Yesterday, we talked about China’s Evergrande being liquidated with $300Bn in debts.

Today we’re going to turn our attention back home as rents at the highest-end buildings have been falling, while the rate of leasing has been slowing. Tenants have become more sensitive to costs in a world of higher interest rates and lingering concerns about a possible economic slowdown, market participants say.

As we step into 2024, a stark reality is unfolding in the American real estate landscape, particularly in the realm of premier office towers. The downturn that began as a ripple in the wake of the pandemic is now swelling into a wave of challenges that threatens to reshape the sector fundamentally.

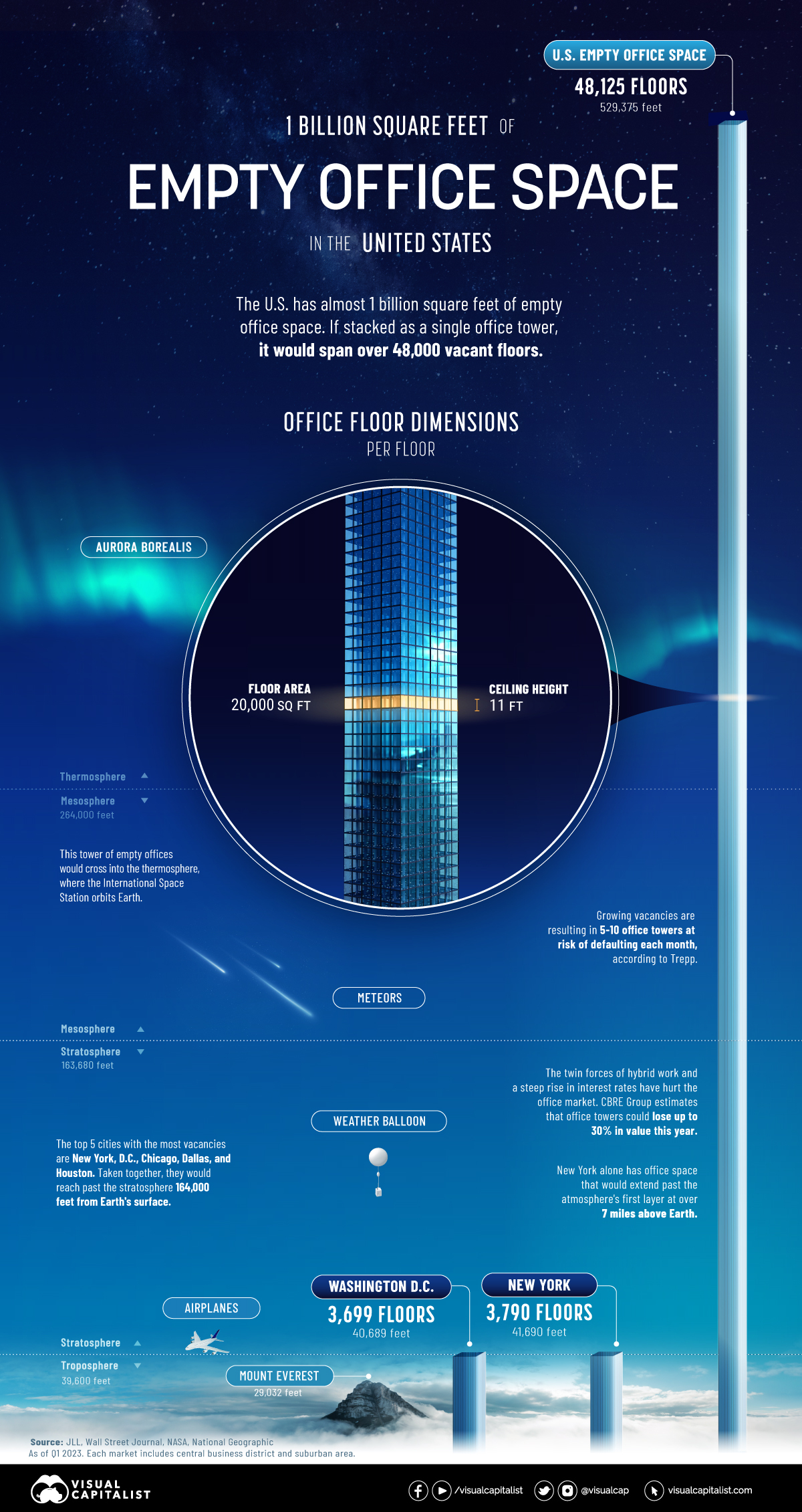

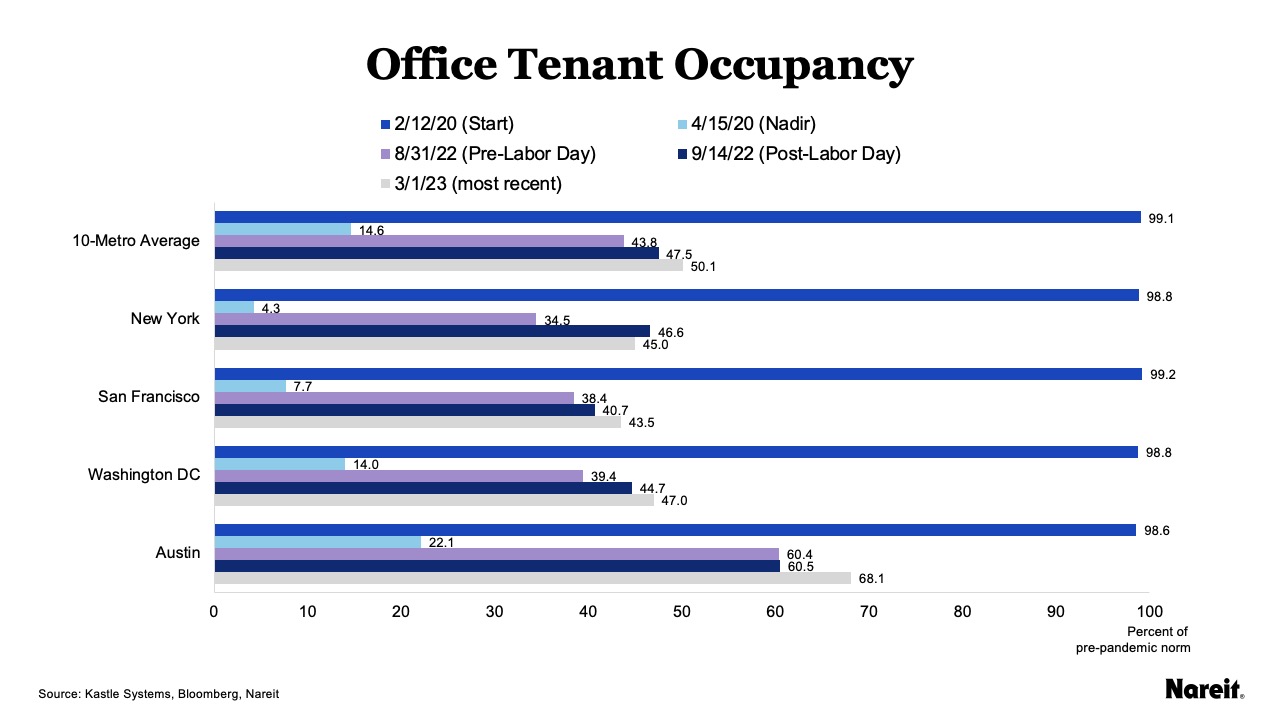

The crux of the problem lies in the seismic shift in work culture. Post-COVID, the adoption of remote work has left many office buildings, purchased at peak prices, grappling with significantly reduced occupancy. Current occupancy levels hover around 75-80%, but the space utilization is even lower, with companies using only about half of their leased areas. This trend is not a temporary blip; it’s a transformative shift that’s here to stay and it’s causing a domino effect that threatens to topple the CRE sector:

-

Rental Revisions and Concessions: As leases come up for renewal, tenants are either seeking smaller spaces or demanding more concessions. This puts landlords in a tight spot, having to choose between reduced revenue or potentially vacant spaces.

-

Rising Interest Rates: The Federal Reserve’s aggressive stance, with rates now at 5.25%, is another blow. Landlords facing debt rollovers or those with adjustable-rate mortgages are feeling the squeeze. The cost of financing is skyrocketing at a time when revenue streams are dwindling.

-

Escalating Operational Costs: The expenses associated with maintaining these architectural behemoths are on the rise. From utilities to maintenance, the cost burden is intensifying, further eroding the profitability of these properties.

The situation eerily mirrors the crisis unfolding in China, where over-leveraged builders are succumbing to financial pressures, leaving banks burdened with Billions in debts and unrealized losses. The U.S. Office Real Estate Market, while different in many respects, is showing early signs of similar strains.

