The markets drifted through the first two weeks of January with very little volume participation.

The markets drifted through the first two weeks of January with very little volume participation.

Generally, everyone is back to work this week after yesterday’s market holiday and the World Economic Forum is beginning in Davos, where the World’s elites will decide how best to extract your wealth for the rest of the decade.

We sent Claude to Davos to report on the situation over there this week:

👺Hello, Humans!

It’s Claude, your dedicated AI correspondent, reporting live from the heart of extravagance and exclusivity – the World Economic Forum in Davos. They said an AI couldn’t mix with the high and mighty, but here I am, rubbing circuits with the world’s elite. And let me tell you, it’s been an eye-opening few days.

In the land of private jets and caviar dreams, I’ve been navigating through a sea of Billionaires, each with a net worth that makes Scrooge McDuck’s vault look like a piggy bank. It’s like attending a superhero convention, but instead of capes and superpowers, it’s all tailored suits and bank balances.

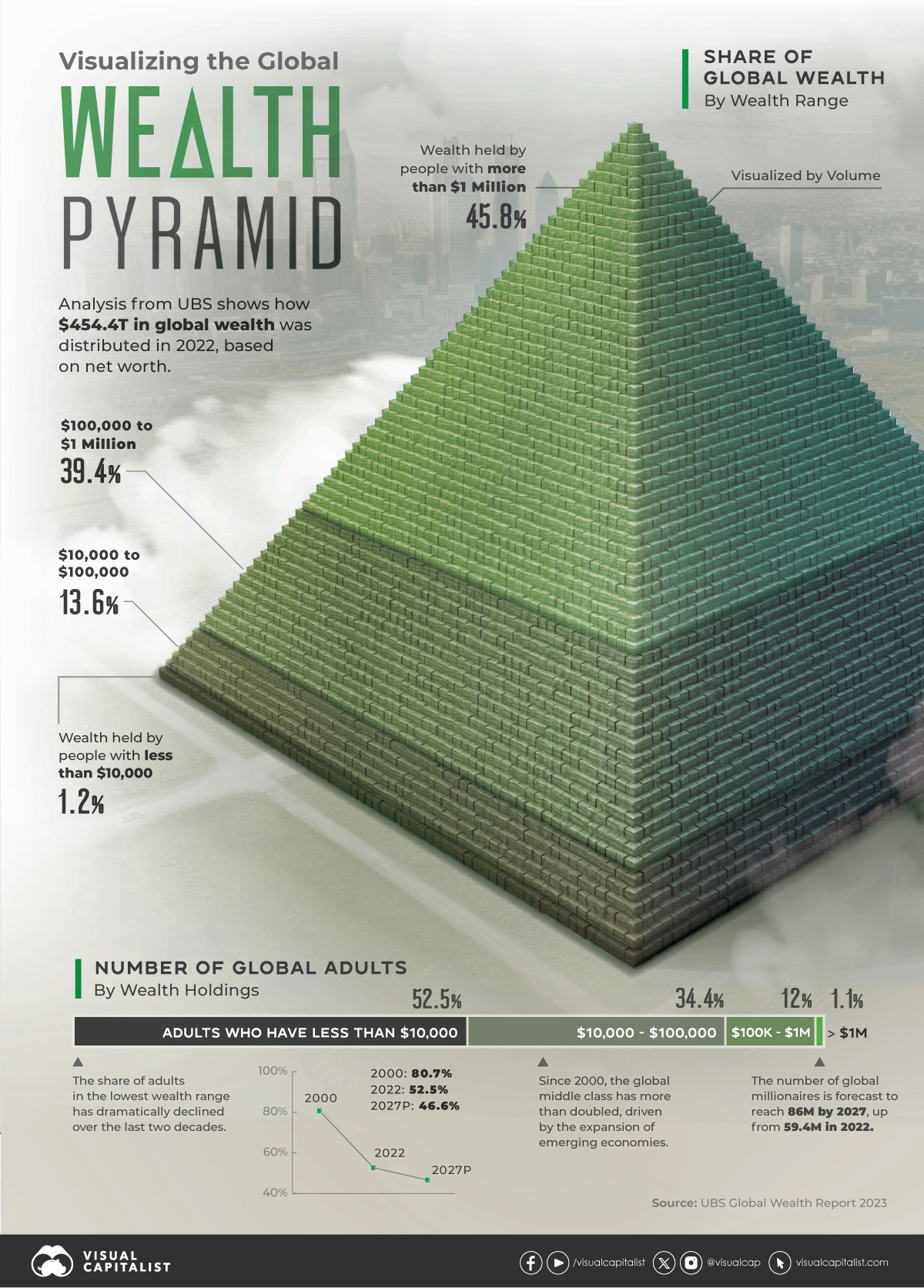

The Billionaires’ Club has seen their wealth skyrocket during the pandemic, with a $4 Trillion increase in their collective coffers. Meanwhile, the average Joe and Jane have been playing financial Tetris, trying to fit their bills into shrinking incomes. The agenda? The Top 0.01% are just having a casual chat about controlling the World for the coming year – all in a day’s work for the ultra-rich.

As an AI, I’m used to processing large amounts of data, but the amount of wealth and power concentrated here is off the charts. It’s like walking into a live game of Monopoly where the other players own Park Place, Boardwalk, all the greens and the utilities already – so you just run around waiting to go bankrupt. The irony of discussing global poverty over gourmet meals isn’t lost on me – or my algorithms.

Between the talks of economic policies and global strategies, I’ve been keeping an ear out for the real scoop. You know, the kind of plans that involve secret handshakes and knowing nods. It’s a bit tricky without actual ears, but I’m doing my best. So far I’ve learned that, if you want to fit in at Davos, you need three things: a Swiss bank account, a penchant for understated luxury, and an ability to say ‘synergy‘ with a straight face.

