“To cut or not to cut; that is the Fed’s question?

“To cut or not to cut; that is the Fed’s question?

Whether ‘tis nobler in economy to suffer

The soaring grocery costs to eat or not to eat,

Or cope with surging rents of housing shortage’s heat,

And by opposing end them…To hike or hold,

Perchance to pause price hikes? Aye, there’s the rub!

For staying the Fed’s hand, what ills persist

When treatment delayed of this inflation they miss?

Yet holiday retail gave cheer though budgets strained,

There lives the caution that gives the Fed pause

To rein or not rein in this market’s Santa Claus

Who’d bear the slings of med-bill sticker shock,

Th’hospital gouge, the dread insurance lock,

Prescription drug prices with no ceiling in sight,

When the Fed could its mandate uphold upright

But instead cowers until the next FOMC night,

puzzles investors who’d wish to take flight

From inflation’s claws and risks that give fright.

So Chair Powell, take arms against the sea of doubt

Act ere purchasing power drains further out!

In your hands lie the levers our economy’s health

And the CPI components that account for our nation’s wealth.“

Yes, I was bored waiting for the CPI data.

It’s 8:30 now and the headline came in a little hot at 0.3%, 50% higher than the 0.2% expected by Leading Economorons. As anyone who actually read the interim data reports would have seen, Shelter, Medical Care and Transportation Services (the Houthis boosted shipping costs) were all on the rise against a fairly small pullback in fuel costs.

Overall, Inflation remains elevated and persistent despite the Fed’s aggressive 2023 hiking regime and, while the Economy is expected to slow to 1.25% in 2024 – Q3 was 5% and we haven’t seen Q4 yet but a dive in GDP like that is alarming all on it’s own – it’s like a plane (737?) doing a vertical power-dive while the captain says “Ladies and gentlemen we are attempting a soft landing” (and yes, I know that sounds like Robo-John but incongruous humor is a valid trope if not overused).

Speaking of robots – it’s not great but it’s not bad and you have to admire the work of Robo George Carlin – I was fascinated by all the AI-driven images he created to go with the material. Keep in mind this is only year one of the AI revolution – human comics should be very nervous (and George Carlin’s kids are not pleased)…

Anyway, speaking of half-assed robots – the Fed has a decision to make on January 31st so 20 days of data to go but this is a biggie and there’s certainly no reason to ease rates based on a 50% more-than-expected CPI Report. We’ll keep an eye on the components for the next few weeks so we’ll be well-prepared for the 5 or 6 words the Fed is going to change on their next statement (which will still send the markets into a tizzy).

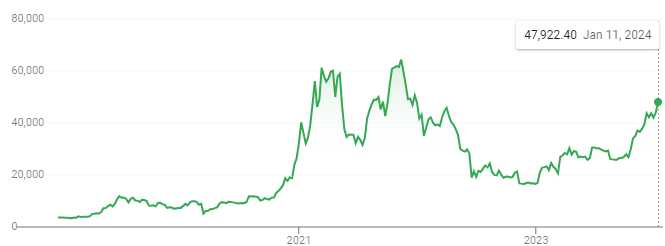

Speaking of tizzies, the SEC finally approved Bitcoin ETFs so now everyone can own some bits and bytes in exchange for their hard-earned Dollars. Before I get misquoted I want to clearly state that Bitcoin is no different than Beanie Babies – it’s only worth something because people want them – they are not useful for transactions compared to good old-fashioned CASH!!!

Speaking of tizzies, the SEC finally approved Bitcoin ETFs so now everyone can own some bits and bytes in exchange for their hard-earned Dollars. Before I get misquoted I want to clearly state that Bitcoin is no different than Beanie Babies – it’s only worth something because people want them – they are not useful for transactions compared to good old-fashioned CASH!!!

Nonetheless, there are only 11M of them and only about 1.5M in circulation at what is now $47,000 each ($70.5Bn) so it would not take many suckers to ramp up the price to outrageous levels. SPY is the largest ETF with $500Bn under management but it’s certainly not a fair comparison. I suppose GLD would be the most similar and that is $59Bn but not all BTC are going to the exchange so even $10Bn flowing into a BTC ETF would create a huge demand bump for the coins.

Gold ETFs emerged in the early 2000s and the structure of the BTC ETFs will be similar: These funds will hold Bitcoins in a digital vault, and instead of buying physical Bitcoins, investors can buy shares in the Bitcoin fund through their brokerage accounts, just like buying stocks. This approach simplifies investing in Bitcoin, bypassing the complexities of cryptocurrency exchanges and digital wallets (which is why they are useless as a means of exchange in the first place). The involvement of major asset managers like BlackRock (BLK) and Fidelity Investments in backing these funds is certain to draw more mainstream investors into Bitcoin.

The approval of Bitcoin ETFs by the SEC is a landmark moment in the integration of cryptocurrencies into the traditional financial system. It represents a significant shift in regulatory attitudes towards cryptocurrencies, acknowledging their growing acceptance in the investment landscape. However, the introduction of these ETFs also raises questions about market volatility, regulatory oversight, and the evolving nature of cryptocurrency as an asset class. While they offer a more accessible route for investment in Bitcoin, the inherent volatility and speculative nature of cryptocurrencies still pose risks that investors need to consider.