This confluence of reduced occupancy, rising interest rates, and escalating costs is creating a perfect storm. Landlords and investors need to brace for a challenging period ahead. Creative solutions, such as repurposing office spaces or restructuring financial models, may be necessary to navigate these turbulent waters but they take a lot of time and money to implement – and neither of those things are in ample supply at the moment.

Current rents don’t pencil out for building expensive spaces. The U.S. had only 31 Million square feet in office construction starts last year, the lowest level since 2010. New buildings will represent only 1% of inventory by 2027, the lowest in at least 25 years, according to CoStar. Asking rents for prime space in 16 U.S. markets declined in the third quarter after increasing on average from about $61 a square foot in mid-2021 to close to about $70 in the second quarter of last year, according to CBRE Econometric Advisors. They were just under $69 in the fourth quarter, CBRE said.

Office building valuations are projected to fall 30%, according to Richard Barkham, global chief economist at CBRE Group. A sharp decline in property values could potentially result in steep losses for banks. This is especially true for small and regional banks that make up the majority of U.S. office loans. Big banks cover roughly 20% of office and downtown retail totals. Buildings in bad locations or without amenities for office workers could see value declines of up to 80%, he said.

“Even if the current rates stay where they are now, new lending rates are likely to be 3.5 to 4.5 percentage points higher than they are for many of CRE’s existing mortgages,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, wrote in an early April report. “Distress of this type has historically not only hurt the landlords and the bankers who lend to them, but also the interconnected business communities, private capital funders and owners of any underlying securitized debt.”

St. Louis Fed President James Bullard recently said the shakeout in the commercial building market would be “very slow-moving” and would “ripple through the economy.” Since early 2020, when pandemic lockdowns began, the amount of empty office space in the U.S. has ballooned by 242.7 Million square feet – or roughly the equivalent of all the office space in the Chicago metropolitan area, according to CBRE data.