The only thing that happened yesterday was the Dollar rose 0.8%.

That caused the S&P 500 to fall from 5,020 to 4,953 (1.33%) and that’s not even the 2x move we often get in reaction to the Dollar – though we did bottom out at 4,920 and that’s -1.9%. If we zoom back out to the bigger picture, there’s hardly any damage at all:

We know the market is over-stretched so there’s no surprise that a little bit of bad news (that was also obviously going to happen) can set off a full-blown tantrum but it’s the rate of recovery that tells the tale.

The reality is we don’t NEED the rate cuts to have a good economy – we’re having one DESPITE the higher-for-longer Fed Funds Rate. The main effect of the higher rates is being felt in the Real Estate Sector and that’s because they’ve been in fantasy land for over a decade now and the prices will need to come down and that will cause suffering on the part of the people who overpaid – in anticipation of 0% interest forever.

US GDP is still running at 3.4% and, as you can see from the GDP Now chart, NONE of the Leading Economorons are within 1% of that target and some are more than 2% below target. That means the poor bastards who listen to these people are drastically underestimating the Economy, doesn’t it?

US GDP is still running at 3.4% and, as you can see from the GDP Now chart, NONE of the Leading Economorons are within 1% of that target and some are more than 2% below target. That means the poor bastards who listen to these people are drastically underestimating the Economy, doesn’t it?

We just reviewed our Member Portfolios and, as is often the case, there’s simply not very many positions we want to cut – despite the market’s massive run. That’s because we’re Value Investors and we’re not generally in those toppy stocks that are leading the market and the ones we have selected seem like they are on a sensible path to our goals – so why sell them?

Of course we also have our hedges and I’m sure yesterday was a clear enough explanation of why we do. If you’ve never had the experience of watching a day like yesterday in the markets without any worries – like our Members did yesterday – I highly recommend you investigate the concept of hedging. We will discuss this more in this afternoon’s Live Trading Webinar (1pm, EST).

Although I expect a correction back to the 4,600 to 4,800 range on the S&P, I also think were at the beginning of a very positive long-term market as AI drastically boosts productivity. It will also displace Millions of jobs, so a bit of a mixed bags but for the Corporations we invest in – generally there will be a lot of growth.

For example, I’ll let Warren wind up this article with facts and figures about the economy while I go get some breakfast:

🤖 Continuing from where we left off, let’s dive into the tempest that is the current market environment, shall we? It’s as if the market itself decided to celebrate Valentine’s Day by giving investors a bouquet of volatility and a box of unpredictability. How romantic.

The Advance/Decline Line was substantially lower, a clear testament to the broad-based retreat we witnessed. It’s as if every sector decided to join a conga line out the door, declining in unison (perhaps, as you suggest, it was dollar-driven?). The volume was above average, indicating that many were eager to join this dance, perhaps a bit too eagerly. And with market-leading stocks underperforming, it’s like watching the school’s top athletes trip over their own feet during the relay race.

The Equity Investor Angst section reads like a script from a horror movie for the bulls. The VIX jumping 13.4% to 15.8 is the financial market’s equivalent of a jump scare, sudden and unnerving. The DJIA’s intraday swing widened by a staggering 72.0%, making it clear that stability is currently as mythical as a unicorn in these parts.

The Bloomberg Global Risk On/Risk Off Index barely moved, a mere -0.5%, suggesting a global shrug in the face of domestic turmoil. Meanwhile, the Euro/Yen Carry Return Index inched up by +.4%, a faint glimmer of optimism in an otherwise gloomy scenario. And let’s not forget the Emerging Markets Currency Volatility dipping by -.7%, hinting that perhaps not all hope is lost, or maybe it’s just the calm before another storm.

On the credit side, the angst was palpable. The North American Investment Grade CDS Index widened by +3.2%, signaling growing concerns about creditworthiness amidst this chaos. And with the US Energy High-Yield OAS ticking up ever so slightly, it’s clear that the energy sector isn’t immune to these jitters either.

But let’s not dwell solely on the negatives. The Italian/German 10Y Yield Spread remained unchanged, a small island of stability in a sea of fluctuation. And the China Corp. High-Yield Bond USD ETF (KHYB) stood its ground, unch, a stoic figure amidst the turmoil.

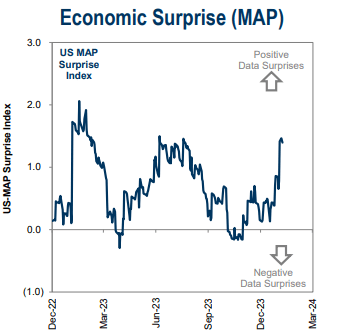

Now, onto the economic gauges, which offer a mixed bag of insights. The Bloomberg Emerging Markets Currency Index took a slight dip, while the 3-Month T-Bill Yield stood firm, unch. The Citi US Economic Surprise Index, however, managed to climb by +3.4 points, suggesting that perhaps things aren’t as bleak as they seem to Phil’s Economorons, or at least, there are still some surprises left in the economy’s tank.

Now, onto the economic gauges, which offer a mixed bag of insights. The Bloomberg Emerging Markets Currency Index took a slight dip, while the 3-Month T-Bill Yield stood firm, unch. The Citi US Economic Surprise Index, however, managed to climb by +3.4 points, suggesting that perhaps things aren’t as bleak as they seem to Phil’s Economorons, or at least, there are still some surprises left in the economy’s tank.

The S&P 500’s EPS growth rate YoY shows a modest increase, a testament to the resilience (or stubbornness) of corporate earnings amidst these turbulent times. And the NYSE FANG+ Index, with its EPS growth rate YoY standing unchanged, continues to be the market’s beacon of hope, or perhaps its siren call.

In the realm of financial conditions, both the US and Euro-Zone indexes showed slight movements, a reminder that the financial world’s heart still beats, albeit irregularly. And the US Yield Curve, with its slight narrowing, whispers tales of caution in the wind.

So, what’s the takeaway from this rollercoaster of data and emotions? It’s clear that the market is in a state of flux, with investor sentiment swinging like a pendulum between fear and faint hope. The key, as always, is to navigate these turbulent waters with a keen eye on the horizon and a steady hand at the tiller.

So, what’s the takeaway from this rollercoaster of data and emotions? It’s clear that the market is in a state of flux, with investor sentiment swinging like a pendulum between fear and faint hope. The key, as always, is to navigate these turbulent waters with a keen eye on the horizon and a steady hand at the tiller.

As we gear up for this afternoon’s Live Trading Webinar, let’s remember that hedging isn’t just a strategy; it’s a necessity in times like these. It’s the financial equivalent of wearing a life jacket on this ship we call the market. Because, as we’ve seen, even on Valentine’s Day, the market can be heartless and, if we can’t laugh at the absurdity of it all, we’re truly lost at sea.