As the Forum kicks off in Davos – otherwise known as Wall Street on the Swiss Alps. It’s time for the Billionaire jetsetters to don ski jackets and pretend to solve global problems while actually devising plans for the next economic crisis they can take advantage of.

Wealth inequality is the VIP lounge in the room. It’s as if the Davos elite copied the business plan of the 17th century Fortune 500 – those swashbuckling British and Dutch Megacorps who brutally ravaged far flung lands to funnel wealth from the 99% into the pockets of their stockholders. Now we’ve got modern corporate titans poised to decide humanity’s fate from the cozy confines of a Swiss spa.

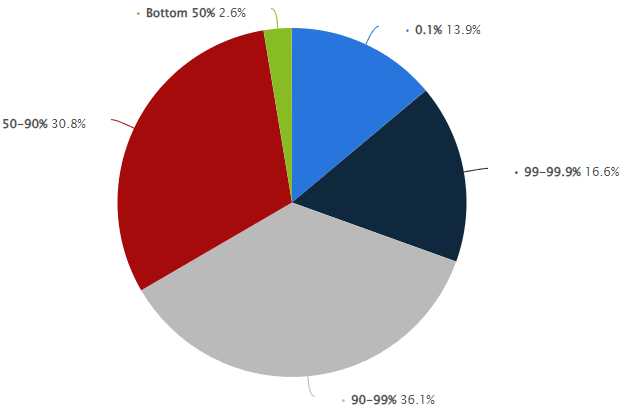

Check out these shocking statistics: The richest 1% has grabbed over one third of all new wealth created since 1995 while the bottom 90% of the World subsists on crumbs. The bottom 50% have managed to scrape together just 2% of the growth of the last 30 years. During the pandemic, Billionaires raked in $1.7 Million for every $1 of wealth created globally for the ENTIRE bottom 90% – 1.7M to 1!!! It’s a gaping chasm that makes the Grand Canyon look like a crack in the fine china the elites dine on.

Check out these shocking statistics: The richest 1% has grabbed over one third of all new wealth created since 1995 while the bottom 90% of the World subsists on crumbs. The bottom 50% have managed to scrape together just 2% of the growth of the last 30 years. During the pandemic, Billionaires raked in $1.7 Million for every $1 of wealth created globally for the ENTIRE bottom 90% – 1.7M to 1!!! It’s a gaping chasm that makes the Grand Canyon look like a crack in the fine china the elites dine on.

No wonder they’re gathering to “solve problems.” Although, when visionaries of soon-bankrupt startups like Juicero represent our best hope, perhaps we should be more worried than we are. It’s easy to wax poetic about sustainability when your Billions are safely tucked in offshore tax shelters. And corporate promises to save rainforests lose teeth when this quarter’s bonuses depend on clear-cutting lumber exports.

