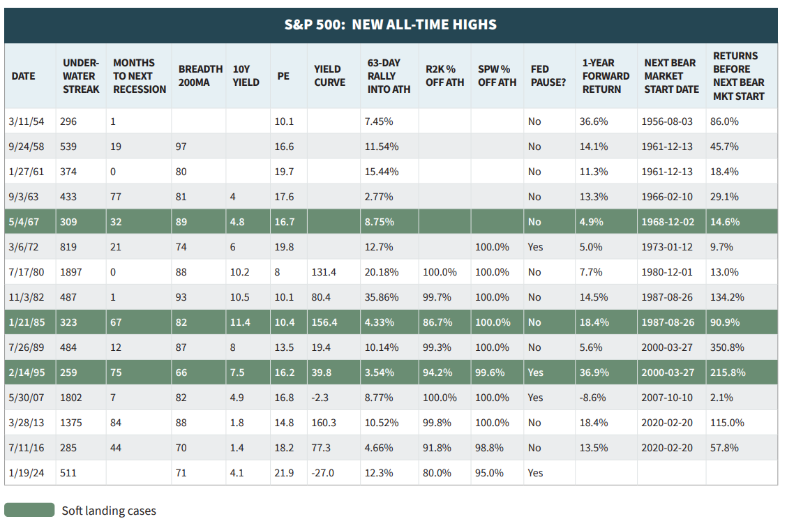

Well, it is for the Magnificent 7 and that's got our indexes (the whole planet except China) at all-time highs but, as I noted on Wednesday, not EVERYTHING is participating in the rally - yet... As you can see from Barry's chart above, all-time highs tend to beget all-time highs - with the notable exception of 2007 BUT, as I have also noted, we may be seeing gains in productivity, thanks to AI, that haven't happened since the 1990s - and that was a very good decade to go long in!

Looking at the data, we can see that even drawdowns following new ATHs tend to be shallower compared to other periods, suggesting that reaching an ATH does not typically precede significant market downturns. This can be attributed to the lack of selling resistance at these levels, as well as behavioral factors like fear of missing out (FOMO) and greed.

Let's also keep in mind that the 2007 exception was due to the fake, Fake, FAKE earnings being reported by the banking sector, which spread to the real estate and mortgage sectors and that caused a bubble in furniture, appliances - even paint. Certainly the exception and not the rule. We do have a bit of a Commercial Real Estate bubble (the one that is taking down China) but that's a very slow-moving disaster (like lava).

30-year mortgages are 7.14% this morning, by the way - pity the poor home-buyers. That would explain why Mortgage Applications were down 10.6% this week. Existing Home Sales, however, LOOK like a Recession at 4M homes (out of 110M) but this is also very different than 2008/9 because it's not so much a lack of demand as it is a lack of supply - because people can't afford to move away from their 3% mortgages.

30-year mortgages are 7.14% this morning, by the way - pity the poor home-buyers. That would explain why Mortgage Applications were down 10.6% this week. Existing Home Sales, however, LOOK like a Recession at 4M homes (out of 110M) but this is also very different than 2008/9 because it's not so much a lack of demand as it is a lack of supply - because people can't afford to move away from their 3% mortgages.