Animal Spirits: New All-Time Highs

Today’s Animal Spirits is brought to you by YCharts. See here to get 20% off your initial YCharts subscription for new customers.

On today’s show, we discuss:

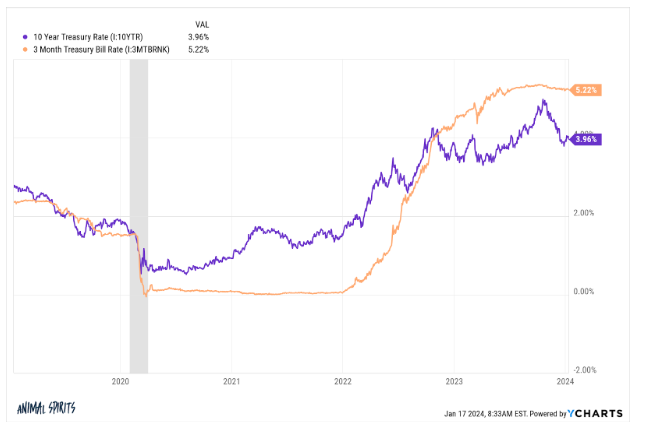

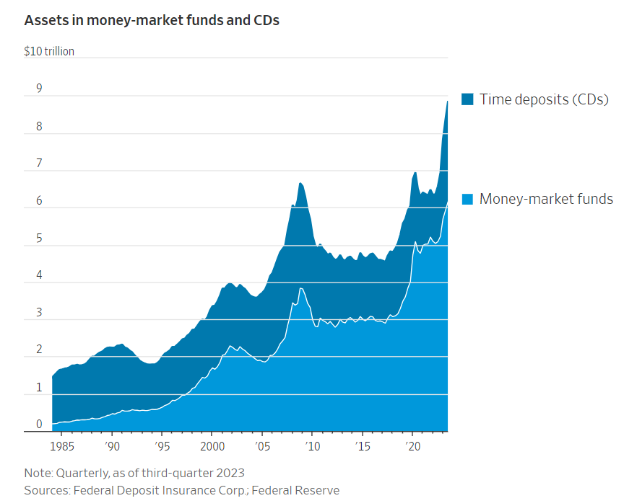

- The $8.8T cash pile that has stock market bulls salivating

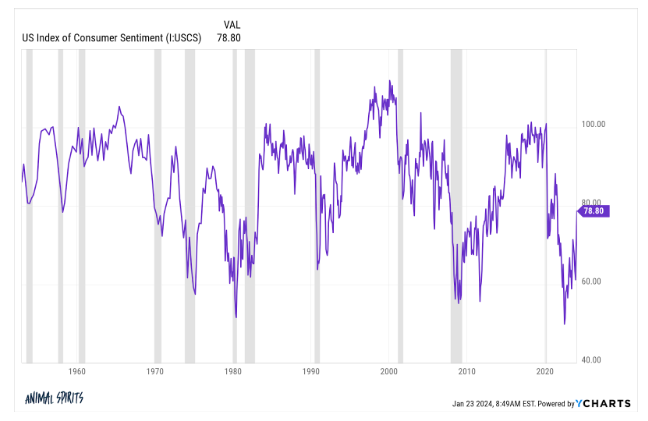

