is likely to do and what it should do are so divergent… and then we remember: 2024 is an election year of course).

9. Will the Fed stop balance sheet reduction by Q3?

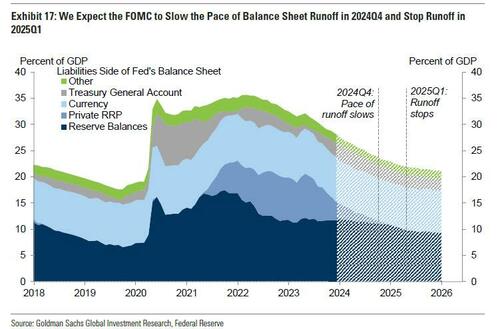

No. The FOMC will aim to stop balance sheet normalization when bank reserves go from “abundant” to “ample”—that is, when changes in the supply of reserves have a real but modest effect on short-term interest rates. We recently summarized a variety of indicators that can serve as warning signs that this point is approaching, and they still suggest that the end of runoff is a way off.

We expect the FOMC to start considering changes to the speed of runoff in 2024Q3, to slow the pace in 2024Q4, and to stop runoff in 2025Q1. At that point, we expect bank reserves to be around 12-13% of bank assets and the Fed’s balance sheet to be around 22% of GDP, versus 18% in 2019, a peak of almost 36%, and 28% currently. The main risk is that the increased supply of debt that we expect in 2024 could cause intermediation bottlenecks in the Treasury market that could lead the Fed to stop runoff earlier.

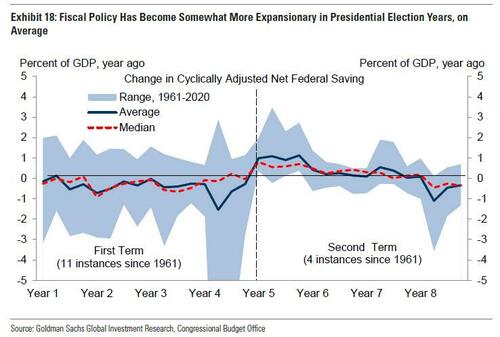

10. Will fiscal policy become more stimulative ahead of the election?

No. While fiscal policy has become somewhat more expansionary in presidential election years, on average, we do not expect this to be the case in 2024. This pattern is driven in part by the fiscal response to major downturns in some recent election years (e.g. 2008 and 2020) and we do not expect any substantial fiscal policy measures to be enacted in 2024.

Instead, we see some downside risk to government spending from automatic spending cuts that will take effect in May if Congress continues to avoid government shutdowns by passing temporary extensions instead of full-year spending bills. This is a serious risk because there is still a $120bn gap between House Republicans and the Senate on proposed spending levels. If the automatic cuts do take effect, they would cause a 1% cut to “discretionary” funding (0.2% of GDP) and, within that lower total, a reallocation of $33bn from defense to non-defense. Since this cut would be implemented in May 2024, it would be concentrated in the second half of the fiscal year, resulting in a step-down in funding of around 2% (0.4% of GDP).

To summarize: forget about a soft landing; Goldman is expecting the most flawless Fed landing in history, one where economic growth does not slow, but actually accelerates, one where a looming government shutdown does not serve as a headwind to growth, one where jobs and wages continue to post solid growth, yet one where inflation somehow drops as low as 2% despite a budget deficit that will be double that in 2023 and the Treasury will have to sell trillions more in debt. And the cherry on top: the S&P closes about 6% higher from today, printing at a record 5,100 on Dec 31. 2024 despite the Fed’s reverse repo facility getting drained some time in March and despite QT then proceeding to cause havoc with the financial system and as it drains $100BN in liquidity every month. Good luck with that.

Much more in the full note available in the usual place.