Here we go:

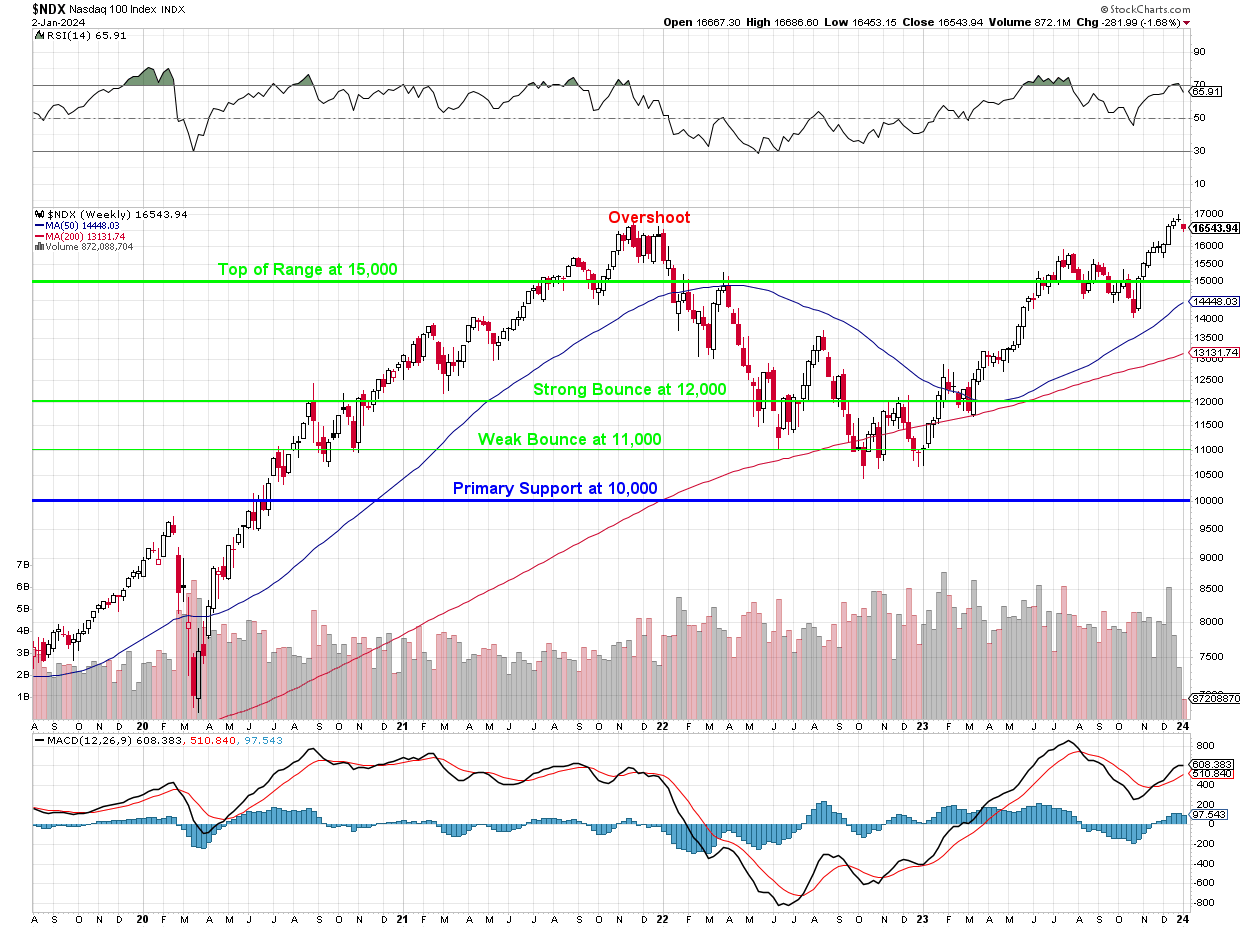

We knew that RSI wasn’t going to last and now we’ll see how quickly it cools off. You can predict the depth of the sell-off by doing the math on the RSI and yesterday the Nasdaq fell just under 300 points and the RSI dropped 4 points to 66 and we should at least end up at 50 so 4 more 300-point drops would be 1,500 Nasdaq points (10%) and we’re back to 15,000 – which is what the 5% Rule™ projected and THAT is how you do TA!