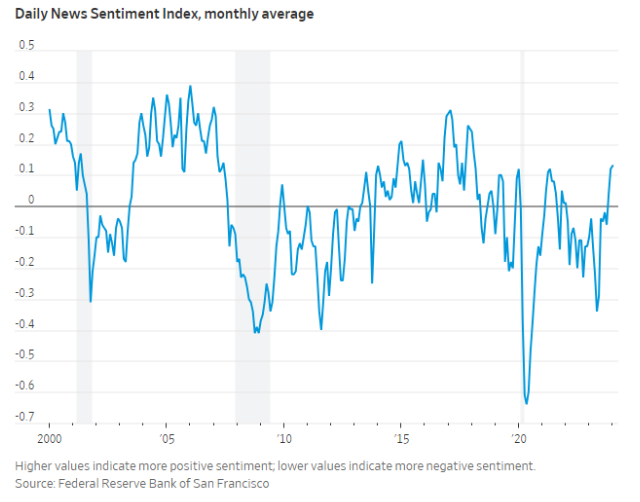

- Americans are suddenly a lot more upbeat about the economy

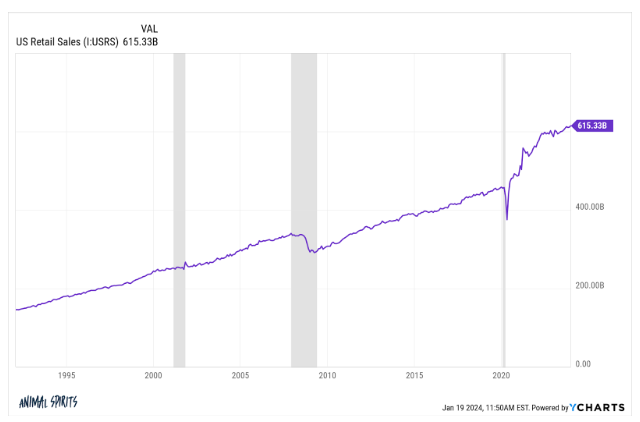

- The US seems to be dodging a recession. What could go wrong?

- More workers want to change jobs, but the market is getting tougher

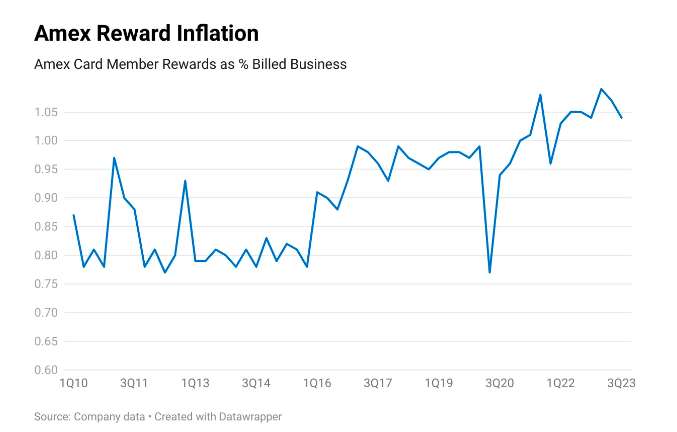

- Inside the business of air miles

- How big can Bitcoin get?

