Nvidia (NVDA)’s quarterly results and forward-looking guidance have left Wall Street in a state of pleasant shock, marking what many are calling a “game-changing moment” for the company and the broader tech industry.

Nvidia (NVDA)’s quarterly results and forward-looking guidance have left Wall Street in a state of pleasant shock, marking what many are calling a “game-changing moment” for the company and the broader tech industry.

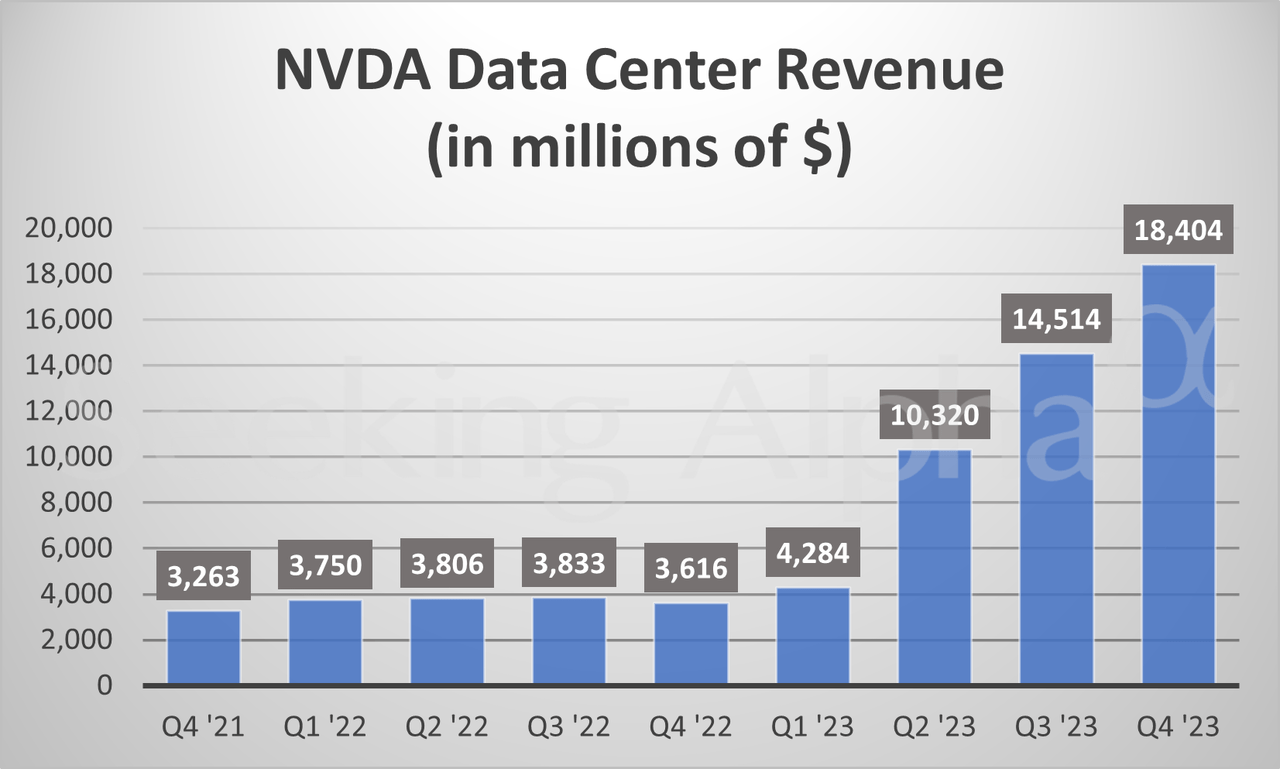

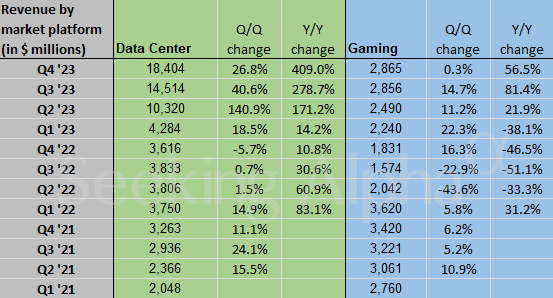

The earnings report not only exceeded analysts’ expectations but also solidified Nvidia’s position as a frontrunner in the rapidly expanding field of Generative Artificial Intelligence. Nvidia’s forecast for Q1 fiscal 2025 revenue is $24Bn, surpassing analysts’ predictions of $21.9Bn. The company anticipates an adjusted gross margin of around 77%, with adjusted operating expenses near $2.5 billion. This performance is a testament to the surging demand for accelerated computing and generative AI across various sectors.

