Starting…NOW!

Starting…NOW!

Google will start a limited test this morning that will restrict cookies for 1% of the people who use its Chrome browser, which is by far the world’s most popular. By the end of the year, all Chrome users – a hefty chunk of the internet populace – will experience a cookie-free browsing environment. This isn’t just a minor inconvenience for the ad industry; it’s a game-changer.

Marketers, ad tech companies, and web publishers are scrambling saying Google, which has introduced software tools designed to help replace cookies, hasn’t done enough to prepare the market. They also said “What Global warming?”

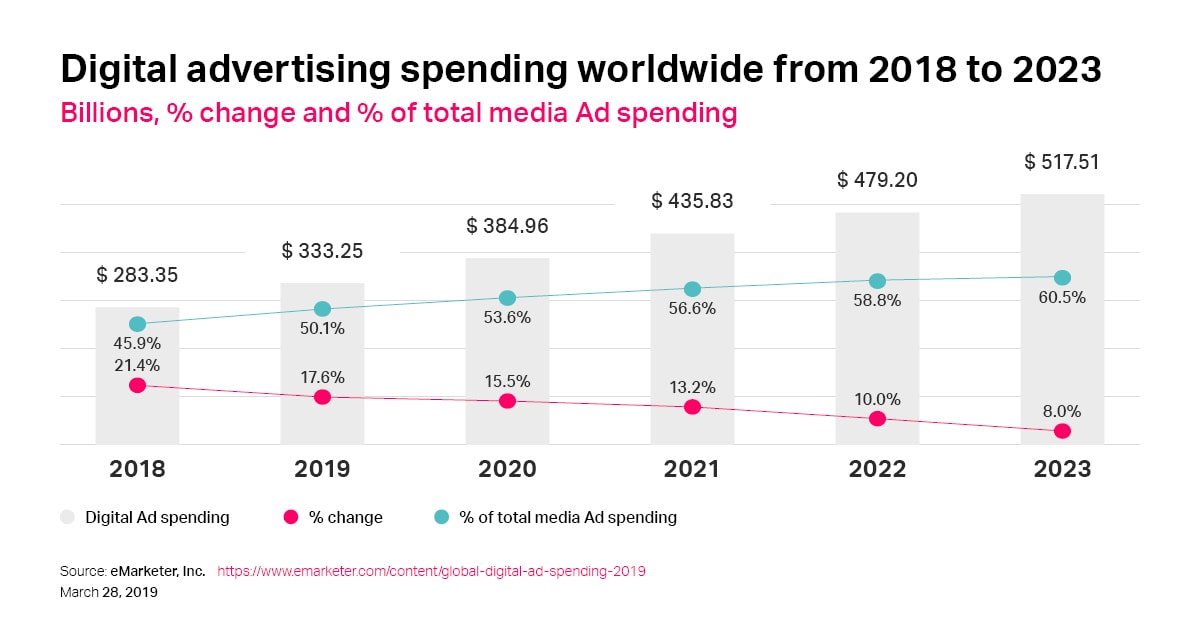

This change, which has been in the works for years, represents one of the most substantial shifts in the $600Bn/year online ad industry. Cookies have traditionally been used to log the activity of internet users across websites, enabling advertisers to target them (often annoyingly) with “relevant” ads. While Google has been signaling this move for years, it seems many in the industry have been caught off guard. The transition to a post-cookie world is fraught with challenges and uncertainties.

One of the key concerns for investors and industry players is the impact on ad revenue. Cookies have been instrumental in enabling highly targeted, and thus more effective, advertising. Without them, there’s a fear that ad campaigns could become less efficient, potentially leading to lower ad revenues. This could particularly impact smaller publishers and businesses that rely heavily on ad revenue from targeted ads.

One of the key concerns for investors and industry players is the impact on ad revenue. Cookies have been instrumental in enabling highly targeted, and thus more effective, advertising. Without them, there’s a fear that ad campaigns could become less efficient, potentially leading to lower ad revenues. This could particularly impact smaller publishers and businesses that rely heavily on ad revenue from targeted ads.

Google’s proposed alternatives, like the Privacy Sandbox initiative, aim to strike a balance between user privacy and targeted advertising. However, these solutions are still in development, and it’s unclear how effective they will be in replicating the precision of cookie-based targeting. Moreover, there’s a broader question about the evolving regulatory landscape around privacy and data protection, which could further complicate the picture for advertisers and publishers.

For investors, this represents both a risk and an opportunity. On one hand, companies that are heavily reliant on cookie-based advertising might face headwinds. On the other, there’s a potential upside for businesses that are developing innovative, privacy-compliant advertising technologies. Companies that can successfully navigate this transition, offering effective advertising solutions that respect user privacy, could emerge as the new leaders in the digital ad space. Companies like:

-

Trade Desk (TTD):

- What They Do: Trade Desk specializes in a demand-side platform (DSP) that allows clients to purchase digital advertising inventory across various ad formats and devices.

