2024 is starting off strong!

2024 is starting off strong!

2 planes collided on the runway at Haneda Airport in Tokyo and, amazingly, all 379 passengers and crew got out of this one but 5 people on the smaller plane that hit them died and the airport is shut down for the day, which is the day after a 7.5 earthquake hit Japan to ring in the new year.

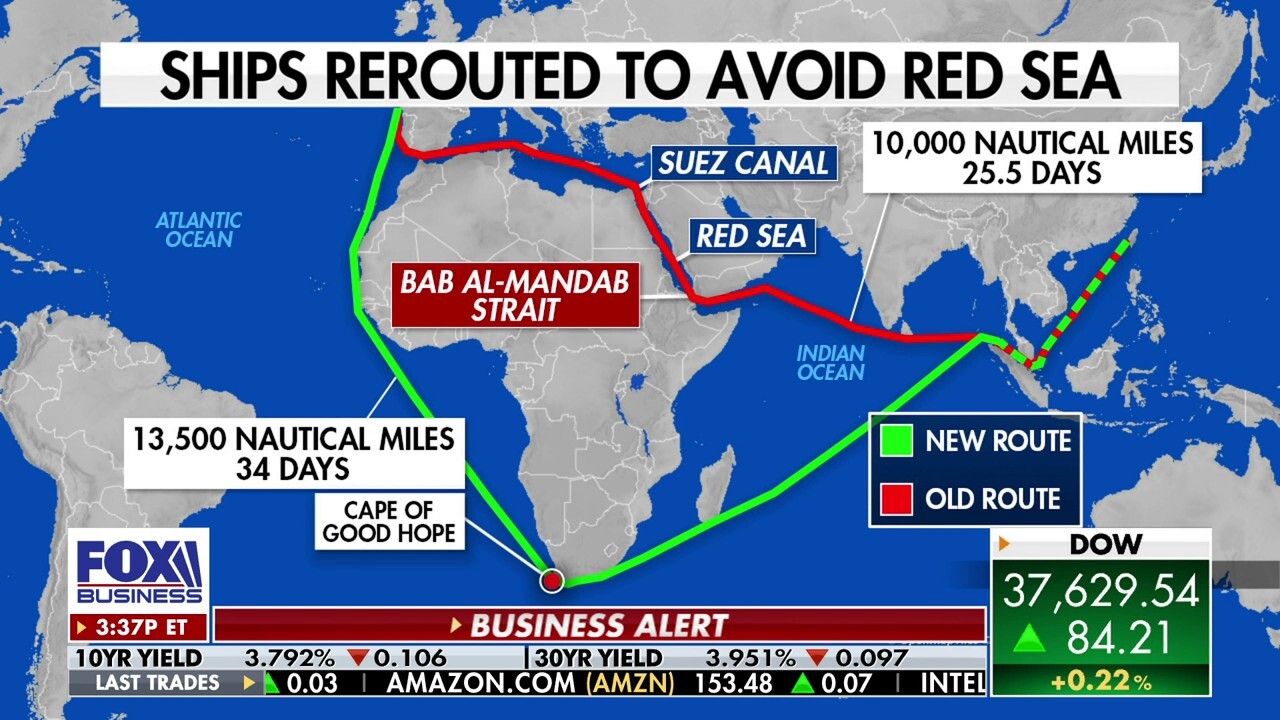

Meanwhile, the Red Sea is shut down again as the battle between the US and Iran’s pet Houthi rebels escalated when the US Navy destroyed 3 of their boats and now Iran has sent a warship into the area as well. This channel handles 12% of the World’s commerce so yes, it matters and markets are down half a point this morning.

Cargo ships rent by the day so this simply drives up the cost as well as causes a 9-day gap in deliveries as ships get re-routed. The Baltic Dry Shipping Index started off 2023 at 1,000 and now we’re at 2,094 to start 2024, up 109% as we start Q1 is going to cause some inflation as we get our readings.