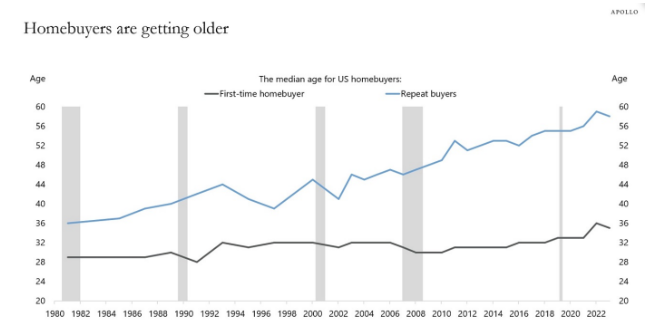

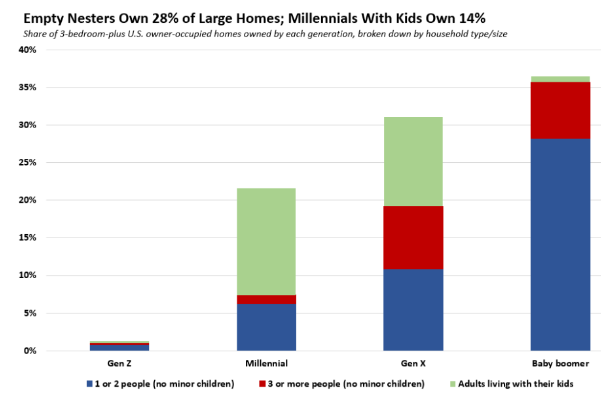

- Empty nesters own twice as many large homes as Millenials with kids

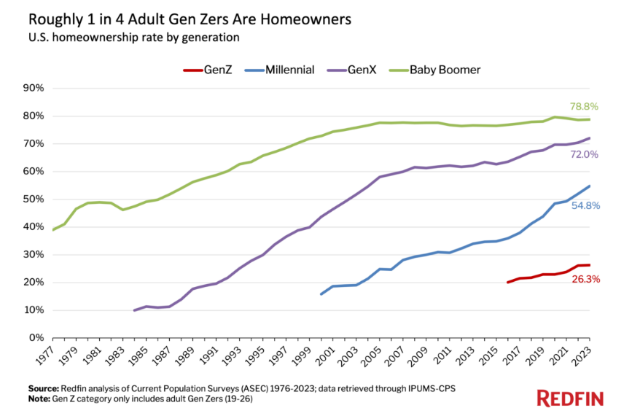

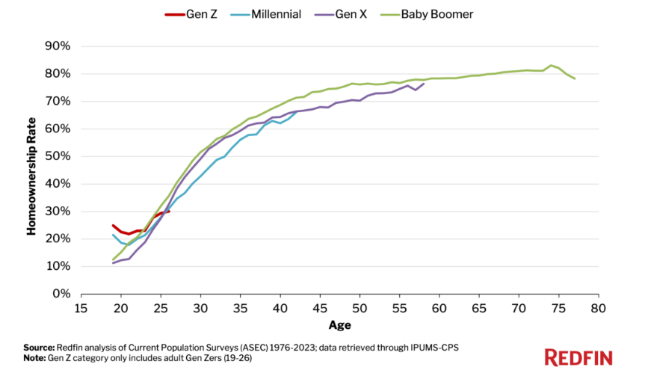

- Gen Z’s homeownership rate stagnated in 2023, but Millenials and Gen Xers saw gains

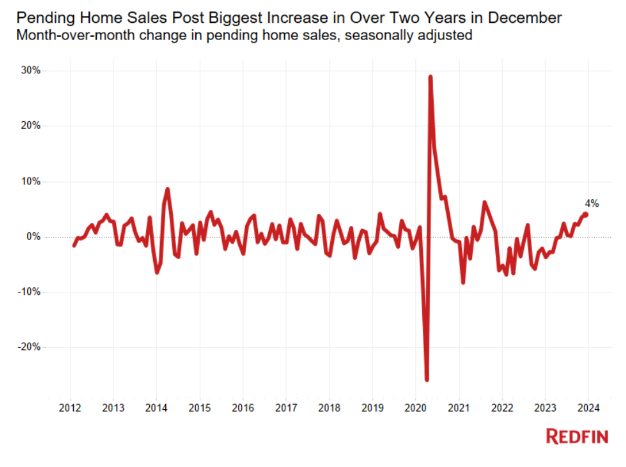

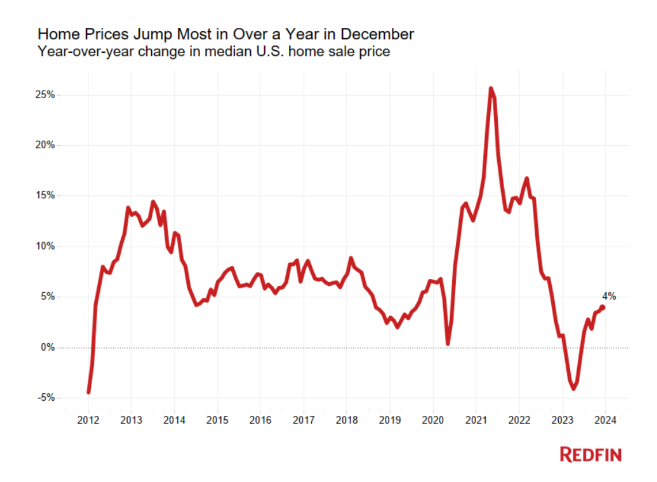

- Pending home sales rose 4% in December – biggest jump in over two years

- Blackstone doubles down on the US housing market with acquisition of Tricon and its nearly 40,000 homes

- Upbeat America

- Wells Fargo reflect card review: A best-in-class 0% APR promotion

- Your new $3,000 couch might be garbage in three years. This is why.

- Netflix, WWE strike deal to move Monday Night Raw to streamer in 2025 for $500M per year

Listen here:

Recommendations:

- Slow Horses

- Friday Night Lights on the Stick the Landing Podcast

- Killers of the Flower Moon

- Burning

- The Creator

Charts:

Tweets:

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

- Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

- Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.