- Privacy Focus: They are developing a new approach called Unified ID 2.0, which is a privacy-focused alternative to third-party cookies. This solution aims to provide a unified, anonymized identifier for users, enabling targeted advertising without compromising individual privacy.

- Strengths: Unified ID 2.0 is designed to be a collaborative and open-source framework, which could make it more adaptable and widely accepted. It’s focused on creating a standardized, privacy-compliant way of targeting ads without relying on third-party cookies.

- Best For: Advertisers looking for a broad, industry-wide solution that balances user privacy with targeted advertising.

-

LiveRamp Holdings (RAMP):

- What They Do: LiveRamp offers a data connectivity platform, focusing on data onboarding and identity resolution across various devices and platforms.

- Privacy Focus: They have developed “Authenticated Traffic Solution (ATS),” which helps publishers and advertisers match user data in a privacy-compliant way. This solution leverages first-party data, aligning with the growing emphasis on user consent and data protection.

- Strengths: ATS leverages first-party data, which is becoming increasingly important as privacy regulations tighten. It’s a robust solution for advertisers who have or can develop strong first-party data strategies.

- Best For: Advertisers with access to quality first-party data who need to onboard this data effectively for targeted advertising.

-

Criteo S.A. (CRTO):

- What They Do: Criteo is known for its retargeting technology, which helps advertisers reach their audience more effectively.

- Privacy Focus: Criteo is working on a new AI-driven solution that can deliver personalized ads without relying on individual user data. This approach uses machine learning algorithms to analyze aggregated data, ensuring privacy compliance while still enabling effective targeting.

- Strengths: Criteo’s AI-driven approach can analyze aggregated data to deliver personalized ads without infringing on individual privacy. This could be a powerful tool in the absence of cookies.

- Best For: Advertisers who rely heavily on retargeting and personalized ads but lack strong first-party data capabilities.

-

PubMatic (PUBM):

- What They Do: PubMatic operates a sell-side platform (SSP) that provides digital advertising tools for publishers.

- Privacy Focus: They are investing in solutions that enhance first-party data capabilities for publishers, enabling them to leverage their own data more effectively in a privacy-compliant manner.

- Strengths: PubMatic’s focus on enhancing first-party data capabilities for publishers can be a significant advantage for advertisers who partner with these publishers.

- Best For: Advertisers who work closely with publishers and can benefit from enhanced first-party data capabilities.

-

Magnite (MGNI):

- What They Do: Magnite is a large independent sell-side advertising platform, facilitating the buying and selling of digital ads.

- Privacy Focus: Magnite is focusing on contextual advertising technology, which targets ads based on the content of the webpage rather than user behavior, aligning with privacy regulations.

- Strengths: Magnite’s emphasis on contextual advertising is a privacy-compliant way to target ads based on the content rather than user behavior. This approach is less reliant on individual user data.

- Best For: Advertisers who want to maintain effective targeting without the complexities of user data management.

Google’s move to eliminate cookies from Chrome is a watershed moment for the online advertising industry. It underscores the growing emphasis on user privacy and the need for the ad industry to evolve. For investors, keeping a close eye on how companies adapt to this change will be crucial in identifying potential winners and losers in the shifting digital advertising landscape.

These changes will also favor large-cap companies with in-house advertising departments, who are likely to be well ahead of the curve on implementing changes. A lot of small-caps are going to get caught with their pants down as the old system phases out – something we’ll have to keep an eye on all year.

We reviewed the minutes of the Fed Meeting in yesterday’s Live Trading Webinar and they were nothing for the bulls to get excited about. No one is talking about cutting rates until the summer and not by much if then. In fact, if Inflation data ticks up again, most of the Fed Governors are favoring more hikes. Richmond Fed President Barkin says a soft landing for the US economy is looking more likely – but hardly certain…

