Yes, we need to talk about China again.

Yes, we need to talk about China again.

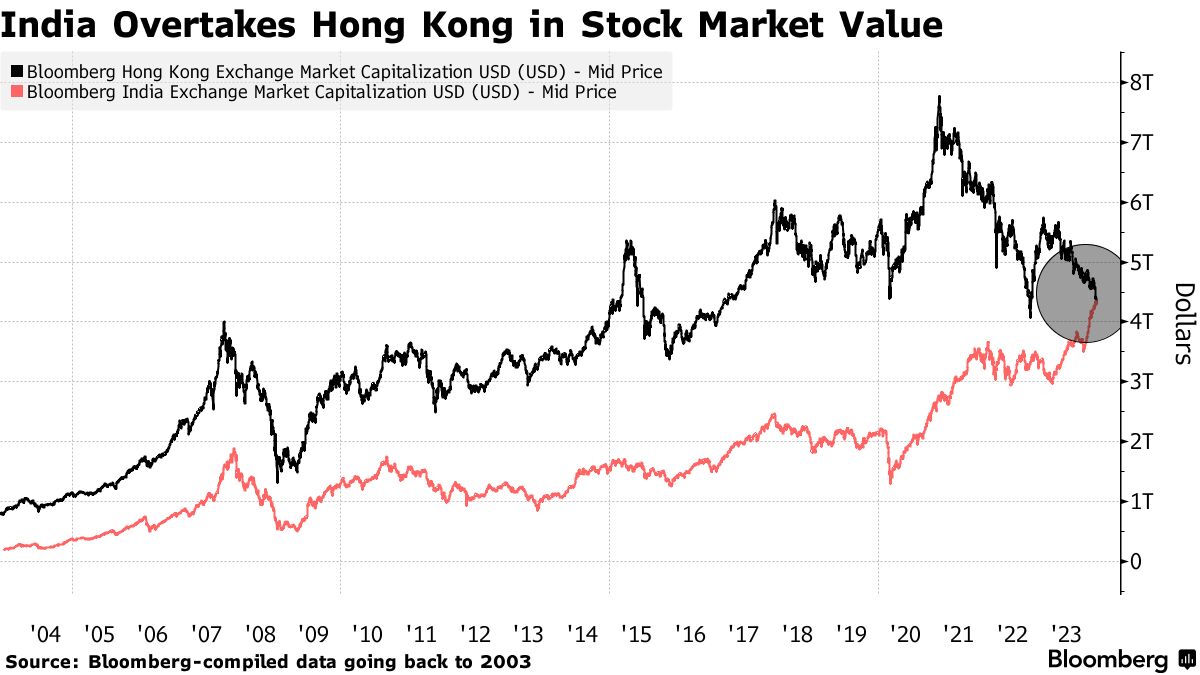

India just passed China as the World’s largest stock market and that’s because India is rising as it is China is falling – with the Hong Kong Exchange falling over 40% since 2021 while India’s Exchange has popped 50% during the same period. Equities in India have been booming, thanks to a rapidly growing retail investor base and strong corporate earnings. The world’s most populous country has positioned itself as an alternative to China, attracting fresh capital from global investors and companies alike, thanks to its stable political setup and a consumption-driven economy that remains among the fastest-growing of major nations.

Foreigners who until recently were enamored with the China narrative are sending their funds over to its South Asian rival. Global pension and sovereign wealth managers are also seen favoring India, according to a recent study by London-based think-tank Official Monetary and Financial Institutions Forum.

Asia Genesis Asset Management, a Singapore hedge fund, is closing its macro fund after suffering unprecedented losses due to incorrect bets on Chinese and Japanese stocks. The fund faced an 18.8% decline in early January, primarily due to long positions in Hong Kong and China equities and short positions in Nikkei.

