Now we start to get serious.

Last week the markets were still in vacation mode and, as noted by Claude in the Weekly Wrap-Up, Bond yields pushed up and the indexes pushed down as the Dollar pushed back from 100.50 to 102.20 to start the year and job growth came in strong with a 0.4% increase in earnings so the demand for Dollars should push them higher this week as well – although lower demand for Oil Dollars ($71.28 traded for 36.5Bn barrels a year) is offsetting Labor demand somewhat.

That’s a good rule of thumb, by the way as each 10 cent change in US Labor Costs is $34.5Bn so that has about the same impact as a $1 change in oil cost does Globally. The other major mover of the Dollar is housing – if 5M homes are sold in a year for and AVERAGE (median doesn’t help here) price of $500,000 demands $2.5Tn per year – which is about the same as total Global Oil Demand for Dollars.

$2.5Tn is also the same as Corporate Profits (the ones they admit to after deductions, depreciation and cheating) and then we have $6Tn of Consumer Spending ($1.7Tn is deficit!), and $6Tn of Government Spending but not much variation in those categories so they don’t move the Dollar much but it’s important to see the whole picture.

Other wildcards that demand Dollars for payments are Stocks and BitCoins with Stocks converting Dollars into fractional shares of a company but, generally, each Dollar that goes in releases a Dollar going the other way – so not a huge impact despite $206Tn worth of trades last year (about $1Tn per day!). BitCoins (and other crypto), on the other hand are magic beans where you hand in your Dollars in exchange for some code someone made up in their basement but BitCoin is now a $5Tn beanstalk and all of Crypto we can call $10Tn that has been sucked out of circulation since 2010 – when 10,000 BitCoins were used to buy a pizza…

Other wildcards that demand Dollars for payments are Stocks and BitCoins with Stocks converting Dollars into fractional shares of a company but, generally, each Dollar that goes in releases a Dollar going the other way – so not a huge impact despite $206Tn worth of trades last year (about $1Tn per day!). BitCoins (and other crypto), on the other hand are magic beans where you hand in your Dollars in exchange for some code someone made up in their basement but BitCoin is now a $5Tn beanstalk and all of Crypto we can call $10Tn that has been sucked out of circulation since 2010 – when 10,000 BitCoins were used to buy a pizza…

The fact that 10,000 BitCoins are now trading for $450M does not mean BitCoin is valuable so much as it means people are idiots but PT Barnum said there was a sucker born every minute in the 1850s, when the population of Earth was 1Bn people and now we have 8Bn people so there’s 8 suckers per minute times 525,600 minutes is 4.2M new suckers each year to sell 11M total BitCoins to – this can go on for ages!

