It’s a big data day.

It’s a big data day.

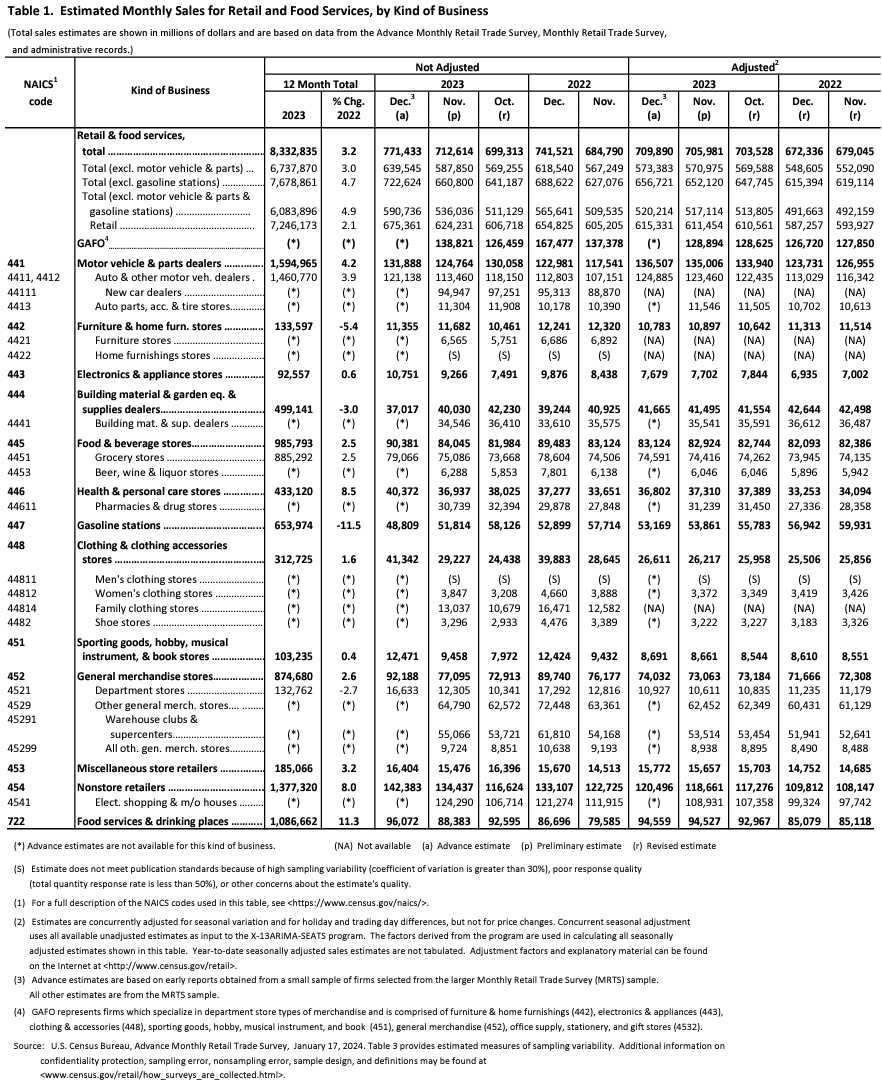

This afternoon we get the Fed’s Beige Book, which summarizes the current economic conditions across the Fed’s 12 districts. This morning we get the Retail Sales Report for December along with Industrial Production & Capacity Utilization as well as Import & Export Prices. Tomorrow we get Housing Starts and Building Permits along with the Philly Fed and Friday we finish the week with Consumer Sentiment so we should have good idea of what’s going on by then!

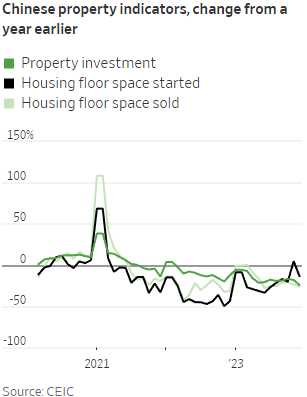

We already got bad news out of China where GDP “only” grew 5.2% in Q4 and that’s not very good coming off a severe lock-down. Forecasts for China’s growth rate this year among several global investment banks range even lower – from 4% to 4.9% as the country is shying away from more stimulus as their debt levels are starting to match ours.