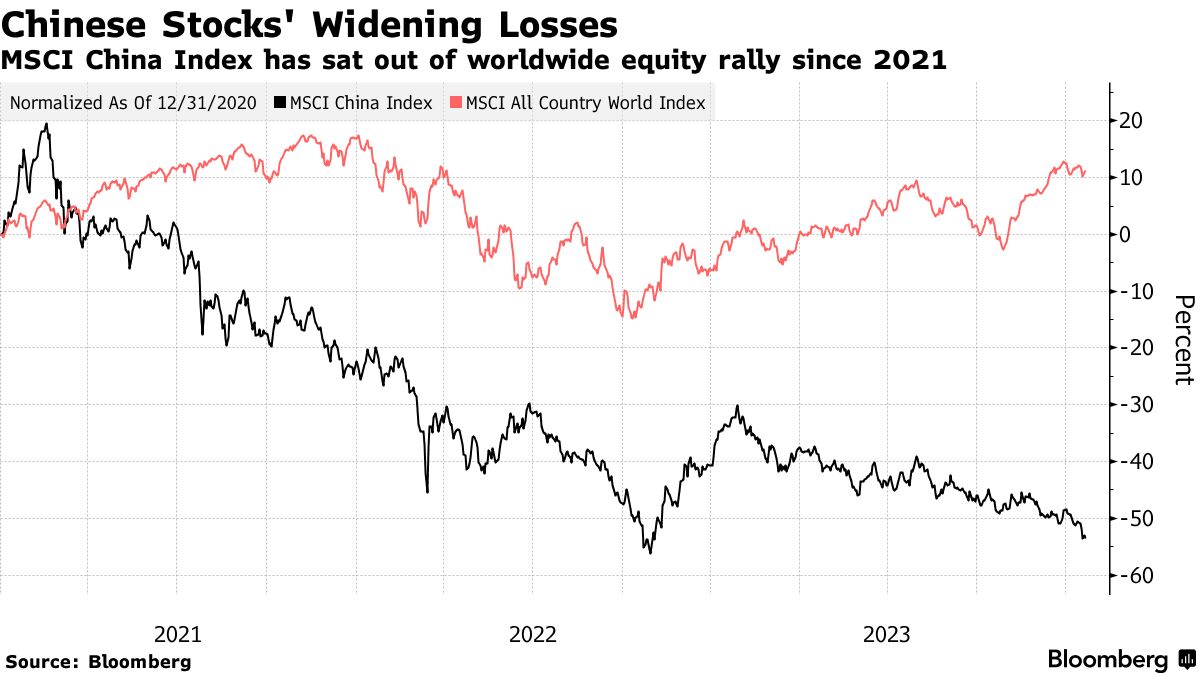

As Chinese stocks continue to tumble, the country’s largest state-owned stockbroker, Citic Securities, is suspending short selling for some clients in mainland markets. This move follows other market interventions, including state buying of bank shares, which have not successfully halted the market decline. All in all, over $6 TRILLION has been wiped off the market value of Chinese and Hong Kong stocks since 2021. Banning short selling has proven to be an abject failure in past crises.

With all this going on, China’s share in the MSCI Emerging Markets Index has fallen to a record low, now accounting for around 23.77%, the lowest since 2017. This decline reflects a bearish outlook for China’s economy, diverging from other emerging markets. The drop in weight is significant, considering China’s dominant position in the index just a few years ago (38.5%).

China’s loss in index weights is being compensated with gains in other major emerging markets. India has increased its share to a record 16.7% of the MSCI Index, more than double the 7.7% weight it had in March 2020. Taiwan, at 16%, South Korea, at 12.9%, Brazil, at 5.8%, and Saudi Arabia, at 4.2%, all increased their weightings last month. Any rebound is likely to be tactical, with little to arrest a long-term decline, according to Julius Baer’s Dinic as India SHOULD now be weighted higher than China – and that’s still a long way to go.

The significant drop in China’s weight in the MSCI Emerging Markets Index signals a loss of investor confidence and a shift in the global economic landscape. Efforts to curb short selling reflect the government’s attempts to stabilize the market, but these measures have yet to prove effective. The closure of Genesis Asset Management’s fund due to losses on Chinese stocks underscores the high-risk environment for investors in the region and other funds may seek to get out before they can’t. Even US companies who simply have a high exposure to Chinese sales are starting to feel the pain:

While China’s market problems have been primarily localized so far, there’s a growing concern about their potential to go global. The interconnectivity of today’s financial markets means that significant shifts in a major economy like China can have far-reaching effects, influencing everything from commodity prices to global supply chains.

One of the critical concerns is the risk of contagion. If China’s market woes escalate, they could trigger a domino effect, impacting emerging markets and even developed economies. This scenario requires investors to be even more vigilant and adaptive in their strategies and we will be keeping a close eye on the situation as it develops in 2024!

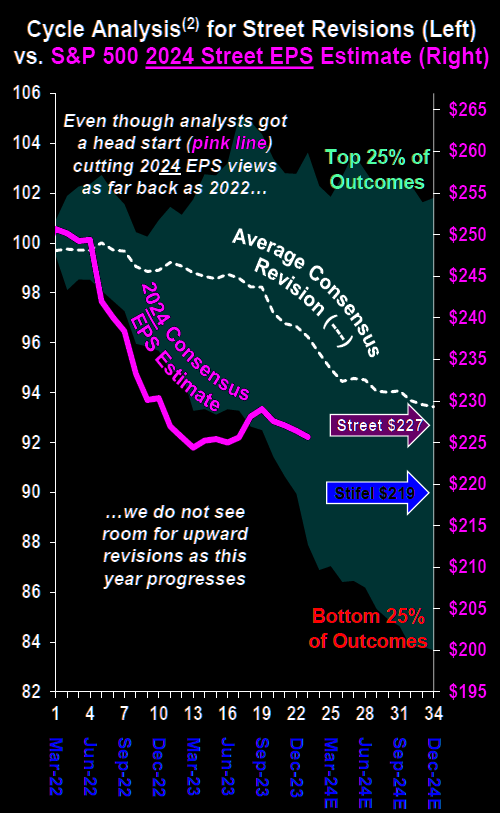

At the moment, money coming out of the Chinese markets is going to India and the US but, overall, the projections for S&P 500’s 2024 earnings are coming down – even while the index is going up and up. Last March, with the S&P at 4,000 the components were expected to earn $250/share, which would imply a p/e of 16 going forward. Now that we’re actually in 2024, the expectations are for $225 share while the SPX is at 4,850 – implying a forward p/e of 21.55.

At the moment, money coming out of the Chinese markets is going to India and the US but, overall, the projections for S&P 500’s 2024 earnings are coming down – even while the index is going up and up. Last March, with the S&P at 4,000 the components were expected to earn $250/share, which would imply a p/e of 16 going forward. Now that we’re actually in 2024, the expectations are for $225 share while the SPX is at 4,850 – implying a forward p/e of 21.55.

Essentially that means we’re now paying 35% more for the S&P than we were last year – even as earnings estimates are trending down (and, so far, the Q4 non-Bank reports have not changed that trend).

As I noted to our Members yesterday, despite how well our long portfolios are doing I am certainly still going to maintain our hedges – just in case…