We won’t for sure hold 15,000 – I’d feel much better if we test 13,500 (the 200 dma by the time we get there) and THAT would be a good time to get back into tech. Let’s take a look at some of the LTP adjustments we made in our last review (Dec 12) for context for today’s Webinar (1pm, EST) – where we will discuss our plans for 2024 (including a discussion of yesterday’s Analyst Summary):

- MRNA – We doubled down on the 2026 $90 puts and added a 2026 $90/130 spread with $100,000 upside potential and guess what happened!

That was fortunate timing but in the last review I had said we needed to add a full position and we caught it just before it took off (after a nice head-fake!). MRNA gained market share in Covid vaccines and their cancer vaccines are looking promising.

- COIN – We had sold 20 Dec 2025 $120s and 10 Jan $90 calls against our long spread and we thought the rally was overdone (obvious top of range) so we cashed out our 2025 $80s and rolled the short calls to 2025 $150s and we widened the 2026 bull call spread and this move back down is PERFECT.

Fundamentals are what matters and COIN was blasting higher in anticipation of a Bitcoin ETF being approved but that’s baked in and they’ll be back at $100 if not approved and, even if it is, will COIN make enough money to justify what is now a $37.5Bn market cap? COIN is still pre-profit – hence our timely adjustment.

- INTC – Much as we love them, the stock got overbought so we rolled all of our short calls to 2026 $45 calls and we still have 10 uncovered longs (60/50) on the $120,000 spread.

INTC was our runner-up for the 2023 Trade of the Year and there was never any doubt they’d head up eventually as their “low income” was simply the result of massive R&D investing in the new chip cycle – we just weren’t sure they would pop by the end of the year but Q4 was huge for INTC. People really don’t understand cyclical investing anymore – which is great for us!

- JPM – We more than doubled down on our long spreads and rolled our short calls to April $160s and it already looks like we’ll have to roll them again!

JPM made out like a bandit in the March collapse and they’ll obviously grow in size as the integrate all those accounts they picked up so a very easy choice for an investment. Our solution to getting burned on 12 short $150 calls was to by 20 additional 2026 $160/175 bull call spreads for $10,000. If getting burned on your short calls gives you an excuse to buy $30,000 more upside for $10,000 – then things are working just fine!

- PFE – We bought 40 more 2026 $22.50 calls as they were down to $5.75 and we had bought our first 80 for $8 in early December, when we thought it was done dropping. It was done dropping but first the head-fake to dump out the “weak hands” so we just bought more because we are FUNDAMENTAL investors and don’t let charts tell us what the price of a company should be. We also bought back 30 short April $30 calls with great timing.

A RIDICULOUS sell-off due to a major reduction in Covid revenues – which was entirely expected. Take away the Covid revenues and all you are left with is the World’s biggest Pharma company at $168Bn that “only” makes $12Bn a year on their non-Covid sales. Idiots…

- QCOM – I can only quote myself: “Let’s roll our 10 short 2025 $140 calls at $20.15 ($20,150) to 15 short April $140 calls at $10.90 ($16,350) and hope it calms down. What’s the difference – the shorter-term premium decay means we can sell $10 of premium 4 times instead of $20 once next year.“

Fundamental investing is not just about calling bottoms but tops as well. If you KNOW the proper value of your stocks – you know when they are too high as well as when they are too low and of course that helps you make much better investing decisions.

- SQ – Again I have to quote: “Everything is taking off but this is a small entry position so happy to buy more (and we’re ahead anyway). We’ll roll the 2 short Jan $50s at $24.83 ($4,965) to 5 short March $75s are $7.40 ($3,700) and let’s cash out the 2026 $45 calls ($23,340) and the short 2025 $65 calls ($10,663) and buy back the short puts ($910) and let’s buy 20 2026 $60s $30.50 ($61,000) and sell 15 2026 $85 calls for $19.50 ($29,250). That’s net $21,240 spent to move from a $12,000 spread to a $50,000 spread that’s $30,000 in the money – worth it!”