As noted by the WSJ: Economists are concerned that China may be falling into a vicious cycle in which falling prices and weak demand reinforce one another, as they did in Japan in the 1990s. Chinese policymakers’ reluctance to stimulate more forcefully has confounded many economists, though others have pointed to leader Xi Jinping’s ideologically-rooted reluctance to shower the economy with government money.

As noted by the WSJ: Economists are concerned that China may be falling into a vicious cycle in which falling prices and weak demand reinforce one another, as they did in Japan in the 1990s. Chinese policymakers’ reluctance to stimulate more forcefully has confounded many economists, though others have pointed to leader Xi Jinping’s ideologically-rooted reluctance to shower the economy with government money.

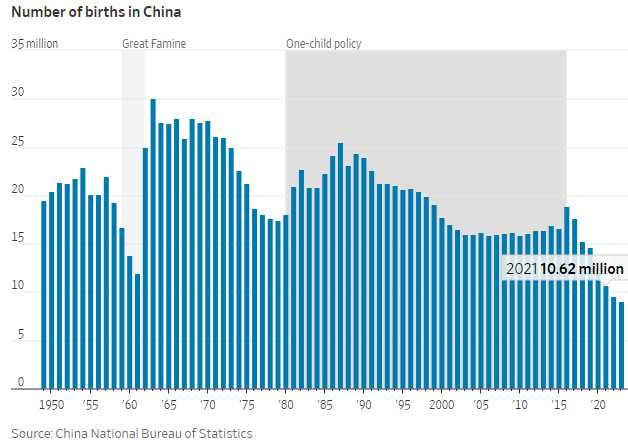

China’s downturn is largely attributed to a persistent property-market meltdown, which has considerably offset the benefits of a post-pandemic recovery. Meanwhile, China’s demographic challenges are intensifying. The country ended 2023 with a population of 1.41Bn – a DECREASE of 2 million from the previous year. This decline is driven by a significant drop in births, with more than 500,000 fewer births last year, bringing the total to just over 9 million. The fertility rate in China is now close to 1.0, a level considered ‘ultralow’ by demographers. This demographic shift could have far-reaching implications for China’s labor market and long-term economic prospects.

Developments in China could have ripple effects across global markets, influencing everything from commodity prices to supply chain dynamics. As we await more data from the U.S. it’s crucial to keep an eye on how these global factors might interact with our domestic economic conditions.

Meanwhile, expectations of stimulus in the form of lower interest rates is all we have in the US and, no matter what the Fed says, the Financial Media is spinning it to rate cuts – soon! The pattern seems to be that the Fed speaks and that sends the markets down for a few hours but then someone goes on CNBC or Bloomberg or Fox and says “don’t listen to them” and the market springs back into action.

