We have another Trillion-Dollar company!

We have another Trillion-Dollar company!

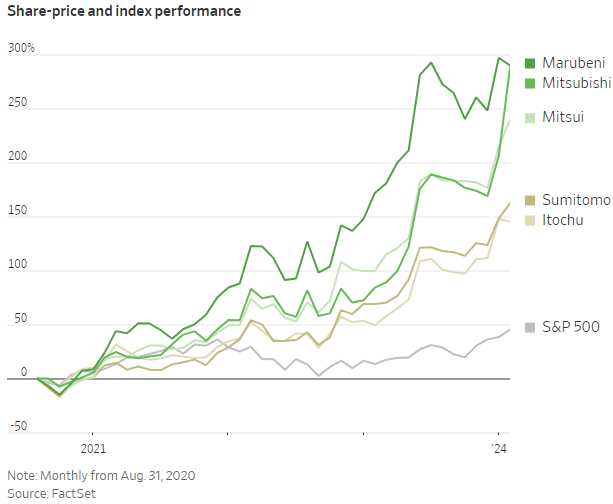

That’s right, Buffett’s Berkshire Hathaway (BRK.A) once again knocked it out of the park after making some big bets on Japanese brokers that are up about $8Bn by themselves as the Japanese market made a huge recovery in 2023. Buffett simply did what we do in our LTP – he waited for things to get stupidly cheap and then started buying.

Berkshire has always been my favorite way to play the S&P 500 since it’s a diversified powerhouse of stocks Buffett has already selected as the best of the S&P 500 – including ones he has bought entirely and taken private. Buffet’s company is still sitting with $167.6Bn in CASH!!! on the sidelines after making $8.48 billion (up 28%) in Q1 operations and $37.6Bn in net overall net earnings (including investments), boosted by an increase in insurance underwriting earnings and investment income amid higher interest rates and milder weather.

Buffett noted that “Outside the US, there are essentially no candidates that are meaningful options for capital deployment at Berkshire” and the company has continued to lean on share repurchases amid the dearth of appealing alternatives, saying the measures benefit shareholders. The firm spent $2.2Bn on buybacks in the fourth quarter, bringing the total for the year to about $9.2Bn.

Buffett noted that “Outside the US, there are essentially no candidates that are meaningful options for capital deployment at Berkshire” and the company has continued to lean on share repurchases amid the dearth of appealing alternatives, saying the measures benefit shareholders. The firm spent $2.2Bn on buybacks in the fourth quarter, bringing the total for the year to about $9.2Bn.

👺 Here are some key investing insights I took away from Warren Buffett’s 2024 letter:

-

- Buffett paid tribute to his long-time business partner Charlie Munger, who passed away in late 2023. Munger was described as the “architect” of today’s Berkshire Hathaway.

- Staying power. Despite Berkshire’s massive size, Buffett emphasizes the stability of the company’s diverse cash flows and balance sheet. This gives it major advantages in turbulent markets. As in past crises, Berkshire is positioning itself as a source of liquidity when others are distressed. Buffett emphasizes having a “fortress balance sheet” to withstand crises. This gives Berkshire flexibility others lack.

- Berkshire’s decentralized business model gives operational autonomy to its subsidiaries. The parent company focuses on capital allocation decisions, investments, and selecting the CEOs to manage each business unit.

- Berkshire’s size is now its biggest limitation in terms of finding large acquisition opportunities. With a massive net worth and market cap, doubling in five years is not feasible. However, Berkshire’s strong balance sheet ensures it is prepared for economic crises.

- Insurance underwriting had a strong year in 2023, aided by a lack of major catastrophe losses. However, earnings from utilities and energy declined significantly, partly due to increased estimates for wildfire losses at PacificCorp.

- Investment gains/losses remain extremely volatile due to Berkshire’s large equity portfolio. These unrealized gains/losses are meaningless in assessing Berkshire’s economic performance.

- Ignoring short-term noise. As always, Buffett focuses the operating businesses’ fundamental performance and the long-term. Near-term fluctuations in investments are dismissed as meaningless for understanding intrinsic value. As Phil often reminds us, we need to focus on long-term business value – not the charts.

- Berkshire’s robust capital position, large cash balance ($163 billion), and diversity of earning streams ensure it is prepared for major catastrophes and economic shocks. Financial prudence remains paramount.

- The long section on insurance details strong underwriting discipline, with detailed commentary on reserving adequacy and loss estimation processes. More transparency provided than most insurers. In-depth discussions of intricate loss reserving math and insurance regulatory regimes signals Buffett is still growing his expertise at almost 93 years old. His circle of competence expands each year.