Again we roll our short calls out of trouble – this is exactly how these trades are designed to work. In this case we also added the 2026 $60/85 spread and left 5 uncovered to cover the short calls and now it’s an income play that can generate $3,700 per quarter while we wait. You can see SQ taking off all around you, they are those white credit-card readers you see every day. SQ has 30% of the POS market, Toast has 24.84 and Clover is next with 7% so it’s a Coke and Pepsi sort of market and SQ is gaining.

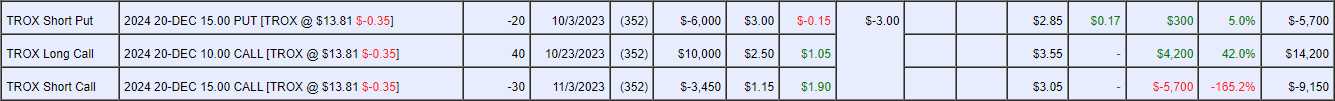

- TROX – We did not adjust but I said to our Members: “TROX – Net $1,950 on the $20,000+ spread that is $16,000 in the money? Are you friggin’ kidding me??? “If they are giving away money – TAKE IT!!!” – Phil”

TROX was a runner-up for our 2024 Trade of the Year and now this spread is a net $650 CREDIT on the $20,000+ spread – aren’t options amazing?!?

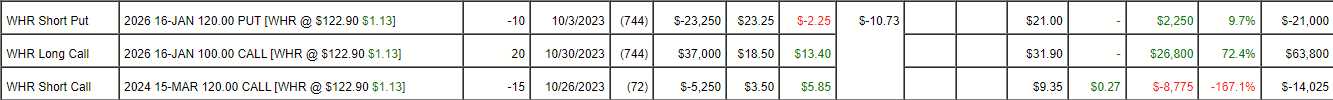

- WHR – Another one where they are trying to give you money for free:

It doesn’t look THAT great as it’s net $28,775 on a $40,000+ spread (5 longs are open) but the short calls are March so they will either be rolled (June $130 calls are $8) or, if they expire worthless, we sell 15 more somethings for $5,250, which is 18.2% of our $28,775 – PER QUARTER! Had to say if we want WHR to go up (we’re already over goal) or down – and that means it’s an excellent spread, doesn’t it?

If it goes up, we roll up to the June $130s, the Nov $140s (now $9), etc and then we’d have an $80,000 spread as WHR goes up and up. If they go down, we make 18% per quarter selling short calls for 2 years – that’s fine too!

Options STRATEGIES can make you great, consistent returns if you learn how to employ them correctly and that’s exactly what we teach at PhilStockWorld. Notice how we diversify even when we’re making adjustments:

- Biotech: MRNA, PFE

- Finance: COIN, JPM, SQ

- Tech: INTC, QCOM

- Materials: TROX

- Consumer Durables: WHR

These just happen to be the areas we feel are worth investing in in 2024. AI is likely to make Biotech much more efficient by streamlining development and studies. The Finance bets are from very different ends of the spectrum. QCOM is how we’re taking advantage of the new phone cycle and INTC is now out of the R&D doldrums and ready to sell some 7-angstrom chips! TROX is a specialty material and our Trade of the Year, VALE, is basic materials and WHR will benefit from a lot of new homes being built and also a delayed replacement cycle in that sector.

As the year moves on, we’ll be focusing on those sectors and, next on my list is copper, which has been rocketing higher recently. EVs and other Green Energy generators require a lot of copper and inventories are running low at the moment. FCX is one of my favorits along with RIO and then there’s SCCO and TECK – we’ll take a closer look in our Live Member Chat Room.

We get the Fed Minutes at 2pm, which we’ll review in the Webinar. Mortgage Applications were down 9.4% to end the year but ISM ticked up a little – from 46.7% to 48% but 48% is still contraction.

Just because we’re doing a bit of shopping doesn’t mean we’re out of the Recessionary woods just yet – the economy is still very slow and consumers are very stretched so we’re going to stick to our Watch List, which already gave us a fantastic 2023.