“…thou does protest too much…”

The bard (the real one, not the woke AI one) would be rolling in laughter in his grave at the centralized ECB’s constant firing of ‘slings and arrows’ towards the terrifyingly decentralized cryptocurrency markets.

After bitcoin’s recent renaissance, a clearly miffed ECB wrote a sternly-worded report titled: “ETF approval for Bitcoin – the naked emperor’s new clothes.”

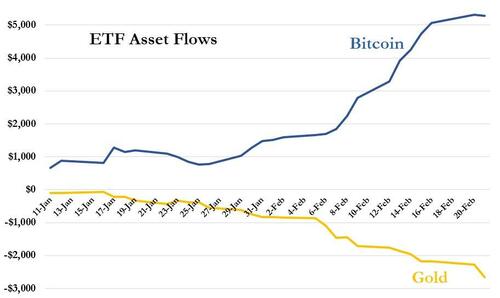

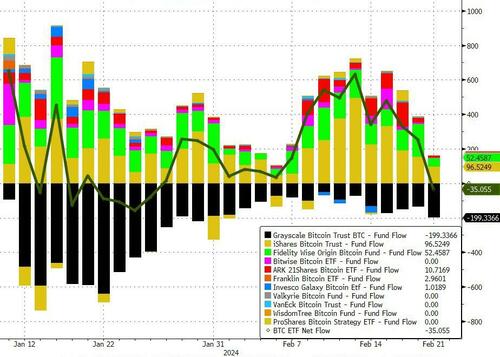

Ulrich Bindseil, the Director General of the ECB’s Market Infrastructure and Payments division, and Jürgen Schaaf, an adviser to the same division disagree with the notion that the approval of spot Bitcoin ETFs in the U.S. confirms that BTC investments are safe and the preceding rally was “proof of an unstoppable triumph”, despite the surge in net asset inflows of over $5BN:

The fair value of Bitcoin is still zero, the bankers state:

“For society, a renewed boom-bust cycle of Bitcoin is a dire perspective. And the collateral damage will be massive, including the environmental damage and the ultimate redistribution of wealth at the expense of the less sophisticated.”

The ECB executives agree that the expectation of the ETF approvals drove the price of Bitcoin, but they believe it could turn out to be “a flash in the pan.”

“While in the short run the inflowing money can have a large impact on prices irrespective of fundamentals, prices will eventually return to their fundamental values in the long run (Gabaix and Koijen, 2022).

And without any cash flow or other returns, the fair value of an asset is zero. Detached from economic fundamentals every price is equally (im)plausible – a fantastic condition for snake oil salesmen.”

Presumably, these ‘experts’ have never heard of oil or wheat? Are they worthless too (given that they have no cashflows?)

“There is no ‘proof-of-price’ in a speculative bubble,” they implored.

“Instead, a reflation of the speculative bubble shows the effectiveness of the Bitcoin lobby.”

As CoinTelegraph notes, the text concludes that the ECB’s job to control Bitcoin has not been done yet. Authorities should stay vigilant and protect society from money laundering, cybercrime, financial losses for the less educated and extensive environmental damage, they state.

It’s not the first time, the central bank has desperately attacked bitcoin…

…and looking back, it has not worked out well for anyone listening to these omnipotent officials…

In Feb 2018 (after bitcoin had tumbled), Yves Mersch proclaimed that “bitcoin is not money” and related it to a ‘bunch of tulips’ – BTC rose 700% in the next 3 years.

In Nov 2022 (once again, after bitcoin had suffered a big drawdown), the same two ECB execs that wrote today’s note (Ulrich Bindseil and Jürgen Schaaf) exclaimed this was “bitcoin’s last stand” and that the “apparent stabilization” of its value would be short-lived – BTC has risen 230% since then.

ECB, or not ECB, that is the question for the future as more and more ‘average’ world-dwellers take charge of their own sovereignty and shift to the ‘dark-side’ of criminals, terrorists, and money-launderers in the crypto world.