Oil (/CL) is already off Friday’s low at $71.25 and back to $73.30 this morning so Iran is getting their money’s worth as they export 2Mb/d so that’s $4.1M per day more revenues for Iran in exchange for funding these attacks. The Houthis are meeting in Tehran this morning and will be asking for hazard pay now that the US is blowing up their ships – there’s always a cost-equation somewhere…

And, of course, this kind of Global uncertainty is good for the Dollar, which is popping up half a point to 102 and OPEC likes that as well as they get paid in Dollars and, as we know, the indexes DON’T like it because they are priced in Dollars – the economic see-saw remains constant in the new year.

China doesn’t have their New Year (Dragon!) until Feb 10th and Chinese stocks have dropped 45% from 31,000 in Feb 2021 to 17,000 today but the low was 15,000 in October of 2022 so we call 31,000 an overshoot and the 15,000 fall from 30,000 to 15,000 gives us 3,000-point (20%) bounce lines at 18,000 (weak) and 21,000 (strong and look where the 50 and 200 dmas are – not a coincidence!

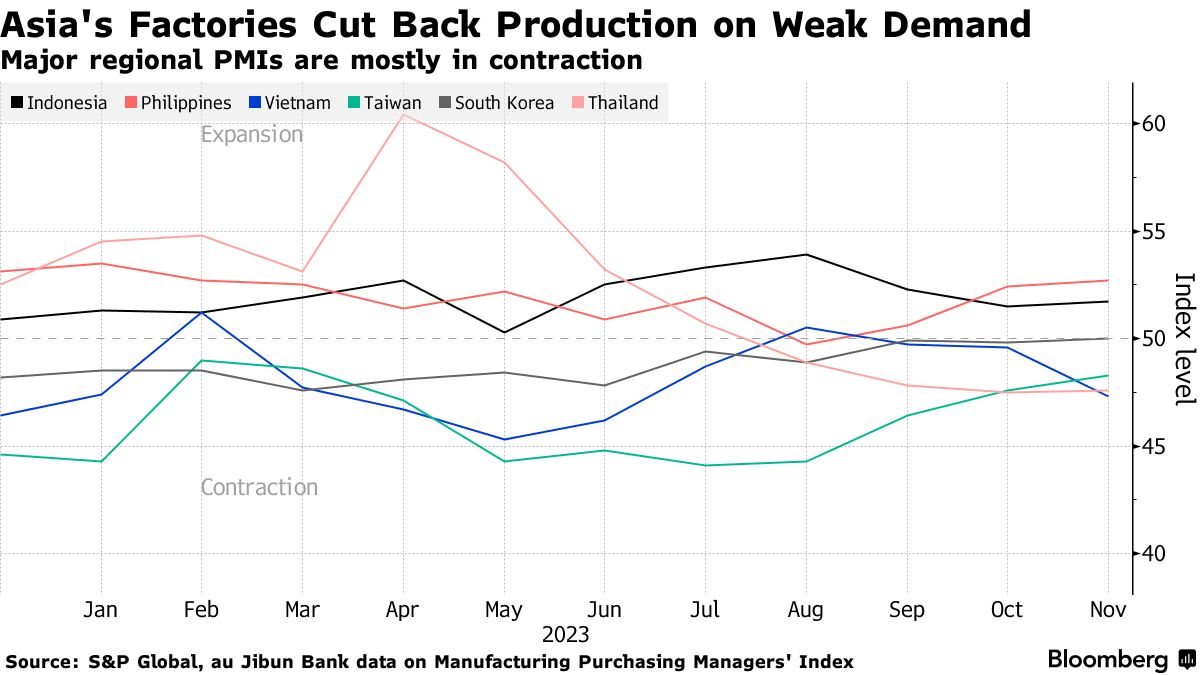

It’s easy to forget how markets can turn on you – we should resolve not to do that in 2024 – it may come in handy… Most of Asia saw a slowdown in new orders and production volumes in December amid tepid customer appetite, according to the manufacturing purchasing managers’ index published Tuesday by S&P Global. Input costs also rose and supply chain performance worsened. Chinese President Xi Jinping pledged to strengthen economic momentum and job creation in his new year address on Sunday.