CEO Jensen Huang highlighted the transformative impact of generative AI, describing it as a new paradigm in software creation and computing. NVDA’s shares saw a significant premarket jump of over 14%, which is up $200Bn – the entire market cap of DIS, PEP or MCD! This is, of course, causing a positive ripple effects across the entire semiconductor sector. Analysts from major financial institutions have lauded the company’s performance, with some adjusting their price targets and earnings estimates upwards, reflecting renewed optimism about Nvidia’s future prospects.

CEO Jensen Huang highlighted the transformative impact of generative AI, describing it as a new paradigm in software creation and computing. NVDA’s shares saw a significant premarket jump of over 14%, which is up $200Bn – the entire market cap of DIS, PEP or MCD! This is, of course, causing a positive ripple effects across the entire semiconductor sector. Analysts from major financial institutions have lauded the company’s performance, with some adjusting their price targets and earnings estimates upwards, reflecting renewed optimism about Nvidia’s future prospects.

Yesterday I raised concerns about Nvidia’s lofty valuation, pegged at 390 times its 2023 earnings, and the sustainability of such valuations without continuous, groundbreaking performance. Nvidia’s latest earnings, showcasing a bullish outlook driven by generative AI and exceeding revenue forecasts, temporarily alleviates these concerns by justifying its valuation through strong growth prospects. However, our skepticism remains relevant as we are still dealing with very easy comps and we still have a precarious balance between innovation-led growth and market expectations down the road.

Given Nvidia’s bullish outlook and the analysts’ fervent endorsements, do we stand on the brink of an AI revolution that could redefine industries, or is there still a risk of overestimating AI’s near-term impact? Certainly the surge in Nvidia’s performance, particularly around generative AI, is not just a blip on the radar but a harbinger of the transformative changes AI is poised to bring across industries.

The AI revolution is indeed underway, but it’s a gradual, iterative process. Nvidia’s earnings are an indicator that we’re already moving beyond the hype into tangible, impactful applications of AI technology. The enthusiasm is warranted, given the broad implications for productivity, creativity, and efficiency. However, as with any technological advancement, the trajectory will have its ebbs and flows.

Nvidia’s earnings underscore a broader trend that’s reshaping the economic landscape: the rise of AI as a fundamental driver of innovation and growth. While the path will undoubtedly have its ups and downs, the direction is unmistakably forward. As investors and analysts, our job is to navigate this terrain with a mix of optimism, skepticism, and strategic acumen.

During the Conference Call, CEO Huang said: “We are now at the beginning of a new industry where AI-dedicated data centers process massive raw data to refine it into digital intelligence. Like AC power generation plants of the last industrial revolution, NVIDIA AI supercomputers are essentially AI generation factories of the digital economy,” drawing a parallel between the role of AI supercomputers today and the impact of AC power generation in the past, suggesting the foundational role of NVIDIA’s technology in the emerging digital economy.