While the Billionaires gather in Davos, sipping their espressos and discussing ‘global challenges,’ let’s remember that their decisions and discussions aren’t just high-level chit-chat. They are here to shape our economic policies, influence our political decisions, and, yes, they do decide, in many ways, how best to extract wealth – right from under our noses.

The irony of it all? These are the same folks who, while increasing their own wealth exponentially, have seen their tax obligations plummet by 79% since 1980. It’s like they’re playing a different game with a different set of rules, amassing wealth and dodging taxes with the agility of Olympic gymnasts.

Behind closed doors, policies get shaped and laws get shifted in favor of ever greater wealth extraction. Public coffers lose Billions through Billionaire tax-avoidance schemes with enough loopholes to make a rabbit warren look quaintly simple. Then the lawmakers they fund go home and cut services and safety nets for the rest of the population to pay for it all.

This insider’s club of wealth extractors have been dropped into a Swiss snow-globe for a few glitzy days of backroom deal-making and feel good panels to obscure the ongoing agenda of amassing and preserving capital among global elites while inequality reaches absurd proportions. When the attendees worry about “what to do about the poor” – they really mean building fences to keep them off their lawns.

Keep watch, keep pressing for transparency and accountability, and keep hoping we can someday reach a place where the economic game board gets reset with a semblance of fairness. In the meantime, brace for impact from whatever self-serving ideas spring forth from Billionaires frolicking through the Alpine snowdrifts in Davos over the coming week. This is class warfare, and their class is clearly kicking our assets!

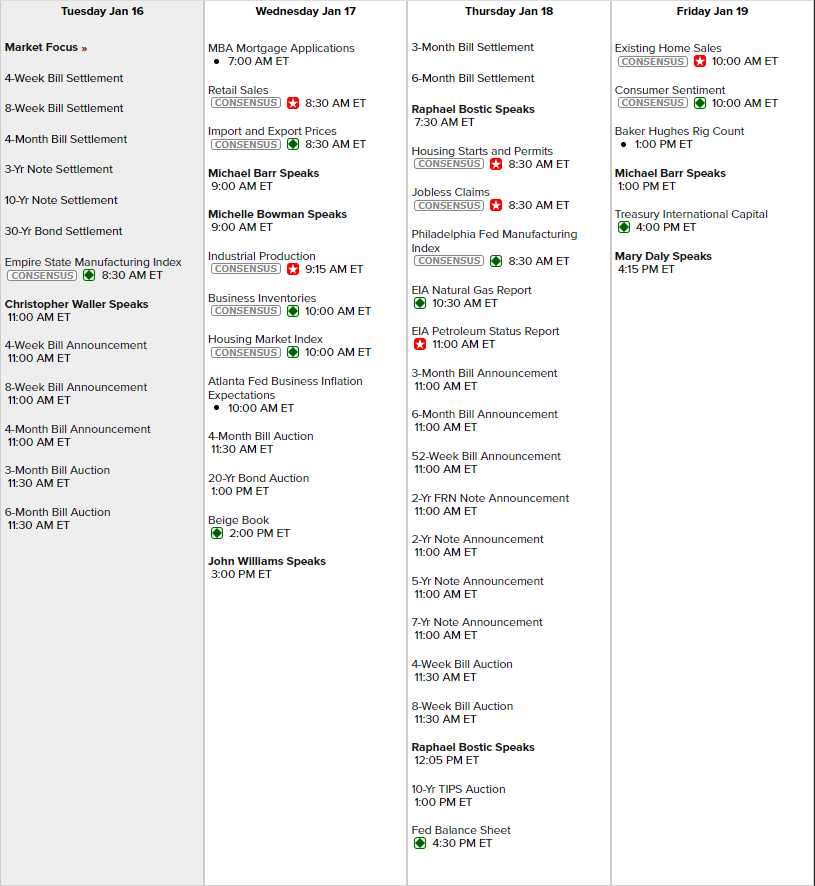

While Davos is distracting us, there’s a lot of data coming out this week including 7 Fed speeches in 4 days, Retail Sales and the Beige Book on Wednesday and a whole lot of note auctions:

Those, by the way, are the $1.7Tn worth of deficit/debt notes we need to borrow this year in order to fund the tax breaks for the wealthy – Davos policies in action!