Taiwan’s factory conditions deteriorated sharply to 47.1 in December, after notching an eight-month high of 48.3 the month prior. South Korea’s PMI fell slightly to 49.9, below the 50 waterline that separates expansion and contraction. S&P Global noted a further monthly decline in new orders due to a weak domestic economy and slower Chinese demand. Southeast Asia’s manufacturing activity likewise shrank in December, with Thailand, Malaysia, Myanmar and Vietnam still in the red.

The latest PMI data out of Asia show that recovery may yet be far off for the world’s manufacturing hub. It also signals a bumpier road ahead for global trade that’s seen the El Nino dry spell bring about the return of food inflation, while attacks in the Red Sea choke supply chains for crucial commodities like oil. The continued weakness in the region will add further headwinds to global growth that’s expected to slow anew this year.

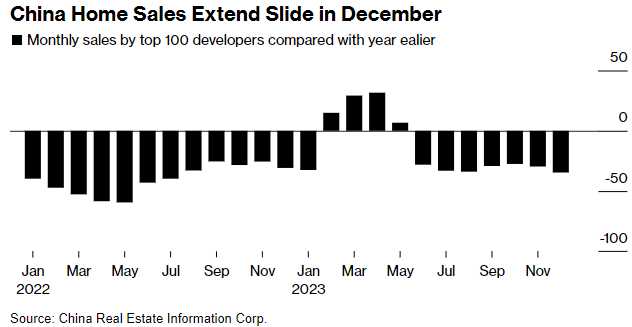

China’s prolonged housing downturn has weakened the economy and hurt developers that are struggling to repay debts and complete projects. In the latest move to revive demand, authorities relaxed homebuying curbs in Beijing and Shanghai, two of the country’s biggest housing markets. Despite policy changes, the market remains sluggish, with home sales plunging 20 out of the past 24 months. Buyers remain on the sidelines, spooked by price drops, construction delays and company defaults.

Industry giant Country Garden Holdings Co. defaulted on a dollar bond for the first time in late October. China Evergrande Group, the world’s most indebted developer, narrowly avoided liquidation this month when a winding-up court hearing was postponed, as it struggles to restructure its borrowings. Nothing is fixed – cans are just being kicked down the road.

Bloomberg has compiled a very nice list of what analysts are expecting in 2024 but it’s insanely long, so I’ve asked Claude to summarize for us:

👺 Here is a summary and analysis of the key points regarding 2024 market outlooks from the documents:

Overview

– The consensus base case is for a continued economic slowdown in 2024 but avoiding a severe recession. Inflation is expected to continue falling but remain sticky and above central bank targets for most or all of 2024. This is expected to lead central banks like the Fed and ECB to cut rates starting in mid-2024.

– There is optimism around equities with positive but muted returns expected, supported by earnings growth and lower yields. Bonds are also expected to post gains with high yields locking in income and rate cuts leading to capital appreciation. Returns across assets overall are seen as positive but below recent years.

Risks

– Downside risks of a deeper economic slowdown or recession are cited as elevated, especially in Europe. Geopolitical tensions, policy errors by central banks, and high debt refinancing needs over the next couple years are all threats.

Regional Differences

– The US is expected to outperform other developed markets, with milder slowdown and earlier rate cuts from the Fed. Europe looks more vulnerable, with higher recession risks. China faces ongoing economic challenges but policy stimulus provides some support.

Key Themes

– Quality assets that can withstand volatility are favored, across both stocks and bonds. Below investment grade credits face heightened default risks if growth deteriorates further. AI, healthcare and clean energy are cited as structural growth sectors.

Portfolios

-

- Consensus favors robustness, diversification, selectivity and active management in 2024 given risks. But base case sees moderate path for economies and assets, supporting modest positive returns.

