I don’t get it.

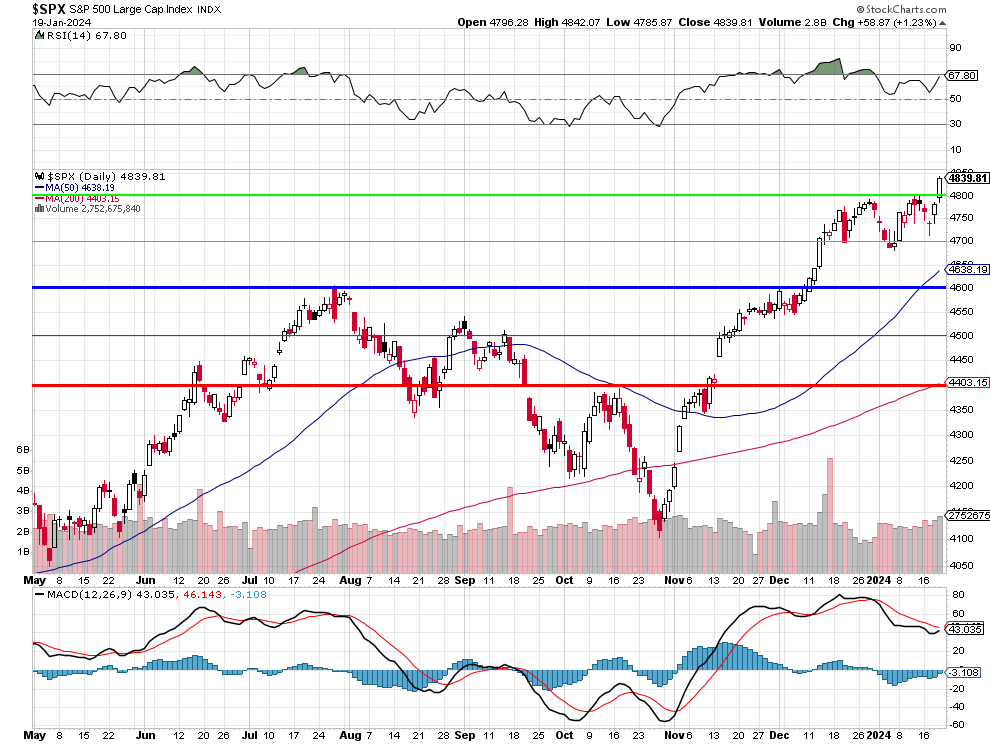

The S&P is rocketing up to test 4,900 this morning – may as well make it 5,000 since numbers seem meaningless. Tomorrow we’ll get a report of Leading Economic Indicators that is likely to show continued contraction. Leading Economic Indicators (LEIs) are key predictive metrics that help forecast future economic activity. They include a range of data points like unemployment claims, manufacturing orders, stock market returns, consumer expectations, and more. These indicators are used to gauge the health of the economy and predict its direction in the short to medium term.