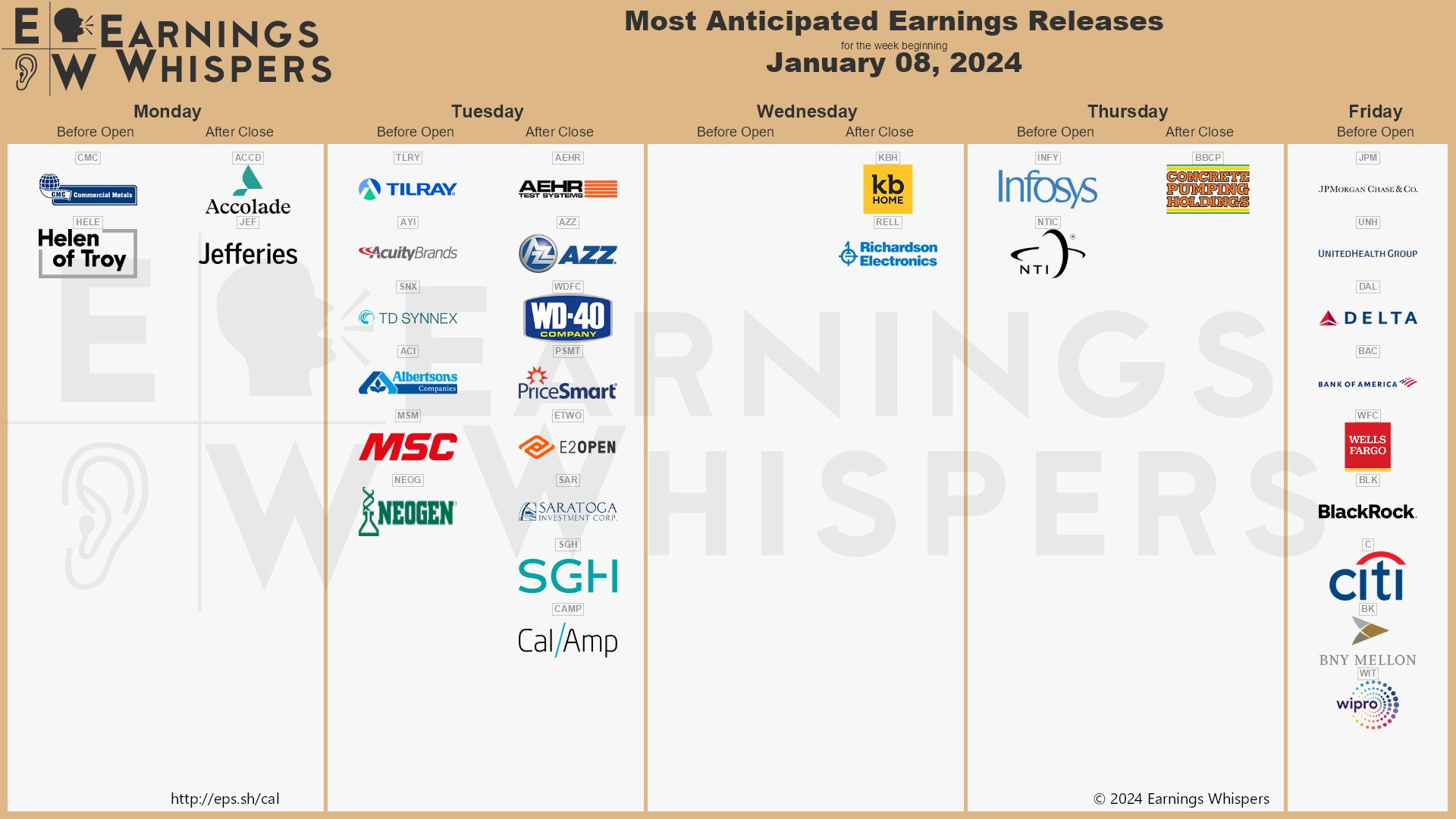

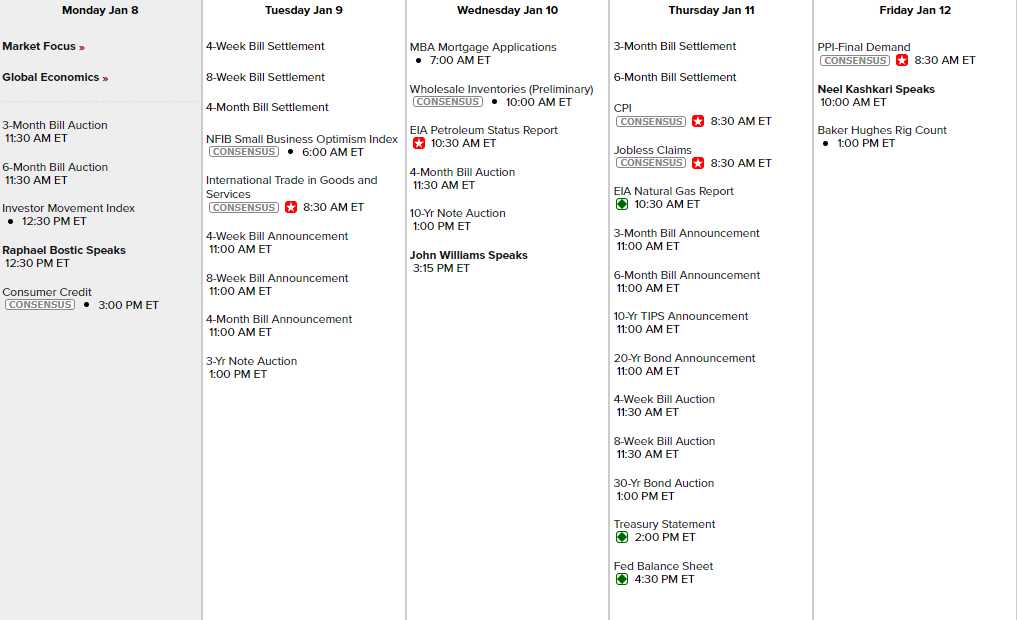

This week we get CPI on Thursday and PPI on Friday and Inflation is another thing that has an impact on the demand for Dollars. There’s not much other data this week and not much Fed Speak and not much earnings either – although Friday we get BlakcRock – who are pushing to start a BitCoin ETF! People may be getting back to work but not so much that they are ready to produce reports just yet. Next week we get into the meat of Earnings Season.

Meanwhile, here’s some news highlights for the weekend with the biggest story being more trouble for Boeing, which will drag down the Dow and S&P this morning as, once again, the 737 Max’s are GROUDED – this time due to a panel blowing out in-flight where it was only extremely lucky no one was killed.

Keep your seatbelts fastened at all times indeed!

Also of interest:

- Weekend News Round Up – Newsquawk Asia-Pac Market Open

- The 2023 U.S. economy, in a dozen charts

- Speaker Johnson Announces $1.66 Trillion Bipartisan Package To Avert Shutdown

- These Are the Five Potential Trouble Spots That Could Knock the Global Economy Off Course

- Top U.S. Economists Are Short-Term Happy, Long-Term Glum

- Positioning and technical indicators flash warning signs

- Can Stocks Surpass 2022 Highs? Yes, but the Math Looks Scarier From There

- Americans are racking up more ‘phantom debt’ — why that’s a problem

- Why stock-market investors will remain at mercy of shifting rate-cut expectations after wobbly start to 2024

- Whether or not it’s technically a recession, the U.S. is headed for a soft patch, economists say

- High-Flying Profit Forecasts Head Back Down to Earth

- The Stock Rally Has Stalled. Now Comes Earnings Season.

- Investors Are Looking to Share Buybacks to Keep US Stock Market Afloat

- “Largest Selling Since Mid-October”: Hedge Funds, Long-Onlies Resume Dumping Tech Stocks At Furious Pace

- Pension Fund Crisis? Calstrs Seeks $30 Billion In Leverage Amid CRE Turmoil

- Blinken Calls Gaza Situation Dire as Risks Grow of Wider War

- Top Diplomats Converge on the Middle East to Prevent Wider War

- Xi’s Solution for China’s Economy Risks Triggering New Trade War

- China Sanctions Five US Defense Firms on Taiwan Arms Sales

- Hundreds of Flights Canceled Due to Storms Across the US

- Spirit Aero made blowout part but Boeing has key role

- Florida Becomes First State Allowed to Import Drugs From Canada

- Largest U.S. radio company Audacy files for bankruptcy protection as ad sales tank

- Apple’s stock has started 2024 on a sour note not seen in 42 years

- Visualizing 50 Years Of Video Game Revenues, By Platform

That’s right, back to work everyone!