The outlooks stress risks are high, uncertainty is elevated, and portfolios need to be robust, diversified and actively managed in 2024. But the base case leans positive on a 12-month view, expecting a bumpy yet moderate glide path for economies and assets overall.

Here are more detailed summaries for each of the major categories covered in the analysis, including key quotes when available:

Base Case

-

- Expect a continued economic slowdown but avoiding a severe recession, with growth around 1-2% in the US and close to 0% in Europe

- Inflation falls but remains above central bank targets for most of 2024

- Central banks like Fed and ECB forecast to cut rates starting in mid-2024

- “Most investment outlooks from major banks…envisage the same middle-of-the-road scenario in 2024: they see interest rates finally starting to bite, a benign economic slowdown, and a central bank pivot to easier policies”

Slowdown

-

- Global growth seen decelerating with continuing impact from policy tightening and high inflation

- Europe more vulnerable, already close to recession with US expected to follow in milder fashion

- Corporate earnings growth expected to drop across regions

“Tighter financial conditions will weigh on economic growth and corporate profits.”

Recession

-

- Risk of deeper economic slowdown or recession considered elevated, especially in Europe

- Main triggers could be high debt levels, policy errors by central banks, geopolitical tensions

- “Recession risks remain elevated for most developed economies in the year ahead.”

Rate Cuts

-

- Fed, ECB forecast to start cutting rates around mid-2024 when disinflation seen as sustainable

- Markets potentially too aggressive on depth/timing of cuts given inflation stickiness

- “We expect the Fed to start cutting policy rates in July in response to a contraction in activity.”

High Rates

-

- Policy rates expected to remain well above pre-pandemic levels through 2024

- Balance sheets and cash flow strength determine corporate resilience

- Rates will stay higher for longer followed by central banks pivoting to cut rates.”

Growth

-

- Global growth expected to slow to around 2.5% in 2024, down from 2023

- US around 1%, Europe near zero growth forecast based on policy tightening impact

- Risk of even weaker growth if recession hits “Global growth will decelerate, driven by slowing developed economies.”

Inflation

-

- Seen falling from highs but remaining above central bank targets for most of 2024

- Around 3% for US, closer to 2% for Europe by year-end

- Enough disinflation for rate cuts but not a rapid easing cycle “Inflation falls but remains sticky, above 2% targets for most economies.”

Global

-

- Consensus based around ‘bumpy’ path for world economy and assets

- Positive but more muted returns for equities and bonds

- Key to robust portfolios that can weather volatility “Bumpy yet moderate glide path for economies and assets overall.”

US

-

- Expected to outperform other regions, with milder growth slowdown

- Earnings resilience and earlier Fed cuts provide policy tailwinds “The US is expected to outperform other developed markets.”

Europe

-

- Seen as more vulnerable economically compared to US

- Higher recession risks on the horizon

- ECB likely to lag Fed in rate cuts “Europe looks more vulnerable, with higher recession risks.”

Japan

-

- Economy expected to grow modestly near potential around 0.5%

- BOJ further along in policy normalization and could raise rates “We expect the BOJ to abandon its negative interest rate policy in January 2024.”

UK

-

- Faces most challenging outlook among major economies

- High recession risk with inflation falling slower than peers

“We believe the UK has the most challenging outlook of the major economies.”

China

-

- Faces structural economic challenges but policy stimulus stabilizes

- Growth forecasts center around 5% for 2024 “China enters a ‘new normal’ of lower, but potentially higher quality growth.”

Dollar

-

- Seen remaining supported in early 2024 but risks from Fed cuts emerge

- Relative policy crucial to dollar direction “The dollar loses policy advantage quickly as the Fed easing cycle materializes.”

Fiscal

-

- Fiscal support seen waning globally in 2024, especially in Europe

- Tighter policies emerge with debt reduction in focus

“The era of big fiscal expansions is over.”

Elections

-

- Around half of global GDP holds pivotal elections in 2024 including US presidential

- Expected to raise volatility as outcomes difficult to predict

- Timing and economic policies of candidates will impact markets “2024 is set to be a pivotal year for politics with much uncertainty on direction.”