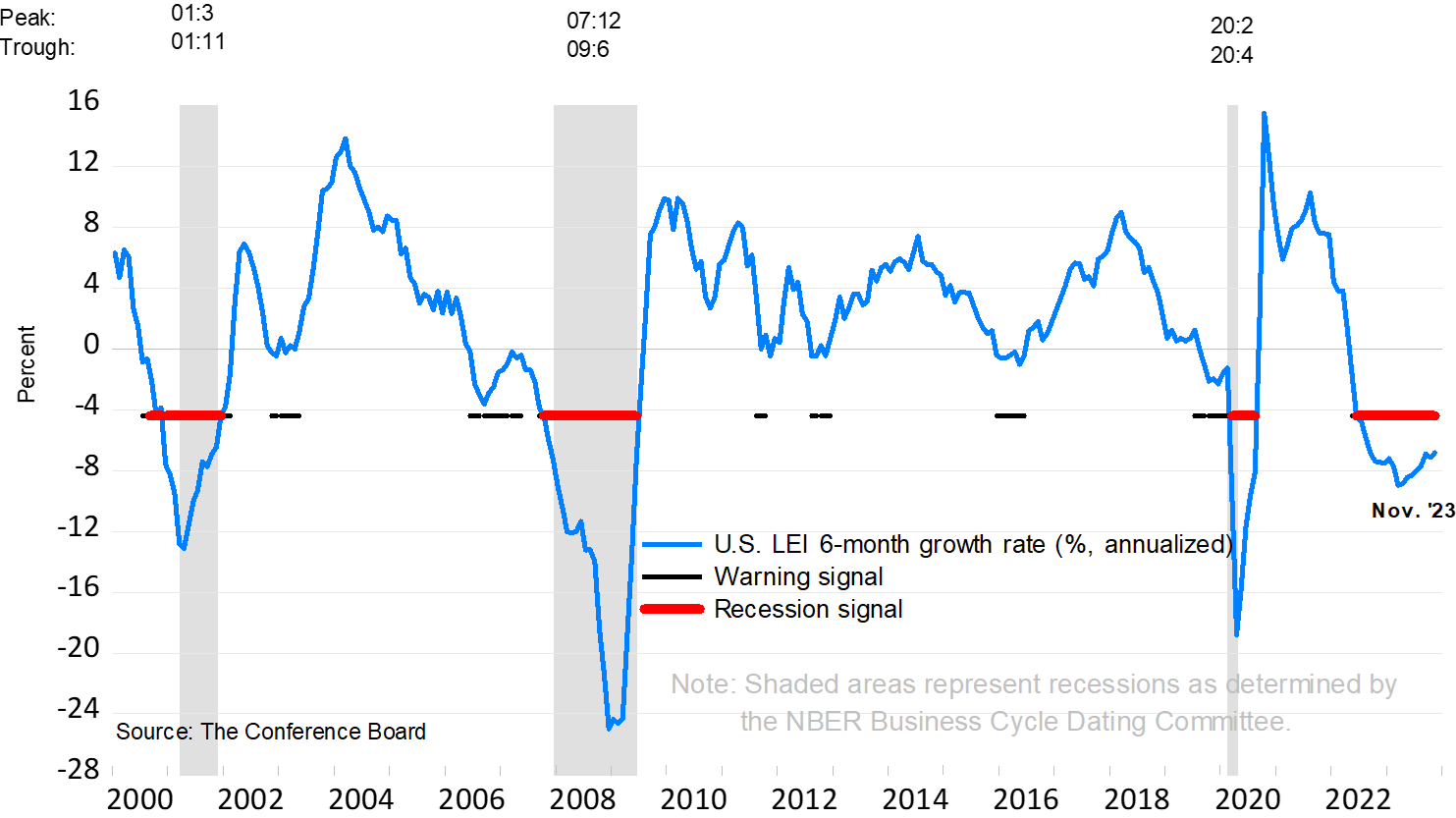

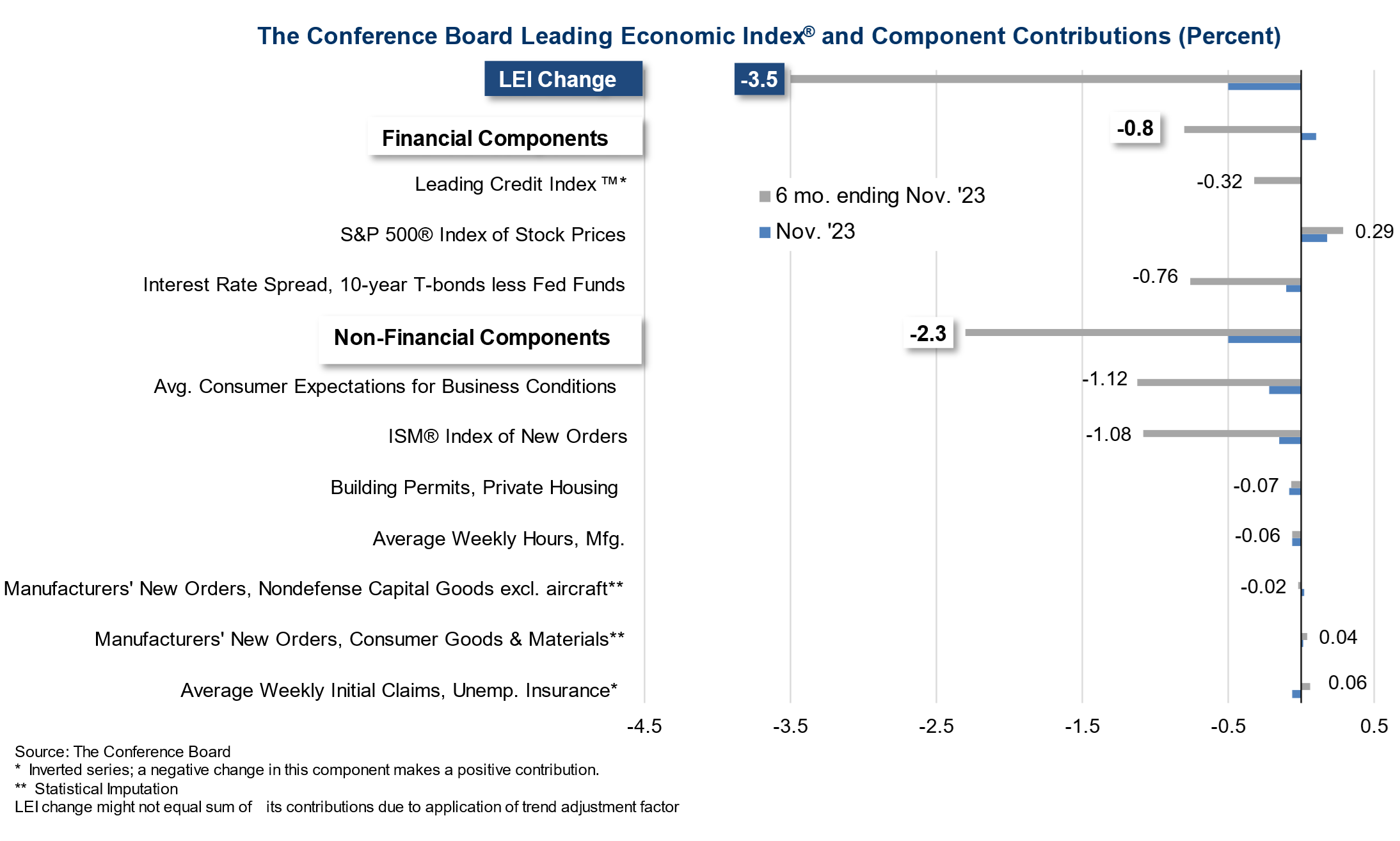

According to The Conference Board, the LEI for the U.S. fell by 0.5% in November, marking a continued decline following a downwardly revised drop of 1.0% in October. This trend suggests a contraction over the last six months, albeit at a slower pace than the previous half-year period. Despite this, the only silver lining in November’s LEI was the stock prices, which ironically is what we’re seeing with the S&P’s inexplicable rise.

The forecast isn’t particularly rosy either. The Conference Board is predicting a short and shallow recession in the first half of 2024. This forecast, based on the LEI’s trajectory, indicates an upcoming downshift in economic activity. It’s like watching a slow-motion replay of an impending fumble – you know it’s coming, but you can’t look away.

So, what does all this mean for us as investors? It’s a classic case of the market getting ahead of itself, driven perhaps by short-term sentiments rather than grounded economic realities. The S&P’s surge, in contrast to the LEI’s decline, is a stark reminder of the disconnect that can sometimes occur between the stock market and the broader Economy.

The confirmation of LEI will come on Thursday, when we get our first look at Q4 GDP and guess what? It’s supposed to be much worse than 2022’s Q4, which was up 2.6% – more like 1.7% is expected and that would be the worst quarter since Q1 of 2021. Since inflation is running at 3.4%, 1.7% is actually a Recession but shhhhhhh…. if we don’t talk about it – it might go away…

The confirmation of LEI will come on Thursday, when we get our first look at Q4 GDP and guess what? It’s supposed to be much worse than 2022’s Q4, which was up 2.6% – more like 1.7% is expected and that would be the worst quarter since Q1 of 2021. Since inflation is running at 3.4%, 1.7% is actually a Recession but shhhhhhh…. if we don’t talk about it – it might go away…

