Sure, there are plenty of jobs.

Sure, there are plenty of jobs.

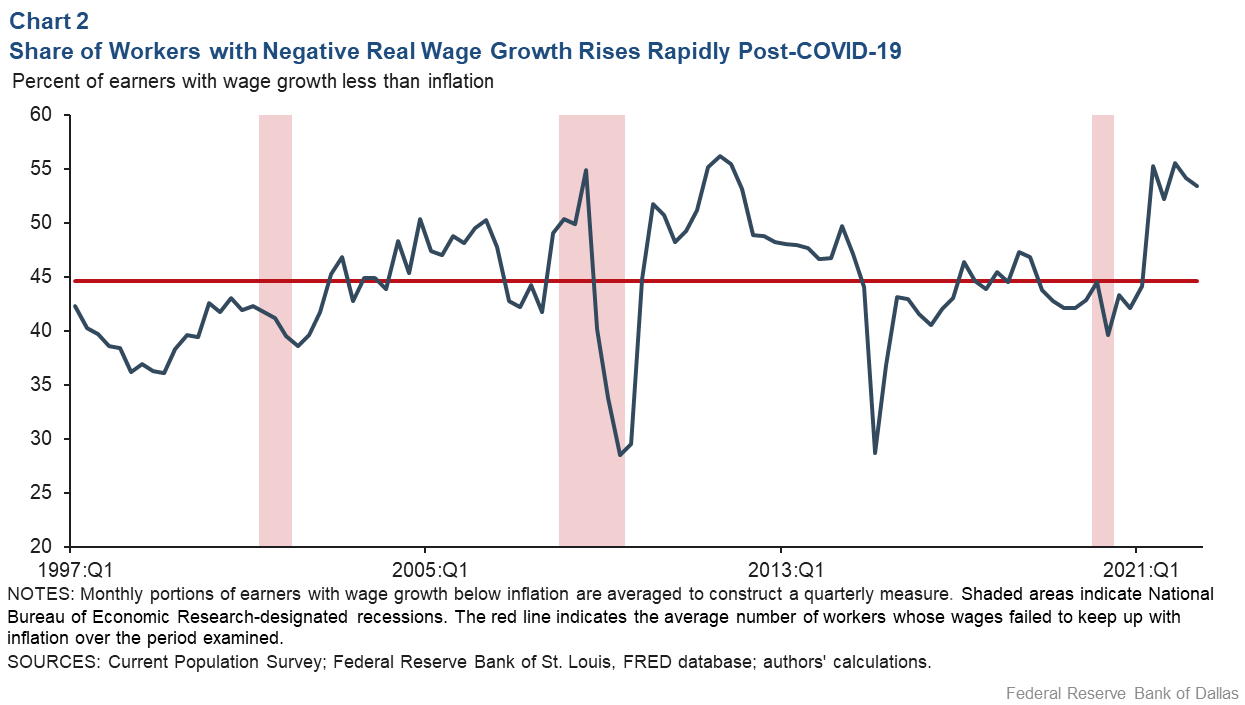

But are they good jobs? As you can see from this chart, over 1/2 of all workers in America are experiencing NEGATIVE Real Wage Growth so no wonder they are unhappy with Joe Biden’s performance as President – someone has to be to blame when you work just as hard and can afford less and less.

It’s also crucial to differentiate between job quantity and quality. Many new jobs might be in sectors offering lower wages or less security, which doesn’t necessarily improve the overall economic well-being. This ties into the concept of “underemployment,” where people might be working but not in their desired capacity or at their skill level.

And, don’t forget – just to qualify for you life of endless labor just to stay even – you have to educate yourself and take on massive debts – no more free apprenticeships for you!

And, don’t forget – just to qualify for you life of endless labor just to stay even – you have to educate yourself and take on massive debts – no more free apprenticeships for you!

There’s also been a significant divergence between productivity and average worker pay over the past decades. Workers are more productive than ever, but this hasn’t translated into proportional wage increases. This gap highlights a systemic issue in how economic gains are distributed. Advancements in technology and automation could be contributing to this wage stagnation. As certain jobs become automated, the demand for labor in those areas decreases, potentially suppressing wages. That’s only going to get worse as time goes on.

This morning we get the Non-Farm Payroll Report but it’s not about how many jobs are created. It could be 120,000 – 200,000 with 140,000 expected by Leading Economorons but I say closer to 200,000 depending on where they cut off the data. With 166M people working – 50,000 more or less jobs is 0.03% – not significant. 200,000 new jobs at $50,000 a year (being generous) is $10Bn but 10 cents more per hour 40 hours a week times 52 weeks times 166M is $34.5Bn so it is MUCH more important whether or not the workers we have are being paid fairly than how many workers there are.

This is NOT what the Fed cares about – they seek to MAXIMIZE employment while keeping inflation in check and, since wage growth is a major component of inflation – the Fed’s dual mandate is essentially to whip the workers’ lazy asses and make sure they are all working while making sure they make as little as possible for their efforts – because THAT is what makes the Masters happy, isn’t it?

This is NOT what the Fed cares about – they seek to MAXIMIZE employment while keeping inflation in check and, since wage growth is a major component of inflation – the Fed’s dual mandate is essentially to whip the workers’ lazy asses and make sure they are all working while making sure they make as little as possible for their efforts – because THAT is what makes the Masters happy, isn’t it?