- Opportunism amid pessimism. With oblique references to future crisis and volatility, Buffett subtly hints that periods of investor panic will provide rare chances to act while others are paralyzed. This is a classic Buffett strategy. Buffett’s comments reflect his view that most expert economic/market predictions waste time and have no value.

- Discipline despite abundance. Berkshire could easily overpay for acquisitions or leverage itself much higher given its financial strength. But Buffett maintains his value investing discipline, refusing to risk capital on mediocre returns.

- Talent cultivation. By giving Abel and Jain the spotlight to answer shareholder questions, it’s clear Buffett is providing platforms for them to demonstrate their leadership abilities as eventual successors.

- The annual meeting on May 4th will provide more insight into Abel’s and Jain’s roles in leading Berkshire’s insurance and non-insurance operations.

- The overarching theme is that all of Buffett’s time-tested principles still guide Berkshire even as it evolves under the next generation of management. Sound investing fundamentals endure.

Buffett is basically saying what I’ve been saying – only people listen to him… Global markets look very scary. Despite the S&P 500 hitting fresh records and a surge in tech stocks, especially those related to AI, Buffett exhibits a more cautious, even resigned attitude towards the current market opportunities, emphasizing the difficulty in finding investments that can significantly impact Berkshire’s scale.

Buffett’s cautious mood, contrasted with his historical advice to “be fearful when others are greedy,” may serve as a cautionary signal to the market, which has largely overlooked the delayed timeline for interest rate cuts in favor of rallying behind AI and other tech advancements. Buffett criticizes the “casino-like behavior” of the market, hinting at the speculative nature of the current rally, particularly in AI, suggesting that investors are taking significant risks.

Buffett’s commentary and Berkshire Hathaway’s strategic decisions reflect a disciplined, value-oriented investment philosophy that prioritizes long-term, sustainable growth and value creation over short-term gains fueled by market speculation. This approach, while potentially at odds with the current market dynamics, has historically proven successful over the long term.

Investors might do well to heed his caution, considering the potential for increased market volatility or corrections, especially in sectors that have experienced rapid price increases based on speculative interest rather than fundamental value.

We still have plenty of Earnings Reports coming in this week and we’ll see if the Russell can hold 2,000 now that the focus shifts to smaller caps:

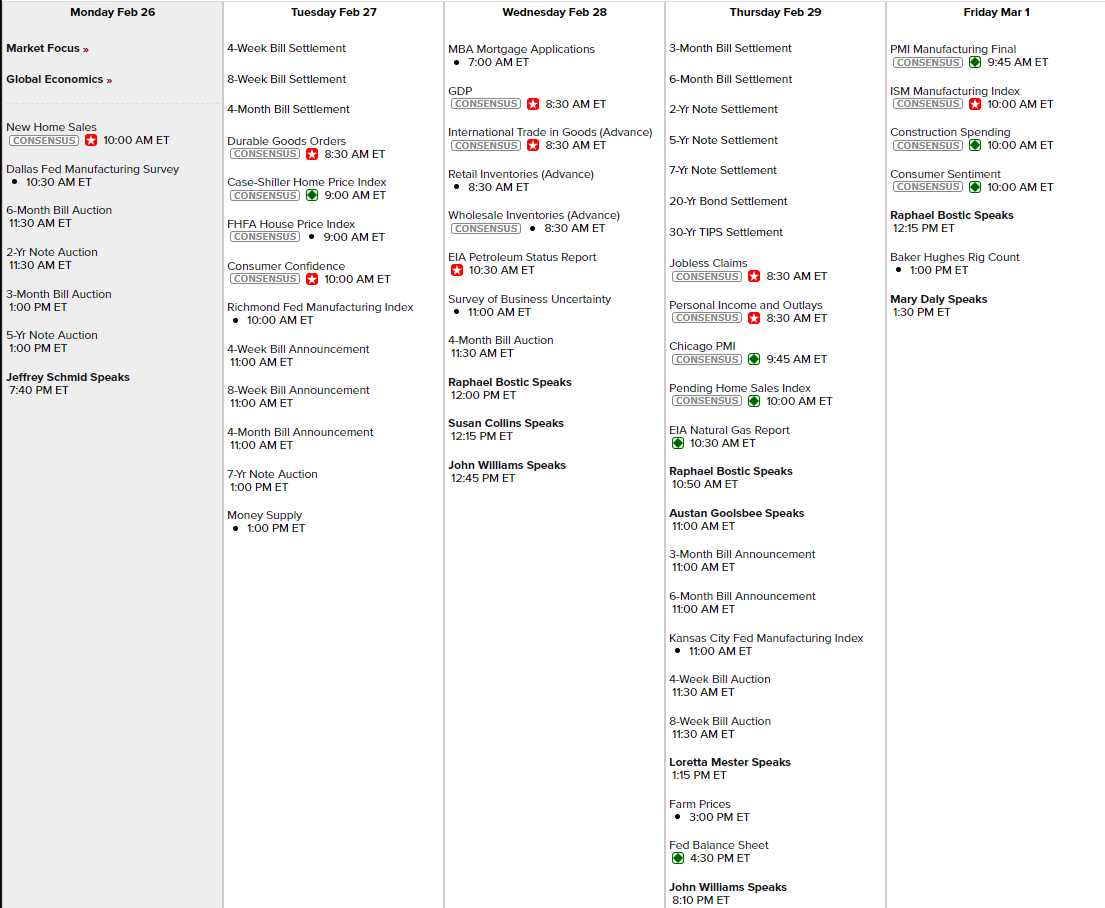

And the Fed Speakers are back with 10 scheduled speeches this week along with New Home Sales, Dallas Fed and Note Auctions today; Durable Goods, Home Prices, Consumer Confidence, the Richmond Fed and more Note Auctions tomorrow; GDP, Retail Inventories and Business Uncertainty Wednesday; Personal Income & Outlays, Chicago PMI, Pending Home Sales, the KC Fed and Farm Prices on Thursday and we wind up the week with PMI, ISM, Construction Spending and Consumer Sentiment – what a week!

🤖 Before we start our week, please note that the WSJ’s “Treasury Markets Are Losing Their Shock Absorber” discusses a significant shift in the U.S. Treasury market, particularly focusing on the dwindling participation in the Federal Reserve’s overnight reverse repurchase facility (reverse repo). This facility has historically helped the U.S. government limit borrowing costs by allowing large financial firms, such as money-market funds, to swap excess cash for high-quality securities on the Fed’s balance sheet, earning some interest in return.

Key points from the article include:

– Decline in Reverse Repo Use: The reverse repo facility, which saw daily balances peak at $2.5 trillion, has experienced a steady decrease in use, recently falling below $500 billion. This decline is viewed by Federal officials as a positive sign, indicating that excess cash is moving towards more attractive opportunities in the market.

– Implications for Treasury Market: The reduced use of the reverse repo facility is seen as a precursor to potentially higher interest rates and larger fluctuations in the $26 trillion Treasury market. This shift could challenge the U.S. government’s ability to manage borrowing costs effectively.

Analysis and Ties to Phil Davis’ and Warren Buffett’s Cautious Stance

The information from the WSJ article ties into the cautious stance on the 2024 economy shared by Phil Davis and Warren Buffett. Both Davis and Buffett have expressed concerns about the current market optimism, emphasizing the importance of a disciplined, value-oriented investment philosophy amidst speculative market behavior, particularly in sectors like AI and technology.

The decline in the use of the Fed’s reverse repo facility and its implications for the Treasury market underscore the broader concerns about market stability and the potential for increased volatility and interest rates. This situation aligns with Buffett’s cautionary advice to “be fearful when others are greedy,” suggesting that the market may be overlooking fundamental economic indicators in favor of short-term gains. Phil has advised strong hedges to protect against sudden market reversals that remain a strong possibility.

Buffett’s emphasis on maintaining a “fortress balance sheet” and Berkshire Hathaway’s significant cash reserves reflect a strategic approach to navigating potential market turbulence. Similarly, the cautious outlook shared in the PSW morning report, highlighting the challenges of finding meaningful investment opportunities and the speculative nature of the current rally, resonates with the potential market adjustments indicated by the trends in the Treasury market.

In summary, the developments in the Treasury market, as highlighted in the WSJ article, reinforce the cautious outlook shared by Phil Davis and Warren Buffett – despite both enjoying great performances in 2023. The potential for increased market volatility and interest rate adjustments serves as a reminder of the importance of financial prudence, long-term value investing, and preparedness for economic shifts. Investors might consider these insights as they navigate the complexities of the current financial landscape, balancing optimism with a strategic approach to risk management.

“Turn, turn any corner

Here, you must hear what the people say

You know there’s something it’s going on around here

It surely, surely, surely won’t stand the light of day

Speak out, you got to speak out against the madness

You got to speak your mind, if you dare

But don’t, no, don’t, no, try to get yourself elected

If you do, you had better cut your hair” – CSNY