Another thing we don’t talk about is the creative financing going on in the CRE world – which is making things LOOK healthier than they actually are. Faking it ’till they made it last year was SL Green (SLG), who popped on the news in June that they sold 49.9% of a Park Avenue building for $2Bn to Japanese investors, which popped their stock 20% and popped the whole sector and led to a recovery in the CRO sector.

BUT, $500M worth of the building’s debt was sold to the buyer at a 6% discount and SLG did not disclose those details in their Earnings Report or on the Earnings Call or on any Press Releases – it was dug up by the NY Times only this weekend.

Office landlords increasingly rely on cash gifts, veiled discounts and other financial engineering to prop up property values as the sector faces its deepest crisis in decades. While the maneuvers are legal and often make business sense, they raise questions from analysts over whether publicly available property valuations are inflated.

Other types of financial engineering proliferate. Landlords increasingly hand out cash or no-rent periods to tenants in return for higher rent. In a recent report, real-estate brokerage CBRE found that free-rent periods on leases at high-end office buildings in a dozen major U.S. cities averaged 10.1 months in 2023, up from 6.8 months in 2019.

Cash payments to tenants for construction work on their offices increased by 37% during the period. That helped high-end office rents rise slightly in 2023, but the number is misleading. Real, so-called net-effective rents that account for concessions fell slightly. “You want to protect the face rents,” said Alan Pontius, national director of the office and industrial divisions at brokerage Marcus & Millichap.