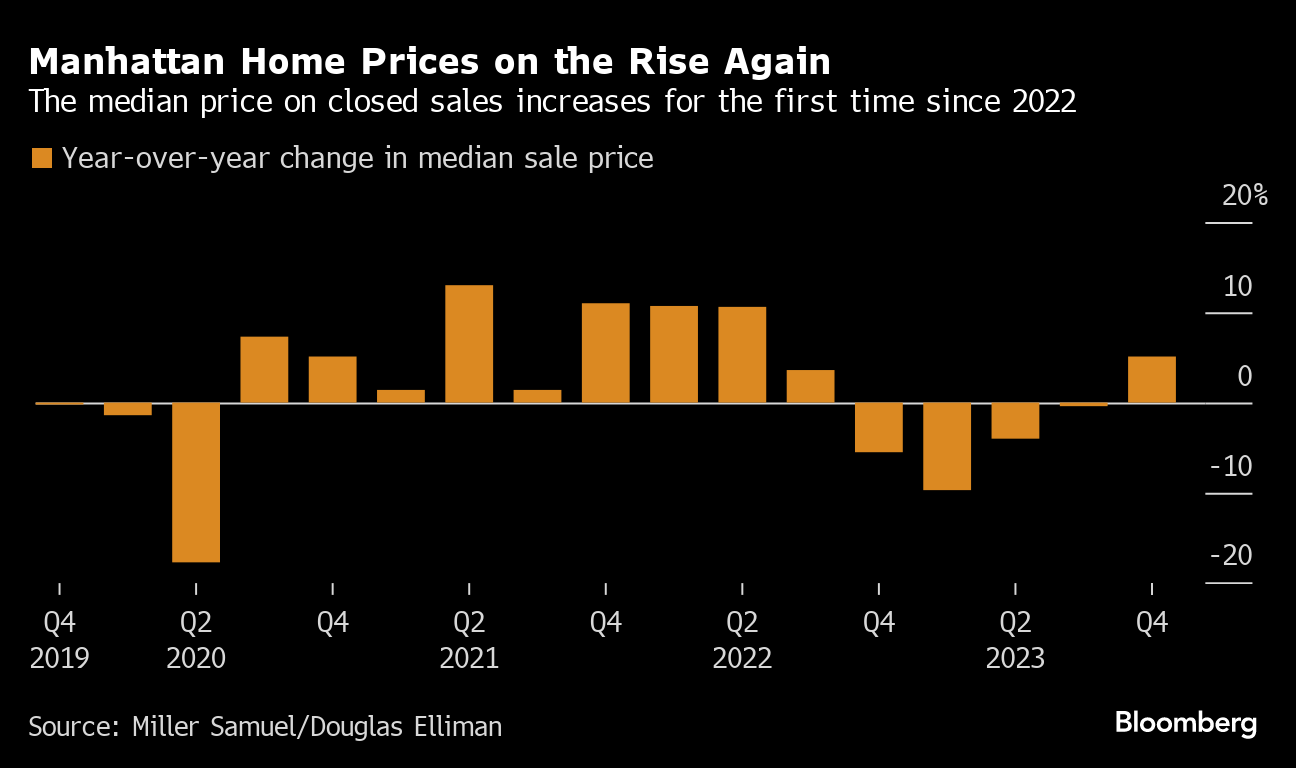

Manhattan home prices rose for the first time in more than a year, lifted by surging high-end sales. Purchases closed at a median of $1.16 million in the fourth quarter, up 5.1% from a year earlier, according to appraiser Miller Samuel and brokerage Douglas Elliman. Sales at or above $5 million jumped, while more than two-thirds of buyers paid cash, the highest share since Miller Samuel started tracking the metric in 2014.

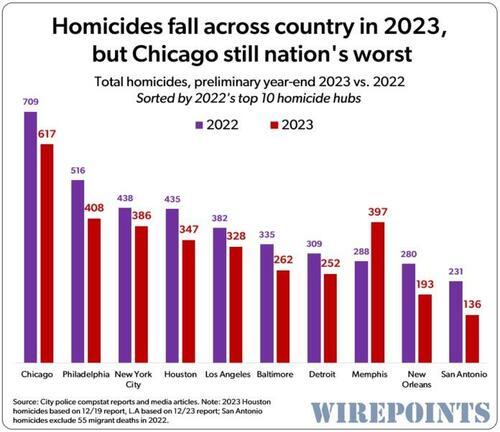

Of course the nice thing about NYC is it’s so much less murdery than Chicago.

Of course the nice thing about NYC is it’s so much less murdery than Chicago.

Consider that Chicago only has 2.6M people while NYC has 8.3M. Detroit only has 620,376 people – oops, make that 620,124! That’s one in 2,461 so, if you are in Detroit at any decent-sized gathering – one of you will be murdered… New Orleans is worse with only 369,749 survivors and one out of 1,915 people being killed each year so, if you live in New Orleans for 60 years – you have a 3.2% chance of being murdered – no wonder they have their own NCIS!

In Memphis, however, you may as well just shoot yourself with 397 murders among 621,056 people – a one in 1,564 chance of being killed each year so one in 26 chance of being murdered if you spend 60 years there.

Speaking of getting murdered and real estate – $1.2Tn worth of Commercial Property Debt is due to roll over in 2024 and the higher rates will make that very painful indeed. Already office loan delinquencies are at 5.28% – a five-year high. This is another major story we’ll be tracking over the course of the year.