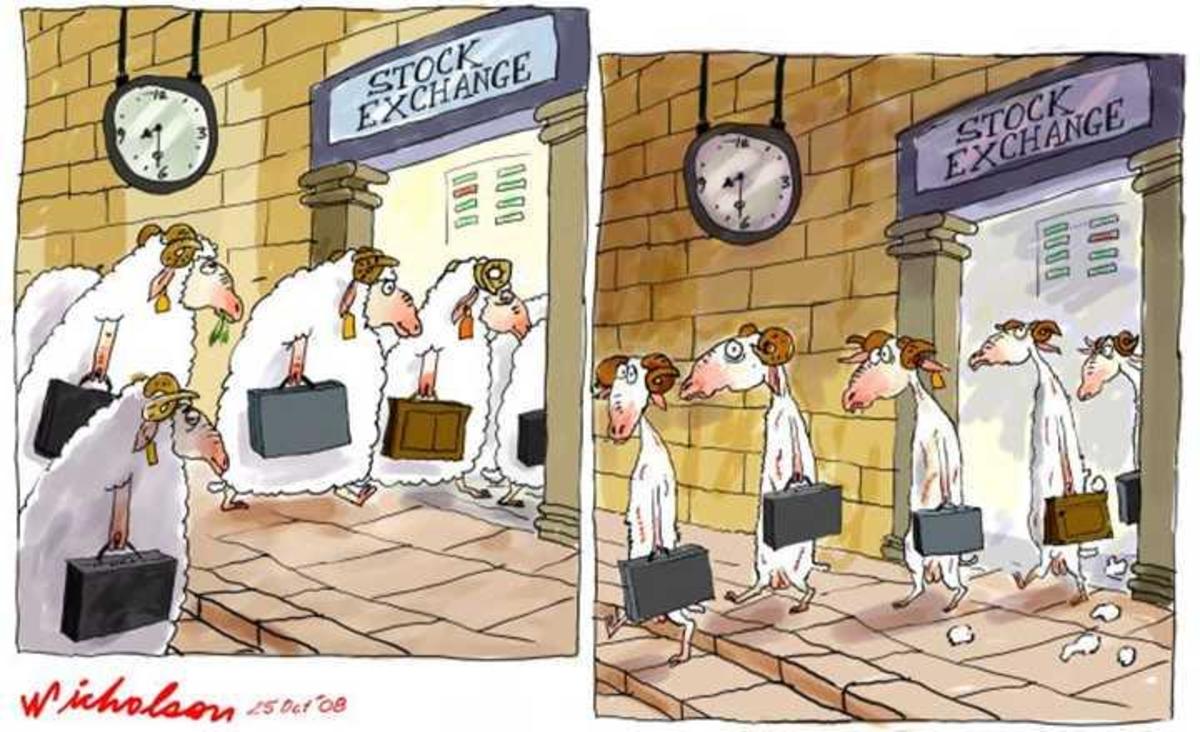

Of course a lot more volume goes to the downside as the big boys exit and dump their shares on the retail suckers the MSM pulls in – but isn’t that always the case?

A combination of a healthy Labor Market with rising Wages is giving the sheeple plenty of wool to be fleeced and Retail Sales are expected to be up 0.5% in December, following through on November’s 0.3% gain. While that does sound exciting, you need to put in perspective how sucky (a valid economic term!) that is as Retail Sales growth has been on a downhill slope since 2021:

A combination of a healthy Labor Market with rising Wages is giving the sheeple plenty of wool to be fleeced and Retail Sales are expected to be up 0.5% in December, following through on November’s 0.3% gain. While that does sound exciting, you need to put in perspective how sucky (a valid economic term!) that is as Retail Sales growth has been on a downhill slope since 2021:

Of course, celebrating mediocrity is all we have in the markets so don’t take this away from us, right? One big positive for Consumers in December were price drops in a number of categories associated with gift-giving. Although overall inflation heated up in December, the prices of products including appliances, footwear, sporting goods and toys all declined from the prior month, according to the Labor Department’s Consumer-Price Index. The retail sales data is adjusted for seasonality to allow for month-to-month comparisons, but not for inflation.

In the bigger picture in the US, $2,200,000,000,000 (about half) of Commercial Real Estate Debt is maturing over the next 4 years and almost all of it was written when the Fed Funds Rates were below 1%. Now 5.25% – having to refinance loans at higher rates can be devastating for offices, hotels, apartments and other building owners across the country. How many times is “lost our lease” the reason your favorite restaurants and retailers shut down after many successful years?

In the bigger picture in the US, $2,200,000,000,000 (about half) of Commercial Real Estate Debt is maturing over the next 4 years and almost all of it was written when the Fed Funds Rates were below 1%. Now 5.25% – having to refinance loans at higher rates can be devastating for offices, hotels, apartments and other building owners across the country. How many times is “lost our lease” the reason your favorite restaurants and retailers shut down after many successful years?