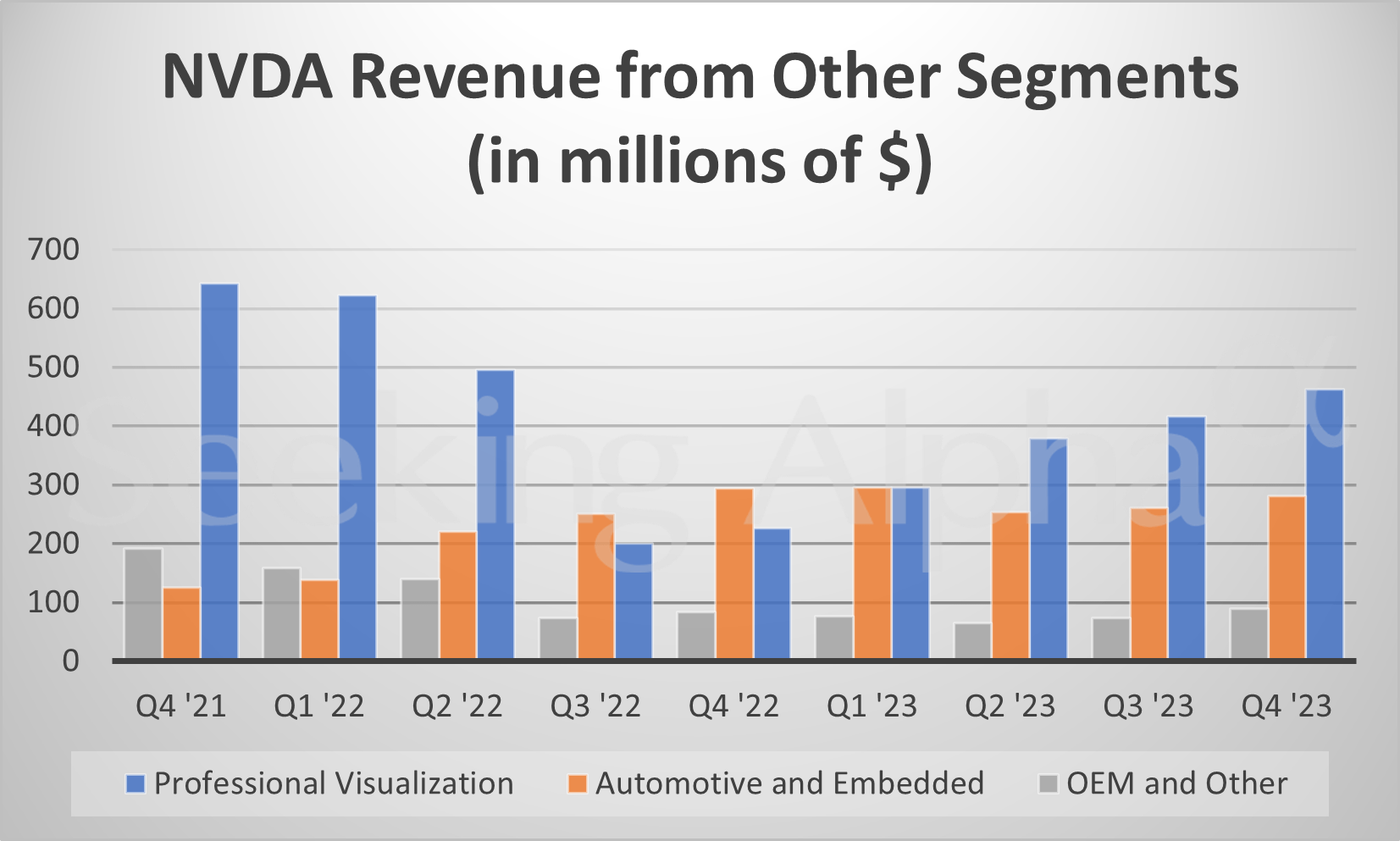

He also said: “We expect NVIDIA’s automotive data center processing demand to grow significantly. In healthcare, digital biology and generative AI are helping to reinvent drug discovery, surgery, medical imaging, and wearable devices,” pointing to the diverse applications of NVIDIA’s technology beyond traditional computing, highlighting significant growth opportunities in the automotive and healthcare sectors.

Still, even with the blowout numbers, NVDA made $5.16 per share and there’s 2.5Bn shares so $12.9Bn (better than 50% margins!) and let’s say they do $90Bn in sales and keep their margins going forward – so $45Bn. That’s STILL 1/41.5 of their now $1.8666Bn valuation!

So, as I said yesterday, let’s enjoy the ride while we can but EVENTUALLY, there WILL be competition in this space and customers won’t pay $50,000 for a $5,000 chip due to scarcity forever – not when their customers are still big enough to buy NVDA if they wanted to – but why pay that kind of money when you can build your own or buy one of their competitors and give them $10,000/chip and still save 80%?

This is not how Capitalism works…