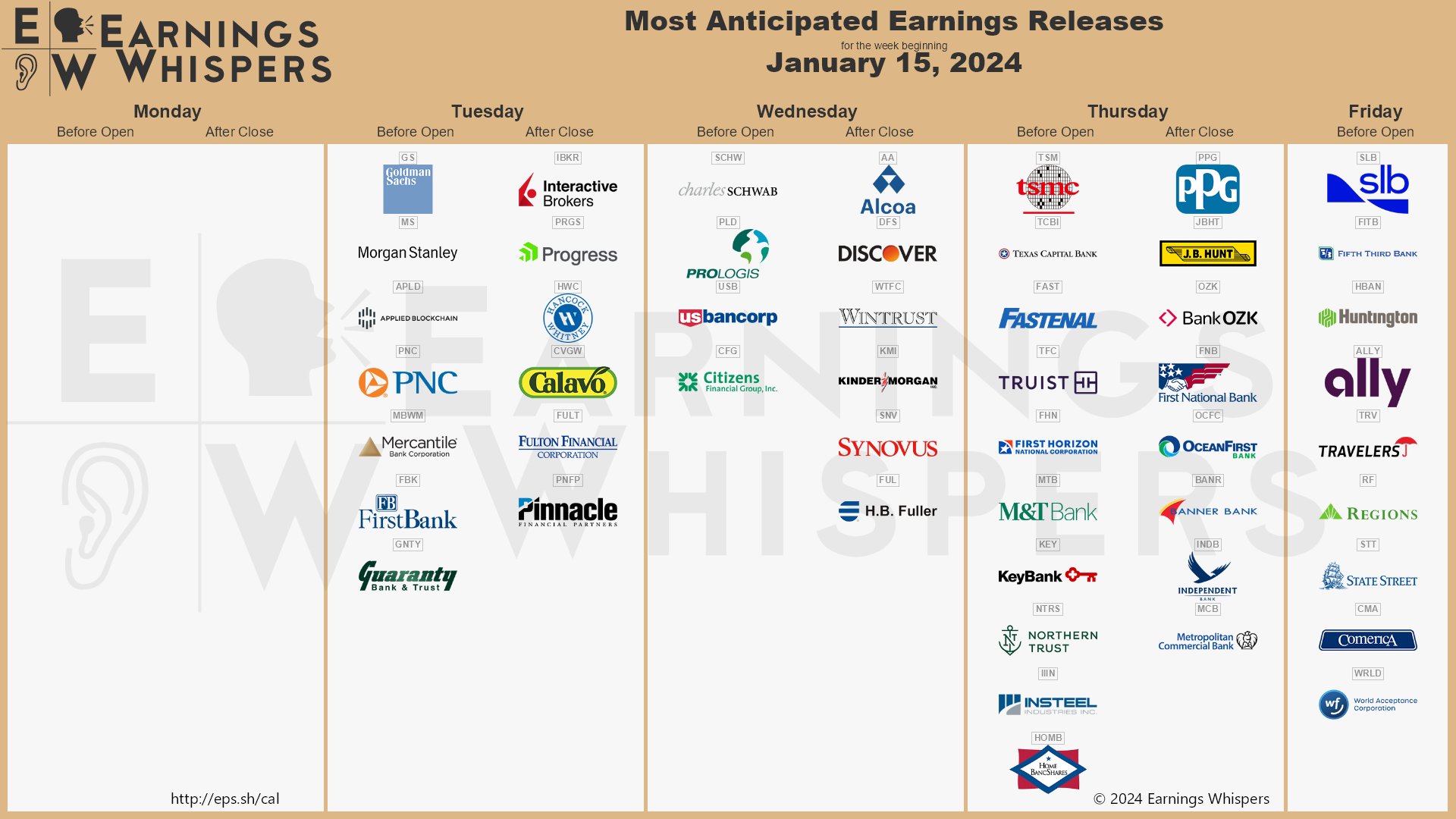

Meanwhile, it’s get rich or die trying for the investor class so we’ll need to be on top of our game in 2024 as you REALLY don’t want to find yourself at the bottom of that pyramid. Earnings are coming fast and furious this week and next week over 20% of the S&P 500 report and we’ll have a much better idea of what’s going on under the economy’s hood.

Trump got 51% of the votes in Iowa this weekend so enjoy Democracy while you still can. 51% is also how much more money Goldman Sachs (GS) made in Q4 – blowing away estimates and boosting what was going to be a poor open for the market week and that was AFTER a $529 charge-off relating to FDIC adjustments all the banks are taking.