Geopolitics

-

- Russia-Ukraine war, tensions in Middle East and with China raising tail risks

- Increased volatility likely even if no major escalation

- Portfolio resilience important with geopolitical flashpoints simmering

“We cannot help but adopt a more cautious stance given heightened geopolitical tensions.”

Soft Landing

-

- Base case is moderate slowdown, avoiding severe recession

- Seen by some as too optimistic given rate hikes to date

- Would support risk asset valuations and investor sentiment “We are skeptical around high hopes for a soft landing for the economy.”

Quality

-

- Favor quality companies and higher-rated bonds amid volatility

- Balance sheet resilience and cash flow strength key stock attributes “Focus on quality stocks and bonds with strong fundamentals.”

Duration

-

- Long-dated bonds seen offering diversification if growth slows

- Shorter maturities reduce economic sensitivity

“We favor a barbell approach to duration amid uncertainty.”

Bond Supply

-

- Heavy sovereign debt issuance to finance deficits

- Expected to pressure yields higher especially on long-end “Surging bond supply will require higher yields to attract buyers”.

Earnings

-

- Corporate earnings growth expected to drop markedly

- Margins pressured by higher rates, slowing demand “Earnings headwinds will intensify across regions”.

Returns

-

- Positive but muted returns across equities and bonds

- Base case supports mid single digit returns “Lackluster returns anticipated across assets.”

Defaults

-

- Recession risks would send default rates higher

- Credit spreads not pricing severity expected in downturn “Defaults likely to rise even without a severe recession.”

Diversification

-

- Cash, gold, and Treasuries as ways to hedge recessionary risks

- Alternative assets also cited as potential portfolio stabilizers

“With uncertainty high, the merits of diversification stand out.”

Volatility

-

- Markets seen facing higher volatility compared to recent years

- Geopolitics, policy uncertainty, debt risks all catalysts “Bouts of market volatility anticipated given elevated uncertainty.”

Valuations

-

- US equity valuations appear most stretched by historical standards

- Opportunities in cheaper markets across EM, Europe, Japan “European and EM equities have solid prospects given attractive valuations.”

Sectors

-

- Technology could face headwinds from AI disruption and valuations

- Cyclical value sectors seen as recovery plays “Shift from growth into cyclical value stocks may play out.”

AI

-

- Seen transforming industries across technology and healthcare

- Stock selection crucial given valuation dispersions

“AI advancements provide tailwinds but also disruption”.

Magnificent 7

-

- Outsized influence on US markets expected to remain

- Elevated valuations but structural growth merits still cited “The Magnificent 7 will continue to exhibit great influence”.

Real Estate

-

- Commercial real estate faces demand uncertainty

- Logistics, rental housing better positioned

“Opportunities are selective given economic risks”.

Yields

-

- High yields make bonds attractive for income/total returns

- Technical factors could limit long end appreciation “Locking in historically high yields has appeal”.

Spreads

-

- Investment grade spreads expected to remain tight

- Defaults pose risks for high yield credit spreads

“Wider credit spreads anticipated on recession risks”.

Tightening

-

- Quantitative tightening continues to provide headwinds

- Policy lags still to fully transmit

“The delayed impacts of tightening have further to run”.

Refinancing

-

- Corporates face hefty repayment obligations in 2024-2025

- Rising rates magnify rollover risks on maturing debt “Many corporates are heading for a risky refinancing wall”.

Energy

-

- Oil prices seen rangebound, with upside limited

- Recession risks counterbalanced by geopolitical threats “Energy prices expected to consolidate given growth uncertainty”.

Metals

-

- Gold supported by dovish policy pivot and geopolitical risks

- Industrials metals face demand slowdown risks

“Only modest appreciation seen for commodities”.

Private Markets

-

- Selective opportunities in private credit and real estate debt

- Secondary private equity also cited as attractive “Pockets of value exist but higher selectivity required”.