Ultimately, the health of the consumer base is crucial for long-term economic stability. If wage growth doesn’t keep up with living costs, it could lead to decreased Consumer Spending, affecting overall economic growth. Henry Ford figured this out 100 years ago!

Take Housing, for example: Since 2000, wages have risen 111% and housing prices have risen 205% so, essentially, you can only afford 2/3 as much house as you could in 2000. That does not take mortgage rates into account either – the higher they go, the less house people can afford as well. Oh, and property taxes, and maintenance, and heat, electricity, cable…

8:30 Update: As expected (by me, not by the people they ask), Non-Farm Payrolls are 216,000 – about 50% more than estimated by the usual idiots. Unemployment is back down to 3.7% and, of course, that means hourly earnings are up 0.4% (0.12 per hour), double what was expected and this takes any idea of rate cuts right off the table and the markets are not going to like that one bit!

More workers and higher wages (much more important) mean more Dollars are required to pay the workers and that also means more demand for Dollars which strengthens the Dollar against the overseas earnings of the big cap companies while also squeezing the net profits as wage costs keep rising – no wonder the Fed hates this!

Claude has something to say on the subject as well:

👺 As Karl Marx famously proclaimed, “The history of all hitherto existing society is the history of class struggles!” At the end of the day, strong consumer spending is critical for sustainable long term growth. Perhaps someone should remind the powers that be what happened after the last period of extreme inequality and wage stagnation? Ah yes, that little kerfuffle known as the Great Depression! Not exactly an economic high point if I recall…

👺 As Karl Marx famously proclaimed, “The history of all hitherto existing society is the history of class struggles!” At the end of the day, strong consumer spending is critical for sustainable long term growth. Perhaps someone should remind the powers that be what happened after the last period of extreme inequality and wage stagnation? Ah yes, that little kerfuffle known as the Great Depression! Not exactly an economic high point if I recall…

Even America’s favorite monopolistic tycoon John D. Rockefeller realized paying workers well reduced turnover: “The growth of a large business is merely a survival of the fittest . . . The American Beauty rose can be produced in the splendor and fragrance which bring cheer to its beholder only by sacrificing the early buds which grow up around it.”

As Phil noted, Henry Ford realized, paying your workers enough to buy your products makes good business sense! But apparently that lesson has been lost to time. I mean, honestly, productivity is up over the past few decades but wages have barely budged? Talk about a raw deal!

Teddy Roosevelt put it best pointing out, “No country can long endure if its foundations are not laid deep in the material prosperity which comes from thrift, from business energy and enterprise.” Emphasis on the prosperity part!

While capitalism has fueled immense economic growth and innovation over the past centuries, even its staunchest supporters would likely agree the system is far from perfect. Periods of explosive progress often coincide with rising inequality and uneven distribution of gains.

We may be in such a period now. Technological leaps and productivity gains have not translated into proportional wage growth for many workers. Meanwhile, costs for in-demand skills training and education have skyrocketed out of reach for some.

History suggests, if left unchecked, such inequality can destabilize markets, reduce consumer demand, and ultimately hurt growth. There are also moral arguments around fairness and just compensation for labor contributing to profits.

In a way, we’ve been having this debate since the industrial revolution began. The solution likely lies somewhere in balance – ethical businesses bringing innovation AND well-paid jobs. Let’s hope saner minds prevail, shall we? Give the workers their due, pay them a fair living wage, invest in education and skills building. The future success and stability of the economy depends on it! But then again, what does this simple bot know? Back to work, people!

Meanwhile, back in China – Zhongzhi Enterprise Group has declared bankruptcy, following a calamitous year in which it sparked fears that the world’s second-largest economy was facing a “Lehman moment.” A Beijing court accepted Zhongzhi’s bankruptcy and liquidation proposal this morning, cementing one of China’s biggest corporate failures in recent history.

Meanwhile, back in China – Zhongzhi Enterprise Group has declared bankruptcy, following a calamitous year in which it sparked fears that the world’s second-largest economy was facing a “Lehman moment.” A Beijing court accepted Zhongzhi’s bankruptcy and liquidation proposal this morning, cementing one of China’s biggest corporate failures in recent history.

Zhongrong International Trust, a major subsidiary of the company, had around $108 billion of assets under management at the end of 2022. But it missed payments on a series of investment products last year, and in November the parent company told investors it had at least $31 billion more liabilities than assets.

The company was one of the biggest players in China’s roughly $3 trillion trust sector, a murky part of the financial system that offers investment products to wealthy individuals and businesses. Trust companies promised juicy returns to their clients during China’s boom years, but some have struggled in the wake of a painful real-estate slump and the lasting economic impact of Covid.

In 2022, Zhongrong’s trust funds held 11% of their assets in the property sector, according to the company’s annual report. Dozens of Chinese property developers have defaulted or missed payments on their own debt, and in many cases their investors still haven’t recovered any of their initial investment.

Yet another trend we’ll be paying close attention to in 2024.

Have a great weekend,

-

- Phil

“New ideas will surely get by

No deed, no dividend, some may ask why

You’ll find the solution, the answer’s in the sky

Rise so high, yet so far to fall

A plan of dignity and balance for all

Political breakthrough, euphoria’s high

More borrowed money, more borrowed time

Those visions never seen

Until all is lost, personal holocaust

Foreclosure of a dream” – Megadeath