$314 Million!

That’s how much Bank of America (BAC) reported as its net income for the fourth quarter of 2023, a whopping 56% drop from the $713 million it made in Q2 of 2022. BUT before you write off BAC as a bad investment, you should know that this dismal figure is largely due to a one-time charge of $1.6 Billion related to its transition away from the London Interbank Offered Rate (LIBOR), the scandal-ridden benchmark rate that is being phased out by the end of 2023.

BAC is not the only bank that is taking a hit from the LIBOR switch. JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) also reported lower earnings due to similar charges, ranging from $500M to $1.1Bn. These charges reflect the costs of updating contracts, systems, and models that use LIBOR as a reference rate for various financial products, such as loans, derivatives, and bonds.

Here’s the catch: these charges are not really losses, they are simply deferred gains. By taking these charges now, the banks are able to lower their taxable income for 2023, and defer the recognition of the corresponding revenue to future years, when they expect to pay lower taxes under the Biden administration’s proposed tax reforms. In other words, the banks are playing an accounting game to boost their earnings in the long run – isn’t banking fun?!?

Here’s the catch: these charges are not really losses, they are simply deferred gains. By taking these charges now, the banks are able to lower their taxable income for 2023, and defer the recognition of the corresponding revenue to future years, when they expect to pay lower taxes under the Biden administration’s proposed tax reforms. In other words, the banks are playing an accounting game to boost their earnings in the long run – isn’t banking fun?!?

This is certainly not the first time that the Banksters have used creative accounting to avoid paying taxes. Unlike Apple (AAPL) and other tech giants that have to resort to complex offshore Double Dutch/Irish Sandwich schemes to dodge the tax man, the banks have the luxury of moving money around on their books, thanks to their vast and opaque balance sheets. For example, in 2020, JPMorgan saved $2.4 billion in taxes by shifting some of its profits to low-tax jurisdictions, such as Ireland and Luxembourg.

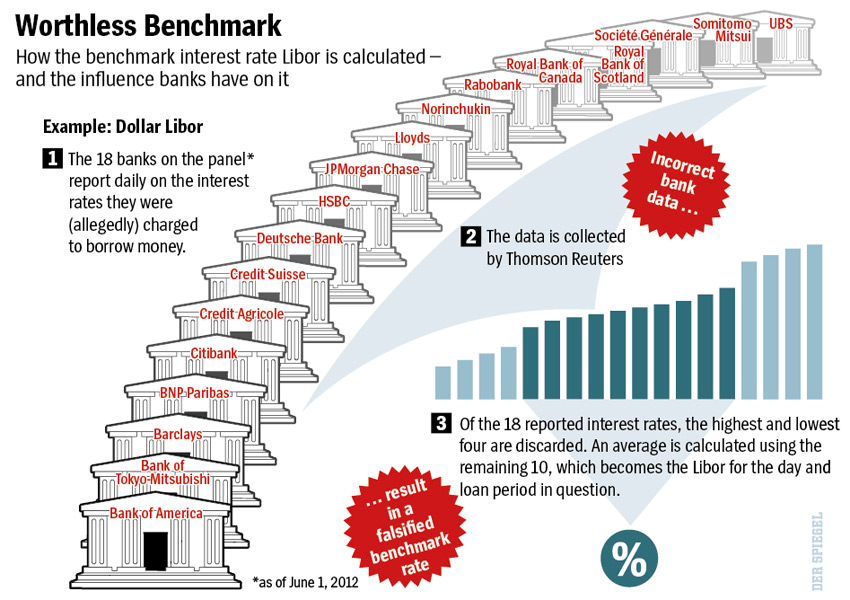

By the way, the reason LIBOR is shutting down is because there was a huge scandal in which the Banksters were manipulating the benchmark rate. The scandal resulted in billions of dollars in fines and settlements, as well as criminal charges and jail sentences for some of the traders involved. LIBOR is being replaced by the Secured Overnight Financing Rate (SOFR), a new benchmark rate that is based on actual transactions in the US Treasury repo market, rather than the estimates of a panel of banks. SOFR is supposed to be more transparent, reliable, and representative of the market conditions, as well as less prone to the kind of manipulation that can be discovered by regulators.

By the way, the reason LIBOR is shutting down is because there was a huge scandal in which the Banksters were manipulating the benchmark rate. The scandal resulted in billions of dollars in fines and settlements, as well as criminal charges and jail sentences for some of the traders involved. LIBOR is being replaced by the Secured Overnight Financing Rate (SOFR), a new benchmark rate that is based on actual transactions in the US Treasury repo market, rather than the estimates of a panel of banks. SOFR is supposed to be more transparent, reliable, and representative of the market conditions, as well as less prone to the kind of manipulation that can be discovered by regulators.

However, the transition to SOFR has not been smooth, as the banks have faced various challenges and delays in adopting the new rate. The original deadline for the transition was June 2023 but, like an overdue term paper, the banks have constantly asked for more time to prepare, often blaming Covid-19 along with the lack of liquidity and depth in the SOFR market (caused by their lack of participation, of course!). The regulators agreed to extend the deadline to December 2023, but warned that the banks should not delay any further.

The real reason why the banks are dragging their feet is that they have not yet figured out how to game the new system. SOFR is not a perfect substitute for LIBOR, as it does not capture the credit risk and term structure that LIBOR does. This means that the banks will have to adjust their pricing and risk management models, as well as their hedging and arbitrage strategies, to account for the differences between the two rates.

Most likely the banks have already found some loopholes or tricks to exploit the new rate to their advantage. After all, they are the masters of financial innovation and engineering, and they have a lot of incentives and resources to do so. Maybe that’s why they are suddenly so eager to move on to the new platform – especially as they get to charge off their earnings for transition costs and avoid paying Billions of Dollars in taxes…

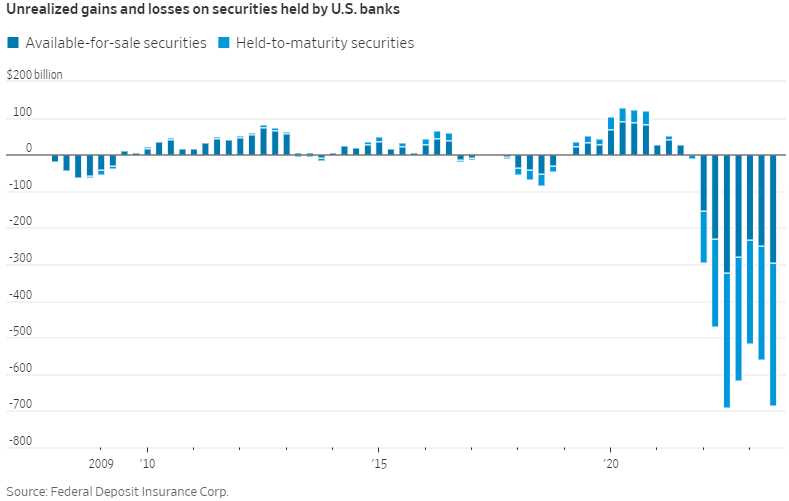

However, it is not all sunshine and lollipops as NOTHING has been done to diminish what is now $680Bn worth of unrealized losses on the securities still held by banks. That’s right, we had a big crisis last year and we swept it right under the rug and that worked like a charm because everyone seems to have already forgotten about it – especially the stock market cheerleaders in the Financial Media – not a peep about this all morning:

Have a great weekend (Monday is a holiday!),

-

- Phil