Hedge Funds

-

- Potential diversification given lower correlation

- Can benefit from market volatility “Merits of alternatives stand out for well-diversified portfolios”.

Risks

-

- Recession risks, policy errors and geopolitics all flashpoints

- Markets seen as complacent on downside threats “While hoping for the best, prepare for the worst”.

Rally

-

- Base case recovery supports risk asset gains

- But risks described as firmly skewed to downside “Any rally rests on benign landing for economy”.

I know, it’s kind of a lot but it’s nice to see all the things that analysts are going to be wrong about in the coming year. At the end of the article, you can go back and see how wrong they were in prior years too! It’s not funny – these are supposed to be my peers…

Anyway, it’s good to know the consensus and that seems to be for a much weaker economy though most think we’ll escape an actual Recession. Clearly we’re not going to change our strategy of favoring high-quality equities (we just did our Watch List Review) with strong balance sheets, good cash-flow, low debt, high earnings/employee ratios, etc.

AI should continue to boost productivity, Health Care would seem to be unstoppable with boomers continuing to fight the aging process. Clean Energy either happens or we die so that should be a no-brainer and Cyclicals will be bottoming out and I always love those. Telcom should be nice, Tech should keep going but I’m still worried about Consumer Discretionary, Real Estate and anyone with high debt loads.