Cash payments to tenants for construction work on their offices increased by 37% during the period. That helped high-end office rents rise slightly in 2023, but the number is misleading. Real, so-called net-effective rents that account for concessions fell slightly. “You want to protect the face rents,” said Alan Pontius, national director of the office and industrial divisions at brokerage Marcus & Millichap.

Another SLG sale of $632.5M went off because SLG made a $234.5M preferred equity investment in the building they just sold – yet they book it as a $632.5M sale, not a 37% less net $398M sale. This is simply “sell financing” which is being used to make losers look like winners in the CRE space and it’s one thing when private companies like Trump do it but it’s NOT the same thing when public companies do it as the net effect is manipulating their stock prices by misreporting profits.

“Net-effective rents were flat 2010 to 2019, yet values went through the roof due to a significant increase in concession offerings,” said David Lipson, chief executive of brokerage Savills North America. Inflated values based on misreported earnings – sounds like the entire market to me!

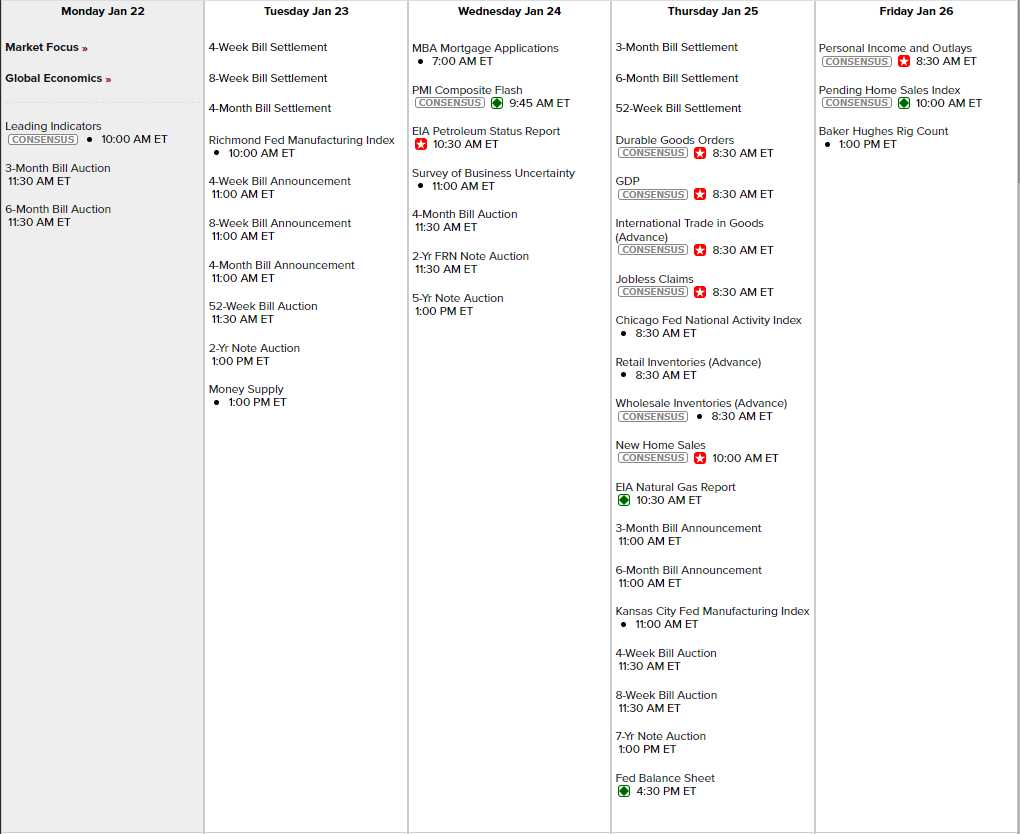

Anyway, I’m very excited about this weeks bullshit and we’ll be getting the Richmond Fed tomorrow along with the 2-Year Note Auction and Wednesday is PMI, Business Uncertainty and the 5-Year Auction and Thursday is Durable Goods, GDP, Chicago Fed, New Home Sales and the 7-Year Auction followed by Personal Income and Outlays on Friday:

What we don’t have is Fed Speak as we’ve entered the STFU period ahead of their Feb 1st meeting. That is both fine AND dandy as it allows us to focus on a busy, busy week of earnings, with over 25% of the S&P 500 reporting this week.

We will be paying a lot of attention to CRE stocks but, if we can’t trust them to fully disclose their sales contracts – then how can we trust the numbers?