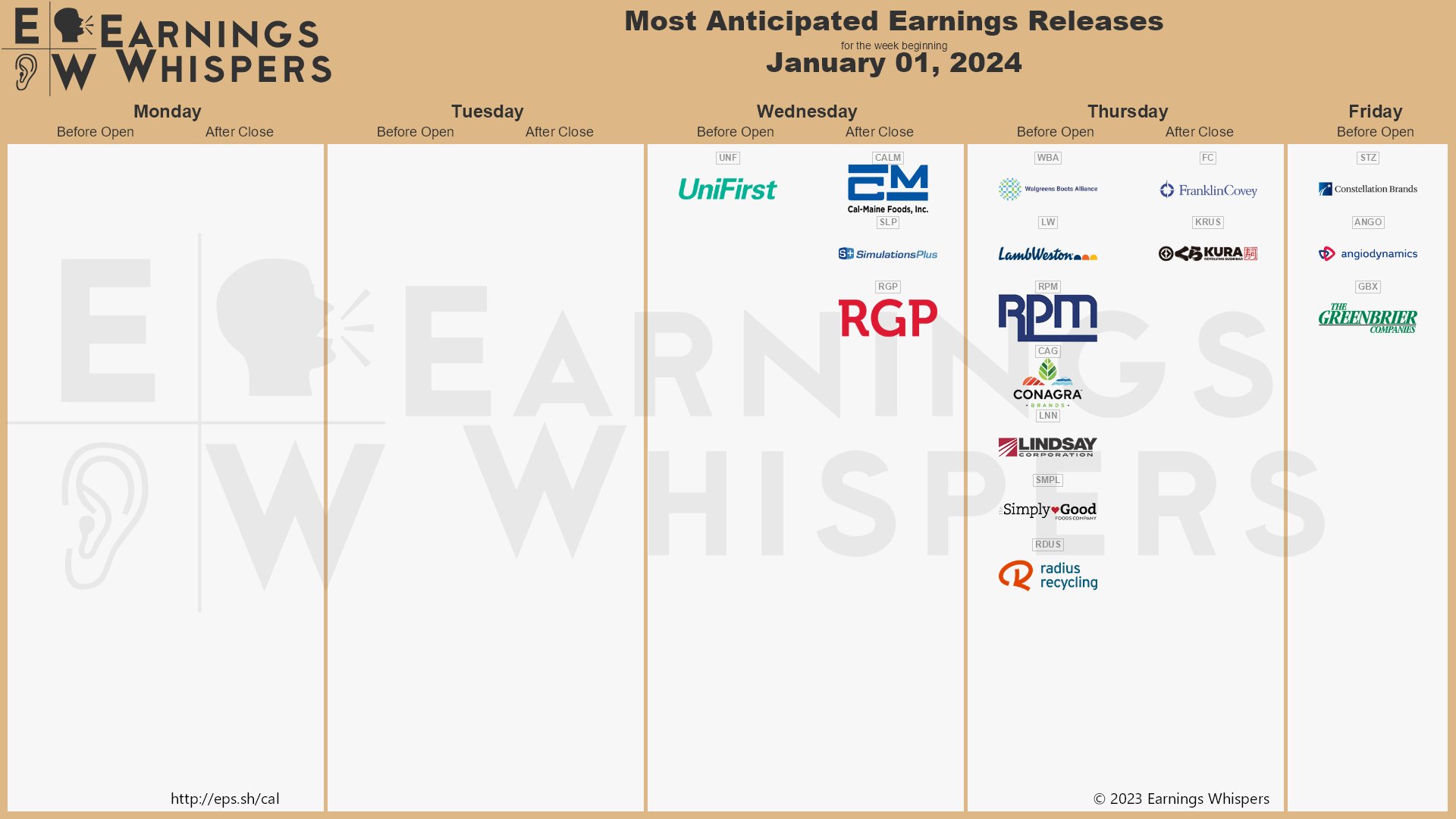

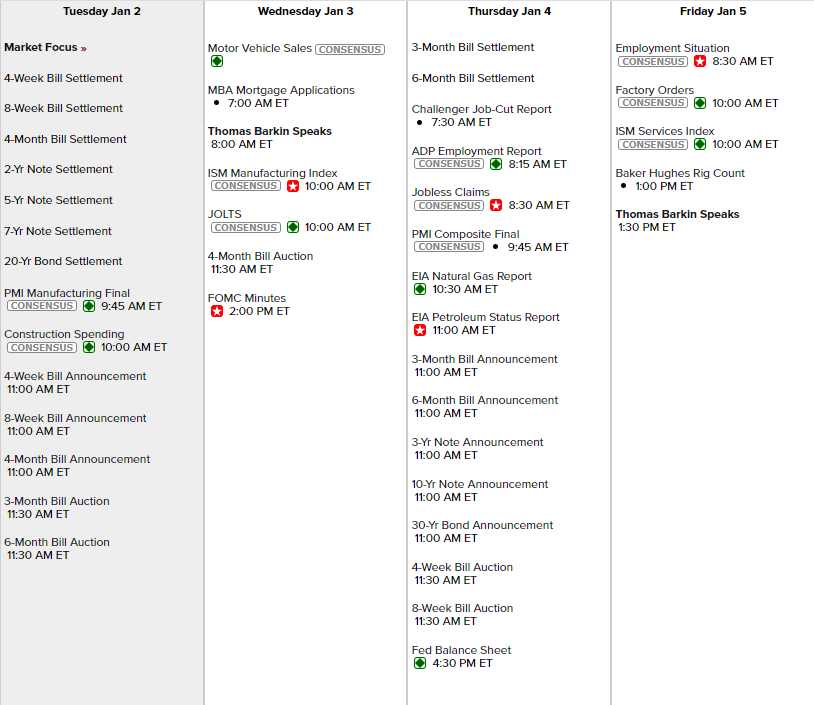

In the nearer term, Earnings season kicks off next Friday with BAC, BLK, C, DAL, JPM, UNH and WFC. This week will not be very meaningful but we are getting a bit of data with PMI and Construction Spending this morning, Barkin (Richmond Fed) speaks tomorrow and Friday and he’s a hawk – so that’s an interesting choice to start the year. We have Fed Minutes tomorrow, so maybe he’s there to offset the doveish meeting? We also have Motor Vehicle Sales tomorrow with ISM and JOLTS, Thursday is PMI and Friday is Non-Farm Payrolls, Factory Orders and ISM. Next week we go back to work.

Here’s looking forward to a healthy, happy and wealthy 2024 with you and your family!

-

- Phil